Aufa Fahmi/iStock through Getty Photos

I’ve among the finest readers and responders on the planet.

Sorry to all my fellow contributors right here on Searching for Alpha and elsewhere, however I stand by that assertion. So lots of the buyers who comply with me are completely superior.

They’re engaged. They’re participating. They assist hold me mentally sharp with their questions and feedback.

To not point out motivated and humble. I can not overlook about that.

It is exceptionally essential for an expert to take care of a wholesome dose of humility. Particularly when he has over 100,000 followers, as I do, it is easy to get immodest. And as soon as he begins pondering he is all that and a bucket of buttered popcorn, he stops pondering as critically.

Which results in errors.

All of us make errors, in fact. That is inevitable. However the entire level of life – skilled or in any other case – is to make as few as doable. Particularly when one thing essential is on the road.

In case I have to say it, you and your cash are essential to me. Subsequently, I admire even the less-than-tactful responses I get.

So, sure, my readers and responders are wonderful for all these causes. However typically I get an additional perk as effectively. A bonus, if you’ll.

That was the case after I learn “Harriho’s” touch upon my latest “It is Not All the time Rainbows and Butterflies” article.

As a result of, because it seems, he is humorous on high of every part else.

Harriho Goes for the REIT Gold

Regardless of the aforementioned article’s title, I did suggest some actual property funding trusts.

As I discussed within the abstract, “I imagine we’re within the early levels of a REIT rally.” And “whereas investing will be troublesome and difficult (not all rainbows and butterflies), I am starting to see the sunshine on the finish of the” tunnel.

As such, I talked up Alexandria Actual Property (ARE), Realty Earnings (O) – in fact – and Mid-America Condo (MAA).

That prompted fairly a number of feedback, together with this one from Harriho:

“It simply appears to me that the slogan ‘do not chase yield’ is just a little too simplistic [which I also mentioned in the article]. Every thing being equal, a 6% yield is best than a 5% yield. The trick, it appears, is to guarantee that the upper yield is just not predictive of a coming drop in share worth.

“However I feel the alternative is perhaps true. A excessive yield often represents an already-occurred drop in share worth and, except the underlying enterprise has cratered, presages a regression to the imply. That’s, a worth appreciation.”

He went on to notice that this notion is why he is “caught with REITs the final couple of years.” He faithfully took the dividends he bought and put them proper again into the dividend-payers, accumulating up increasingly dividends within the course of – all whereas “ready for worth appreciation” to spice up his good points additional nonetheless.

“I do not need to sound simplistic,” he added. “When selecting the high-dividend shares I chosen, I did my finest to know the general well being of every enterprise and the chances that its worth would get well when REITs had been again in vogue… though I can not say that my nerves did not expertise some vital challenges” in consequence.

I admire that clarification, as I will clarify under.

A Large Hurrah! For Harriho

Harriho appears to have an excellent investing strategy:

- He assessed the businesses.

- He assessed the markets.

- He assessed himself, appropriately deeming himself powerful sufficient to face up to short-term disappointments and frustrations.

For all these causes, I salute him!

For any yield-chasing buyers, please notice that he general caught with the 6%-8% dividend-yielding vary. As he went on to acknowledge, double-digit charges often signify “one thing rotten.”

He wasn’t going overboard pondering he may earn money from sucker yields. Which is sweet, as a result of no person can.

Even with this success, although, Harriho nonetheless has one downside, which he addressed with dry wit:

“However now I’m 78 and am starting to must promote some inventory to assist our residing bills. So the costs of no less than a few of my investments matter. I’ve two decisions – blow up each girls’s clothes and/or each residence adorning story on the planet or optimize the money worth of my investments.

“The optimizing investments alternative might be the better path, though intellectually tougher. Utilizing the straightforward precept of promoting excessive, I count on to have some good decisions as REIT costs proceed to extend.

