andreswd/E+ through Getty Photographs

Thesis

Kenvue Inc. (NYSE:KVUE), a subsidiary of Johnson & Johnson, is a distinguished participant within the shopper well being business, specializing in a large spectrum of merchandise throughout numerous well being and private care segments.

With a international attain, Kenvue serves its prospects via e-commerce channels, direct-to-consumer avenues, and in depth partnerships with shops and distributors worldwide.

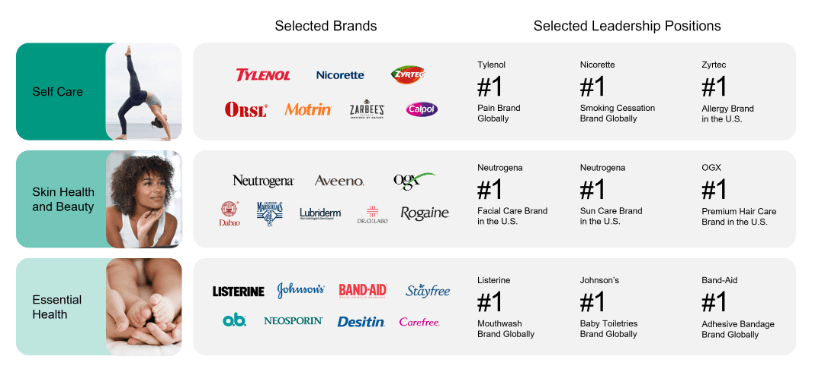

Kenvue is structured into three major enterprise segments, every with a selected concentrate on a various vary of merchandise:

Self-Care Phase

This section encompasses a wide selection of merchandise, together with cough, chilly, and allergy treatments, ache administration options, digestive well being merchandise, and smoking cessation aids, amongst others. On this section, the likes of Tylenol, Zyrtec, and Nicorette supply ache reduction, allergy options, and smoking cessation merchandise, amongst others.

Pores and skin Well being and Magnificence Phase

Kenvue’s Pores and skin Well being and Magnificence section presents a spread of merchandise devoted to non-public care, together with face and physique care, hair care, solar safety, and different magnificence necessities. The Pores and skin Well being and Magnificence section boasts acquainted names like Neutrogena, Aveeno, and Clear & Clear, identified for his or her complete vary of skincare merchandise.

Important Well being Phase

This section is devoted to merchandise associated to oral care, child care, ladies’s well being, wound care, and different elementary healthcare wants. Within the Important Well being section, Listerine takes heart stage with its mouthwash choices, whereas Desitin, Band-Support, and Carefree cater to child care, wound care, and sanitary safety wants.

Kenvue Inc.

This spectacular array of trusted manufacturers positions Kenvue as a major participant within the shopper well being business, devoted to assembly numerous healthcare and private care necessities.

In November 2021, Johnson & Johnson introduced its strategic determination to separate its Client Well being section into a brand new publicly traded firm, marking a major milestone for Kenvue. This transition concerned the switch of the Client Well being Enterprise property and liabilities to Kenvue and its subsidiaries.

Preliminary Public Providing

Kenvue’s transformation continued with its initial public offering (IPO), which commenced on Might 4, 2023, with the inventory buying and selling on the New York Inventory Change beneath the image “KVUE.” Throughout this IPO, Kenvue efficiently bought 198,734,444 shares of frequent inventory, together with the train of the underwriters’ choice to buy extra shares. The providing was priced at $22 per share, producing internet proceeds of roughly $4.2 billion after accounting for underwriting reductions and commissions.

As a part of the IPO and the Client Well being Enterprise Switch, Kenvue distributed a complete of $13.8 billion to Johnson & Johnson. This distribution was composed of internet proceeds from the IPO, internet proceeds from Debt Financing Transactions, and any extra money and money equivalents exceeding $1.17 billion retained by the Firm instantly following the IPO. Following the IPO, Johnson & Johnson retained roughly 89.6% of the full excellent shares of Kenvue frequent inventory, equal to 1,716,160,000 shares.

Aggressive Benefit

Kenvue is poised for gradual gross sales development quickly, amid competitors with consumer-product business leaders like Procter & Gamble Co., in addition to established consumer-health divisions of pharmaceutical firms like Bayer AG and Sanofi SA. Moreover, the corporate faces competitors from shopper spinoffs akin to Haleon, which just lately separated from GSK PLC.

