- The SEC has authorised the primary leveraged MicroStrategy ETF

- Market indicators steered an upward transfer for Bitcoin

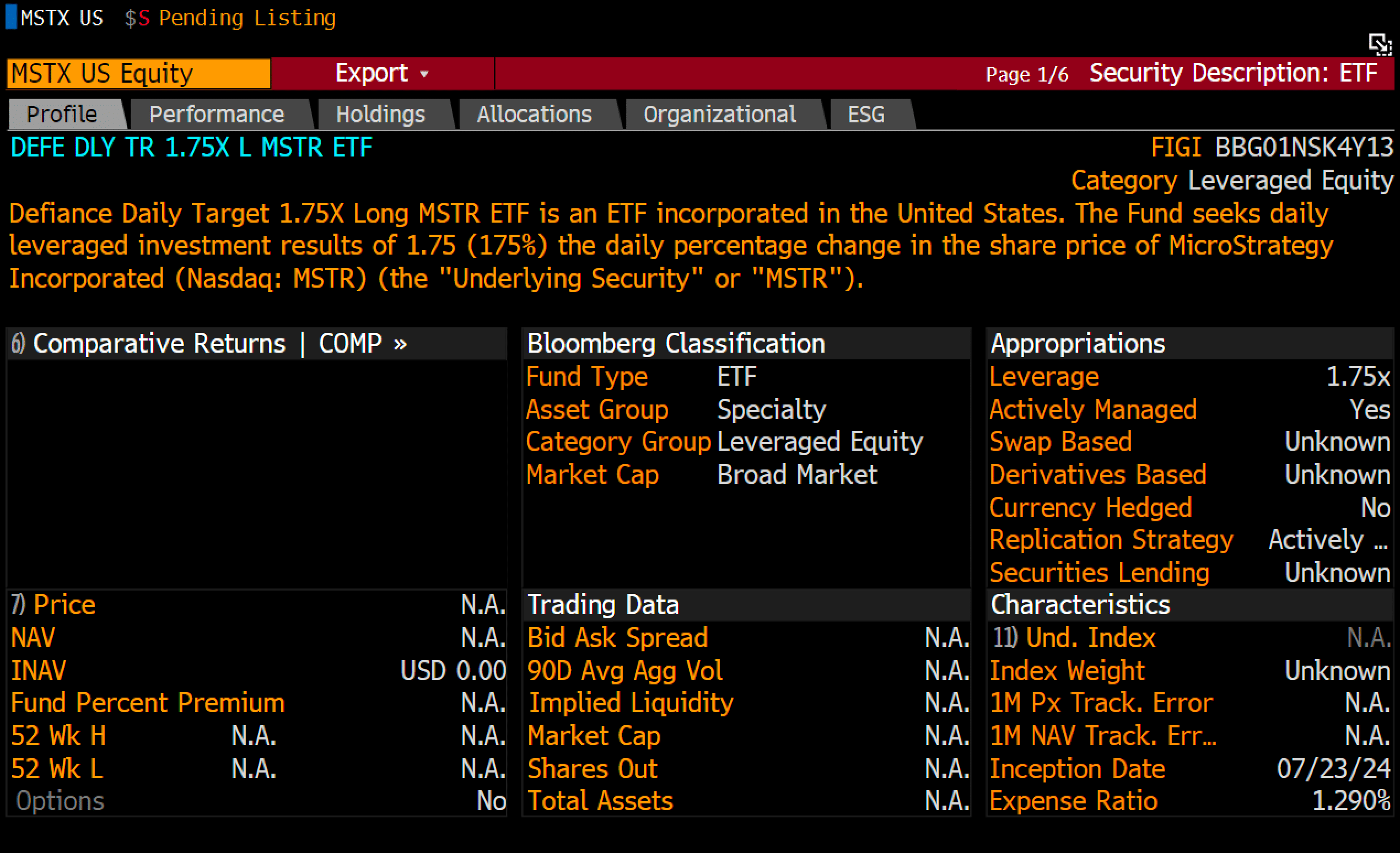

The SEC is within the information right now after it authorised the primary leveraged MicroStrategy ETF, launched by Defiance as a 1.75x fund ($MSTX). This replace was first shared by Bloomberg’s ETF Analyst Eric Balchunas on X.