“Nevertheless, I’m not positive what the proper technique is for selecting the correct inventory to promote. The one with the best appreciation? The one with the bottom dividend? The one whose enterprise appears the least wholesome? Maybe simply these tax heaps which may nonetheless be at a loss in order to cut back taxes for so long as doable?

“Brad – you do an excellent job of telling us what to purchase. How a couple of dialogue about what to promote?”

When you’re in an analogous state of affairs the place you are contemplating a lifetime of crime, hold studying. I feel I’ve an answer. And it is arson-free.

I promise.

When To Maintain Them and When to Fold Them

Let me simply begin by making it completely clear that I’m not attempting to, nor am I certified to, give direct monetary recommendation on any investor’s portfolio or place inside the portfolio. Moreover, I’m not attempting to, nor am I certified to, give tax recommendation.

I’m solely expressing my opinion, what I’ve discovered by the years, to explain how I take a look at issues. Nevertheless, my state of affairs and threat aversion may very well be very completely different than yours, so please don’t misunderstand any of the next as private monetary recommendation on whether or not or to not promote a specific place.

So when to promote?

Harriho gave us some choices to pick from:

- The inventory with the best appreciation

- The inventory with the bottom dividend

- The inventory whose enterprise appears the least wholesome

- The inventory with losses that may offset taxes.

Now, it is no secret that I have been influenced by among the biggest buyers of all time, together with Benjamin Graham, Warren Buffett, and Peter Lynch.

One among biggest classes I’ve discovered is to take a look at the basics of the underlying enterprise reasonably than a inventory as a chunk of paper that adjustments worth every day.

Novel Investor

The explanation I convey this up is as a result of out of the 4 choices listed, just one offers with the enterprise fundamentals whereas the others revolve extra across the inventory:

- The inventory whose enterprise appears the least wholesome.

That is the choice I might personally selected in assessing whether or not or to not promote a enterprise/inventory.

One may argue that the inventory with the bottom dividend yield is a elementary metric, however I view this extra as a perform of market worth.

As an illustration, an organization may have a low yield as a result of they reduce the dividend (enterprise elementary), however sometimes the market worth will endure in consequence, pushing the yield again increased.

Slightly than specializing in the dividend yield, I’d take a look at the corporate’s dividend historical past to see if they’ve ever reduce the dividend, the common dividend progress price, the present and ahead / anticipated dividend payout ratio, and so on.

Basically, I would reasonably personal a inventory yielding 2% if the dividend is on sound footing reasonably than a inventory with an 8% yield and a really excessive payout ratio or every other deteriorating fundamentals.

I maintain Prologis (PLD), which is now yields roughly 2.60%, however I might not promote it just because my different shares had the next yield.

PLD’s dividend yield exceeded 3.00% not too way back. The explanation it’s now decrease is as a result of the inventory’s worth has appreciated roughly 20% during the last month. Usually, many of the main blue-chip REITs don’t pay the best dividend yield.

So my private desire on whether or not or to not promote wouldn’t be primarily based on the dividend yield.

Novel Investor

What concerning the inventory with the best appreciation?

When to take earnings is a tricky one for a lot of buyers.

Do you promote simply because the worth ran up 10% within the final week?

What if the inventory worth continues to be below the companies’ intrinsic worth, do you continue to promote due to the speedy worth appreciation?

To make issues extra sophisticated, I actually suppose the reply to this query is completely different, relying on what stage of life you’re in.

When you’re retired or near retirement, possibly you are taking the revenue even when the worth continues to be below the companies’ intrinsic worth.

For me and the place I am at in life, as long as the enterprise is performing effectively basically, I am not trying to promote except the worth has gotten absurdly increased than the worth of enterprise, through which case I’d trim, however I might not shut out a place completely simply to seize the capital acquire, since I am nonetheless investing for the lengthy haul and need to personal my companies for so long as they’re worthwhile and offering reliable revenue.

An investor in a distinct stage of his or her life, or with completely different threat tolerances, might understandably have a very completely different perspective.

Novel Investor Novel Investor

What about promoting a inventory at a loss to cut back taxes?

