- BlackRock’s Bitcoin ETF noticed inflows of $184.4 million, boosting 2024 totals to $17.944 billion.

- Institutional ETFs are nearing Satoshi’s holdings, probably surpassing them by year-end.

After a interval marked by minimal exercise, BlackRock’s Bitcoin [BTC] ETF (IBIT) has regained momentum, recording substantial inflows beginning on the twenty third of September.

Bitcoin ETF efficiency analyzed

Notably, on the twenty fifth of September, IBIT noticed a powerful influx of $184.4 million, whereas the entire influx throughout all Bitcoin ETFs amounted to $105.9 million.

In distinction, Grayscale’s GBTC, which normally experiences outflows, reported zero motion on the identical day.

Nonetheless, Constancy’s FBTC and Ark’s ARKB skilled outflows of $33.2 million and $47.4 million, respectively.

This resurgence in ETF exercise has propelled the U.S. BTC ETF to an astounding $17.944 billion in inflows for 2024, marking a record-breaking year-to-date accumulation of 916,047 BTC—solely about 84,000 BTC shy of the coveted 1,000,000 BTC milestone.

Seeing this spectacular progress, Eric Balchunas, Bloomberg’s Senior ETF Analyst took to X and famous,

“U.S. bitcoin ETFs had good day yesterday pushing YTD flows to new excessive water mark of $17.8b. They’re now 92% of the way in which to proudly owning 1million bitcoin and 83% of technique to passing Satoshi as high holder. Tick tock..”

Is Satoshi Nakamoto’s place underneath risk?

