- iShares’ Bitcoin Belief inventory rose by 13% in 5 days.

- Blackrock and Trump’s potential political partnership and ETF inflows are some components driving the surge.

Early this 12 months, iShares’ Bitcoin [BTC] Belief soared following the approval of Bitcoin spot ETFs. Moreover, Blackrock has skilled exponential progress, attaining a report $10.6T in property beneath administration.

In keeping with the report, the agency added $83b to ETFs, with the CEO crediting the agency’s progress to Robust ETF inflows.

Supply: Google Finance

Regardless of the agency’s progress, iShares’ BTC Belief inventory has declined by 1.69% previously six months, in line with Google Finance.

Nonetheless, in a reversal of fortunes, the previous weeks have seen a sustained rise. Over the previous 5 days, its shares have surged by 13.08% whereas hovering by 13.68% over the previous 30 days.

The current surge has introduced hypothesis on what’s driving the rise. Due to this fact, numerous current developments have modified the narrative in favor of iShares BTC Belief.

BlackRock CEO and Trump partnership

The U.S. political area is at present going through appreciable affect from the crypto group. Because the nation prepares for 2024 presidential election, crypto is taking heart stage.

In a dramatic flip of occasions, Donald Trump turned a pro-crypto candidate. Based mostly on his present stand, there have been sustained stories that he’s contemplating BlackRock CEO Larry Fink for Treasury secretary.

As reported on numerous X (previously Twitter) pages, as famous by Satyam Singh,

“Donald Trump is contemplating #BlackRock CEO Larry Fink as Treasury Secretary.”

These rumors have been welcomed with pleasure by numerous stakeholders throughout the crypto group. Many consider appointing a pro-crypto Treasury secretary is the one method to finish the present SEC warfare on crypto.

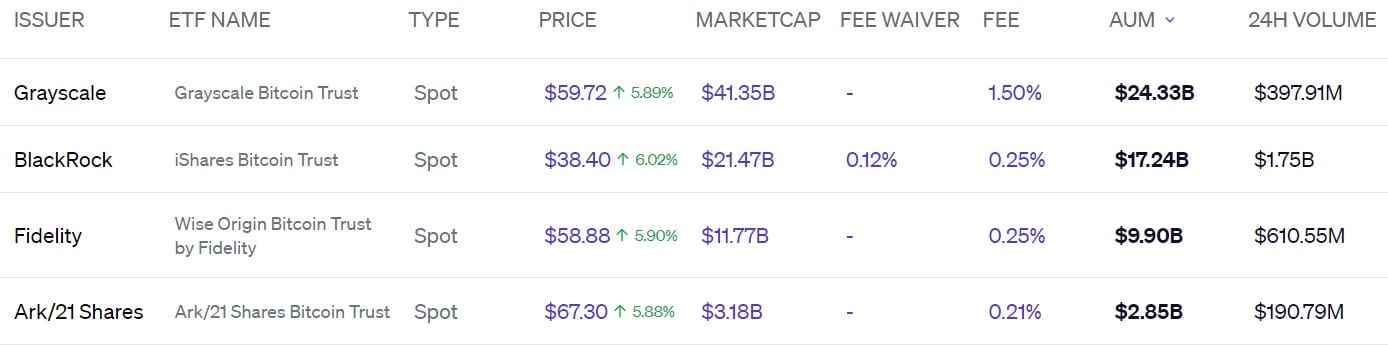

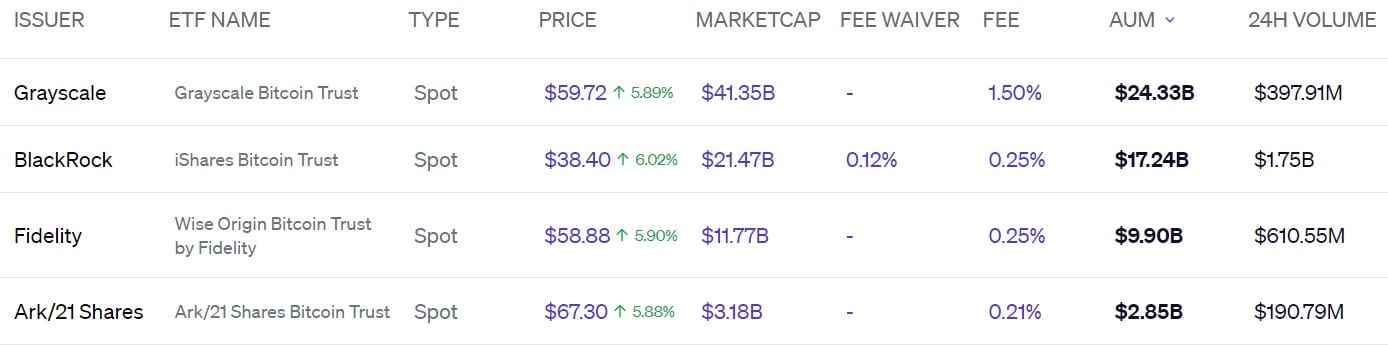

iShares BTC Belief: Elevated influx

Supply: Blockworks

BTC ETFs’ approval has undoubtedly turn into a sport changer for numerous institutional traders. For example, every week in the past, BTC ETF influx reached $310M in a single day, with iShares main the best way.

The elevated influx for iShares BTC Belief primarily rose as a result of it’s low cost, with an expense ratio of 0.25%, and traders pay $25 yearly on a $10k fund.

This affordability has attracted numerous traders to buy iShares whereas promoting others, comparable to Nvidia. Over the previous week, notable people have bought iShares BTC Belief.

First, Ken Griffin at Citadel Advisors began shopping for iShares’ BTC Belief shares after promoting NVIDIA’s stake.

Then, David Shaw and Israel Englander began a large share of the iShares BTC belief stake, making it one of many largest holdings.

This elevated influx has pushed its asset beneath administration to $17.24B, with a buying and selling quantity of $1.78B greater than different corporations.

Bitcoin, a official monetary instrument?

Lastly, the market sentiment in direction of BTC amongst institutional traders has modified drastically. Most establishments investing in BTC are racing to build up and anticipate increased returns.

For example, BlackRock has stood out as a vocal supporter of BTC, encouraging the current influx into iShares BTC Belief.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

In a current interview on CNBC, Larry Fink, BlackRock CEO, acknowledged that BTC could be a official monetary instrument.

This endorsement by Larry is important because it affords consolation to traders contemplating including BTC ETFs to their portfolio. With this trajectory, iShares’ Bitcoin inventory is nicely positioned to soar as many traders be a part of the race.