Jesse Powell, the founding father of Kraken trade, has voiced robust help for Brian Brooks, the previous appearing US Comptroller of the Foreign money, as the subsequent Chair of the Securities and Trade Fee (SEC).

Powell highlighted Brooks’ broad experience in a Nov. 19 submit on X, noting that his understanding extends past crypto to the SEC’s regulatory mandate and outlined limits.

Powell additionally criticized the SEC’s present state, suggesting it has deviated considerably from its core obligations, harming US companies and monetary markets within the course of.

Fox Enterprise reporter Eleanor Terrett confirmed that Brooks is being thought of for varied monetary regulatory roles, together with that of the SEC.

Terrett reported that different companies Brooks is being thought of for embrace the Federal Deposit Insurance coverage Company (FDIC), the Workplace of the Comptroller of the Foreign money (OCC), the Monetary Business Regulatory Authority (FINRA), the Monetary Stability Oversight Council (FSOC), and the Federal Reserve.

In the meantime, Brooks’ candidacy comes amidst latest hypothesis about who will succeed Gary Gensler as SEC Chair. Different potential candidates embrace Robinhood’s Chief Authorized Officer Dan Gallagher, SEC Commissioner Hester Peirce (sometimes called “Crypto Mother”), Commissioner Mark Uyeda, and former CFTC Chair Christopher Giancarlo, also called “Crypto Dad.”

Prediction markets on Kalshi presently place Brooks’ possibilities of turning into SEC Chair at 16%, rating him behind contenders like Teresa Goody Guillen and Robert Stebbins.

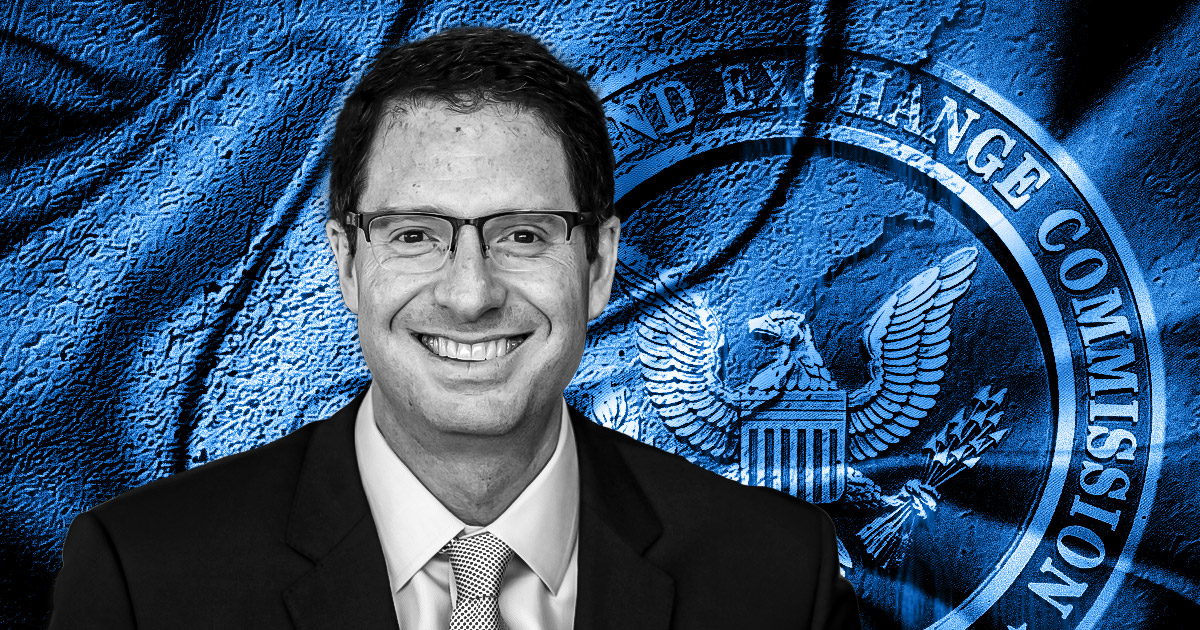

Brooks stance

Commenting on the evolving scenario, Brooks emphasised that any new SEC Chair beneath Donald Trump’s administration would inherit vital groundwork.

He pointed to Trump’s first time period, throughout which nationwide banks have been approved to custody digital property, stablecoin reserves acquired regulatory readability, and banks have been permitted to behave as validator nodes on blockchain networks.

Brooks famous that these measures acknowledged decentralized techniques as professional and set the stage for additional progress.

He concluded that the subsequent SEC Chair can have the chance to construct on these foundations to advance the crypto trade and enhance regulatory readability.