In his newest technical evaluation, veteran crypto analyst Christopher Inks affords an in depth take a look at the present Bitcoin market construction by a complete chart evaluation. The chart, lately shared on X, reveals Bitcoin’s worth actions alongside a number of key technical indicators and ranges that would sign a possible reversal from its bearish pattern.

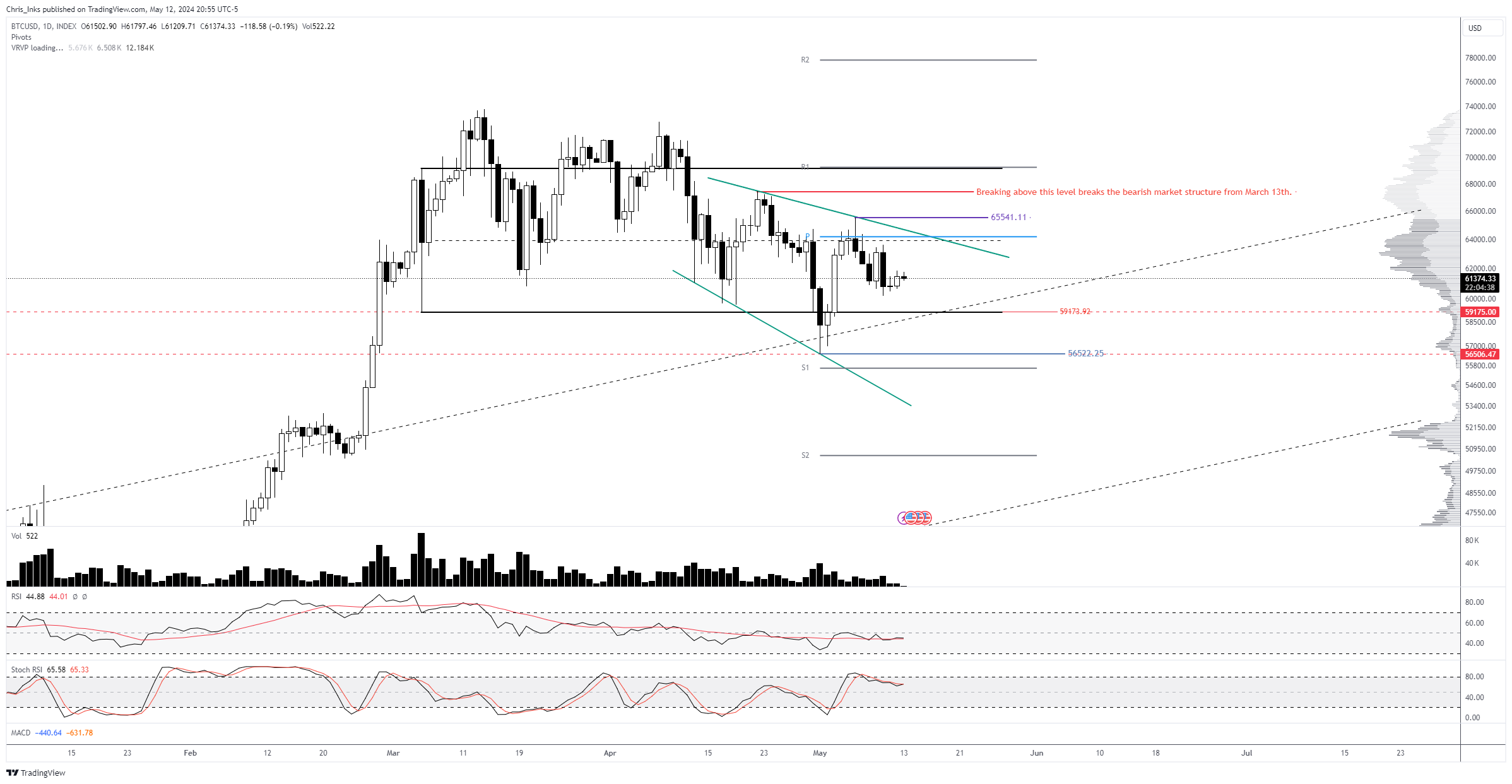

The analyst illustrates Bitcoin’s worth motion with every day candlesticks over the previous few months, pinpointing important assist (S1, S2) and resistance (R1, R2) ranges. As of press time, Bitcoin traded at across the $63,000 mark, encapsulated by two descending pattern traces which signify a bearish market construction.

The Backside Sign For Bitcoin

“We nonetheless wish to see a breakout above the famous degree to sign a break within the bearish market construction that started on the ATH,” Inks said. This degree is of paramount significance as a result of it serves as a junction of a number of technical components: the every day pivot level, the higher descending inexperienced resistance line, and the two-month vary equilibrium.

Associated Studying

In accordance with Inks, “an impulsive breakout and shut above the every day pivot/descending inexperienced resistance/2-month vary EQ confluence space will sign that the low is probably going in.” This means that overcoming this barrier may herald the tip of the bearish market construction that commenced from the all-time excessive.

If this resistance breaks, the following main resistance is situated at $65,541. Afterwards, $68,000 could possibly be on the playing cards. “Breaking above this degree breaks the bearish market construction from March thirteenth,” in keeping with Inks. Then, R1 at $69,000 and R2 at round $78,000 could possibly be the following targets.

On the draw back, probably the most essential assist is at $56,522. It represents the decrease boundary that Bitcoin wants to take care of to stop a brand new low, which might exacerbate the bearish sentiment.

Associated Studying

Inks articulates the significance of this assist, noting, “If we will print a better low now, which might require a breakout above the $65.541 degree with out printing a brand new low beneath $56,522, then that will actually add assist for the concept that the underside is in and a brand new ATH is incoming.”

This assertion underlines the need for Bitcoin to carry above this assist to keep away from additional declines and stabilize inside its present vary. If BTC breaks beneath the pivotal assist, the value could possibly be headed beneath $56,000 (S1) and $50,90 (S2).

Notably, the evaluation is supported by quite a lot of technical indicators. The Relative Power Index (RSI), hovering across the impartial 50 mark, suggests a balancing act between bullish and bearish forces. The RSI’s place signifies that the market is neither overbought nor oversold, leaving room for potential upward motion if bullish indicators strengthen.

The Transferring Common Convergence Divergence (MACD) at present reveals that the MACD line is beneath the sign line, a conventional bearish signal. Nevertheless, the proximity of those traces additionally hints at a attainable upcoming bullish crossover, ought to the momentum shift.

The Stochastic RSI additionally signifies potential for motion in both path however is especially helpful for figuring out when Bitcoin is perhaps coming into overbought or oversold territories, that are vital for predicting short-term worth reversals.

Inks additionally commented available on the market’s dynamics, stating, “The positives of the vary are that provide has continued to lower all through the bearish market construction.” This remark means that diminishing provide, paired with sustaining key assist ranges, may assist stabilize and probably enhance Bitcoin’s worth.

At press time, BTC traded at $62,902.

Featured picture created with DALL·E, chart from TradingView.com