Once more, I’ve to reiterate that I’m not a Licensed Public Accountant, and I’m not giving tax recommendation, nor am I certified to provide tax recommendation. What I can say is that, personally, I look to the enterprise fundamentals no matter its tax implications.

Do not get me incorrect, I do not need to pay extra taxes than I’ve to, however a promote resolution of mine could be primarily based on the enterprise fundamentals and never its influence on my taxes.

Now, if the enterprise is deteriorating, I’d promote at a loss and reap the advantages of tax loss harvesting, however my resolution to promote could be primarily based on the enterprise fundamentals itself, reasonably than what capital good points may very well be offset.

Novel Investor

I assumed it is perhaps useful to try a pair shares I am up on year-to-date (“YTD”) to see how I’d decide whether or not or to not promote.

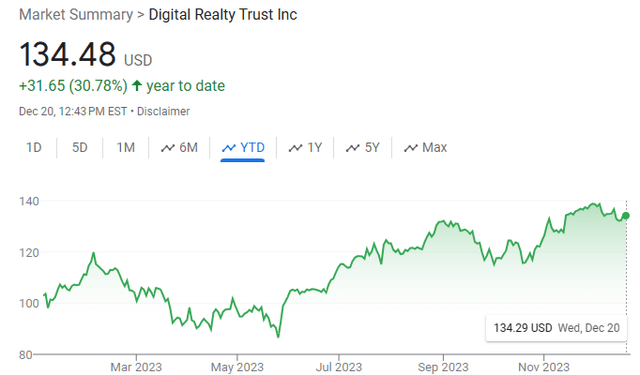

- Digital Realty (DLR): YTD +30.83%

- STAG Industrial (STAG): YTD +20.19%

- Simon Property Group (SPG): YTD +24.45%.

Google

Digital Realty Belief, Inc. (DLR)

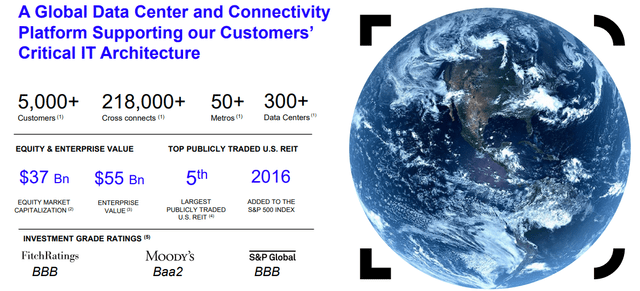

Digital Realty is an information heart REIT that owns properties world wide with a portfolio of comprised of greater than 300 information facilities positioned in over 25 international locations and throughout 6 continents.

Knowledge facilities are a essential element to on a regular basis life, as they’re a part of what I prefer to name the “e-commerce trifecta.” Together with logistic properties and cell towers, information facilities play a pivotal function within the interconnected world we reside in.

Digital Realty’s information facilities are utilized by world main enterprises together with Oracle, IBM, Meta, JP Morgan Chase, and AT&T and supply an array of expertise options together with interconnection, colocation, and devoted server halls for hyperscale prospects.

DLR – IR

Synthetic Intelligence (“A.I.”) has actually been a tailwind for sure tech firms and information facilities all through 2023.

The fundamental thought is that as firms rely increasingly on A.I. options, their want for information storage, group, and processing will solely turn into better.

This could enhance demand for DLR’s server racks, which ought to finally translate into elevated revenues, money stream, and dividends. A.I.’s optimistic influence has already been priced in as DLR’s inventory has gained over 30% YTD.

Google

So I am up fairly a bit on DLR this yr, ought to I promote and seize the +30% acquire? Nicely, to ensure that me to find out that, I might want to take a look at the corporate’s fundamentals.

A.I., the cloud, and all different issues tech will solely proceed to develop for my part, which bodes effectively for expertise REITs like Digital Realty.

The info heart enterprise is simply gaining extra relevance as extra applied sciences are found and applied. The purpose I am attempting to make is that I do not see any situation with DLR’s primary enterprise mannequin of offering specialised area for laptop servers.

