mbogacz/iStock by way of Getty Pictures

Funding Thesis

Lennar Corp (NYSE:LEN) is having fun with a stabilization within the housing market, evidenced by normalized cancellations, resilient monetary efficiency, and a optimistic development outlook, mirroring favorable financial situations regardless of rising rates of interest. Prospects appear to regulate to increased mortgage charges, aided by record-low employment, rising wages, and GDP development. Past macroeconomic indicators, the housing provide stays tight. Though the corporate’s margins declined off their 2022 peak, they continue to be above historic ranges. Our bullish speculation is based on continued favorable macro and microeconomic developments. Housing provide usually modifications slowly, and market tightness has been happening for years, so we’re unlikely to see a big rebound in house provide in 2024. Potential rate of interest cuts assuage the chance of macroeconomic slowdown. For these causes, we see extra upside potential than draw back danger for LEN within the coming twelve months, underpinning our bullish outlook.

Resilient Efficiency Amid Disruptions

LEN maintains a robust place within the housing market, underpinned by strong demand for inexpensive housing and a restricted provide. The market is predicted to stay favorable for LEN, notably with rates of interest stabilizing and extra reasonable financial changes because the Fed maintains its wait-and-see method to financial coverage, versus the speedy and arguably disruptive fee hikes up to now eighteen months. This renewed stability has allowed house patrons to regulate and adapt to increased mortgage prices, saving extra and choosing smaller homes. Cancellation charges skilled a notable decline in the newest quarter, declining to 13%, down from 21% final yr. We count on these dynamics to supply accommodative tailwinds to LEN in 2024 and past. The corporate is the second-largest, entry-level house builder within the US, with a value sale vary between $230,000 – $750,000 (Q3 23 Common Promoting Worth ~$450,000).

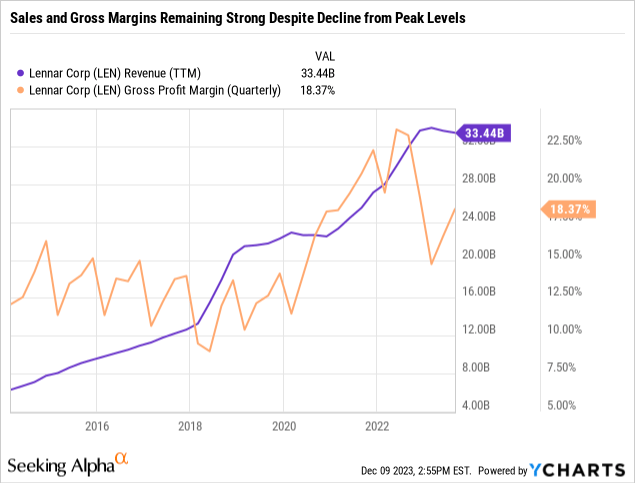

Whereas LEN’s monetary efficiency has moderated from its 2022 peaks, it stays strong. The corporate’s technique focuses on adjusting costs to maintain gross sales volumes in response to the evolving market. The corporate’s 10% gross sales development projections in 2024, which I describe as ‘Managed Development,’ are predicated on its method to engineering costs to generate increased volumes, elevated whole income, money flows, and EPS targets. The consequences of margins are counterbalanced by income improve, economies of scale, and secure provider and contractor relations that shorten the gross sales cycle.

The success achieved by LEN in 2023 by way of its dynamic pricing technique gives a robust basis for projecting its continued success into 2024. Within the 9 months ended August 2023, whole income was $22.6 billion, up from $20.47 billion in the identical interval in 2022. Whereas gross margins on house gross sales barely decreased from 26% to 24%, they continue to be at wholesome ranges.

The rise in neighborhood rely in areas with excessive development potential is promising for future development. As of August 2023, LEN had 1,253 energetic communities, up from 1,189 within the earlier yr. In Q3, the corporate witnessed a big variety of new house orders and closed on extra houses in comparison with the earlier quarter of final yr, aided by an 8.7% decline in gross sales value, as the corporate enhanced its incentive applications to brokers and purchasers.

We imagine that the worst is behind us now when it comes to the affect of rising rates of interest that beforehand alienated house patrons and plenty of buyers from the sector. Regardless of a difficult macroeconomic setting and softening margins and backlog, we see alternative as the corporate continues its concentrate on sustaining volumes, money flows, and economies of scale going ahead into subsequent yr. Given the latest efficiency, it’s doubtless that LEN will proceed to see strong and resilient working efficiency regardless of a higher-for-longer rate of interest regime.

Strengthening Monetary Place

LEN has strengthened its steadiness sheet place by way of a discount in its debt-to-capital ratio, a sturdy money place, and a concentrate on sustaining scale to fulfill EPS targets. The corporate’s adoption of a capital-light method, favoring land buy choices over outright possession, has minimized danger and elevated flexibility, notably within the face of financial downturns. This strategic shift additionally led to an improved stock turnover by decreasing the time land is held earlier than house growth and supply gross sales.

The corporate’s sturdy steadiness sheet paves the way in which for development and helps the continuation of its share repurchase and dividend applications. Within the 9 months ending August 2023, working money movement rose to $2.6 billion, up from $550 million in the identical interval of final yr.

