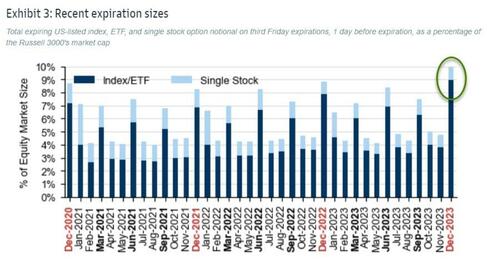

Goldman’s John Marshall estimates that right this moment’s choices expiration would be the largest ever with over $4.9 trillion of notional choices publicity expiring, together with $490 billion notional of single inventory choices.

Whereas December expirations are usually the most important of the 12 months, this one breaks all previous data.

Choices expiring right this moment characterize a notional worth that is the same as 10% of the Russell 3000 market capitalization. The biggest expiration on report.

And with a report $8BN lengthy gamma place about to be unclenched…

As SpotGamma notes, right this moment we see ~30% of S&P500/Nasdaq/Russel gamma expiring, with the majority of that centered within the:

-

4,700-4,750 space for S&P (470-475 SPY),

-

close to the 400-405 strikes for QQQ,

-

and 200 strike for IWM.

The elimination of this gamma with expiration ought to permit for index volatility to extend – an element which has already began to come back into play.

As you may see beneath, December expiration is large with ~1.3trillion of name delta notional set to run out. Places are primarily nonexistent.

A blow-off-top appears to be consensus now, however choices positions appear poised to assist a pointy transfer. Seasonality, charges, and sentiment appear to assist greater shares into 12 months finish – and a “refill, vol up” state of affairs would speed up motion. Additional, single inventory name skews will not be all that heavy after we look broadly throughout names (i.e. calls will not be bid to the extremes).

Loading…