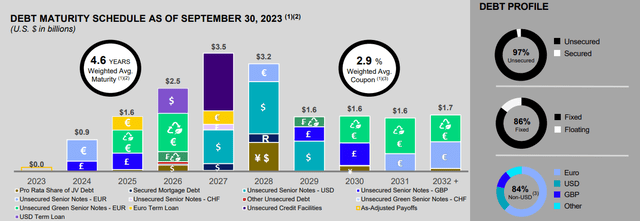

The subsequent factor I need to take a look at is the monetary energy of the corporate. DLR has an investment-grade stability sheet with a BBB credit standing and sound debt metrics together with a web debt to adjusted EBITDA of 6.2x, a set cost protection ratio of 4.1x, a long-term debt to capital ratio of 49.82%, and $2.1 billion in revolver capability.

DLR is in a robust monetary place and should not have any points making curiosity funds on their debt and addressing maturities as they arrive due.

DLR – IR

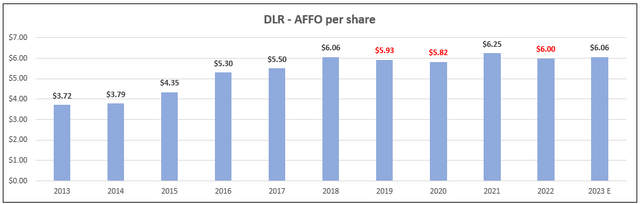

Over the past decade, DLR has had a mean adjusted funds from operations (“AFFO”) progress price of 5.31% and solely had 3 years of damaging AFFO progress since 2013.

Digital Realty generated $3.72 per share in AFFO in 2013 and analyst count on AFFO per share to extend to $6.06 by the top of 2023.

Since 2019, AFFO progress has slowed, however DLR continues to be rising albeit at a slower tempo. It is going to be attention-grabbing to see what influence A.I. will finally have on DLR’s AFFO per share, however I count on it would assist DLR return to progress. Analysts count on AFFO per share to extend by 3% in 2024, after which enhance by 7% in 2025.

FAST Graphs (compiled by iREIT®)

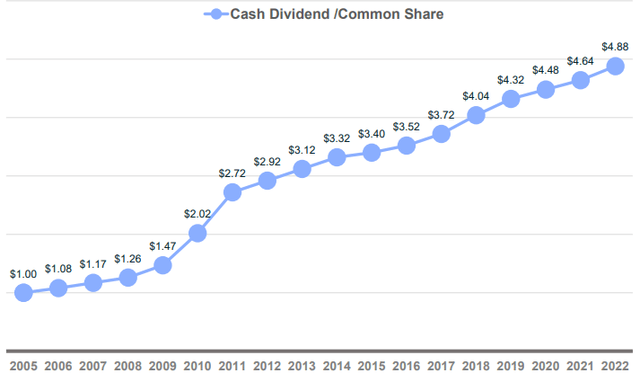

Digital Realty’s dividend has been very dependable for fairly a while and has been elevated annually since 2005.

From 2005 to 2022, DLR grew its dividend at a compound annual progress price of 10%. The dividend is effectively lined with a 2022 year-end AFFO payout ratio of 81.33% and an anticipated 2023 AFFO payout ratio of 80.52%.

DLR – IR

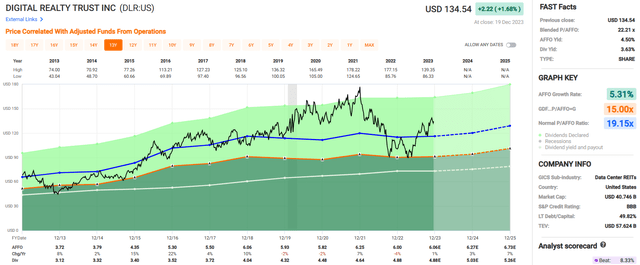

DLR pays a well-covered 3.63% dividend yield and is buying and selling at a premium to its 10-year common AFFO a number of.