Operationally, the most important problem is balancing development with dividends and share repurchases. LEN’s achievements on this space are evident in its monetary outcomes in the course of the 9 months ending August 2023, lending confidence in our bullish speculation. Throughout this era, LEN redeemed $575 million in senior notes, repaid $238 million beneath warehouse amenities, repurchased $919 million of its frequent inventory, and paid $330 million in dividends. This was achieved whereas ending Q3 with $3.9 billion in money, zero internet debt, and no borrowing on its $2.6 billion credit score facility. These vital achievements eclipse the slight softness in margins, backlog, and Common Promoting Worth usually famous by business skeptics.

Engaging Valuation

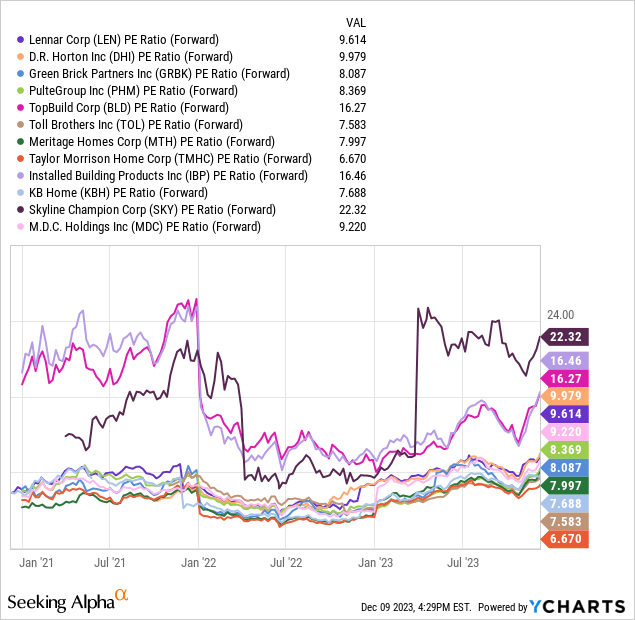

At a ahead P/E ratio of 10x, LEN presents a compelling valuation on a standalone foundation. Though this valuation aligns with business averages, it seems notably enticing contemplating the present business slowdown. Whereas some friends is likely to be buying and selling at a steeper low cost, LEN is likely one of the handful of homebuilders included within the S&P 500 index (SP500), providing a definite benefit when it comes to liquidity. Moreover, LEN’s substantial measurement and strong steadiness sheet additional reinforce the attractiveness of its present valuation for a purchase technique.

The corporate’s stature because the second-largest homebuilder, mixed with its diversified operations, considerably mitigates dangers related to regional financial fluctuations, in contrast to its smaller friends. For instance, KB Residence (KBH), which trades at 7.7x P/E, operates in 9 states, in comparison with LEN’s operations spanning 27 states. This diversification, together with LEN’s substantial market presence, underscores its resilience and potential for development, making it an interesting funding possibility.

What to Anticipate This Thursday

Administration plans to launch This fall 23′ outcomes on Thursday, December 14, 2023, for the 12 months ended November 30. Relating to new orders, administration expects between 16,200 – 17,200, down 12.5% – 17.5% sequentially however up 23% – 30% on a YoY foundation. The November quarter is often a tender interval, as climate patterns affect client house buying developments. Temperature this fall was hotter than common, probably providing a tailwind for the This fall 23′ order e book.

LEN, Creator’s Estimates

Relating to deliveries, buyers must be anticipating a robust This fall 23′, supported by an exceptionally sturdy order e book in the course of the prior quarter, as proven above (the best in two years). The corporate has been making progress in its sale cycle. On common, it takes massive homebuilder around LEN 4-6 months to finish a single-family house.

LEN, Creator’s Estimates

Relating to Common Sale Costs and margins, we do not see vital change in comparison with Q3. Housing provide stays tight, and regardless of LEN’s concentrate on driving volumes, we do not see it vital for LEN to implement extra house value cuts to fulfill its supply and order projections. Thus, we count on house gross sales margins will stay secure, mirroring the degrees noticed in Q3 23′, which had been round 24% on an ASP of $448,000.

Danger

Regardless of the sturdy efficiency of LEN within the face of excessive rates of interest, one cannot ignore the cyclical nature of the sector. The corporate’s techniques, specifically the availability of reductions, may not be sufficient to maintain demand throughout a extreme financial downturn. The corporate can be delicate to commodity costs, specifically lumber, which have just lately supplied margin tailwinds after latest value declines. Nonetheless, an increase in commodity costs will affect margins. Lastly, with rising land costs, the necessity to proactively handle land stock is extra essential than ever. LEN ended Q3 with practically 400,000 land websites, sufficient for 1.5 years of provide, providing confidence in our 2024 bullish outlook. Nonetheless, if the development in land costs accelerates, we might see strain on working capital wants, which might finally affect LEN’s share repurchase and dividend applications.

Abstract

LEN stands as a resilient participant within the housing market, with a confirmed observe document and a strong technique, positioning it for achievement in 2024, particularly as dangers of a tough touchdown are largely behind us now. Regardless of financial uncertainties up to now 9 months and the sector’s cyclical nature, LEN’s monetary efficiency lends us confidence in its 2024 prospects. The corporate’s low valuation is augmented by a shareholder-friendly share repurchase and dividend applications, growing LEN’s enchantment within the housing market.