PM Pictures

We’re coming right down to the wire in 2023 with 3 months remaining. All eyes have been on AI and large tech as these areas have propelled the key indices effectively into constructive territory on the 12 months. Whereas the S&P 500 is up roughly 12%, and the Nasdaq is up round 26% YTD, many dividend-focused firms have been left behind. Dividend-focused firms similar to Altria Group (MO), Verizon (VZ), and Enbridge (ENB) are all experiencing damaging years, and the tough market has bled over into Leggett & Platt (NYSE:LEG). I’d speculate that many traders have by no means heard of Leggett & Platt, though they’ve been in enterprise for over 130 years. Leggett & Platt is the precise reverse of what grabs headlines as they make bedding merchandise, furnishings, flooring, textiles, and specialised merchandise. Shares of Leggett & Platt are experiencing a tough 12 months, having fallen -24.64% YTD and -57.26% from their 52-week highs. That is very fascinating, and I’m trying ahead to beginning a place on this Dividend King because the financial setting ought to ease in 2024.

Searching for Alpha

What goes fallacious for this firm with over a century of operations and 50+ years of consecutive dividend will increase, and why it presents a chance

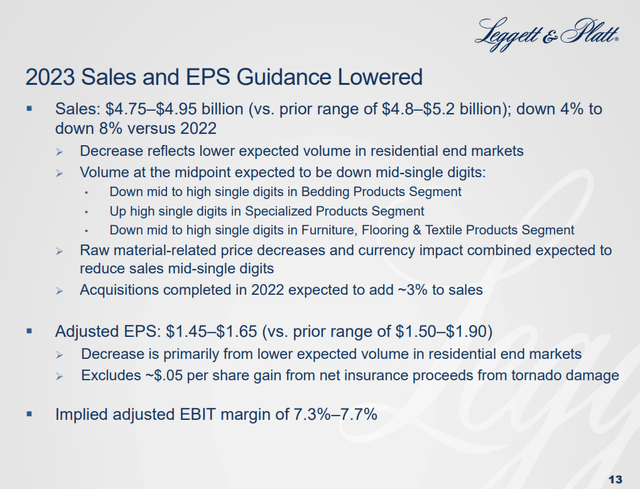

Corporations usually do not expertise selloffs to this diploma except one thing is fallacious. In Q2, gross sales declined by -8% YoY as Leggett & Platt continued to see softened demand within the residential market. Leggett & Platt lately lowered its full-year steering as a result of ongoing volatility within the macroeconomic setting, as their earlier forecast known as for an enchancment within the again half of 2023. Gross sales of their bedding section declined -18% YoY, and gross sales of their Furnishings, Flooring, and Textile section declined -14% YoY. Leggett & Platt have needed to readjust their numbers, and the market just isn’t reacting effectively to the lowered steering. The highest finish of their gross sales declined from $5.2 billion to $4.95 billion, whereas the excessive finish of their projected EPS dropped from $1.90 to $1.65.

Leggett & Platt

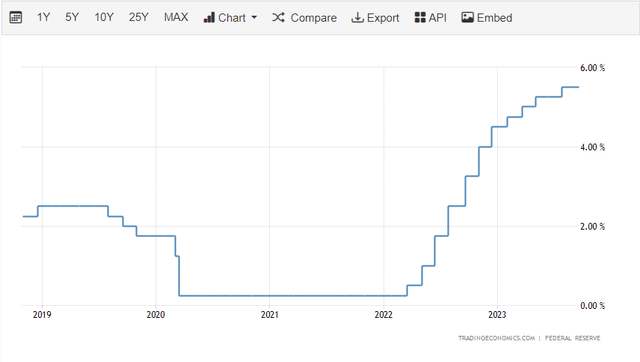

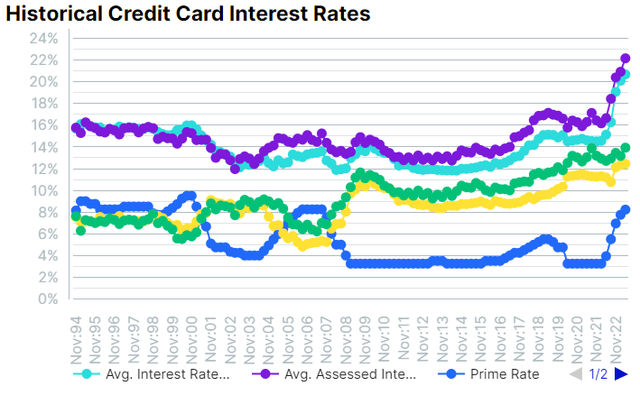

The tightening financial system is straight impacting Leggett & Platt’s high and backside line. We have now watched the quickest tightening cycle over the previous a number of a long time because the Fed elevated the Fed Funds Price 5.25 – 5.50. This has precipitated the curiosity on floating-rate debt to extend, rates of interest on bank cards to extend, and the fee to borrow capital for companies to extend considerably. Because of the Fed growing rates of interest, bank card rates of interest have now exceeded 20%. The high-interest charge setting is not optimum for Leggett & Platt as a result of whereas shoppers are nonetheless spending, they’re much less more likely to make discretionary purchases except they’ll afford it upfront. Many are pushing again changing furnishings, beds, and different gadgets except they completely must be changed. That is having a direct affect on Leggett & Platt, as we will see from the numbers.