At the moment shares of DLR are buying and selling at a P/AFFO of twenty-two.21x, in comparison with its 10-year common AFFO a number of of 19.15x. With AFFO progress moderating during the last a number of years I might be hesitant to pay an excessive amount of of a premium for DLR, however on the identical time I see the enterprise prospering over the long run and suppose it is a good enterprise to personal.

Despite the fact that I am up fairly a bit YTD, I plan to carry my DLR shares.

FAST Graphs

STAG Industrial, Inc. (STAG)

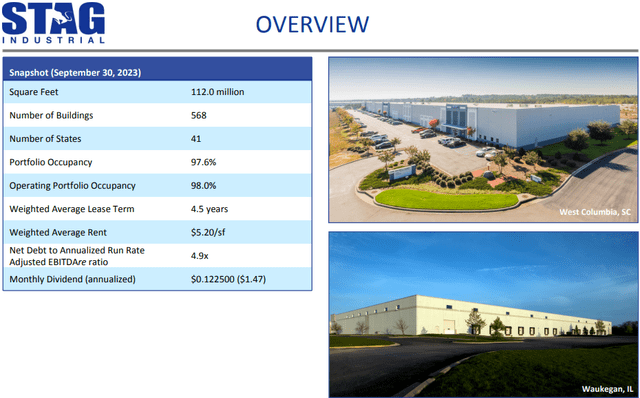

STAG is REIT that focuses on the acquisition and operation of single-tenant industrial properties with a portfolio totaling 112.0 million SF that’s comprised of 568 industrial properties positioned throughout 41 states inside the U.S.

STAG funding technique revolves round 2 fundamental ideas:

- That single-tenant industrial properties have a binary threat in that the constructing both has a tenant or not, and that the market costs single-tenant industrial properties with the next threat profile and consequently a decrease worth relative to its money stream. STAG’s technique is to personal a portfolio of many single-tenant industrial properties which mitigates the binary threat related to anyone property.

- STAG’s not against grabbing low-hanging fruit. Now wait a minute, I am not saying that STAG acquires low high quality or inferior properties, what I’m saying is that STAG is just not against focusing on properties which might be in center markets and doesn’t completely goal main or gateway markets. STAG’s reasoning for that is that center markets don’t garner the identical consideration from institutional buyers and are extremely fragmented the place the competitors for acquisitions tends to be native buyers with out the identical entry to debt or fairness capital. Basically, STAG is just not against being the largest fish in a small pond if the risk-adjusted returns warrant it.

On the finish of the third quarter, STAG had a portfolio occupancy of 97.6% with a weighted common lease time period (“WALT”) of 4.5 years.

STAG – IR

Okay, as a shareholder of STAG I am up just a little greater than 20% YTD – ought to I promote?

Google

As an industrial REIT I do not see any points with STAGs enterprise mannequin, as industrial properties proceed to be in excessive demand and needs to be for the foreseeable future given the speedy adoption of e-commerce.

Like information facilities, industrial / logistics properties are a part of the “e-commerce trifecta” and are needed for on-line retail gross sales and achievement. I see a long-runway for progress for STAG and lots of different industrial REITs.

A thriving property sector is nice, however what does STAG’s stability sheet appear like?

STAG has an investment-grade stability sheet with a Baa3 credit standing from Moody’s and a BBB credit standing from Fitch.

They’ve stable debt metrics, together with a web debt to adjusted EBITDAre of 4.9x, a long-term debt to capital ratio of 43.28%, and a set cost protection ratio of 5.7x.

