MD SHAFIQUL ISLAM

In early June of this yr, MDU Sources Group (MDU) accomplished the spinoff of its aggregates and building companies enterprise that has come to be recognized since then as Knife River Company (NYSE:KNF). This firm, which at present has a market capitalization of $2.26 billion, has performed fairly properly for itself from a income perspective over the previous few years. Income and money flows have been fairly combined, however administration stays optimistic about what the long run holds. This yr particularly, the agency appears to be doing very well for itself and, relative to most different gamers, shares look attractively priced. Given these elements, I’ve determined to fee the enterprise a delicate ‘purchase’ to replicate my view that the inventory ought to most likely outperform the broader marketplace for the foreseeable future.

A brand new aggregates enterprise

Although the operations of Knife River will not be precisely new, its standing as a standalone, publicly traded firm, most definitely is. It was solely in June of this yr that the corporate turned unbiased of its former father or mother. Earlier than we dive into why I really feel the corporate provides upside potential, it could be useful to have a greater understanding of what the company does and the way precisely it operates. In accordance with administration, the agency is among the main suppliers of crushed stone, sand, and gravel within the US. It has operations throughout 14 states and it boasts 1.1 billion tons of mixture reserves right now.

There are a lot of aggregates corporations on the market that merely promote their merchandise off to different gamers to take care of as they’ll. Nonetheless, roughly 40% of the aggregates produced by Knife River are retained by the corporate for the aim of making value-added downstream merchandise. Examples right here can be ready-mix concrete and asphalt. 16% of the corporate’s income comes from aggregates. 19% comes from ready-mix concrete, whereas 14% is attributable to asphalt. One other 13% of income comes from miscellaneous choices. And the biggest chunk of income, 38% in all, comes from contracting companies. Contracting companies supplied by the corporate focus on heavy civil building actions, asphalt paving, concrete building, web site improvement, grading companies, and different related actions.

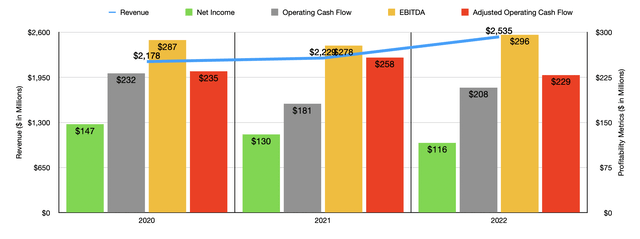

Creator – SEC EDGAR Knowledge

Over the previous few years, administration has performed a very nice job rising the corporate’s high line. Income has gone from $2.18 billion in 2020 to $2.54 billion in 2022. There has not been one main income supply that has caught out as the first driver right here. The very fact of the matter is that all the firm’s main income facilities reported gross sales will increase throughout this three-year window. We do know, nonetheless, that the majority of its gross sales improve could be attributed to a mix of upper quantity of merchandise shipped and better pricing for what it provides. For instance, gross sales of aggregates grew from 30.9 million tons to 34 million tons. Prepared-mix concrete gross sales really dropped barely throughout this time, and asphalt remained kind of unchanged. However the pricing for all of those choices elevated in recent times. The common promoting value for aggregates grew from $13.14 per ton to $14.61 per ton. Prepared-mix concrete grew from $133.86 per cubic yard to $151.80. And eventually, asphalt costs went from $48.58 per ton to $58.93 per ton.

On the underside line, the image has been way more difficult. Internet revenue has really dropped over the previous three years, falling from $147 million to $116 million. Working money move dropped from $232 million to $208 million. Even when we alter for adjustments in working capital, we get a minor decline from $235 million to $229 million. And lastly, now we have EBITDA. It’s the solely profitability metric to enhance throughout this window of time, inching up from $287 million to $296 million.

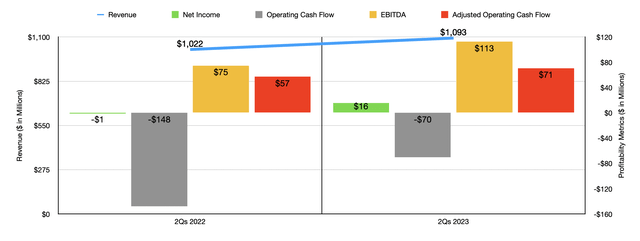

Creator – SEC EDGAR Knowledge

To this point this yr, monetary efficiency has been largely constructive. Income of $1.09 billion beat out the $1.02 billion reported one yr earlier. Profitability fared even higher. The corporate went from producing a web lack of $1.4 million within the first half of 2022 to producing a revenue of $15.5 million the identical time this yr. Working money move improved from damaging $147.8 million to damaging $70.4 million. If we alter for adjustments in working capital, it went from $57.1 million to $70.6 million, whereas EBITDA expanded from $74.5 million to $112.5 million. A whole lot of this enchancment from a profitability perspective happened at the same time as volumes shipped by the corporate declined yr over yr. These declines have been greater than offset by sturdy pricing. For example, aggregates pricing per ton went from $14.77 within the first six months of 2022 to $16.37 the identical time this yr. Prepared-mix concrete pricing went from $147.67 to $168.30, whereas asphalt pricing grew from $57.77 per ton to $66.24.

