A consortium of Japanese corporations plans to concern a yen-based digital foreign money known as DCJPY. The foreign money, slated for launch by July 2024, is designed to facilitate transactions and settlements of fresh power certificates, harnessing DeCurret’s blockchain-backed community.

Cryptocurrency alternate DeCurret mentioned on Thursday that GMO Aozora Internet Financial institution will concern DCJPY. In line with a current report, the telecommunication agency Web Initiative Japan (IIJ) will then use it to settle clear power certificates.

Japan Mints Stablecoin for Clear Vitality Certificates Settlement

DeCurret will execute the DCJPY transactions on a community it developed. Financial institution deposits again the community by means of blockchain expertise. That is just like different nations utilizing digital currencies backed by financial institution deposits and blockchain expertise.

The Revised Funds Settlement Act, handed in 2022, has additionally been instrumental on this improvement. This laws acknowledges stablecoins as a brand new digital fee technique, thereby enabling banks, belief corporations, and switch operators to concern them.

Consequently, Binance, which already holds a license to serve merchants in Japan, has certified as an issuance companion. Different corporations can concern stablecoins as soon as the Monetary Providers Company of Japan approves their license purposes.

Stablecoins on the Come Up

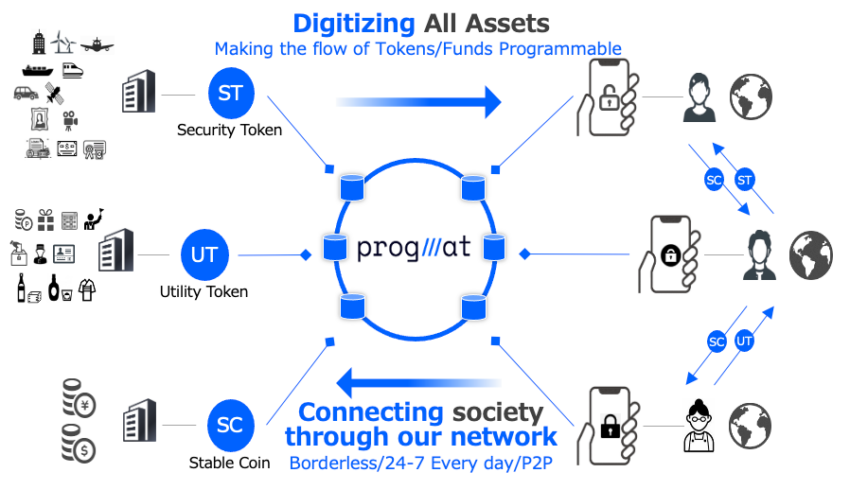

Mitsubishi developed its Progmat platform in step with the Japanese authorities’s ‘Revised Funds Settlement Act.’ The laws, handed in 2022, acknowledges stablecoins as a brand new digital fee technique,” a current announcement revealed.

The Progmat platform, developed by Mitsubishi, helps the issuance of stablecoins backed by yen and US {dollars}. This expertise permits companies to streamline international commerce transactions and buy digital securities in addition to non-fungible tokens (NFTs).

Motoki Yoshida, the advertising and marketing supervisor of TOKI, a Progmat companion said,

Sponsored

Sponsored

“The fundamental structure includes monetary establishments occupied with issuing stablecoins depositing an equal quantity of fiat foreign money with MUFG’s belief financial institution. Progmat then points an equal quantity of stablecoins. The funds within the belief financial institution are bankruptcy-remote, making this probably probably the most safe stablecoin to be used on public blockchains.”

If extra companies undertake these new applied sciences, they might dramatically shift how transactions are carried out. Initiatives like this might additionally assist propel Japan to the forefront of the digital foreign money adoption.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material.

This text was initially compiled by a complicated AI, engineered to extract, analyze, and manage data from a broad array of sources. It operates devoid of private beliefs, feelings, or biases, offering data-centric content material. To make sure its relevance, accuracy, and adherence to BeInCrypto’s editorial requirements, a human editor meticulously reviewed, edited, and authorized the article for publication.