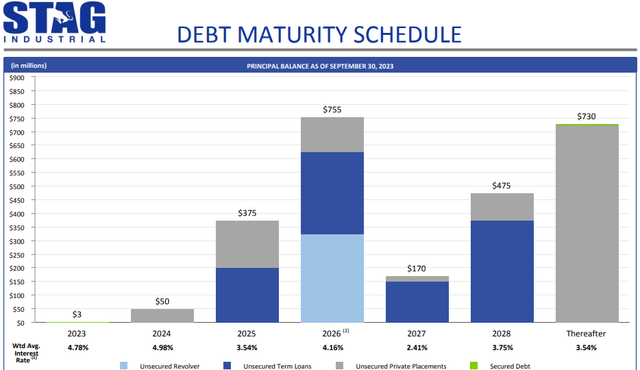

Moreover, STAG has $682.6 million of liquidity and no materials debt maturities till 2025.

STAG – IR

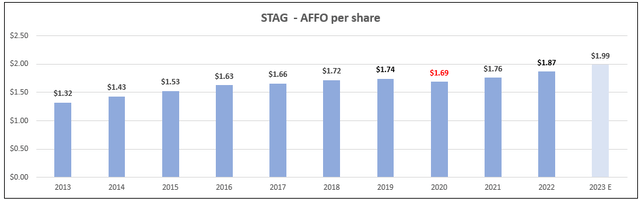

Over the past decade, STAG has had a mean AFFO progress price of 5.00% with only one yr of damaging AFFO progress since 2013.

Analysts count on AFFO per share to extend by 6% in 2023, after which enhance by 3% and seven% within the years 2024 and 2025, respectively.

I do not see something of their earnings efficiency that will make me need to promote the inventory.

FAST Graphs (compiled by iREIT®)

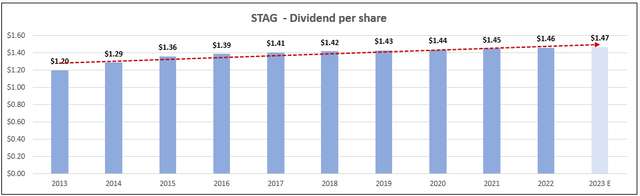

STAG elevated its dividend annually since 2013 and has a mean dividend progress of three.22% over the previous 10 years.

Whereas the dividend progress has solely been reasonable, STAG has been very dependable with its month-to-month dividend, elevating it annually during the last decade, even through the 2020 pandemic.

Moreover, STAG’s dividend is safe, with a 2022 year-end AFFO payout ratio of 78.08%, and an anticipated 2023 AFFO payout ratio of 73.86%.

FAST Graphs (compiled by iREIT®)

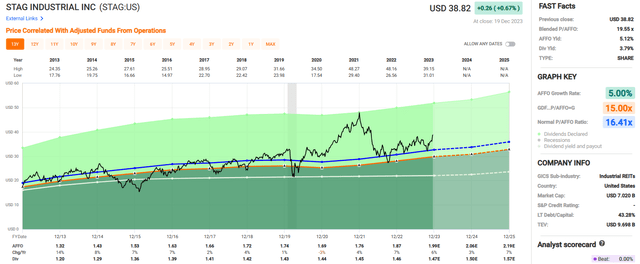

STAG is a good way so as to add industrial publicity at an affordable AFFO a number of.

Many different industrial REITs commerce nearer to a 30x AFFO a number of like Prologis (P/AFFO – 29.07x), or Rexford Industrial (REXR) (P/AFFO – 32.92x). In the meantime, STAG is buying and selling at a P/AFFO of 19.55x.

Granted, STAG doesn’t ship the identical progress charges as the opposite industrial REITs I simply talked about, so a decrease a number of is warranted, however not by 10 to 12 turns.

Whereas STAG is buying and selling at a reduction in comparison with nearly all of its friends, it’s buying and selling at a premium because it pertains to their previous earnings multiples.

At the moment STAG pays a 3.79% dividend yield that’s effectively lined and trades at a P/AFFO of 19.55x, in comparison with its 10-year common AFFO a number of of 16.41x.

I am up fairly a bit on STAG this yr, however plan to carry on to my shares.

FAST Graphs

Simon Property Group, Inc. (SPG)

Simon Property is a mall REIT that develops, owns, and manages a portfolio of premier purchasing, leisure, and mixed-use locations that primarily encompass malls, The Mills, and Premium Shops.

