- Crypto markets are within the inexperienced as soon as once more, due to components like CME, U.S. financial system and long-term holders.

- Bitcoin bulls are dealing with the stress of pulling costs again to the rapid help stage of $68,000.

The worldwide cryptocurrency market cap has seen a rise of 1.8% up to now twenty-four hours, developing on what may be seen as a modest restoration from the beginning of the weekend.

By this time yesterday, Bitcoin [BTC] was barely hanging onto $60,000. At press time, it was value $63,111, up by 4% on the day by day chart. However is there any particular motive for this minute surge? And can it maintain agency?

Why Bitcoin is up

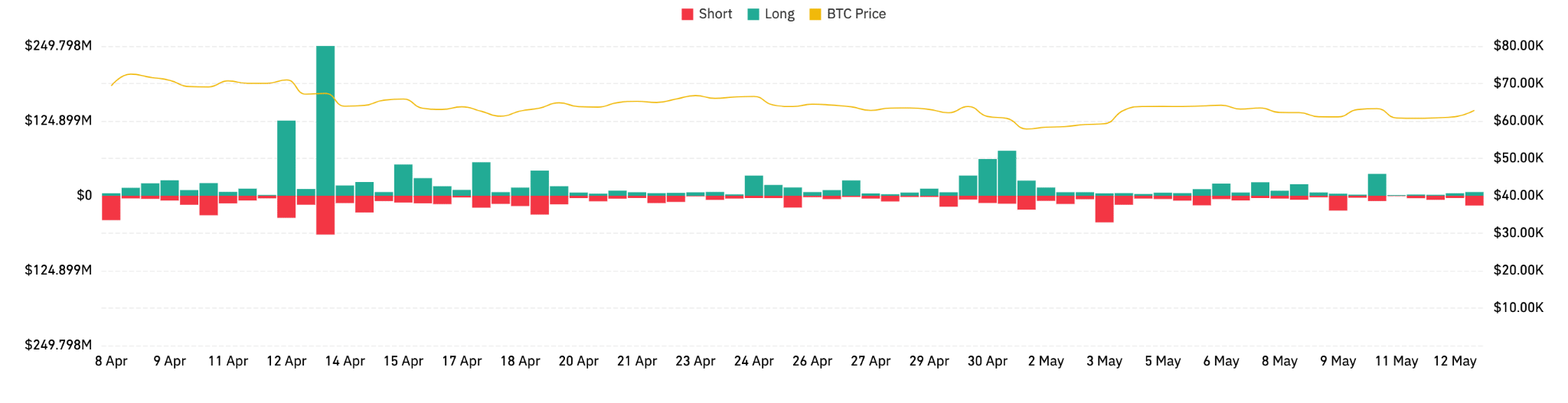

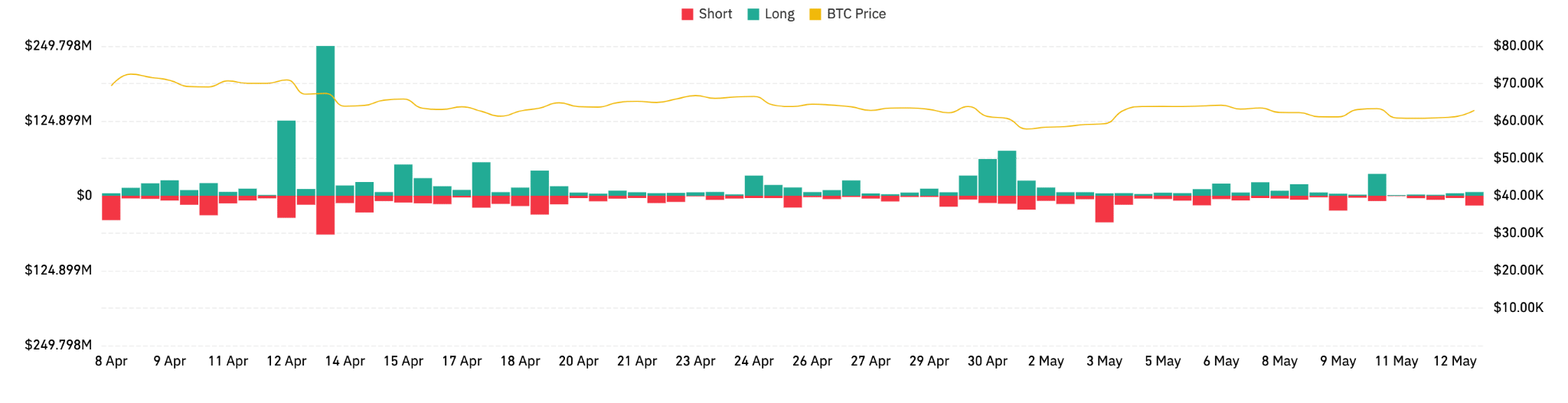

Analyzing knowledge from Coinglass, Bitcoin is probably the most liquidated asset over the previous day. It has seen over $36 million gone, largely from Binance [BNB].