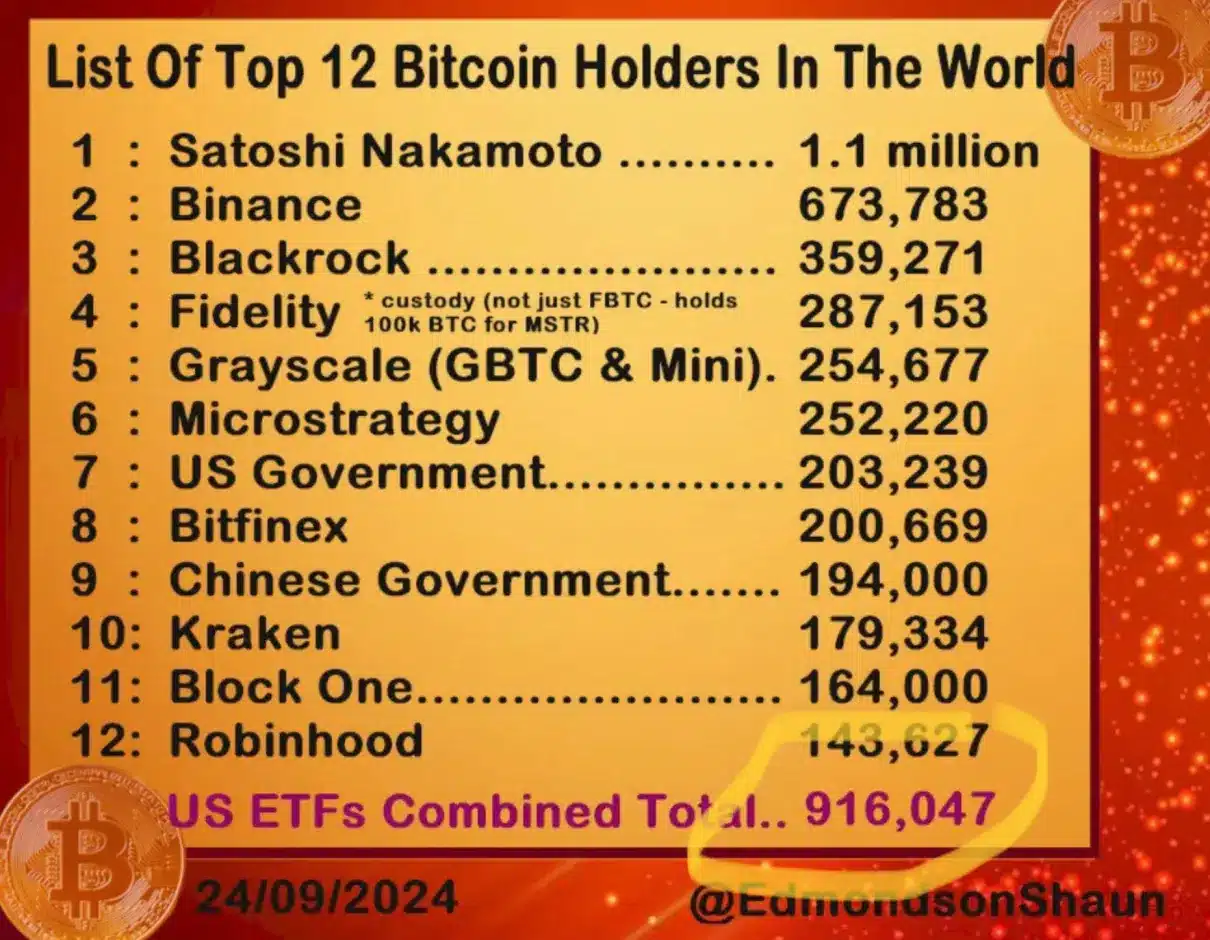

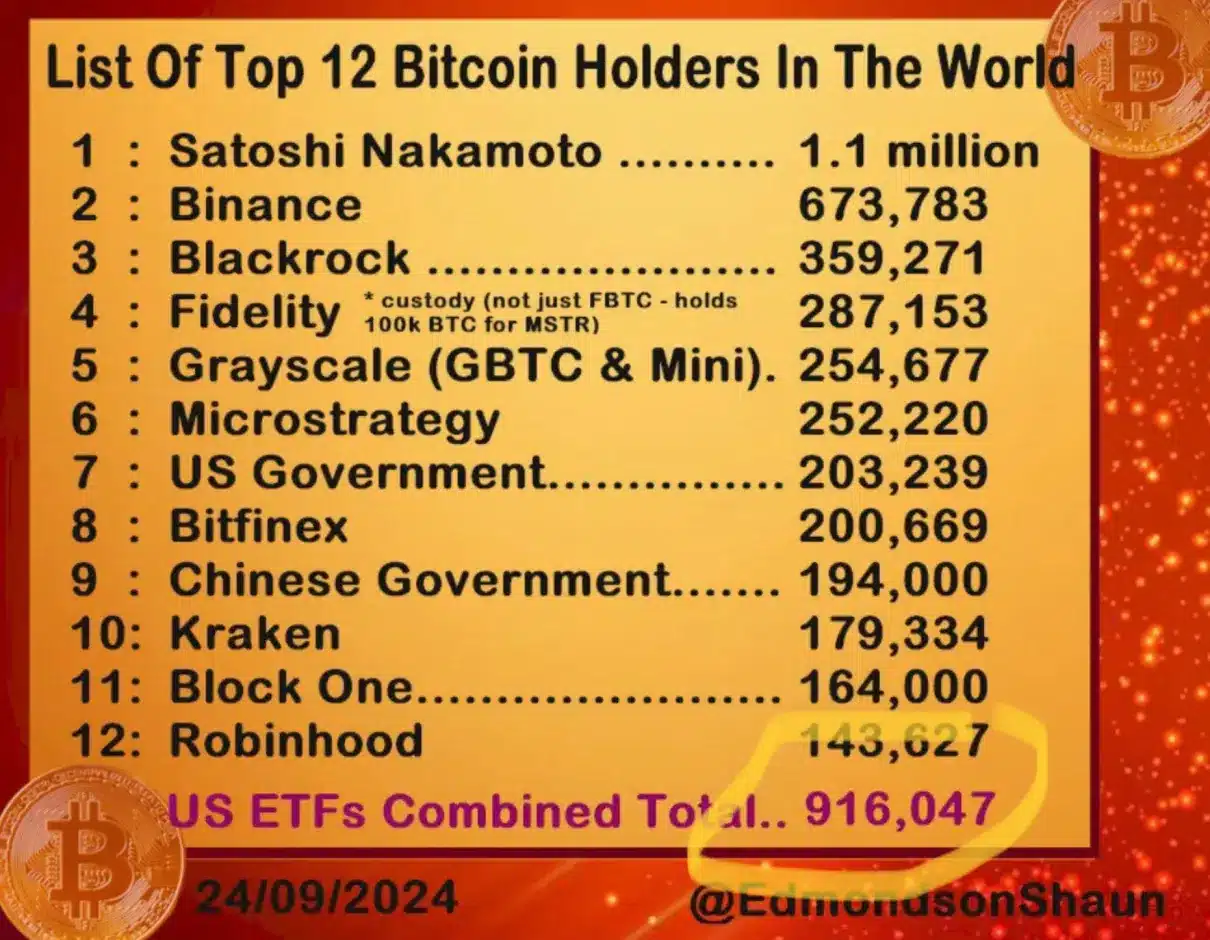

Satoshi Nakamoto, the creator of Bitcoin, is estimated to carry roughly 1.1 million BTC, a determine that institutional BTC ETFs are quickly approaching.

Current knowledge signifies that these ETFs have now amassed about 83% of Satoshi’s holdings, and if the development of accelerating inflows continues, it might quickly surpass him.

At the moment, Satoshi Nakamoto leads the checklist of the highest Bitcoin holders, carefully trailed by Binance with 673,783 BTC.

Notably, main asset managers like BlackRock, Constancy, and Grayscale collectively maintain a big 901,101 BTC by their ETF merchandise, with particular person holdings of 359,271 BTC, 287,153 BTC, and 254,677 BTC, respectively.

Supply: Eric Balchunas/X

In distinction, the remaining 5 asset managers with BTC ETFs possess a mixed whole of simply 14,946 BTC.

Sharing an analogous line of thought was Spencer Hakimian, Founding father of Tolou Capital Administration who mentioned,

“ETF’s going to be greater than Satoshi by Christmas Day.”

What’s extra to it?

In the meantime, MicroStrategy, led by Michael Saylor, ranks sixth with 252,220 BTC and is on a path to probably be part of the highest tier of Bitcoin holders.

Thus, as BTC ETFs proceed to seize consideration, Bitcoin itself has seen a resurgence in worth.

After going through challenges in breaking by the $60,000 barrier, BTC was trading at $64,358, reflecting a modest improve of 0.91% over the previous 24 hours.