- Jasmycoin has a strongly bullish outlook based mostly on the on-chain metrics.

- The Fibonacci extension ranges confirmed the token might rally one other 60%.

Jasmycoin [JASMY] famous excessive volatility over the previous two days. On the third and 4th of June, costs rose by 25% inside 36 hours. They retraced by 11.1% over the subsequent two days and traded at $0.039 at press time.

Regardless of the decrease timeframe volatility, the upper timeframes signaled bullish promise. How excessive can the transfer go, and does the on-chain metric help the concept of continued growth?

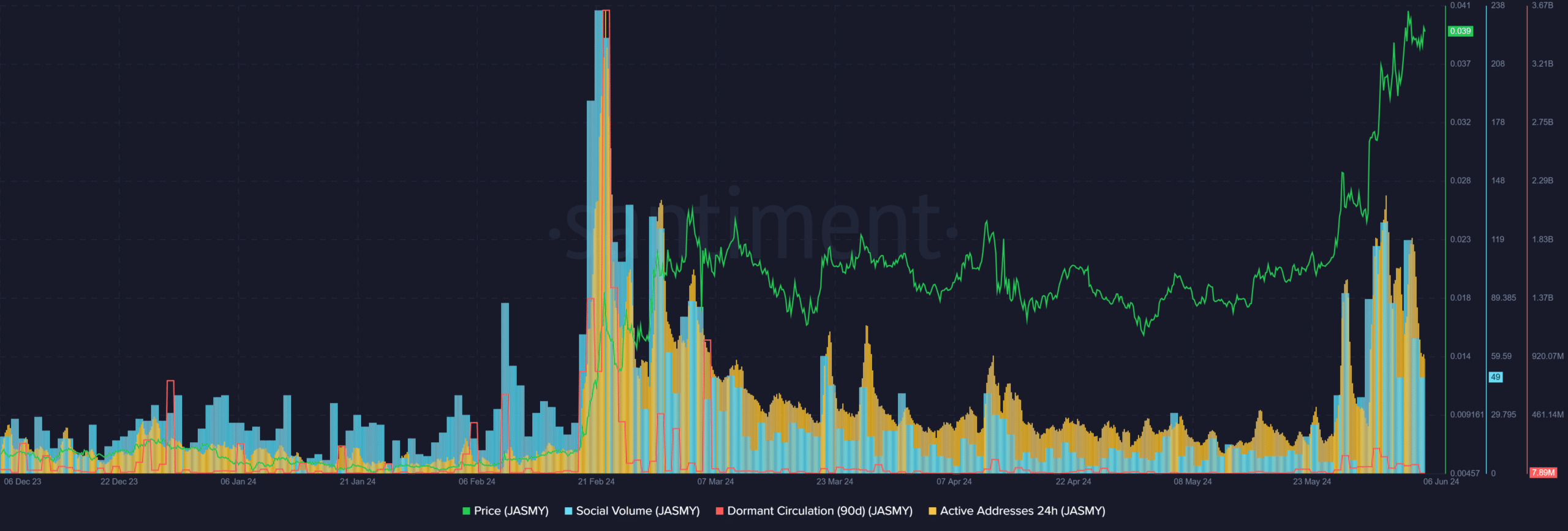

The social metrics promised huge JASMY positive aspects

Just like the February rally, the social quantity, in addition to the each day lively addresses, had been each surging. When it occurred on the twentieth of February, JASMY rallied 263% over the subsequent two weeks.

Whereas this doesn’t assure one other 260% rally, it confirmed that hype and momentum can drag an asset a great distance ahead.

The dormant circulation spikes had been small in latest weeks, displaying that a big wave of promoting was not but in sight.

Through the February rally, regardless of a dormant circulation surging to point profit-taking, the costs continued to climb. Therefore, even when the dormant holders get up quickly, traders have motive to carry on and never panic.