Total, the information means that merchants are actively responding to cost adjustments with corresponding adjustments of their market positions, indicating a market extremely delicate to each exterior influences and inside sentiment adjustments.

Supply: Coinglass

Nonetheless. Bitcoin is within the inexperienced and going up. causes for the abrupt resilience, Coinglass data additionally tells us that Bitcoin’s CME open curiosity has elevated by over 3% in twenty-four hours.

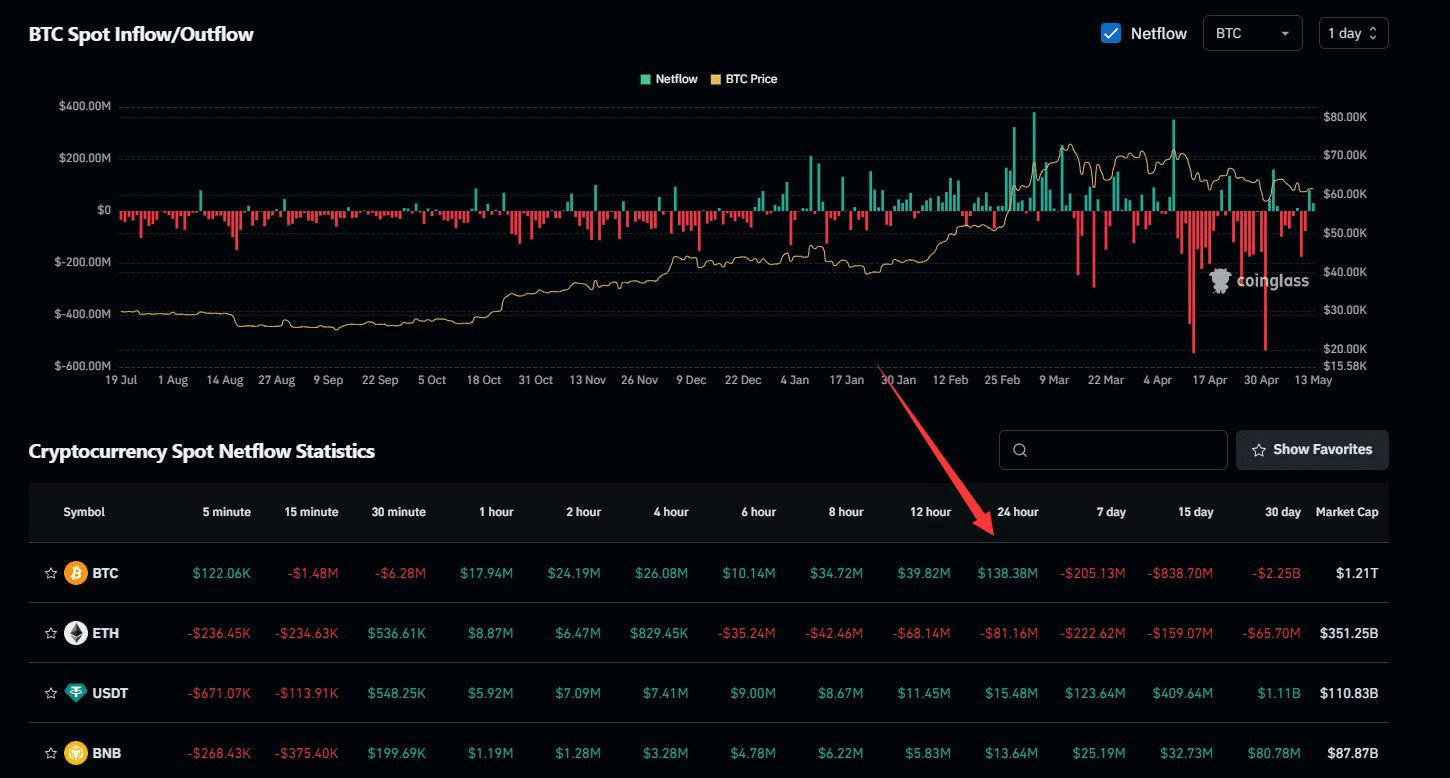

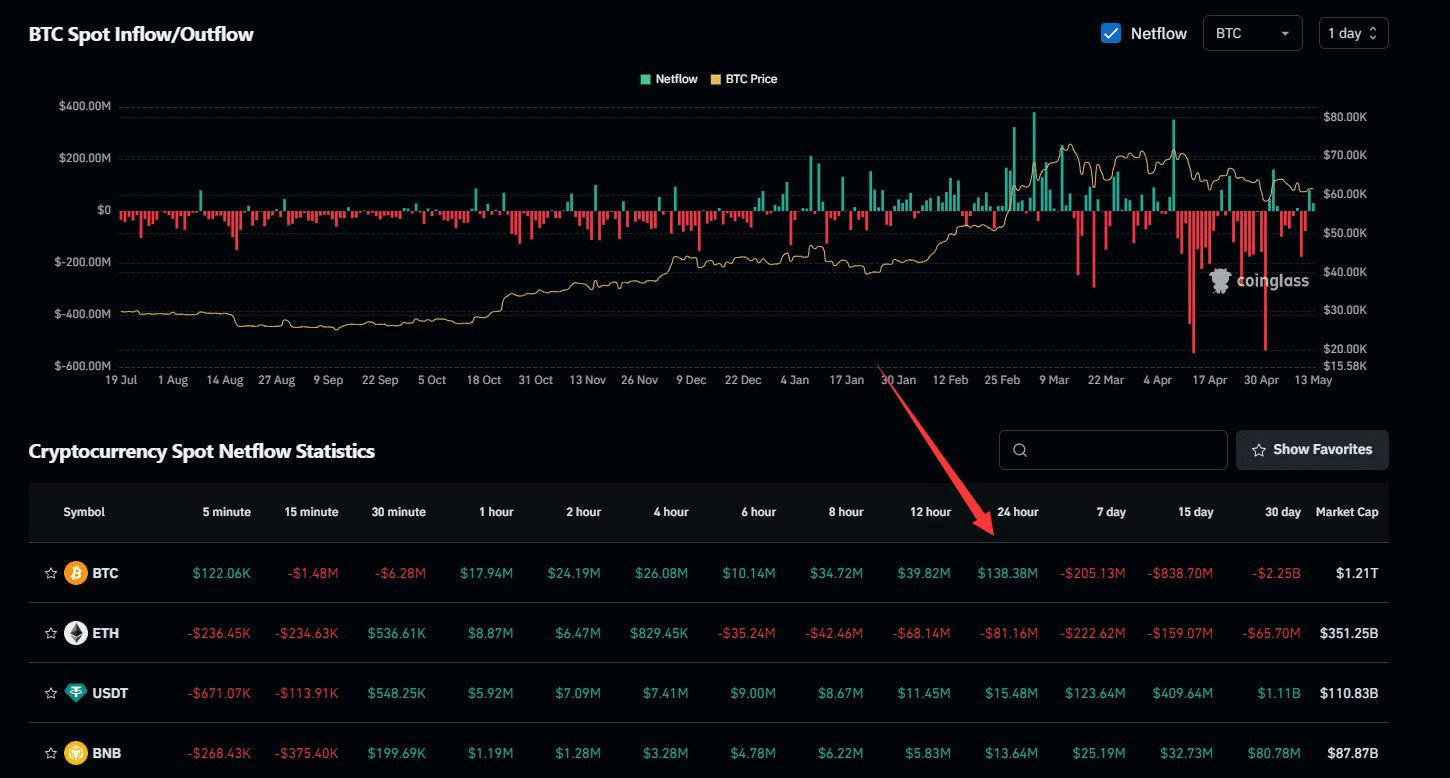

Furthermore, spot netflow has seen almost $140 million over the identical timeframe.

Supply: Coinglass

One more reason why Bitcoin is holding agency is the U.S. financial knowledge getting launched on the 14th of Could.

Going by the damaging sample Jerome Powell has established this 12 months, rate of interest choices have confirmed to be bullish for Bitcoin, seeing as price cuts aren’t coming anytime quickly.

In the meantime, skilled Bitcoin holders are echoing the 2021 bull market vibe, as advised by some on-chain data.

Presently, long-term holders (LTHs) are rising their BTC holdings after having bought off early this 12 months.

The information means that, much like mid-2021, these long-term holders are attempting to accumulate a bigger share of the BTC provide.

They view the low Bitcoin costs as an opportunity to purchase extra cash at a cut price, to then promote them when market pleasure picks up.

