MOHAMED HUSSAIN YOUNIS/iStock through Getty Photographs

ETF Profile

Traders searching for diversified fairness publicity to the biggest economic system within the Center East- Saudi Arabia, could think about wanting on the iShares MSCI Saudi Arabia ETF (NYSEARCA:KSA), a product that focuses on Saudi equities. KSA is in no way, the one ETF out there that focuses on this area (you even have the Franklin FTSE Saudi Arabia ETF), however it’s the preferred and most liquid possibility round, with an AUM of just about a billion {dollars}, and pretty tight spreads of $0.01. These tight spreads additionally improve its positioning as an acceptable buying and selling play, with an honest proportion of bears presently betting towards it (the present quick curiosity as a perform of the full shares excellent of KSA is slightly elevated at over 14%).

Nonetheless, KSA’s reputation is considerably ironic, given that the Franklin FTSE Saudi Arabia ETF (FLSA) is much more cost-efficient (FLSA’s expense ratio is nearly half as a lot as KSA’s expense ratio of 0.74%). Additionally think about that different country-specific ETFs focussing on neighboring areas equivalent to Qatar (QAT) or UAE (UAE) are lots cheaper with expense ratios of 0.58%. Maybe buyers are additionally drawn to KSA’s wider attain; FLSA solely focuses on 58 Saudi shares, whereas KSA’s portfolio encompasses 122 names.

Macro Commentary

After a stellar 2022 the place Saudi proved to be one of many fastest-growing G-20 nations (development of 8.7%), it was at all times going to be a tricky job to maintain the robust momentum going for one more 12 months. Unsurprisingly, the wheels seem to have come off, with the latest Q2 knowledge highlighting that the economic system solely grew by 1.1% on an annual foundation (in Q1 development stood at 3.8%) the bottom price since 2021. For context over a 12 months in the past, the economic system was rising at double-digit ranges.

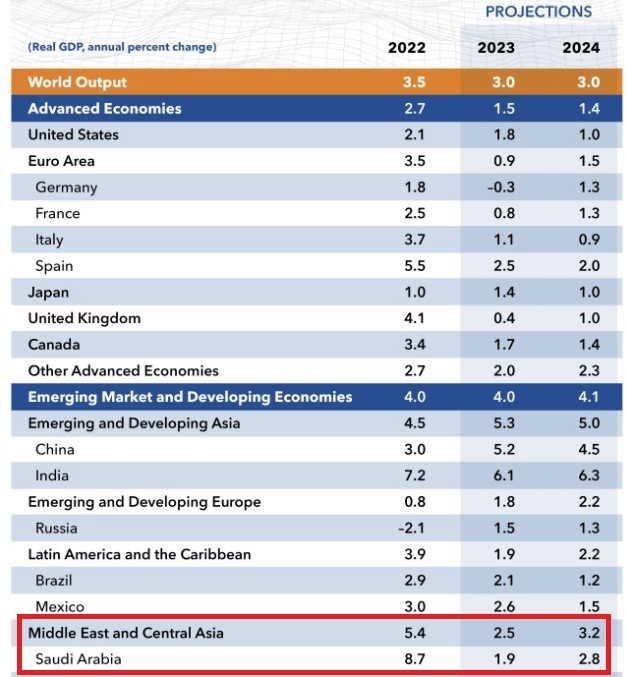

Now, wanting forward, issues aren’t anticipated to be too resilient; a few months again, the IMF had printed its newest WEO report, and in that report, the Saudi area acquired probably the most pronounced minimize in FY GDP estimates amongst most different areas. Beforehand, the IMF felt that Saudi would develop by over 3%, however now, that determine has been curtailed even additional to 1.9%, even decrease than the anticipated GDP development of the Center East and Central Asia areas.

IMF

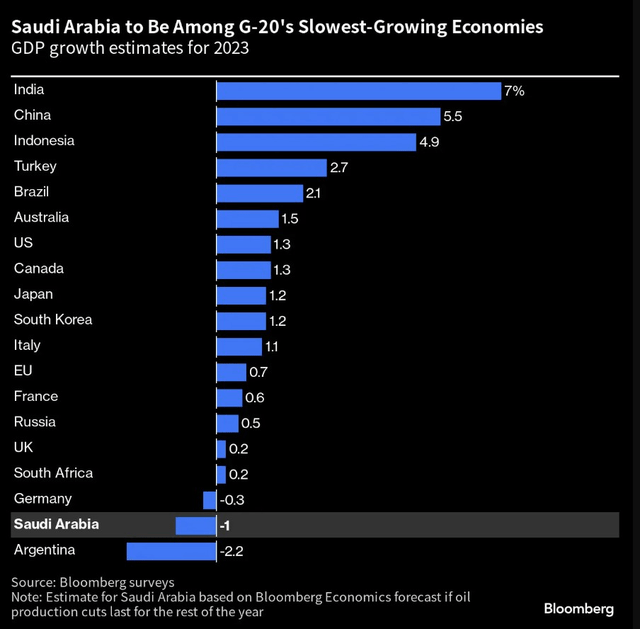

Some establishments like Bloomberg Economics would say that anticipating constructive financial development this 12 months could even be a stretch, given what’s taking place with crude manufacturing.

