PeopleImages/iStock through Getty Pictures

Funding thesis

Our present funding thesis is:

- JCI is a high-quality enterprise with deep experience and vital scale, positioning it as a number one participant within the decarbonization transition and the adoption of sensible applied sciences inside buildings. Underpinning this is its rising companies phase, creating higher income certainty and superior unit economics.

- We anticipate wholesome development and margin appreciation within the coming years, which can drive shareholder worth. At a FCF yield of ~7%, traders can already win immediately.

Firm description

Johnson Controls Worldwide (NYSE:JCI) is a diversified firm offering constructing merchandise, applied sciences, and options. It operates via a number of segments, together with Constructing Options North America, Constructing Options EMEA/LA, Constructing Options Asia Pacific, and World Merchandise.

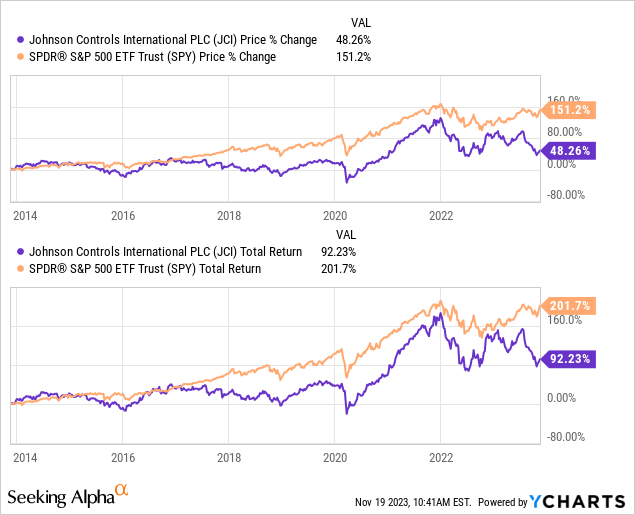

Share value

JCI’s share value efficiency has been respectable, returning over 90% to shareholders inclusive of distributions. This has lagged behind the market, nonetheless, owing to a divergence in current quarters because the market has been held up by a small handful of tech companies.

Monetary evaluation

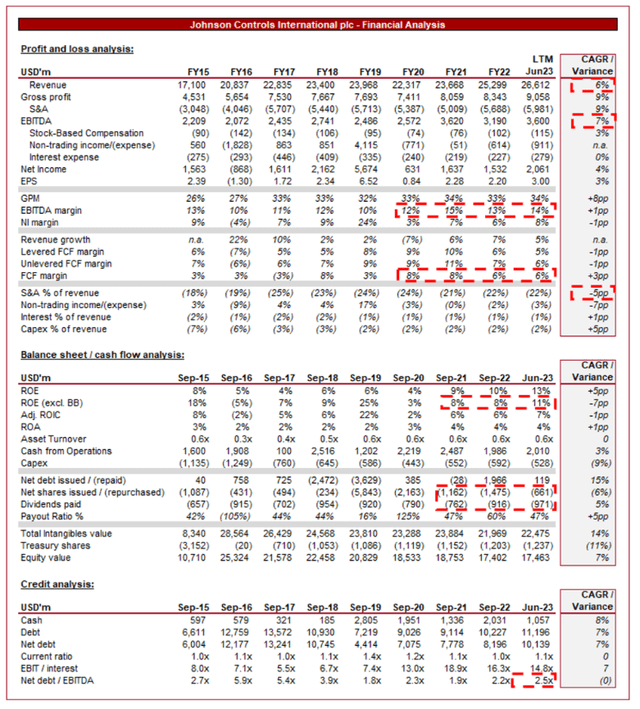

Johnson Controls Worldwide Financials (Capital IQ)

Introduced above are JCI’s monetary outcomes.

Income & Business Components

JCI’s income has grown properly over the last decade, partially supported by M&A, with a CAGR of +6% into the LTM. Together with this, EBITDA has tracked properly, with a CAGR of +7%.

Enterprise Mannequin

JCI is a pacesetter in constructing applied sciences and options. It supplies HVAC programs, constructing automation, safety programs, Hearth and Safety companies, and different options to boost the effectivity and sustainability of buildings. This range has helped JCI help differing markets, enhancing diversification.

Together with its core “set up” companies, the corporate has developed a spread of “companies” that it sells over time, akin to upkeep and inspections. These companies are extremely essential to the long-term success of the corporate, as margins are increased and it is a recurring income stream. This reduces the cyclicality of JCI, as the corporate is much less reliant on infrastructure spending.

JCI has developed a number one market presence via innovation, experience, and scale, with a powerful world presence and operations in quite a few nations. This world footprint helps to legitimize the corporate as a market chief, contributing to a higher scope for development and model growth.

Sustainability and decarbonization is a key side of JCI’s enterprise mannequin going ahead. The corporate supplies energy-efficient options for buildings, leaning closely into the broader environmental sustainability trigger. This is a crucial development space in our view, notably within the coming many years as nations transfer towards their net-zero targets.

