- Bitcoin ETFs are accumulating vital inflows, nearing $20 billion in internet inflows

- Bitcoin was valued at $67,847 at press time – An indication of sturdy resilience amid market developments

As Bitcoin [BTC] ETFs proceed their spectacular streak of inflows, accumulating $253.6 million on 11 October, $555.9 million on 14 October, and $371 million on 15 October, the momentum is unmistakable.

Eric Balchunas’ remarks spark concern

Seeing this, Eric Balchunas, a outstanding ETF analyst at Bloomberg, made a daring prediction.

He believes that BTC ETFs are poised to surpass Satoshi Nakamoto, the enigmatic creator of Bitcoin, as the biggest holders of the flagship cryptocurrency by Christmas.

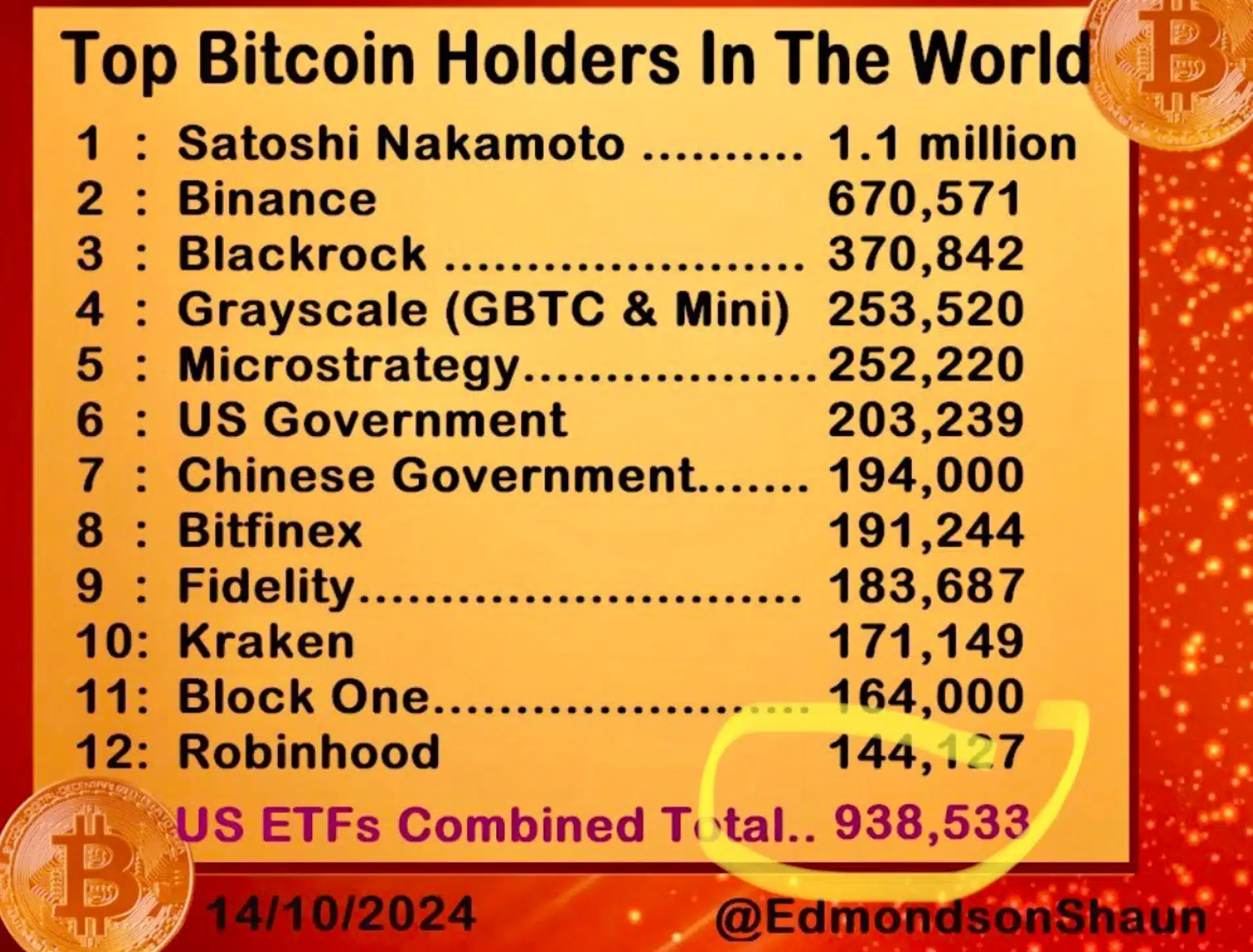

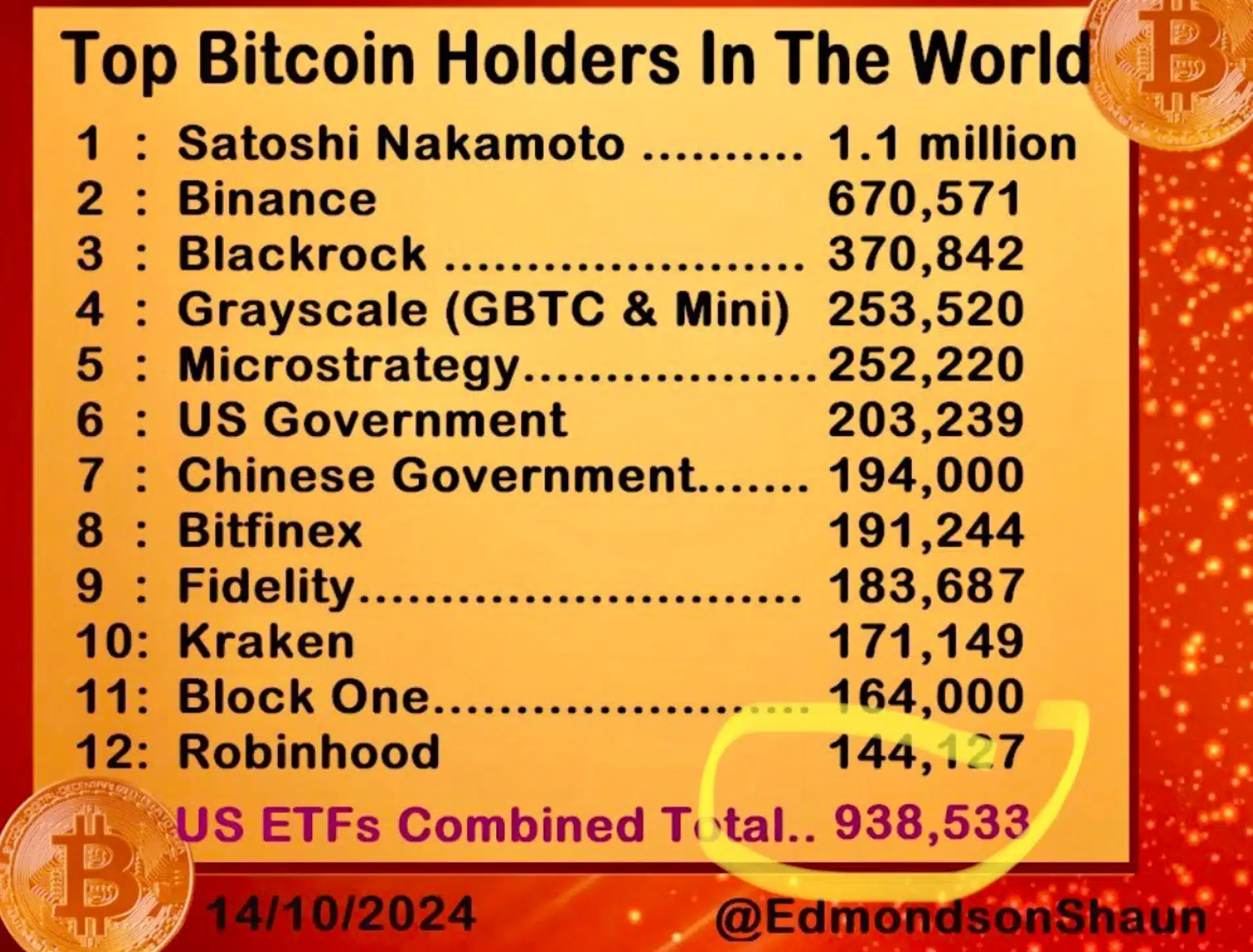

“Monster circulation day for the bitcoin ETFs, over half a billion, complete internet flows (most imp quantity) hair away from $20b. They now 94% of solution to holding 1mil btc and 85% away from passing Satoshi as largest holder in world- legit shot to hit milestone by Xmas. Ht @EdmondsonShaun.”

Supply: Eric Balchunas/X

At the moment, the overall holdings of Bitcoin ETFs are a powerful 938,533 BTC.

How is the group reacting?

Based on Farside Investors, Bitcoin ETFs are nearing the numerous milestone of $20 billion in internet inflows.

Right here, it’s value noting that analysts imagine Satoshi Nakamoto possesses round 1.1 million BTC – A benchmark that institutional Bitcoin ETFs are swiftly closing in on.

Owing to the speedy inflows and rising curiosity in these funding automobiles, it seems more and more believable that BTC ETFs will quickly rival Nakamoto’s holdings.

Nevertheless, an X user painted a distinct image when he stated,

“There isn’t any definitive proof Satoshi owns 1 million BTC.”

Another X user quickly chimed in, noting,

“How can we have now such monster inflows, however weak value motion?”

Nevertheless, this argument was quickly dismissed by David Lawant, Head of Analysis at cryptocurrency brokerage FalconX. He claimed,

“There’s a statistically vital relationship between adjustments in ETF flows and costs, however it’s not a robust one. The correlation coefficient is 0.30, which signifies that lower than 10% of the change in costs will be defined by the change in internet flows.”

What else occurred in connection to Bitcoin?

Apparently, this information broke only a day later after a dormant Bitcoin whale from the Satoshi period resurfaced, sparking intrigue within the crypto group.

The pockets, which first mined its cash again in 2009, made waves by transferring roughly $630,000 value of BTC to Kraken on 14 October.