Kenvue’s sturdy market share and well-known manufacturers make it a number one shopper healthcare firm. Kenvue’s aggressive benefit is rooted in its in depth and trusted model portfolio, cultivated over 135 years, together with family names like Tylenol, Listerine, and Band-Support. This numerous portfolio allows the corporate to supply holistic shopper well being options throughout numerous classes and areas, reaching roughly 1.2 billion folks. With a worldwide presence and quite a few #1 model positions each globally and regionally, Kenvue maintains sturdy market management. Moreover, Band-Support’s recognition because the #1 most trusted model in the USA underscores the deep shopper belief in Kenvue’s merchandise. The corporate’s model recognition is a pivotal differentiator, enabling it to thrive in aggressive markets and seize the eye of health-conscious shoppers worldwide.

Kenvue Inc.

Catalyst

The introduction of a new brand and advertising technique for Kenvue’s shopper enterprise marks a catalyst for its development by addressing a number of crucial elements.

Firstly, recognizing that consumer-oriented operations require distinct methods in comparison with pharmaceutical or medical system companies signifies a strategic concentrate on the distinctive wants of the patron market. This specialised consideration can result in extra tailor-made product improvement, advertising, and buyer engagement, enhancing the corporate’s capacity to fulfill shopper calls for successfully.

Moreover, the choice to nominate new administration solely devoted to the patron enterprise suggests a dedication to optimizing operations and techniques on this section, fostering innovation and development. As firms with numerous enterprise segments usually face challenges in useful resource allocation and focus, the transfer to separate these segments can lead to improved operational effectivity and focused investments.

Moreover, studies have proven that each the remaining mum or dad firm and the newly fashioned entity can obtain enhanced efficiency after a break up, which bodes properly for Kenvue’s prospects.

Financials

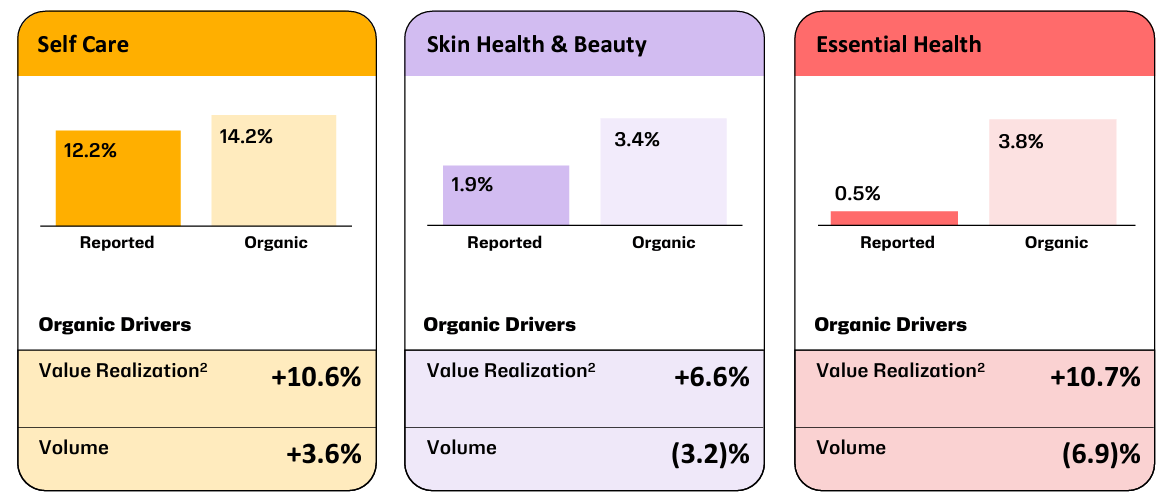

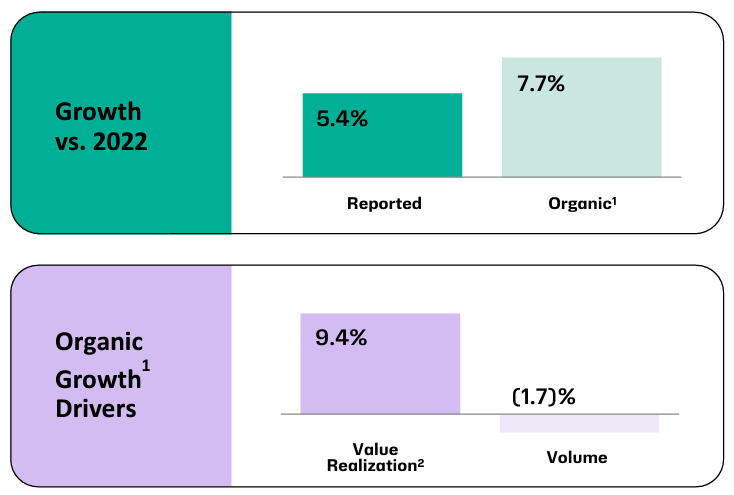

Kenvue Inc.’s monetary efficiency within the second quarter of 2023 paints a nuanced image of alternatives and challenges. Notably, the corporate reported a major 5.4% increase in internet gross sales, indicating the attraction of its product portfolio and types within the shopper well being market.