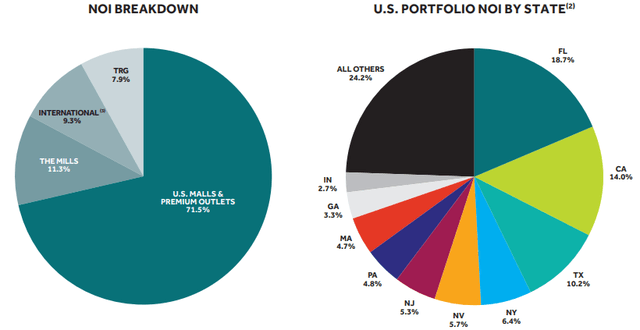

On the finish of the third quarter, SPG’s portfolio consisted of 195 properties throughout 37 states within the U.S., which incorporates 93 malls, 14 Mills, and 69 Premium Shops.

Moreover, SPG has an curiosity in 24 super-regional and outlet malls in america and Asia by its 84% noncontrolling curiosity within the Taubman Realty Group (“TRG”).

Internationally, SPG owns 35 Premium Shops that are positioned in Europe, Canada, and Asia.

And SPG owns a 22.4% fairness stake in Klépierre, which is an actual property firm primarily based out of Paris that owns or has an possession curiosity in purchasing facilities throughout 14 international locations in Europe.

SPG – IR

To date this yr, SPG is up roughly 22%, ought to I promote it?

Let’s examine what the enterprise fundamentals appear like so as to resolve.

Google

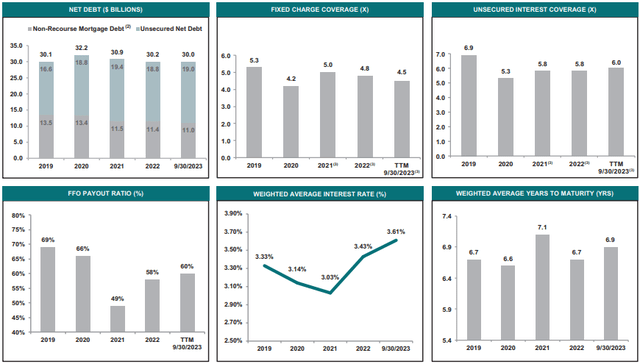

Simon Properties has an investment-grade stability sheet with an A- credit standing from S&P International and powerful debt metrics together with:

- whole debt to whole belongings ratio of 42%

- web debt to EBITDA of 6.10x

- mounted cost protection ratio of 4.5x.

- 3.61% W.A. rate of interest

- W.A. time period to maturity of 6.9 years

- $8.8 billion of liquidity.

Simon’s stability sheet and monetary place look sturdy, so no worries on this entrance.

SPG – IR

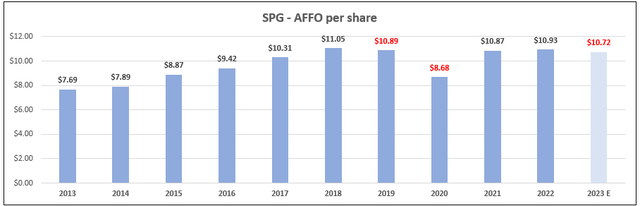

Since 2013, SPG has had a mean AFFO progress price of three.90% and has solely had 2 years of damaging progress and 1 yr of anticipated damaging progress (2023).

The pandemic hit malls significantly onerous, and in 2020 the corporate’s AFFO fell by roughly -20%, however then recovered the next yr with AFFO growing by 25% in 2021.

Since that point, AFFO progress has been muted, with AFFO per share growing 1% in 2022, anticipated to fall by -2% in 2023, after which anticipated to extend by 2% in each 2024 and 2025.

FAST Graphs (compiled by iREIT®)

Sadly, on account of the pandemic and compelled closures, SPG’s AFFO fell by -20% in 2020 and compelled the corporate to chop its dividend from $8.30 per share in 2019 to $6.00 per share in 2020, representing a dividend reduce of roughly -27.71%.