Fed Funds Price

Buying and selling Economics WalletHub

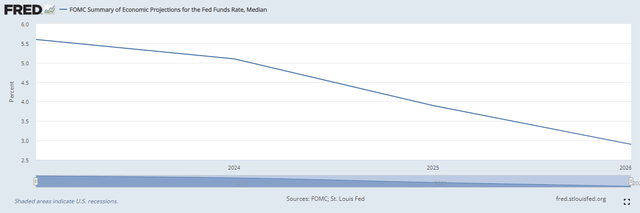

Leggett & Platt hasn’t had an optimum 12 months, however there are some fascinating points to think about. They function in a boring setting, and corporations aren’t lining as much as make bedding materials, aerospace tubing, ducting, fabricated assemblies, hydraulic cylinders, or elements for furnishings. The downturn might be a long-term alternative as shares of Leggett & Platt have declined by greater than -50% from their latest highs. With greater than a century of working altering macroeconomic environments, Leggett & Platt has been via each financial cycle that has been thrown their means. The market could also be overreacting a bit as this isn’t an organization that will probably be displaced by the subsequent Cloud or SaaS firm. The St. Louis Fed is projecting that charges will probably be increased than anticipated in 2024, however we’ll begin to see some charge cuts, which is able to ultimately find yourself within the 2.9% space in 2026. The nice factor is that we’re on the finish of the tightening cycle, and over the subsequent 12 months we’ll see charges begin to decline. As charges decline the price of capital for each shoppers and companies will loosen, and Leggett & Platt ought to see constructive impacts on their high and backside line.

St. Louis Fed

Leggett & Platt is among the highest-yielding Dividend Kings and I’m

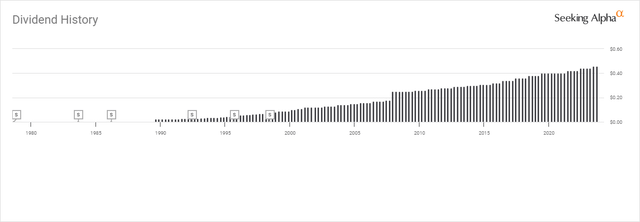

For an organization to implement a dividend program, it must be in a robust monetary place that can also be predictable. Whereas points of the enterprise or financial setting can at all times change, companies want monetary stability to implement an ongoing dividend program that pays traders quarterly. It is one factor to begin paying a dividend, however being able to extend it over an prolonged time period is a wholly totally different accomplishment. Few firms ever get to offer shareholders with a decade of steady dividend will increase, and solely a choose bunch grow to be Dividend Aristocrats, having supplied 25 years of dividend will increase. From the choose group of Dividend Aristocrats, few firms grow to be a Dividend King, offering 50 years of steady dividend will increase. Dividend Kings have supplied annual dividend will increase since 1973. These firms have gone via the oil embargo, the double-digit rate of interest setting of the early 80s, the dot com bust, a number of wars, a monetary disaster, a mortgage disaster, and a pandemic. It is secure to say that firms which have elevated their dividend for 50 years know tips on how to function in difficult working environments.

Leggett & Platt has grow to be a Dividend King as they’ve elevated their dividend for 52 consecutive years. Over the previous 5-years Leggett & Platt has a 5-year dividend progress charge of three.99% and pays a dividend of $1.84 per share. Its dividend yield now exceeds 7% and is available in at 7.49% ($1.84 / $24.58). The one Dividend King that exceeds Leggett & Platt’s dividend yield is Altria Group, whereas the one different Dividend King that exceeds a 5% yield is 3M Firm (MMM). On the Q2 convention name, administration mentioned that their liquidity place was $632 million, comprised of $272 million in money and $360 million of their revolving credit score facility. The board elevated the Q2 dividend to $0.46, a 4.5% improve YoY. Leggett & Platt disclosed that they count on to pay roughly $240 million in dividends for 2023, and their long-term priorities embrace natural progress, shopping for again shares, and paying dividends. With an organization that has elevated the dividend for 52 consecutive years, it is laborious to not think about these statements. I’m trying on the present downtrend as a chance to begin a place in one of many solely 2 firms to be on the Dividend King record that pays a yield that exceeds 7%.

