AlbertPego/iStock through Getty Pictures

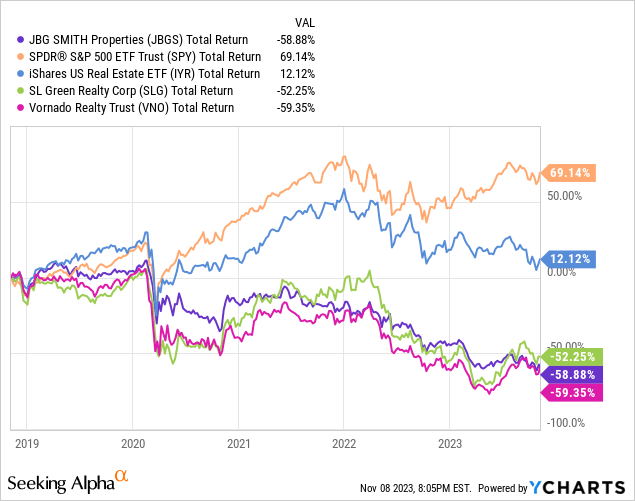

Shares of JBG Smith Properties (NYSE:JBGS) have proved a difficult funding of late. Over the previous 5 years, JBGS shares have delivered a complete return of -59% in comparison with a complete return of 69% delivered by the S&P 500 throughout the identical interval. JBGS has additionally faired poorly in comparison with the true property sector particularly. The true property sector will be proxied utilizing the iShares US Actual Property ETF (IYR) which has delivered a complete return on 12% over the previous 5 years.

JGBS has carried out roughly inline with workplace REITs Vornado Realty Belief (VNO) and SL Inexperienced (SLG).

Not like most different REITs, JBGS has used the drop in its inventory to aggressively repurchase inventory and views this as probably the most environment friendly use of capital.

I imagine JBGS are engaging at present ranges and characterize a shopping for alternative.

]

Firm Overview

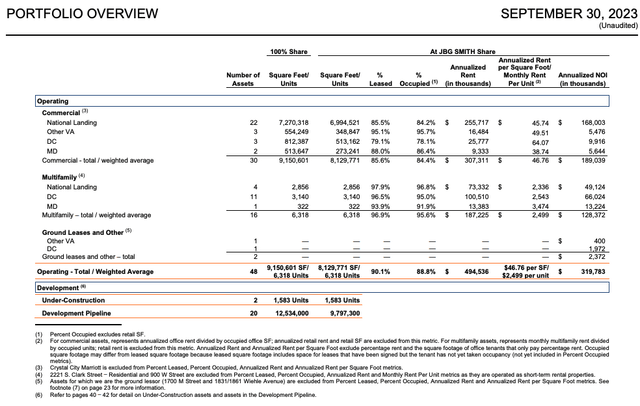

JBGS is a REIT that owns and operates a portfolio of economic and multifamily belongings in and across the metropolitan space of Washington, D.C.

At present, the corporate is weighted extra closely in direction of the industrial facet (which is closely targeted on workplace) of the enterprise which has a footprint of ~8.1 million sq. toes. The industrial facet of the enterprise at the moment accounts for ~59% of internet working revenue (“NOI”). The multifamily a part of the enterprise contains 6,318 models and represents ~40% of JBGS’s NOI.

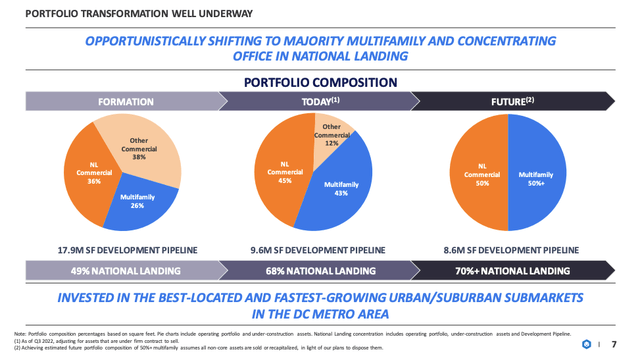

Over the previous few years, JBGS has been targeted on shifting its enterprise combine to be extra balanced between multi-family and industrial. Moreover, JBGS has been shifting publicity to focus extra on the nationwide touchdown, an space in Northern Virginia which has grow to be house to Amazon’s HQ2.