Although initially meant as a 2x ETF, the SEC’s restrictions restrict its leverage. This ETF will likely be extremely risky, just like a 13x SPY ETF, surpassing even the $MSOX (2x weed ETF) in danger.

Supply: Eric Balchunas on X

Defiance has overwhelmed Tuttle to market with this product, though Tuttle can be trying a 2x MicroStrategy ETF.

The marketplace for extremely risky ETFs is robust, evident from the $5 billion Nvidia 2x ETF. This approval could also be an indication of larger shopping for stress and bullish sentiment for Bitcoin.

USD cycles, treasury, & BTC bull markets

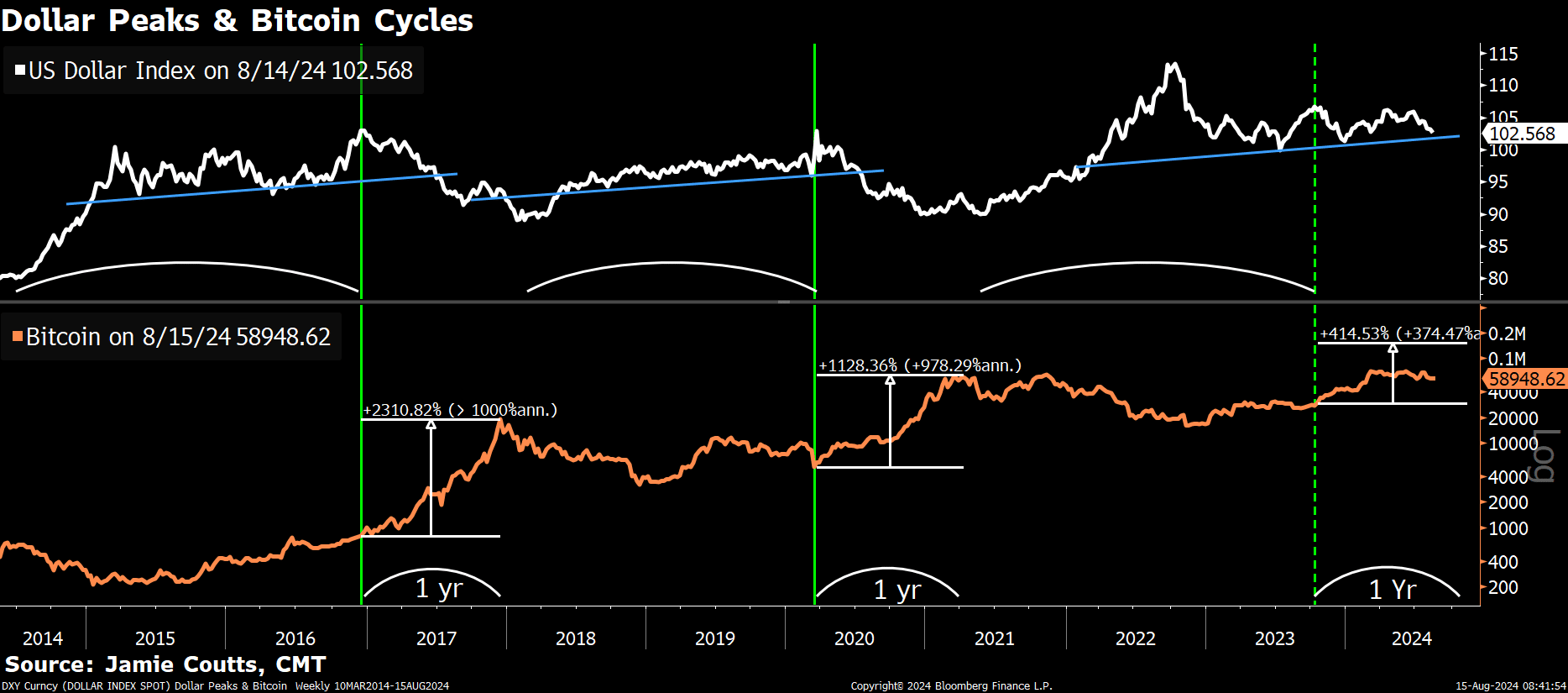

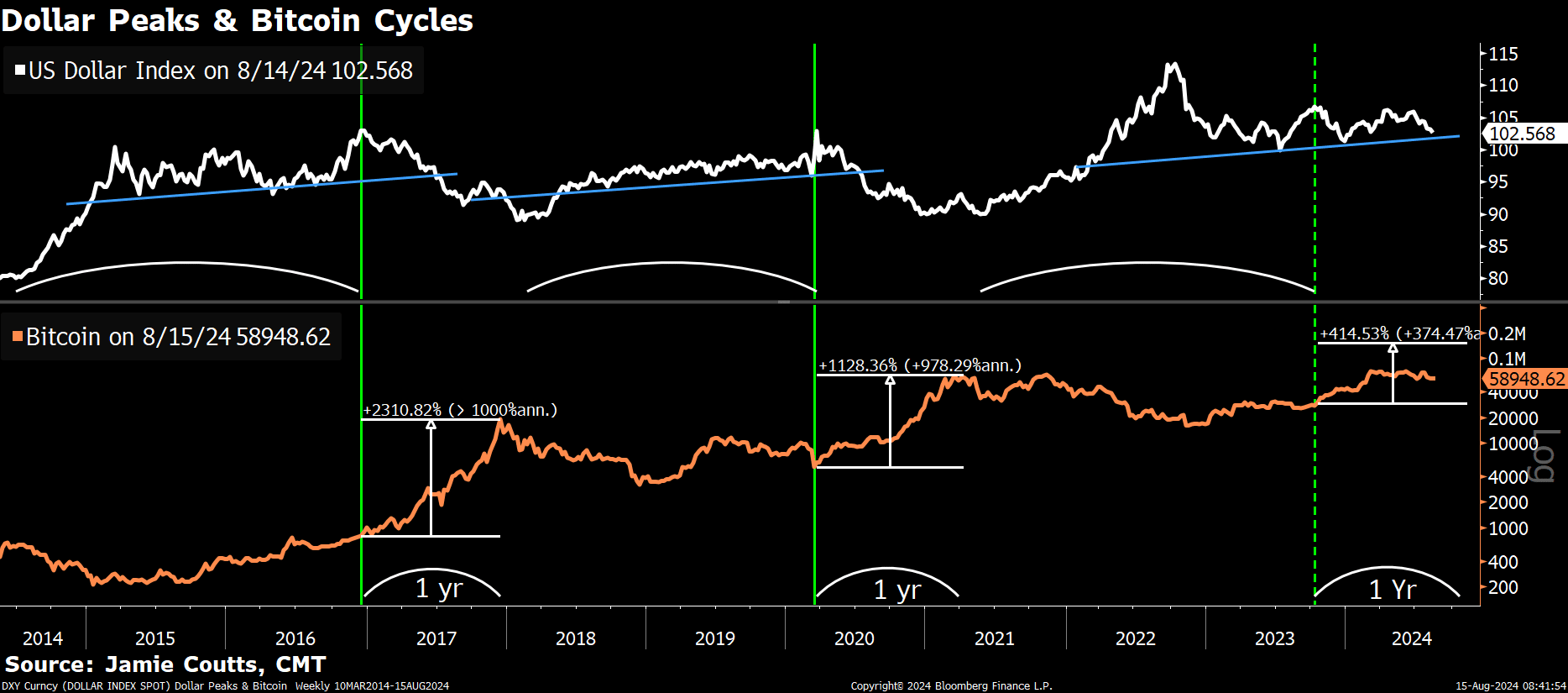

Bitcoin [BTC] tends to rise most sharply when the U.S greenback ($DXY) weakens. The Federal Reserve’s actions and elevated world liquidity are possible inflicting the DXY to say no.

The DXY has now hit equal highs, indicating a possible reversal. Because the DXY drops, Bitcoin is predicted to climb greater, doubtlessly surpassing its all-time excessive on the charts.

Supply: Bloomberg

Treasury market volatility is an important but typically neglected think about shaping danger asset methods. It’s a serious concern for Federal Reserve Chair Jerome Powell and his staff.

To forestall market instability, they goal to scale back treasury volatility. Consequently, this suppressed volatility might shift to Bitcoin, doubtlessly driving its value greater.

