- The crypto market is down right this moment because of a major correction section.

- Bitcoin struggles across the $56,000 assist degree, with technical indicators suggesting a possible reversal.

Checking the crypto market right this moment, you will notice nothing however crimson. The whole market appears to have tumbled, with Bitcoin [BTC] and Ethereum [ETH] taking most hits, dropping far beneath their vital assist ranges.

Bullish sentiments in the neighborhood appear to be virtually utterly gone. As soon as once more, buyers are panicking, presumably on the fringe of giving up. So, what’s going on? Why is the crypto market down now?

2024 is mostly anticipated to be a extremely bullish yr for the markets. And it has. However we’re at present coping with a powerful case of the corrections.

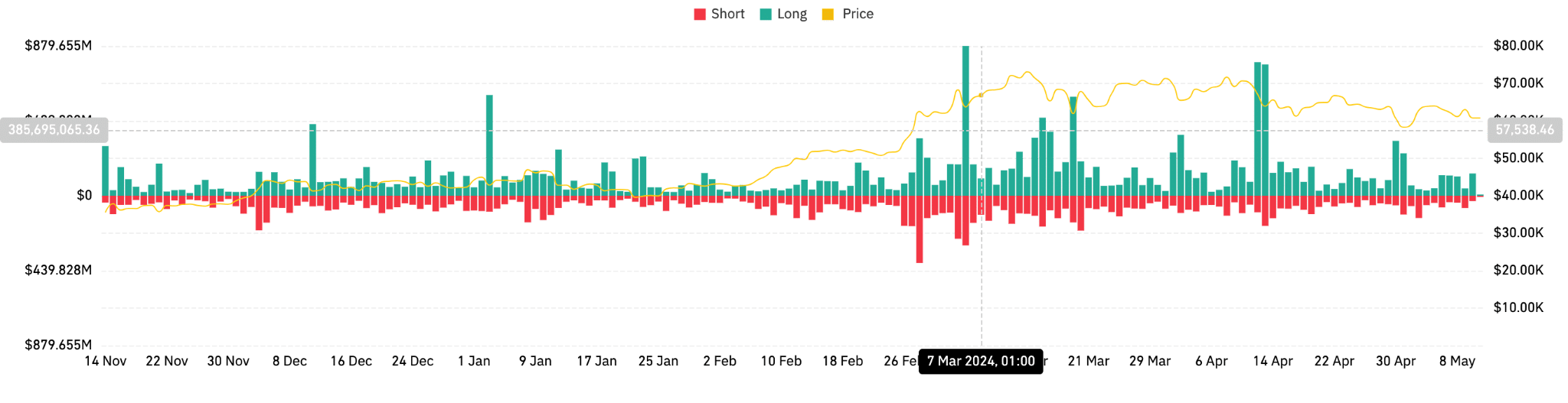

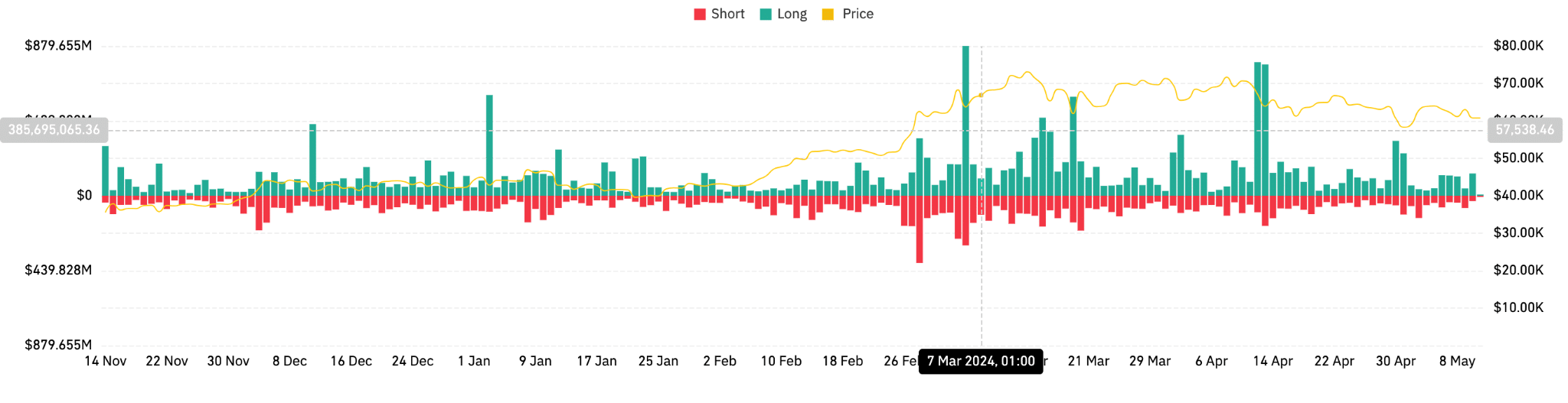

Information from Coinglass exhibits us that each tokens have seen extra inflows than outflows previously twenty-four hours. Additionally, liquidations are comparatively low.