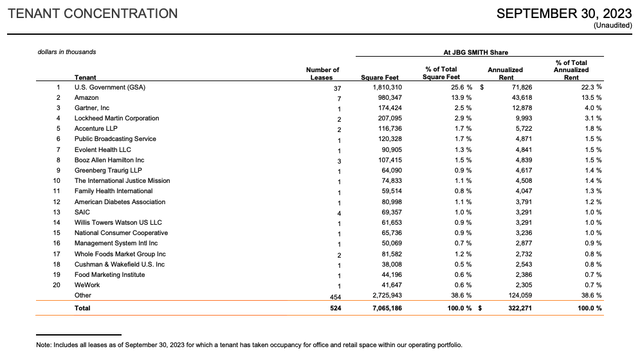

JBGS tenant base is properly diversified with the 2 largest tenants being the U.S. Authorities (25.6% of whole sq. toes) and Amazon (13.9% of whole sq. toes). No different tenant accounts for greater than 2.9% of whole industrial sq. footage.

JBGS Investor Bundle

JBGS Nov 2022 Investor Presentation

JBGS Investor Bundle

Resilient Monetary Efficiency

Regardless of a really difficult workplace actual property market, JBGS has continued to publish strong outcomes.

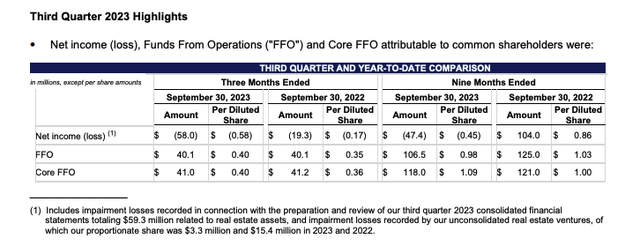

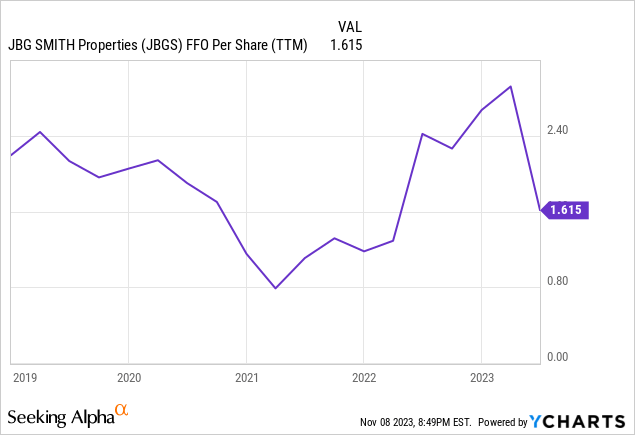

For Q3 2023, JBGS reported quarterly Core FFO per share of $0.40 vs $0.36 throughout the identical interval a yr in the past. Furthermore, the $0.40 of Core FFO represents an 11% enhance from Q2 2023.

On a yr up to now foundation JBGS reported Core FFO of $1.09 per share up from $1.00 throughout the identical interval a yr in the past and $1.04 throughout the identical interval for 2021.

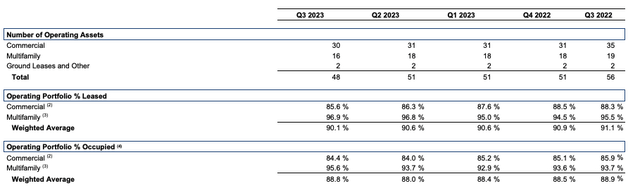

Regardless of a difficult working atmosphere in workplace, JBGS reported that 84.4% of its industrial working portfolio and 95.6% of its multifamily working portfolio was occupied as of Q3 2023. You will need to be aware that these occupancy ranges characterize a rise from the 84.0% and 93.7% industrial and multifamily working portfolio occupancy throughout Q2 2023.

The elevated occupancy ranges and Core FFO per share vs the prior quarter recommend the corporate might have turned the nook and Core FFO might start to rise from right here.