Kenvue Inc.

Additional evaluation reveals a 7.7% natural development fee, underpinned by worth realization and elevated demand in key product classes, pushed by heightened chilly and flu incidences. These numbers replicate Kenvue’s capability to drive inner development and adapt to shifting market situations.

Kenvue Inc.

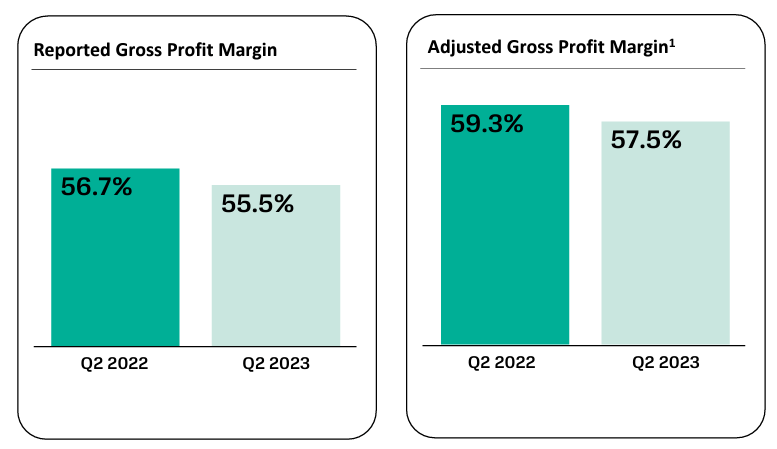

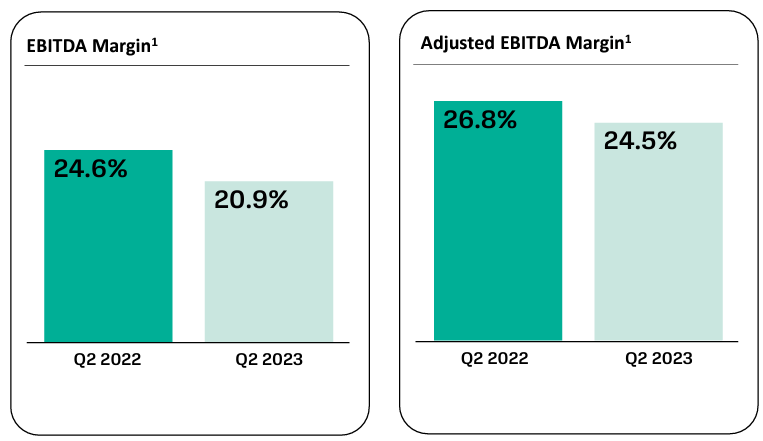

Nevertheless, the declining gross revenue margin and adjusted EBITDA margin (55.5% and 24.5%, respectively) reveal the persistent strain on revenue margins attributed to elements akin to inflation and overseas forex fluctuations. This will require the corporate to effectively handle prices and operations to keep up profitability.

Kenvue Inc.

Kenvue Inc.

Moreover, the upper efficient tax fee (32.7%) in comparison with the prior 12 months (22.1%) and a discount in internet revenue from $604 million to $430 million underscore challenges that impacted the corporate’s backside line.