Searching for Alpha

After going via the financials, I’m nonetheless excited about Leggett & Platt

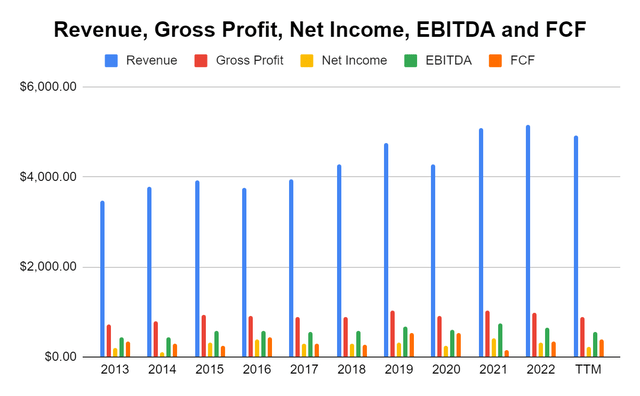

Leggett & Platt would not have giant margins, however it is a firm that is aware of tips on how to generate earnings. Over the previous decade, Leggett & Platt has elevated the quantity of income it generates by 41.64% to $4.93 billion whereas growing every line of profitability. Its gross revenue has elevated by 24.07% to $880.80 million, its internet revenue elevated 17.54% to $231.90 million, and its Free Money Move [FCF] elevated 16.62% to $392.20 million. Over the previous decade Leggett & Platt has by no means generated a loss, and even throughout 2020, they produced a whole lot of tens of millions in profitability. Within the TTM, their gross revenue margin has fallen from 31.72% to 26.33% YoY whereas their revenue margin has declined to 4.71%, however their FCF yield elevated to 7.96%.

We’re nonetheless residing via a interval of inflation, and uncooked supplies are nonetheless buying and selling at elevated costs. Crude is over $90 per barrel and is up over 16% on the 12 months, whereas gasoline is up 12.65% YoY, and metals similar to aluminum have elevated in worth by 6.24% YoY. Though Leggett & Platt has diminished its 2023 steering, it is nonetheless going to be worthwhile in 2023, and its FCF trajectory is greater than sufficient to cowl the $240 million in estimated dividend funds. I believe that we will see inflation proceed to return down and oil costs begin to decline in 2024. Leggett & Platt ought to see their value of income decline a bit in 2024 and 2025, which might result in stronger margins and bigger earnings. Whereas they’re experiencing a troublesome working setting, they made it via oil embargos and harder intervals than as we speak.

Steven Fiorillo, Searching for Alpha

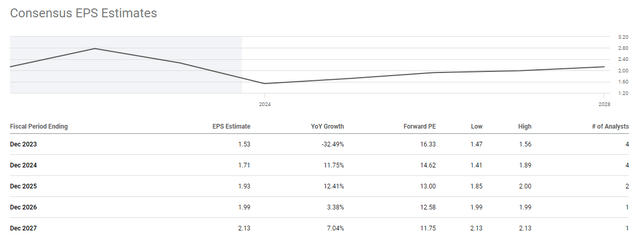

Wanting on the consensus estimates for 2023 and onward, Leggett & Platt continues to look fascinating. Analysts have readjusted for the up to date steering and sees them producing $1.53 of EPS in 2023. Leggett & Platt is buying and selling at 16.33x 2023 earnings. Based mostly on the ahead estimates of $1.71 in 2024 and $1.93 in 2025, Leggett & Platt trades at 14.62x 2024 earnings and 13x 2025 earnings. Over the long-term, they’re projected to proceed rising and ultimately exceed $2 per share of EPS in 2027. The market may proceed to punish them, however their stage of profitability and future EPS projections make this an fascinating funding.

Searching for Alpha

Conclusion

I’m warming as much as Leggett & Platt as I’ve been following them nearer after exceeding 5%. They’re a boring firm, and they aren’t more likely to seize headlines because the market is targeted on expertise. As shares fell beneath $25 and the yield exceeded 7%, this now appears to be like fascinating as a chance to put money into a real Dividend King at a low valuation. Leggett & Platt has been a falling knife and it may proceed to fall. That is an funding that will take years to play out, and I’m trying on the long-term potential. Even when shares had been to succeed in $20 and even fall into the excessive teenagers, Leggett & Platt has been in enterprise for greater than 130 years, and primarily based on the macroeconomic panorama, they need to see an easing working setting in 2024 and a a lot looser setting in 2025. From a long-term perspective, Leggett & Platt might be a great alternative, paying over 7% with a rising dividend that may be reinvested whereas shares recuperate. I plan on beginning a place in Leggett & Platt, and if shares decline towards the $20 stage, I’d most likely greenback value common into the place as there’s nothing within the chart that signifies a backside is in.