JBGS Investor Bundle

JBGS Investor Bundle

Optimistic Washington, D.C. Metro Traits

In its latest Q3 2023 earnings package deal, JBGS offered shade which suggests potential near-term energy within the DC rental market:

Lease development within the DC market was modest at 1.1%, however outpaced the opposite gateway markets which solely grew 0.4%. DC’s new provide pipeline market-wide (6%) in keeping with CoStar can be lower than among the sunbelt markets like Austin (15%), Nashville (12%), or Jacksonville (10%) which must also assist our lease development on a relative foundation. Lastly, excessive house costs in our market, coupled with excessive rates of interest and intensely low manufacturing, ought to maintain renting much more in-favor than in decrease value sunbelt markets with extra permissive new development environments.

From a micro market perspective, we imagine there’s a constructive story within the medium time period ensuing from restricted go ahead new deliveries. Markets just like the Ballpark and Union Market in DC, after a number of years of large-scale deliveries, now have only one challenge beneath development between them, in keeping with CoStar information. With new provide unlikely to start out within the close to time period, and continued sturdy absorption, it’s seemingly that these markets and their mixed-use amenity-rich environments will be capable to drive lease sooner or later. The identical goes for Nationwide Touchdown the place we management practically your complete under-construction pipeline with only one 500-unit asset beneath development in between Crystal Metropolis and Potomac Yard exterior our management.

JBGS additionally highlighted positives regarding the nationwide touchdown workplace market:

In Nationwide Touchdown, a lot of our leasing exercise comprised two giant Amazon five-year renewals: 100% of the workplace part, roughly 260,000 sq. toes, at 1770 Crystal Drive, and 88,000 sq. toes at 241 18th Avenue South. Wanting forward, we count on our demand drivers in Nationwide Touchdown to assist us seize an outsized share of recent demand inside the market. That is particularly evident when GSA tenants and authorities contractor focus within the submarket, and we count on these tenants, which account for 44% of our annualized lease, will proceed to be a sticky type of workplace demand regardless of the macroeconomic atmosphere. Mission essential GSA businesses in Nationwide Touchdown comprise 87% of our GSA tenancy, and 96% of our authorities contractor tenants are positioned in Nationwide Touchdown.

Excessive Leverage Ranges

One of many the reason why JBGS shares have carried out so poorly is the truth that the businesses stays extremely levered. As of Q3 2023, the corporate reported a complete of ~$2.47 billion of Web Debt, a complete Web Debt/Complete EV of 60.5% and Web Debt to Annualized Adjusted EBITDA of 8.1x.

The corporate’s weighted common debt maturity stands at 4.0 years after adjusting for extension choices. JBGS’s publicity to rising charges is at the moment restricted as 90.8% of the corporate’s debt is fastened or hedged. Nevertheless, the corporate is uncovered to a possible enhance in rates of interest when it must refinance current debt.

Whereas the corporate’s debt load is excessive, I imagine it does have levers essential to cope with any potential refinancing challenges as a lot of the debt is non-recourse in nature which suggests the corporate might stroll away from sure uneconomic belongings. JBGS additionally asset gross sales as a software to de-lever. Throughout Q3 2023, JBGS closed on $141.8 million of non-core asset inclinations and used the proceeds to deleverage its steadiness sheet.

Concentrate on Share Repurchases

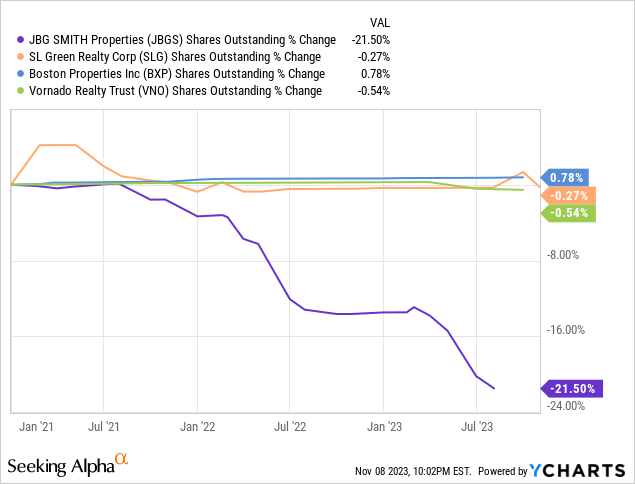

As proven by the chart beneath, over the previous three years JBGS has been aggressively shopping for again shares. The result’s that JBGS has steadily decreased its shares excellent by ~21% over the previous 3 years. Comparably, different huge workplace REITS comparable to SL Inexperienced (SLG), Vorndao (VNO), and Boston Properties (BXP) haven’t carried out important buybacks.