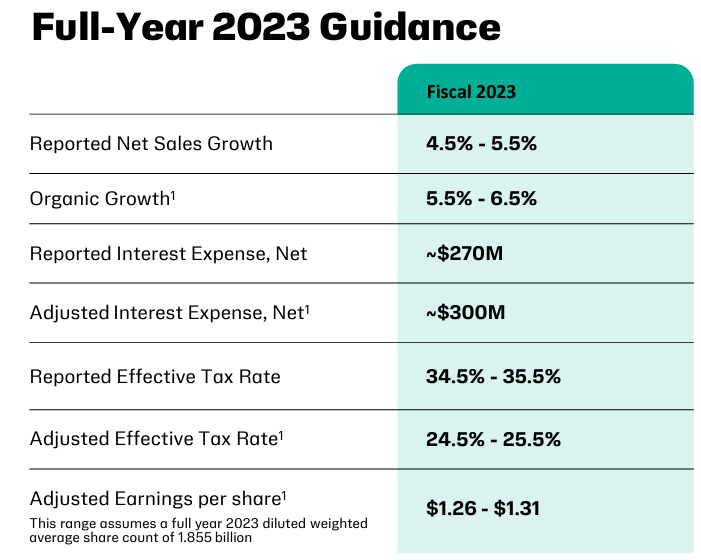

Regardless of these hurdles, Kenvue stays optimistic about its fiscal 12 months 2023 outlook. The corporate expects continued development in gross sales, with reported internet gross sales development projected within the vary of 4.5% to 5.5%.

Kenvue Inc.

The dedication to delivering worth to shareholders is obvious via the initiation of a money dividend and strategic capital allocation plans. In sum, Kenvue’s monetary efficiency showcases its adaptability and dedication to long-term worth creation whereas navigating the complexities of the patron well being sector.

Valuation

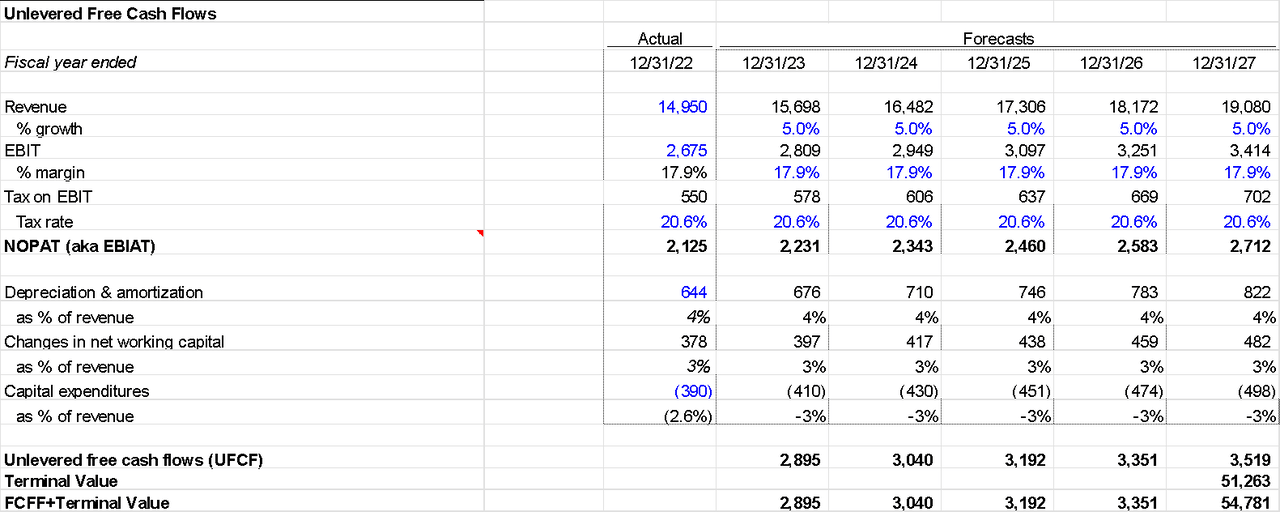

The dimensions of the worldwide shopper healthcare market is predicted to develop at a CAGR of 7.2% throughout the subsequent few years. Contemplating Kenvue as a pure-play enterprise on this section, I count on the corporate to develop alongside the rising business. Nevertheless, that is an especially aggressive business, subsequently it’s nonetheless being decided how the corporate will carry out within the subsequent few years adjusting to new administration. Subsequently, I’ve assumed a conservative development fee of 5% for the following few years. Contemplating this development fee, I’ve constructed a easy DCF mannequin to estimate the intrinsic worth of the enterprise.