A sample may be traced from 2018 and 2021, exhibiting a recurring cycle the place long-term holders buy throughout market lows and promote throughout highs.

Regardless of these cycles, there’s a noticeable, persistent development the place an more and more majority portion of Bitcoin is being held by long-term holders.

Bitcoin’s present stand

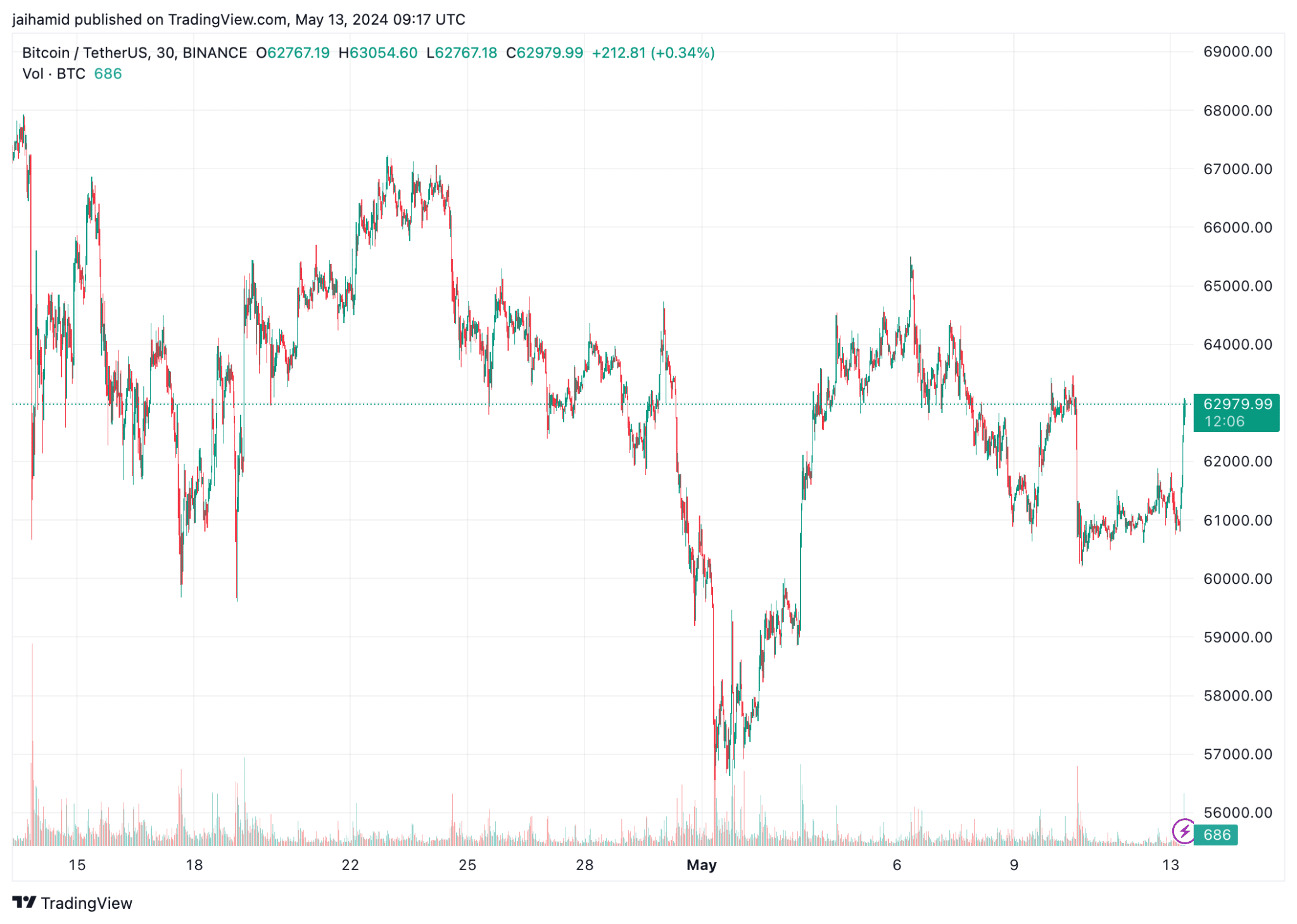

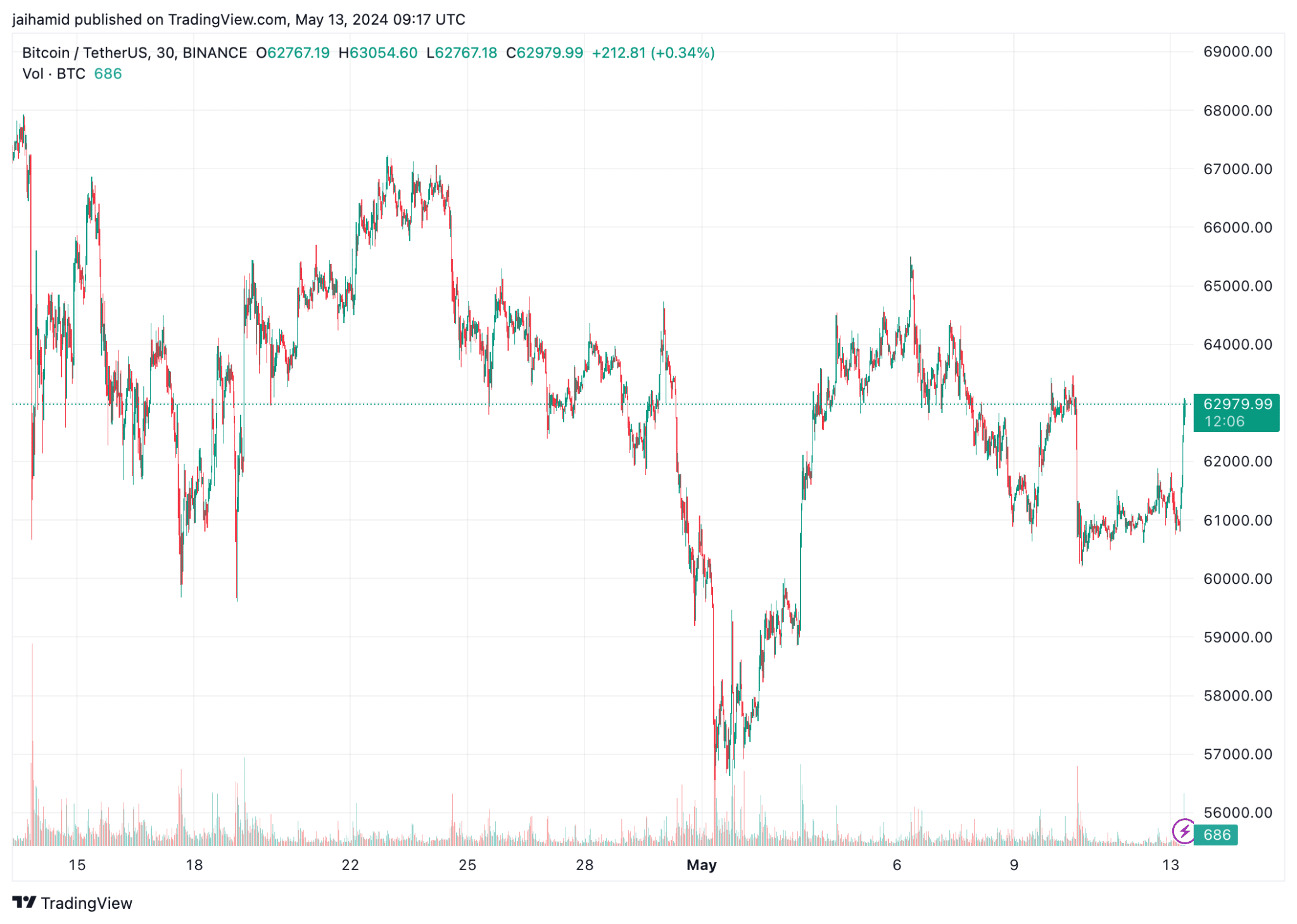

AMBCrypto’s dissection of TradingView knowledge for the BTC/USDt pair reveals a powerful resistance stage across the $68,000 mark, which BTC has examined a number of occasions over the previous month and not using a sustained breakthrough.

Conversely, a transparent help stage is obvious close to the $60,000 stage, beneath which, if Bitcoin falls, additional corrections to $55k and past may very well be witnessed.

The frequent and comparatively giant worth swings inside brief intervals (as seen from the candlestick sizes) spotlight the continued volatility within the Bitcoin market.

This sample suggests a dealer’s market, the place short-term positive factors may be captured primarily based on swift actions.

Supply: TradingView

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

As of the most recent knowledge level, the value is experiencing one other pullback in direction of the upward help stage.

This may very well be indicative of one other potential shopping for alternative if the sample holds as earlier situations recommend. All in all, the bears are very a lot in management.