In its Q3 2023 earnings launch JBGS stated that share repurchases proceed to be probably the most accretive use of capital obtainable given the fabric low cost to NAV. On a YTD foundation, JBGS has repurchased 20.5 million shares at a weighted common value of $14.87 per share totaling $304.7 million.

I imagine the numerous quantity of share repurchases over the past three years means that JBGS is extremely assured in its place. The corporate has a really sturdy understanding of its portfolio and the precise asset values in comparison with what the market is pricing in.

Dividend

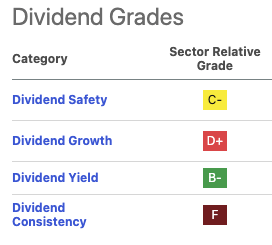

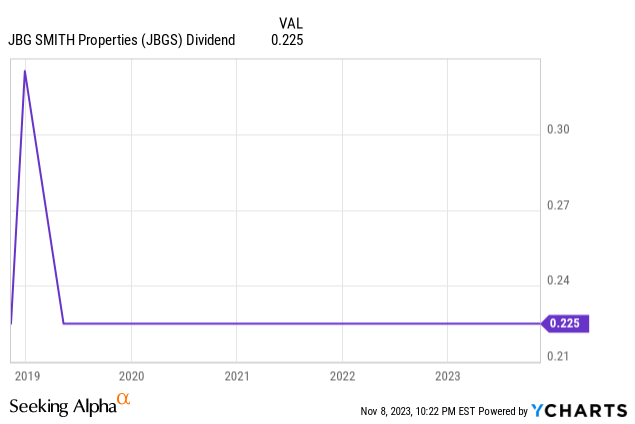

Whereas workplace targeted REITs comparable to Vornado and SL Inexperienced have been compelled to cut or suspend their dividends, JBGS has been in a position to keep its dividend. JBGS shares at the moment yield 6.52% and obtain a dividend security ranking of C- from Looking for Alpha quant scores.

Whereas the corporate seems dedicated to the dividend, it has additionally famous that it might regulate its dividend to protect money whereas persevering with to cowl taxable revenue distribution necessities. Thus, I might not be shocked to see a dividend minimize sooner or later as the corporate might wish to discover methods to cut back debt or enhance its buyback.

Looking for Alpha

Valuation

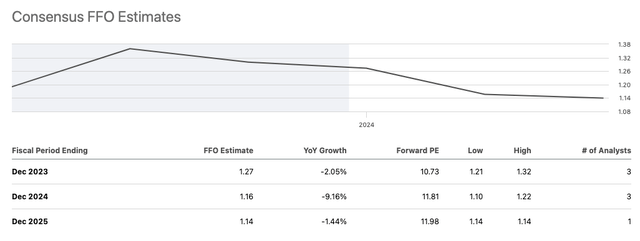

As proven by the desk beneath, JBGS trades at 11.8x 2024 consensus FFO per share. This represents a premium to workplace targeted REITs comparable to VNO, SLG, and BXP. Nevertheless, this a number of represents a big low cost to Elme Communities (ELME) which is a multifamily targeted REIT with a heavy DC focus.

Thus, primarily based on a relative valuation JBGS seems moderately valued vs friends given the corporate’s cut up between workplace and multifamily.