Additional, JCI is invested closely in its sensible constructing capabilities, searching for to develop new options and combine IoT (Web of Issues) gadgets into its choices, aligning with the rising pattern of sensible buildings.

Equally to different giant friends, JCI has engaged in strategic acquisitions to strengthen its portfolio and develop its market attain. This can be a core element of its enterprise mannequin and continues to efficiently drive worth for the enterprise incrementally.

Margins

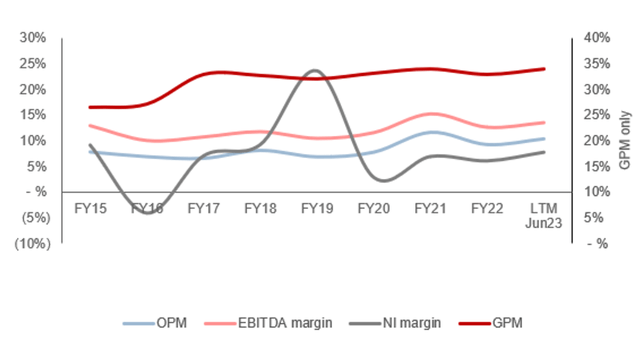

Margins (Capital IQ)

JCI’s margins have progressed properly over the last decade, with EBITDA-M rising from ~10-13% to constantly in extra of 12%. Margin enchancment is a mirrored image of Administration’s deal with high-margin companies, searching for to streamline the corporate and take away non-core segments.

Additional, the corporate has benefited from optimistic pricing motion and operational enhancements driving value leverage. We suspect the advantages of it will soften within the coming quarters, though with inflation declining, JCI is positioned properly to retain its good points.

Quarterly outcomes

JCI’s current efficiency has been sturdy, with top-line income development of +5.2%, +3.5%, +9.6%, and +7.8% in its final 4 quarters (10 successive quarters of >2.5% development). Together with this, margin development has softened, barely impacted by adverse product combine.

The corporate’s sturdy development is a mirrored image of broader spending momentum, with development throughout varied segments of the corporate. Constructing options backlog grew 8% in its final quarter, as long-term planning and required capital expenditure offset the influence of near-term macroeconomic headwinds. There’s a sturdy push throughout the West to spend money on the advance and enhancement of infrastructure, front-run by the IIJA.

Additional, JCI’s deal with creating its companies phase, which is positioned to be extremely worthwhile to its wider enterprise mannequin via much less risky income era, has continued to outperform, rising by +12% in its final quarter.

Moreover, as mentioned above, the corporate is seeing its decarbonization efforts materialize into sturdy income contribution, with LTM orders up +20% and powerful momentum. With Administration anticipating this to be a ~$240b alternative, the runway for a continuation of this momentum is excessive.

Lastly, JCI continues to see optimistic value/quantity combine good points, with value contributing +8% and quantity offsetting at (2)%. These components have allowed the enterprise to primarily drive its development organically, a formidable achievement in a mature trade at a considerable scale.

The corporate has seen offsetting softness in its residential phase, as shoppers have skilled adverse stress on their residing prices as a consequence of inflation and rates of interest. That is dissuading giant ticket purchases, not solely within the capital expenditure phase but additionally within the acquisition of recent houses. It will seemingly proceed into FY24 as charges stay elevated within the coming quarters. Because of this, we anticipate JCI’s quarterly outcomes to be barely weighed down, though its spectacular momentum suggests it may keep MSD development.

JCI lately introduced that it had delayed its Q4 earnings to the 14th December as a consequence of a cyberattack, which has precipitated “disruptions to parts of the corporate’s programs that help or present knowledge utilized in monetary reporting“. It’s unclear if any client-related knowledge was taken, though Administration has not indicated this to be the case. This represents a small threat, though we aren’t able to invest.

Stability sheet & money flows

JCI is reasonably financed, with a ND/EBITDA ratio of two.5x. Administration’s capital allocation coverage is properly balanced, with sturdy shareholder distributions alongside constant M&A exercise. This enables the enterprise to guard its long-term development story alongside rewarding shareholders with its spectacular FCFs.

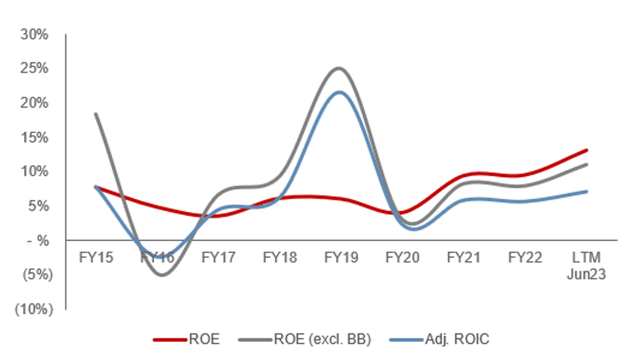

Return (Capital IQ)

Outlook

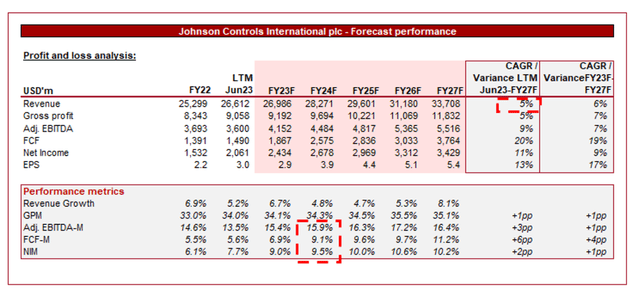

Outlook (Capital IQ)

Introduced above is Wall Avenue’s consensus view on the approaching years.