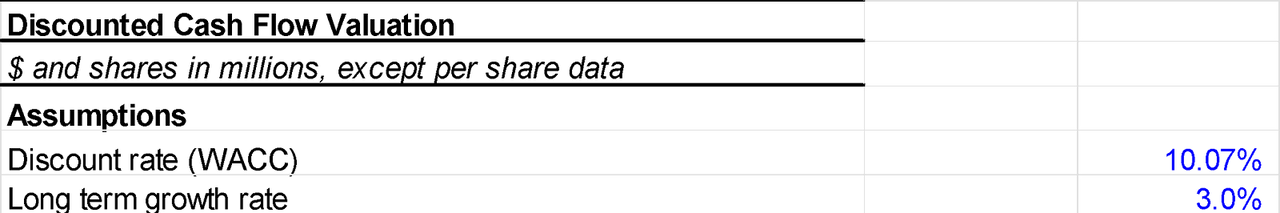

I’ve assumed a WACC of 10.07% (based mostly on NYU/Aswath Damodaran estimates) and terminal development of three% to maintain the calculations easy.

Creator’s Materials

Within the valuation course of, because of the absence of full historic knowledge, I wanted to make sure assumptions. I projected Depreciation and capital expenditures (CAPEX) in correlation with income tendencies and derived the networking capital because the variance between complete property and liabilities. The corporate additionally just lately secured a $7.6 billion debt issuance to help its ongoing operations.

Creator’s Materials

Creator’s Materials

Based mostly on these monetary strikes, the corporate’s enterprise worth is estimated at $43 billion, lower than the preliminary public providing (IPO) valuation. This valuation interprets to a present inventory value of $19.46, mirroring the corporate’s present buying and selling value.

Dangers

Authorized Complaints: Potential Danger to Kenvue’s Popularity and Investor Confidence

The current news discusses a authorized criticism in opposition to Kenvue, a shopper healthcare firm, relating to the disclosures made in its IPO providing paperwork. The criticism alleges that Kenvue’s disclosures concerning the industrial viability of its nasal decongestant merchandise containing phenylephrine (PE) had been deceptive and incomplete. It means that the corporate didn’t disclose considerations concerning the efficacy of PE and didn’t handle identified efficacy points associated to PE courting again to 2007. Moreover, particular litigation dangers related to adversarial findings on PE’s efficacy had been allegedly not disclosed.

The potential danger for traders lies in the truth that if these allegations maintain, it may signify that Kenvue didn’t present correct and clear info to traders throughout its IPO. This might undermine investor belief and doubtlessly result in authorized and monetary penalties for the corporate. Consequently, traders in Kenvue could face uncertainties relating to the corporate’s monetary well being, fame, and future authorized obligations, which might impression the inventory’s efficiency and shareholder worth. It underscores the significance of thorough due diligence and the standard of data supplied in IPO disclosures for traders within the shopper healthcare sector.

Market Competitors and Client Preferences:

Kenvue finds itself working in a fiercely aggressive shopper healthcare panorama the place established business giants like Procter & Gamble and different pharmaceutical corporations have a powerful presence. For example, Procter & Gamble reported a internet gross sales income of $80.2 billion in 2022, highlighting the formidable competitors Kenvue faces. This aggressive surroundings usually leads to pricing pressures. Established opponents can leverage their market affect and economies of scale to supply merchandise at aggressive costs. In response, Kenvue could also be pressured to regulate its pricing methods to stay aggressive, which might impression its revenue margins.

Authorized Challenges Loom for Kenvue’s Tylenol Amidst Spinoffs

Kenvue additionally faces potential authorized dangers stemming from lawsuits alleging that their product Tylenol prompted neurological problems in kids when taken throughout being pregnant. Kenvue contends that acetaminophen is protected, however the lawsuits are advancing, and the approval of plaintiffs’ consultants may result in vital penalties. This authorized problem is rising as Kenvue seeks to disentangle itself from Johnson & Johnson’s talc litigation. The result of those Tylenol instances poses a possible menace to Kenvue’s monetary stability and fame, making them a noteworthy concern as the corporate embarks on its impartial journey.

Conclusion

In my evaluation, Kenvue seems to be a powerful firm with a portfolio of high-quality merchandise that boast a stable monitor document and benefit from the belief of shoppers. The corporate’s anticipated steady efficiency and dedication to sustaining fixed dividends are noteworthy strengths. Nevertheless, as Kenvue faces the formidable competitors of business giants like P&G, its future efficiency and talent to safeguard its market place current notable challenges. Subsequently, at this juncture, I might train warning and undertake a wait-and-see method to look at how Kenvue upholds its aggressive edge and responds to the evolving market dynamics. Contemplating the valuation and the aggressive panorama throughout the shopper healthcare sector, my advice can be to assign a HOLD score to the corporate. It might be prudent to await the decision of the present authorized challenges earlier than making additional funding choices.