Keep knowledgeable with free updates

The conflict between Israel and Hamas is heaping strain on borrowing prices in neighbouring nations, as worldwide traders develop more and more involved that the battle will quickly escalate.

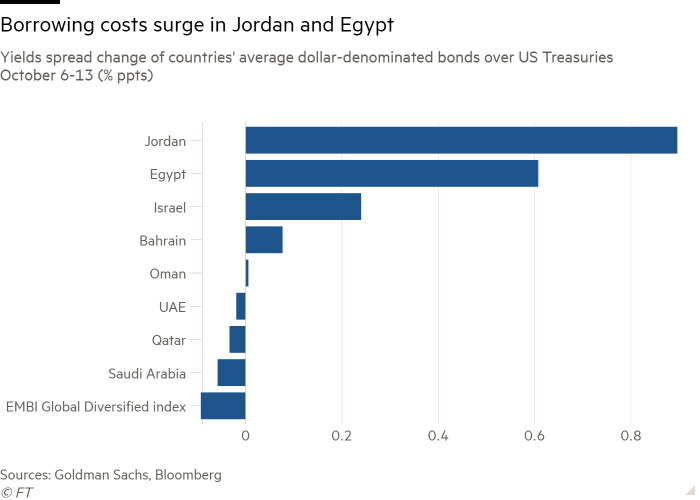

The spreads — or gaps — between the common yields on each Jordan’s and Egypt’s dollar-denominated bonds and equal US Treasuries have shot up this week as traders have priced in additional threat for proudly owning the debt. In distinction, spreads throughout the broader rising markets index have tightened.

Spreads moved wider on Friday after Israel’s navy warned greater than 1mn Palestinians to go away Gaza Metropolis and its outskirts, in a transfer the UN mentioned would trigger a “calamitous” mass civilian displacement.

Since October 6 the yield on Jordan’s 2030 dollar-denominated bond has jumped from 8.5 per cent to 9.45 per cent, the best stage since October final yr. Yields transfer inversely to costs.

“By Jordanian requirements, it’s a giant transfer,” mentioned Edwin Gutierrez, head of rising market sovereign debt at fund supervisor Abrdn. “The market is studying by means of and pricing that Jordan and Egypt might be coping with a refugee disaster.”

Jordan’s financial system can also be closely reliant on tourism, which accounts for roughly 10 per cent of gross home product. Analysts at Goldman Sachs mentioned this left Jordan “significantly susceptible” because the battle unfolded, “however thus far it has not pushed Jordan’s USD [dollar] bonds into misery”.

Egypt’s debt has additionally come beneath renewed pressure regardless of already buying and selling in distressed territory. The worth of its greenback bond maturing in 2031 has fallen from 53 cents to 51 cents since October 6, including strain to a rustic going through a wall of debt refinancing within the coming years.

“A refugee disaster would solely add to Egypt’s woes, although satirically it may gain advantage from worldwide donors ought to one ensue,” Gutierrez mentioned.

Egypt sealed its fourth mortgage since 2016 from the IMF in October final yr however stays in tense negotiations with the company. The nation’s gross financing wants in 2023 quantity to “a staggering 35 per cent of its GDP”, in accordance with the IMF.

The possibilities of debt restructuring talks in Lebanon, which defaulted on its debt in 2020, have additionally fallen, traders mentioned. The nation’s bonds bought off on fears that the militant group Hizbollah may turn into concerned within the Israel-Hamas conflict.

“The one hope Lebanese bonds had for a constructive final result was based mostly on a state of affairs of each regional and home political normalisation being achieved,” mentioned Thys Louw, portfolio supervisor for the rising markets laborious forex debt technique at asset supervisor Ninety One. He added that the prospects for this “had deteriorated”.

Throughout the broader Gulf area, the market response has been muted, with spreads throughout sovereigns with funding grade-rated debt ending the week tighter regardless of an preliminary sell-off on Monday. These nations have low debt ratios, excessive overseas forex reserves and profit from elevated oil costs.

“There was a knee-jerk sell-off however all of them got here again as a result of it’s not just like the battle will dent the financing state of affairs within the likes of the UAE, Qatar and Saudi Arabia,” Gutierrez mentioned.

Paul Greer, an rising markets mounted revenue portfolio supervisor at Constancy, mentioned that “for the second, the market has seen the conflict to be contained to inside Israel and Gaza”.

“If this spills out into different nations within the area, then we might count on Center East sovereign credit score spreads to widen extra materially,” he added.