Scott Olson/Getty Photographs Information

The retail area has seen a brutal 12 months resulting from stock points and shopper spending shifts to experiential occasions. Kohl’s (NYSE:KSS) has been hit onerous by weak demand, however the division retailer retailer continues to ship substantial earnings with higher days forward. My funding thesis is extremely Bullish with KSS inventory buying and selling on the lows whereas earnings are scraping alongside the underside.

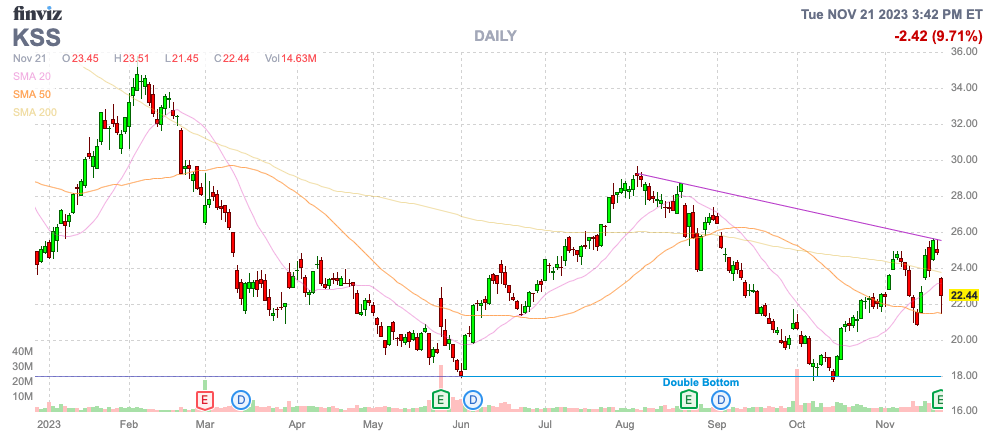

Supply: Finviz

Not Horrible

Kohl’s reported weak gross sales for FQ3’23, however the firm has an initiative to strip out some on-line promotions impacting gross sales, however not earnings. The division retailer reported the next quarterly numbers:

Supply: Looking for Alpha

The inventory is down considerably due presumably to the gross sales miss, however the firm boosted EPS targets for FY23 following the FQ3 beat. Kohl’s now forecasts a yearly EPS of $2.30 to $2.70, up from $2.10 to $2.70, with a really low working margin of simply 4%.

The division retailer proprietor generated a $7+ EPS again through the Covid boosts, however the retail sector has run into powerful comps together with a weak demand atmosphere. New CEO Tom Kingsbury made the next assertion on the FQ3’23 earnings name summing up the headwinds:

We achieved this regardless of a softer-than-expected demand atmosphere pushed by less-than-ideal climate and protracted macroeconomic pressures on our buyer.

Sephora stays a giant development driver with a goal of reaching 2025 gross sales of $2 billion. The sturdy development within the magnificence phase hasn’t helped the general enterprise as weak spot in areas like attire have utterly offset all the development in magnificence.

The CEO was clear the retailer is positioned accurately to profit from developments outdoors of attire per this second on the earnings name:

Enhancing the client expertise stays our high precedence and represents the biggest development alternative for Kohl’s. As I shared on our Q2 name, we consider Sephora, gifting, impulse and residential decor, and longer-term, new shops, would be the most vital contributors to our future development, as these are largely white area alternatives for Kohl’s.

A variety of buyers see the division retailer retailer as a dying firm, however Kohl’s stays poised for strong development within the years forward.

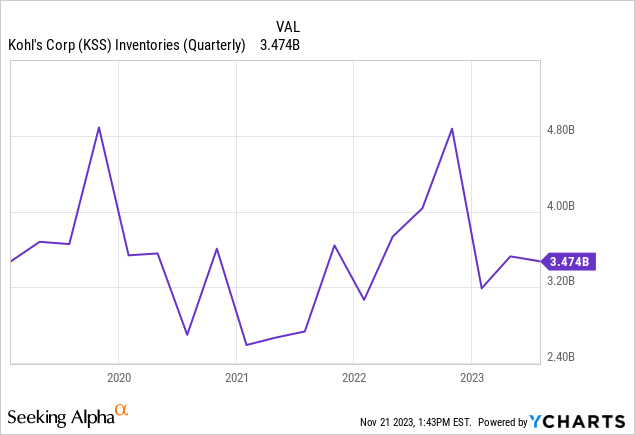

The corporate has dramatically lowered stock ranges heading into the vacation interval organising the higher FY24. Stock ended the quarter at $4.2 billion, down 13% from final 12 months’s degree of practically $4.9 billion.

Kohl’s truly has much less stock going into the 2023 holidays than again in 2019 previous to Covid when inventories have been a much like the $4.9 billion degree final 12 months.

Double Margins

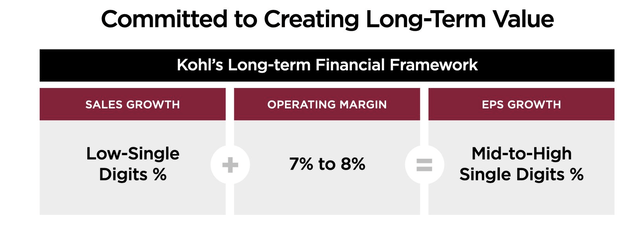

All Kohl’s has to do to be able to produce a $5+ EPS is to recapture an working margin within the 8% vary. When mixed with precise gross sales development, the corporate has the potential to develop EPS by single digit price on high of the $5 EPS goal.

Supply: Kohl’s FQ3’23 presentation

Not way back, enterprise corporations have been battling over paying $60+ for the inventory. Kohl’s solely must commerce at 12x a normalized $5 EPS to be able to return to $60.

Again in FY19, the division retailer retailer was a struggling idea engaged on initiatives to return to constant development. Even in that interval, Kohl’s earned ~$5 per share with an working margin of 5.5%.

The corporate seems vastly improved with the Sephora enterprise and the enhancements in magnificence, house items and impulse offering precise catalysts for development. All whereas buyers are getting a $2 dividend with an enormous 8% yield as a result of normalized path of the enterprise again to a spot the place the payout ratio is sub-50% and the dividend yield seemingly dips again to a traditional 3% degree.

Takeaway

The important thing investor takeaway is that Kohl’s is scraping alongside the underside in FY23 as a result of macro headwinds and the attire sector stock ranges. The division retailer has higher days forward and buyers get the chance to load up on the inventory right here on the multi-year lows.