Analysts are forecasting a continuation of its present development trajectory, with a CAGR of +5% into FY27F. Alongside this, margins are anticipated to sequentially enhance.

We broadly concur with this evaluation. With a number of development levers, specifically decarbonization and infrastructure spending, alongside its non-cyclical nature and financial development, the enterprise is positioned properly to ship this. Additional, its deal with high-margin segments and rising its companies ought to permit for margins to extend.

Business evaluation

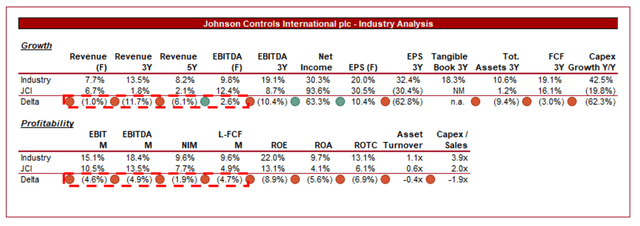

Constructing Merchandise Shares (Looking for Alpha)

Introduced above is a comparability of JCI’s development and profitability to the typical of its trade, as outlined by Looking for Alpha (37 corporations).

JCI’s monetary efficiency relative to its friends is pretty underwhelming. The corporate is missing in each development and margins when put next, contributing to a noticeably decrease ROTC/ROE.

This can be a reflection of variations in options supplied and the scope for worth growth via such components as innovation, limiting JCI’s potential to earn increased unit economics. This stated, there’s inherently an underperformance baked in right here, as a enterprise of its measurement and capabilities ought to be extra worthwhile.

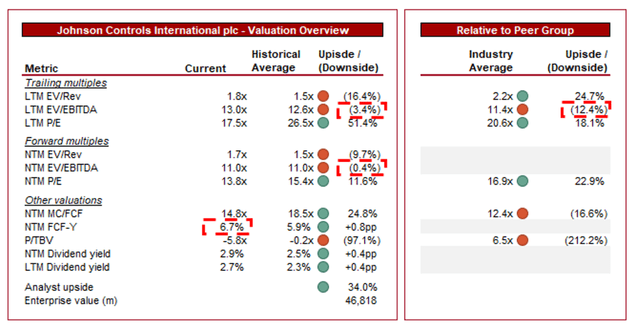

Valuation

Valuation (Capital IQ)

JCI is presently buying and selling at 13x LTM EBITDA and 11x NTM EBITDA. That is broadly according to its historic common.

A premium to its historic common is warranted in our view, owing to the streamlining of the corporate and the event of recent applied sciences, positioning the corporate properly for wholesome development within the coming years alongside margin appreciation. From a draw back perspective, the enterprise has restricted weaknesses in comparison with its common place over the last decade, at the very least implying it’s inside vary of its truthful worth.

Additional, JCI is buying and selling at a reduction to its friends on a P/E foundation, each LTM and NTM, though this isn’t the case on a LTM EBITDA or NTM FCF foundation. A reduction to its friends is warranted in our view, principally because of the monetary weak point skilled, though its relative efficiency over the approaching 5 years might exceed the typical.

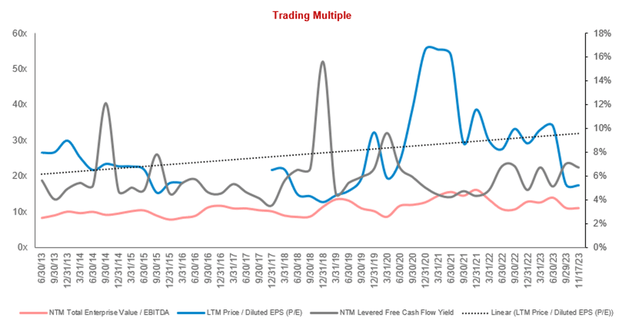

Total, we consider the inventory is undervalued. Confirming this for us is its FCF yield, which is a formidable ~7% and above its historic common. Given the distribution observe report of the enterprise, this instantly interprets to shareholder worth.

Valuation evolution (Capital IQ)

Key dangers with our thesis

The dangers to our present thesis are:

- Prolonged financial difficulties affecting the development trade.

- Intense competitors limiting margin enchancment.

- Worth damaging M&A.

Closing ideas

JCI is a high-quality enterprise in our view, owing to its sturdy market place and trade tailwinds supporting the sustainability of income development. With elevated infrastructure spending, decarbonization, and sensible expertise demand specifically, we see MSD/HSD development within the coming decade with restricted volatility. When partnered with sequential margin enchancment, we see sturdy worth within the coming years.