On the tenth of Could, titans of the U.S. banking sector, JPMorgan and Wells Fargo, made headlines with their disclosures of holding spot Bitcoin ETFs.

But, this revelation has barely made a ripple within the general market dynamics. Bitcoin, for one, appears caught in a protracted correction cycle, stubbornly testing investor persistence.

Supply: Coinglass

Why is the crypto market flailing?

The rapid assist degree for BTC now could be someplace round $56,000, for merchants. Breakout remains to be imminent, as is extensively anticipated by the group.

Information from TradingView tells us that that is the place worry and optimism collide, the place merchants hover between hope for a breakout and dread of additional decline.

Bitcoin is retesting its former all-time excessive resistance ranges, now as new assist zones.

This exercise exhibits a typical case of RSI Bullish Divergence on the 4-hour chart, hinting that the downtrend’s momentum is shedding steam and would possibly quickly reverse.

But, the foreign money remains to be navigating by way of the perilous falling wedge sample—a technical indicator suggesting that whereas the tip of the tunnel could also be close to, the highway stays full of worry and uncertainty.

The group’s consensus leans in the direction of an eventual breakout, which may catapult Bitcoin’s worth to new heights, probably reaching as excessive as $78,000 within the bullish surges to return.

Supply: TradingView

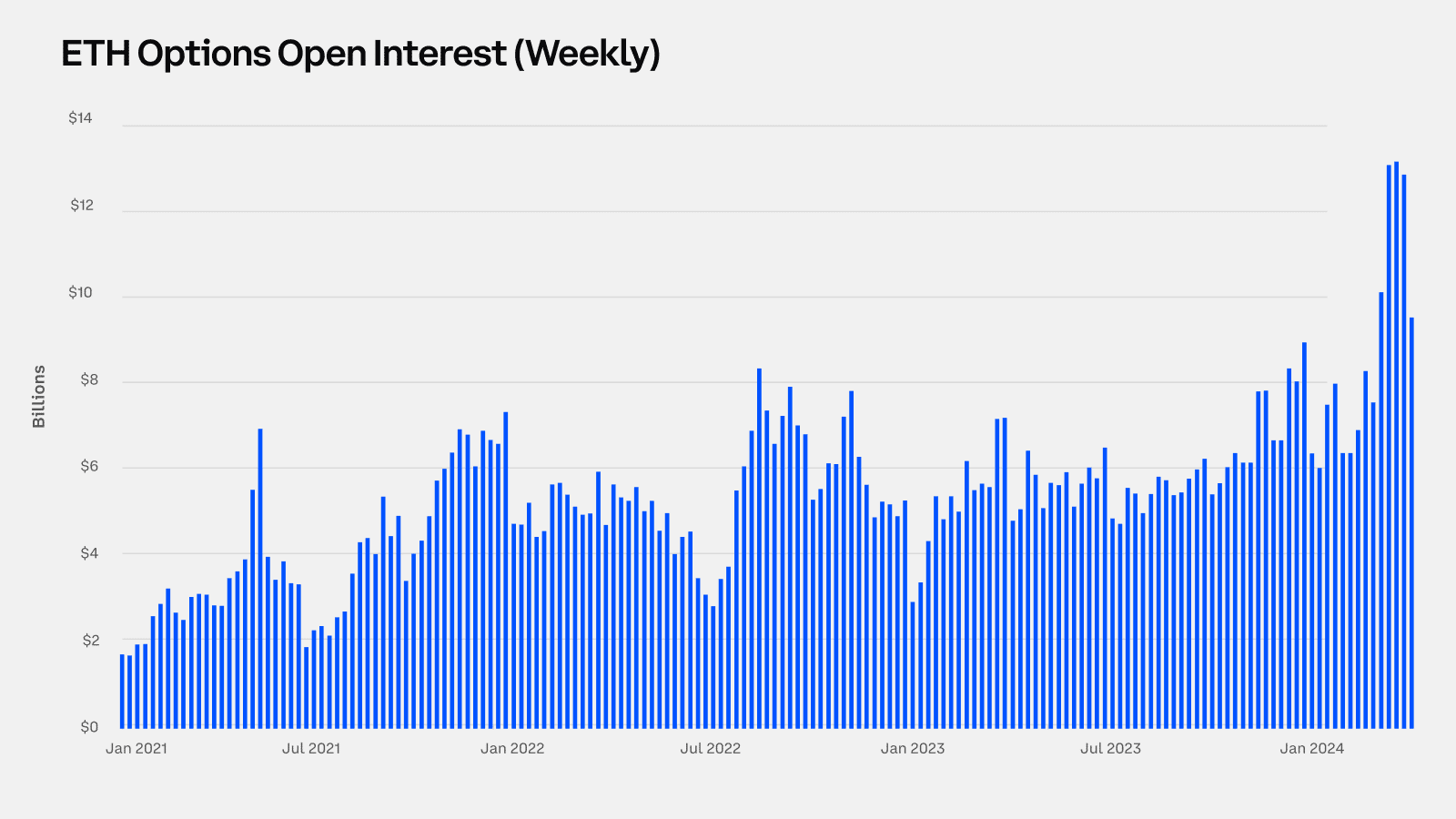

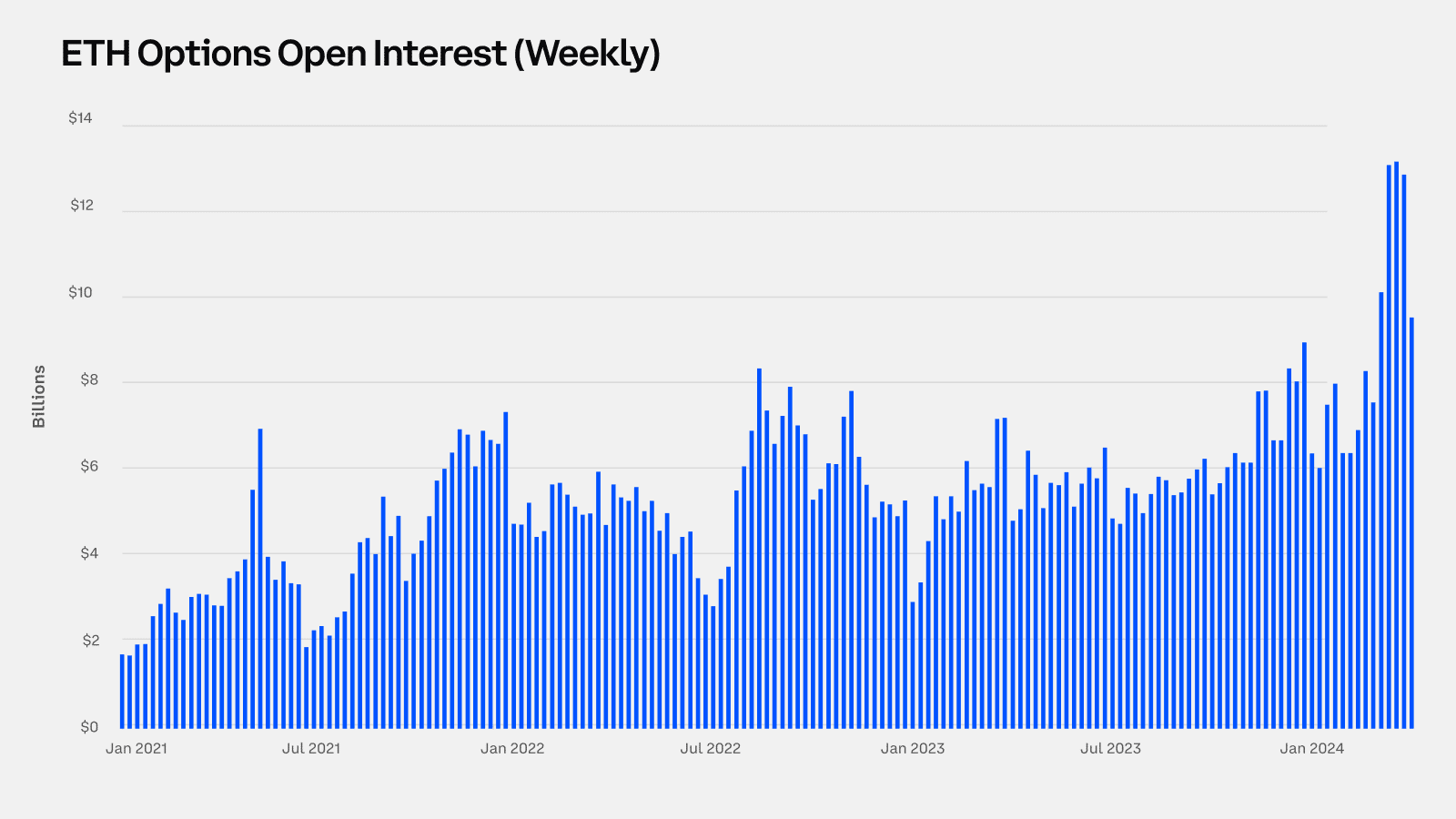

As for Ethereum, its present trajectory is barely completely different from Bitcoin’s. The Ethereum derivatives market is exhibiting indicators of elevated exercise and investor curiosity, in line with Glassnode.

Open Curiosity has surged by 50%, indicating a powerful engagement with Ethereum’s monetary merchandise.

Nonetheless, regardless of these optimistic indicators in derivatives, Ethereum’s efficiency relative to Bitcoin this cycle is far slower.

The lag in speculative curiosity, notably from the Brief-Time period Holder group, is a cautious method amongst these buyers.

In the meantime, Lengthy-Time period Holders appear to remain on the sidelines, eyeing extra profitable alternatives for profit-taking in future rallies.

Supply: Glassnode

At press time, Ethereum was value $2,897.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Even because it battles by way of the present market downturn, the rising curiosity in its derivatives means that these holders could quickly see the favorable circumstances they’re ready for.

All in all, the rationale for the retreat is that the market remains to be consolidating, and consultants count on a breakout regardless. Traders are suggested not to surrender. 2024 remains to be crypto’s yr.