I’m not the kind of particular person to make excuses, however on this case I can perceive the blemish on their dividend report, because the pandemic was a black swan occasion and hopefully won’t occur once more in our lifetimes.

After the massive dividend reduce in 2020, SPG reduce the dividend by -2.50% the next yr, however then elevated it by virtually 18% in 2022.

One of many strongest options of SPG’s dividend is its conservative payout ratio. At 2022 year-end, SPG had an AFFO payout ratio of 63.13% and are anticipated to have an AFFO payout ratio of 69.49% in 2023.

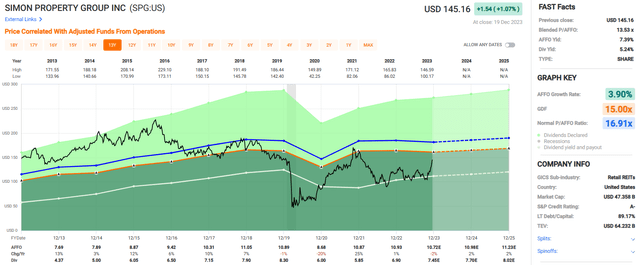

At the moment Simon Property pays a 5.24% dividend yield that’s safe and trades at a P/AFFO of 13.53x, in comparison with their 10-year common AFFO a number of of 15.96x.

I will must admit that malls aren’t my favourite property sector proper now, and there are a number of indications that the way forward for brick & mortar retail might want to have an omni-channel element, which malls aren’t arrange effectively to do.

Nevertheless, on the identical time, nobody is aware of for positive what the longer term holds, and the Simon household has been making a living off its actual property since 1960 and I imagine they’ll proceed to take action for the foreseeable future.

Nicely, I am up over 20%, ought to I promote?

This one might be the toughest for me to resolve. The corporate’s administration is high class, possibly the very best within the retail area, and the corporate is in good monetary well being. They pay a excessive yield that’s well-covered, so I do not see any elementary points relating to SPG’s skill to make its dividend funds.

My solely reservation is the way forward for malls and the way they’ll match within the post-covid world given shoppers demand for omni-channel retailers. If the worth was discounted sufficient, I might nonetheless add to my place in small batches, however provided that the P/AFFO ratio is simply a number of turns below its common –

I plan on holding my SPG shares for now.

FAST Graphs

In Closing

One of many largest myths with regards to shares is the saying that,

Nobody ever went broke taking a revenue.

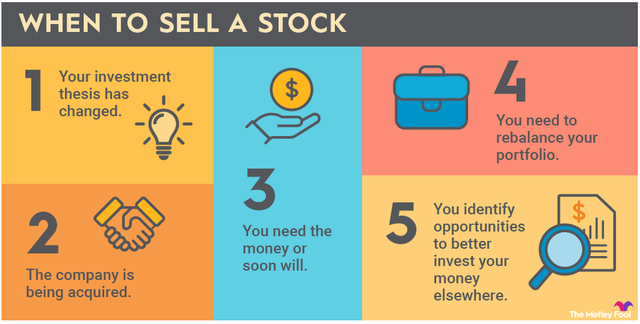

That is false, as a result of promoting merely as a result of inventory worth going up is just not a sound funding coverage. In keeping with Motley Idiot, there are a number of good causes for promoting a inventory:

The Motley Idiot

I lately bought shares in OneMain Holdings (OMF) and Toll Brothers (TOL) so as to recycle the capital into REITs.

I additionally bought out of W.P. Carey (WPC) after the corporate reduce its dividend.

I additionally bought my shares in Alpine Internet Lease (PINE), CTO Realty (CTO), International Medical (GMRE), and Nationwide Storage (NSA), and Postal Realty (PSTL) as a result of I wished to deal with blue-chip names like Agree Realty (ADC), Realty Earnings (O), and VICI Properties (VICI).

Inquiring minds need to know, what are you promoting?