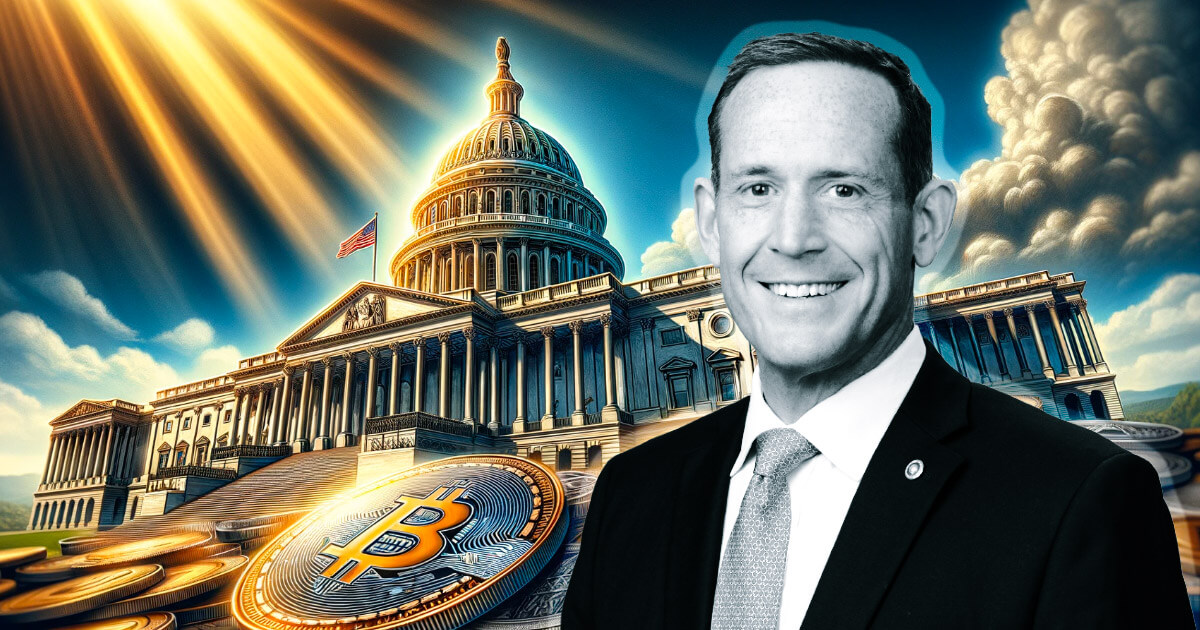

The push for higher monetary freedom and decentralization within the crypto ecosystem continues with the introduction of the “Maintain Your Cash Act” to the U.S. 118 Congress by Senator Ted Budd (R-NC) on Nov. 7.

The brand new invoice goals to empower people to keep up full custody of their digital property like Bitcoin (BTC) with out reliance on third-party intermediaries like exchanges.

This self-custody laws comes from the disastrous FTX collapse, highlighting the dangers of leaving funds on centralized platforms.

A part of the invoice reads:

“To ban Federal companies from limiting the usage of convertible digital foreign money by an individual to buy items or providers for the individual’s personal use, and for different functions.”

Senator Budd careworn the rising want for traders to regulate their digital property amidst rampant trade turmoil.

“As shoppers face new challenges and dangers related to the usage of digital currencies, we ought to be empowering people to keep up management over their very own digital property,” Senator Budd mentioned. “This method will foster monetary freedom and a extra decentralized cryptocurrency ecosystem.”

If handed, the act would prohibit federal companies from enacting guidelines in opposition to self-hosted wallets.

In the meantime, the Senate invoice mirrors earlier efforts within the Home, the place Rep. Warren Davidson launched comparable laws in 2022.

Davidson’s “Maintain Your Cash Act” handed the Home committee final July, although it has but to see a full flooring vote. The congressman has been a vocal advocate for safeguarding self-custody wallets from authorities overreach and has additionally been a outstanding supporter of the rising trade in opposition to regulators just like the U.S. Securities and Trade Fee (SEC).

The Home and Senate payments underscore a broader push in the direction of a extra decentralized crypto ecosystem, the place customers retain private management over property. This goals to mitigate third-party dangers whereas preserving monetary freedoms.

Whereas the destiny of self-custody laws stays unsure, the most recent Senate introduction retains the dialog alive as lawmakers grapple with crypto oversight approaches.