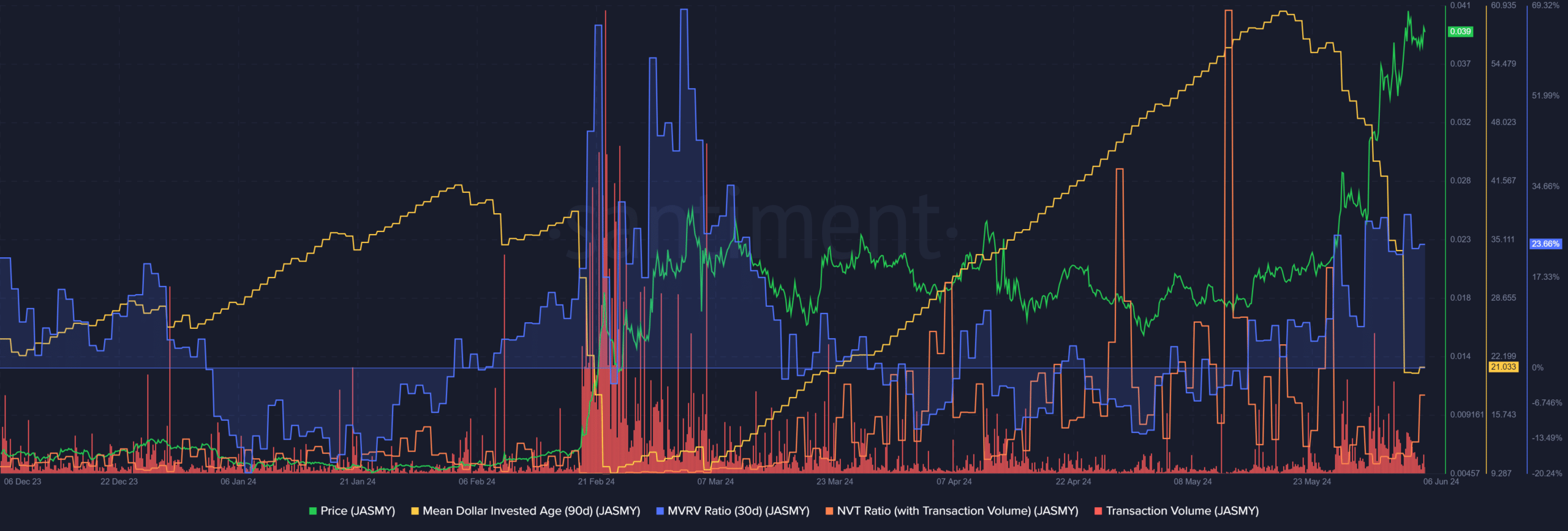

Strong bullish sentiment was detected based mostly on these two metrics

The 30-day MVRV exhibits whether or not short-term holders are in revenue or not. The imply greenback invested age (MDIA) downtrend is a sign that the community is just not stagnating. Collectively, they had been robust proof for a bullish JASMY.

The NVT ratio was not excessive, which indicated the coin was not overvalued based mostly on its transaction quantity. General, the metrics had been constructive.

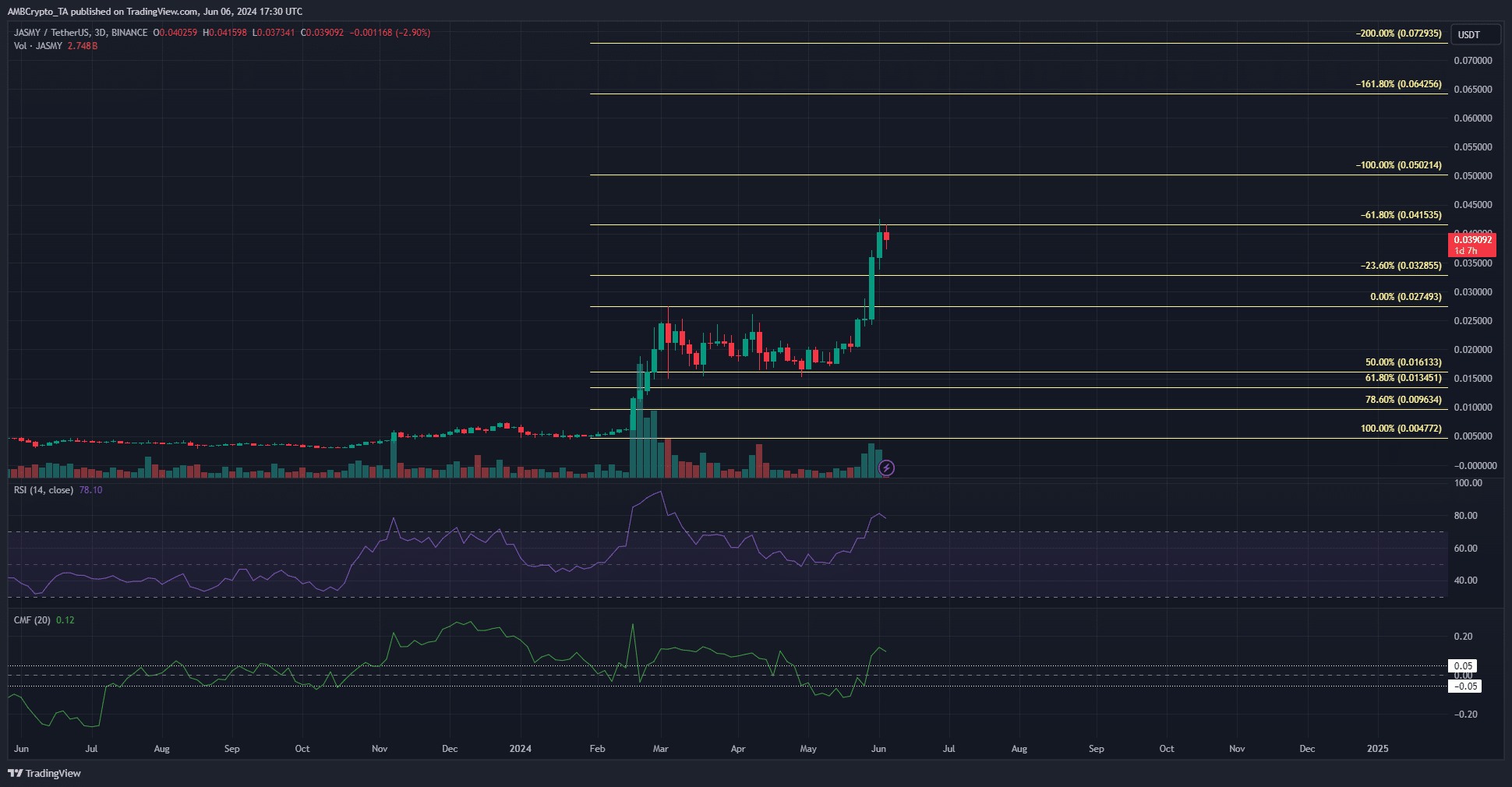

Supply: JASMY/USDT on TradingView

The 50% Fibonacci retracement stage served as help from March to Might earlier than the latest uptrend occurred. Utilizing the identical transfer, a set of extension ranges had been plotted. The $0.0415, $0.05, and $0.064 are the subsequent bullish targets.

Learn Jasmycoin’s [JASMY] Worth Prediction 2024-25

The RSI on the 3-day chart confirmed intense bullish momentum and the CMF’s studying of +0.12 supported the concept of agency capital influx.

Therefore, it’s doubtless we see one other 30%-60% transfer greater. In case of a retracement, the $0.0256-$0.0288 area would provide a barely aggressive long-term bullish re-entry.