Creator – SEC EDGAR Knowledge

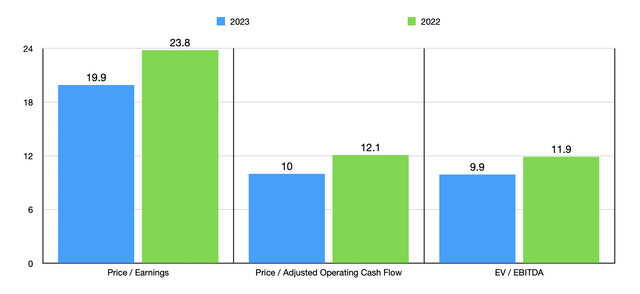

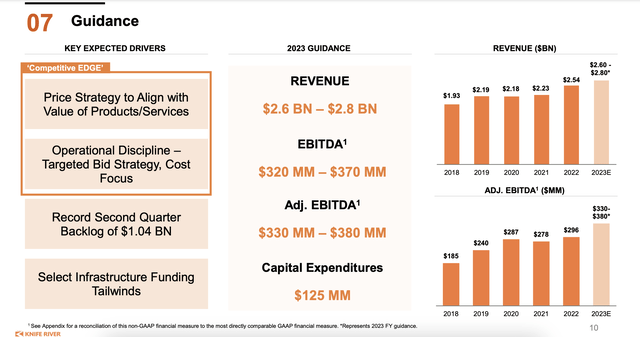

For 2023 in its entirety, administration is forecasting income of between $2.6 billion and $2.8 billion. From a profitability perspective, steerage requires EBITDA of between $330 million and $380 million. If we take the midpoint right here of $355 million, this could translate to adjusted working money move of $275 million and web earnings of roughly $139 million.

Knife River Company

Utilizing these figures, I used to be capable of worth the corporate as proven within the chart above. And within the desk under, I in contrast the enterprise to 5 related corporations. On a price-to-earnings foundation, Knife River ended up being the second least expensive of the group. On the subject of the worth to working money move strategy, it’s the least expensive. In the meantime, utilizing the EV to EBITDA strategy, I discovered that three of the 5 corporations ended up being cheaper than our goal.

| Firm | Worth / Earnings | Worth / Working Money Stream | EV / EBITDA |

| Knife River Company | 19.9 | 10.0 | 9.9 |

| Summit Supplies (SUM) | 22.1 | 10.3 | 9.2 |

| Compass Minerals Worldwide (CMP) | 122.4 | 11.3 | 8.8 |

| Eagle Supplies (EXP) | 12.3 | 10.5 | 8.8 |

| Vulcan Supplies (VMC) | 36.8 | 20.1 | 17.4 |

| James Hardie Industries (JHX) | 22.0 | 15.8 | 12.8 |

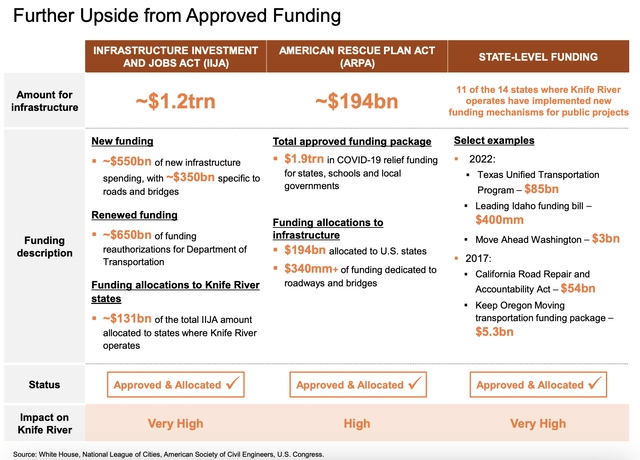

No person is aware of what the long run holds. Nonetheless, administration does appear very optimistic. Utilizing midpoint estimates for this yr, we find yourself with an EBITDA margin of 13.1%. Via cost-cutting initiatives and refocusing to emphasise the next mixture of aggregates, administration expects to extend this margin to fifteen% by 2025. Even when gross sales do not rise, reaching this margin enchancment would translate to an additional $51.3 million in EBITDA per yr. I’d think about, nonetheless, that the underside line affect will really be bigger than this as a result of I imagine that a rise in gross sales is very possible between every now and then. You see, loads of what the corporate does is reliant on authorities spending. And in line with administration, there’s a lot of money getting used on loads of initiatives. For example, the Infrastructure Funding and Jobs Act can open up $1.2 trillion value of infrastructure spending. Of this, $550 billion is new funding, with $350 billion of that quantity being particular to roads and bridges. The opposite $650 billion is renewed funding.

Knife River Company

In fact, it solely issues if a few of the funding has been earmarked for states through which Knife River operates. The excellent news is that this quantity comes out to roughly $131 billion. The American Rescue Plan Act resulted in one other $194 billion being allotted throughout states for infrastructure actions. And 11 of the 14 states the place the corporate operates have carried out new spending initiatives that relate to infrastructure. Clearly, greater spending like it will result in greater demand. And better demand results in extra income and earnings for a corporation like our prospect.

Takeaway

From what I can see, Knife River is a reasonably stable firm. I do not just like the weak point on the underside line over the previous few years. However sturdy pricing this yr has helped the enterprise fairly a bit. There definitely is a development catalyst for the corporate to profit from within the type of greater public spending. And relative to most of its friends, the inventory does look pretty attractively priced. On account of these elements, I’ve determined to fee the enterprise a delicate ‘purchase’ for now.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.