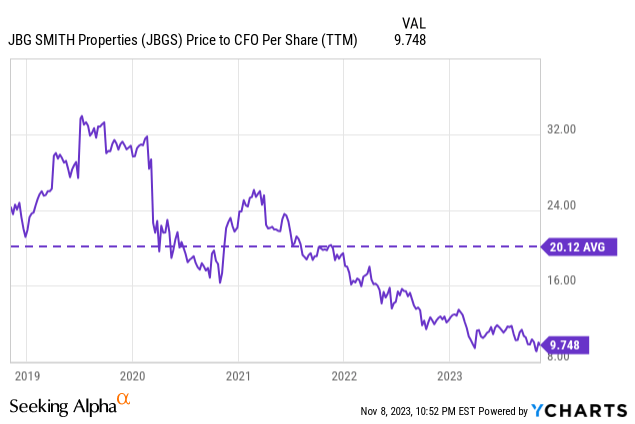

JBGS seems attractively priced relative to its historic valuation vary. Furthermore, the truth that the corporate has been aggressively shopping for again shares serves an essential indictor since they’ve the very best sense of the prospects for the corporate transferring ahead.

Creator (Looking for Alpha information)

Looking for Alpha

Development Expectations

At present, consensus estimates name for JBGS to report FFO of $1.17 for FY 2024 and FFO of $1.14 for FY 2025. This compares to FFO of $1.39 for FY 2023.

I imagine the corporate will be capable to beat these estimates and ship not less than steady FFO from FY 2023 ranges for 2024 and 2025. The corporate expects leasing at its 1900 Crystal Drive, a two residential tower improvement in Nationwide Touchdown totaling 808 models, to begin in early 2024. Given a complete multifamily footprint of 6,300 models this improvement marks a serious enhance in rentable area.

Throughout Q3 2023, the corporate generated 12.2% and 10.5% identical retailer multifamily NOI development for the three and 9 months ending September 30, 2023. I count on this development to proceed going ahead on the prevailing portfolio.

On the industrial facet, I imagine we are going to proceed to see an upswing in occupancy charges resulting from return to workplace insurance policies which can drive improved efficiency from the industrial facet of the enterprise as properly.

Dangers To Contemplate & The Bear Case

JBGS is uniquely targeted on the Washington, DC metro space actual property market. Whereas the corporate is diversified throughout each the industrial and multifamily segments, it stays extremely uncovered to any particular downturn within the Washington, DC actual property market.

Whereas the DC actual property market tends to be extra resilient to recessions given the big authorities footprint it might face headwinds within the occasion of great authorities spending reductions resulting in job cuts. I view this as unlikely however it a threat traders should take into account.

The bear case for JBGS, like different workplace targeted REITs, is that work at home is right here to remain and occupancy charges will proceed to say no from present ranges. The bears imagine that JBGS might be compelled to chop its dividend resulting from decrease FFO as workplace occupancy charges and rents sink going ahead. Beneath the bear case declining FFO will make it troublesome for JBGS to handle its extremely levered steadiness sheet.

An extra decline within the workplace actual property market doesn’t seem like the development given rising return to workplace mandates over the previous few months. Furthermore, the tick up in occupancy charges that JBGS reported vs the prior quarter additionally serves as a constructive indicator that the workplace market could also be turning. Lastly, JBGS has a robust multifamily enterprise which is rising and can enable the corporate to navigate any extended interval of workplace market weak spot.

Conclusion

JBGS is a singular REIT in that’s solely targeted on the Washington, DC metro space. This focus permits administration to be extremely targeted on the alternatives at hand in that market.

Shares of JBGS have bought off over the previous few years resulting from workplace market headwinds associated to office modifications following COVID-19. Moreover, REITs extra usually have confronted a difficult atmosphere resulting from rising rates of interest.

JBGS has used the drop over the previous few years to implement a big share repurchase program which has decreased the share depend my greater than 20%. Administration has stated it continues to see share repurchases as the simplest use of capital. This capital allocation technique stands out vs different workplace REITs which haven’t targeted on repurchasing shares.

JBGS has a extremely levered steadiness sheet however has hedged most of its rate of interest threat. Furthermore, the corporate has been actively promoting non-core belongings in a bid to cut back leverage.

JBGS seems to be buying and selling at an affordable valuation relative to its friends and low-cost relative to its historic norm. I imagine administration’s give attention to shopping for again shares regardless of business headwinds is a crucial datapoint relating to valuation as they seemingly have the very best insights relating to the corporate’s prospects.

I’m initiating JBGS with a purchase ranking and would take into account downgrading the inventory within the occasion it moved important extremely from right here. Moreover, I might take into account downgrading the inventory within the occasion the Washington, DC actual property market experiences a big headwind.