Bloomberg

For context observe that final 12 months, the Saudi economic system was pumping crude output of 10.5 million barrels per day, however this 12 months, the economic system has been implementing manufacturing cuts of 1 million barrels per day, which are actually additionally prone to lengthen until the top of the 12 months. Khalij Economics means that this might translate to a manufacturing drop of 9% for the 12 months, which might signify the largest drop in 15 years. In the meantime, oil costs which averaged over $100 a barrel final 12 months have come off this 12 months. Despite the fact that, as a part of the Vision 2030 plan, Saudi has been pulling out the stops to diversify away from oil, it’s asking for lots for this phase to carry issues collectively, whilst non-oil metrics equivalent to The Riyad Financial institution Saudi Arabia Buying Managers’ Index drops to its lowest degree in a 12 months.

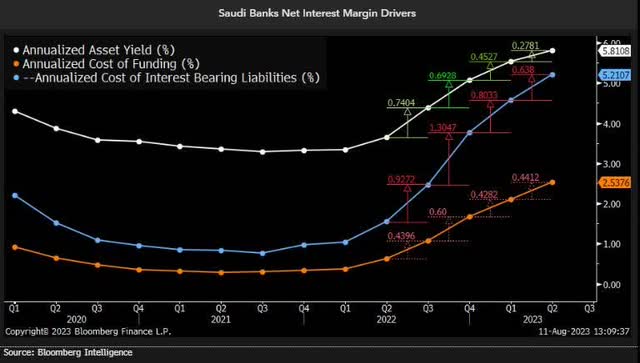

In the meantime, buyers must also think about that the outlook for Saudi banks (they dominate KSA’s portfolio, accounting for 40% of all holdings) isn’t probably the most resilient both. In current quarters, the gap between the yield on loans and the price of funding has been narrowing, and this pattern will persist because the latter usually reacts to larger coverage charges with a lag. All in all, the online curiosity margin (NIM) trajectory of Saudi banks is prone to compress even additional within the quarters forward.

Bloomberg Intelligence

Closing Ideas

In terms of the valuation and technical sub-plots, it’s arduous to be too enthusiastic about KSA proper now.

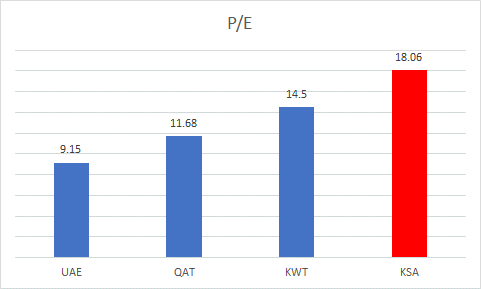

Firstly, on a P/E foundation, this isn’t a very low-cost product to personal; Morningstar knowledge exhibits that it’s priced at an elevated a number of of 18x, a 35% premium over the common of different country-specific ETFs from the Arab area. One may maybe think about paying the premium when you had been getting strong long-term earnings development, however that isn’t the case with an anticipated development price of solely 8%.

Morningstar

Investing

Then on KSA’s weekly chart, we are able to see that because it peaked on the $51 ranges in April final 12 months, the value motion has largely adopted a descending channel sample. There have been some makes an attempt to interrupt previous the higher boundary of the channel in late July this 12 months, however that didn’t materialize, and the ETF has continued to reveal weak point since then (as famous earlier, this ETF additionally has a big chunk of quick curiosity stress driving behind it). Despite the fact that we have seen the value drift away from the higher boundary of the channel, when you think about the place the decrease boundary is presently perched, the reward-to-risk equation at present ranges nonetheless doesn’t look engaging.

Stockcharts

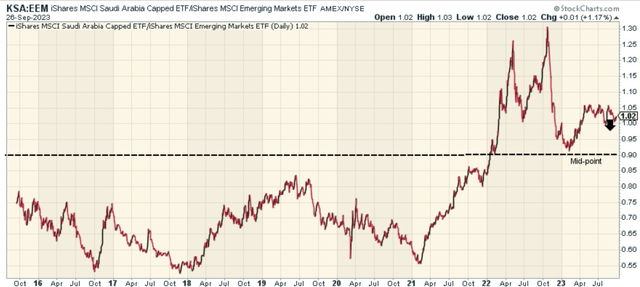

Lastly, additionally think about that relative to the broad rising markets universe, KSA continues to be buying and selling above the mid-point of its long-term vary, growing the chance of additional mean-reversion within the durations forward.