Supply: Bloomberg

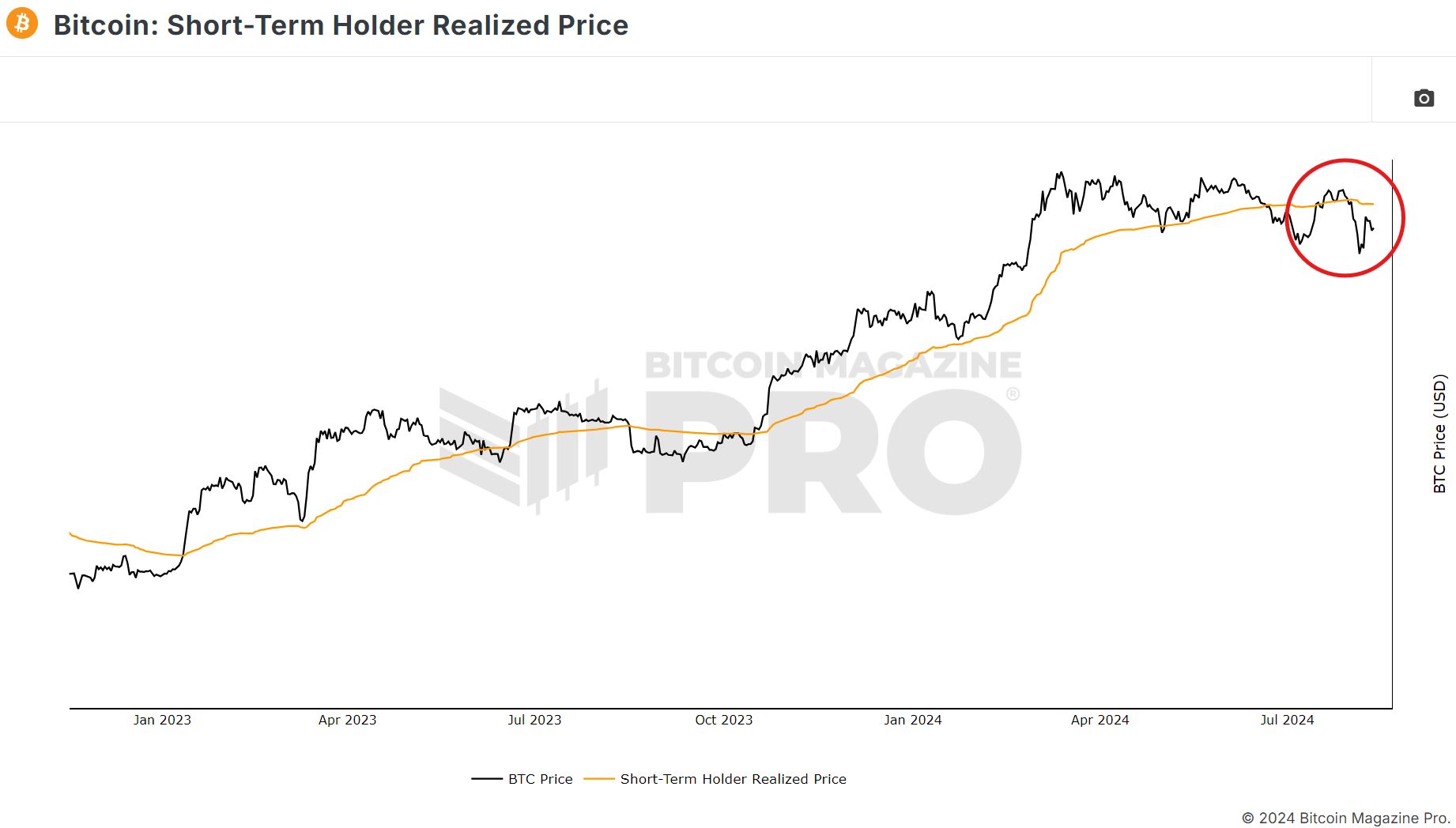

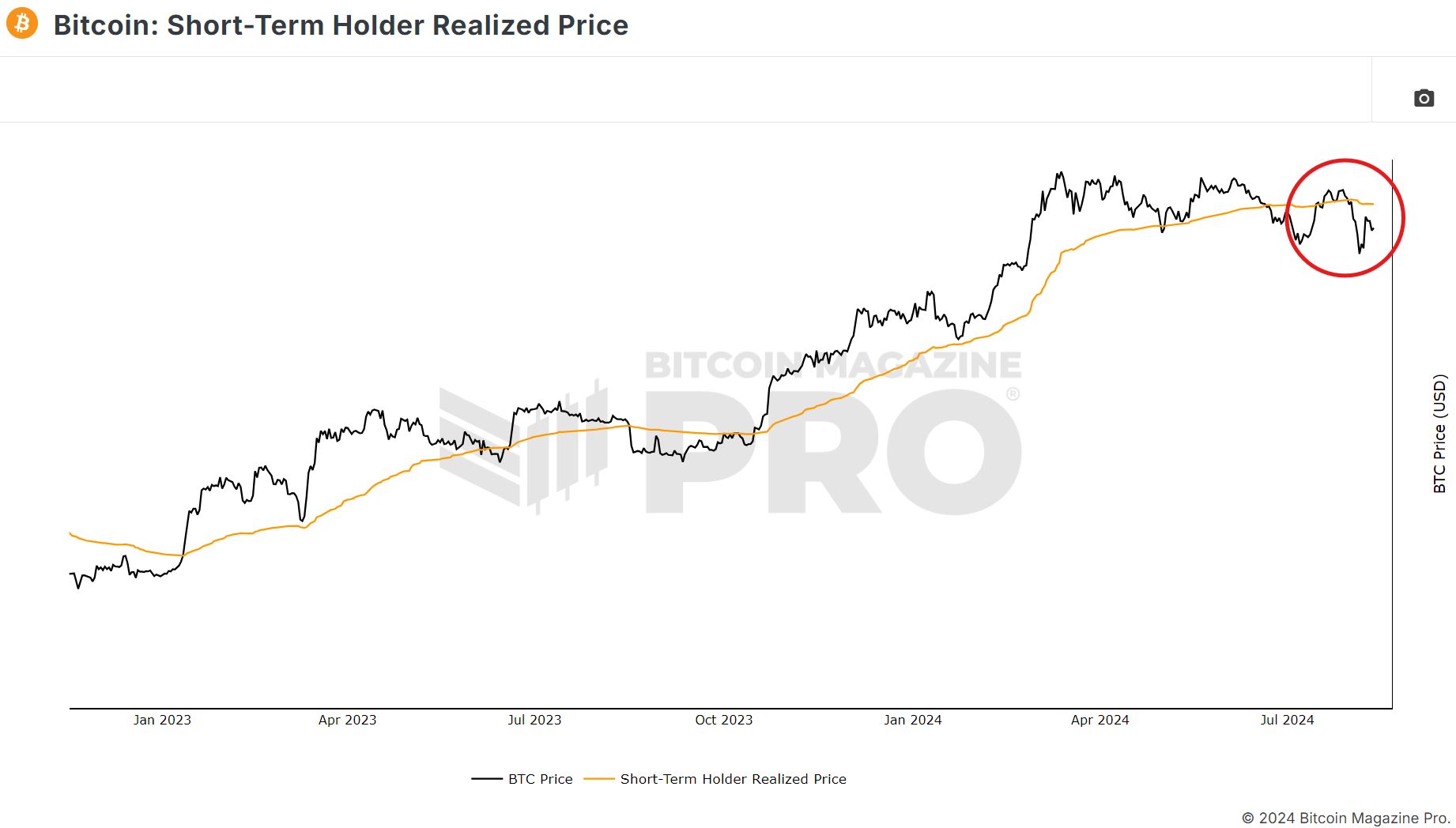

Bitcoin is demonstrating robust momentum too, breaking above the Brief-Time period Holder Realized Value of roughly $65K.

If this degree is reclaimed on the charts, it might function a basis for Bitcoin to push in the direction of the $70,000-mark and presumably past. This efficiency reinforces Bitcoin’s place as a best choice for crypto funding.

Supply: Bitcoin Journal PRO

Leverage liquidations and RSI sign bullish sentiment

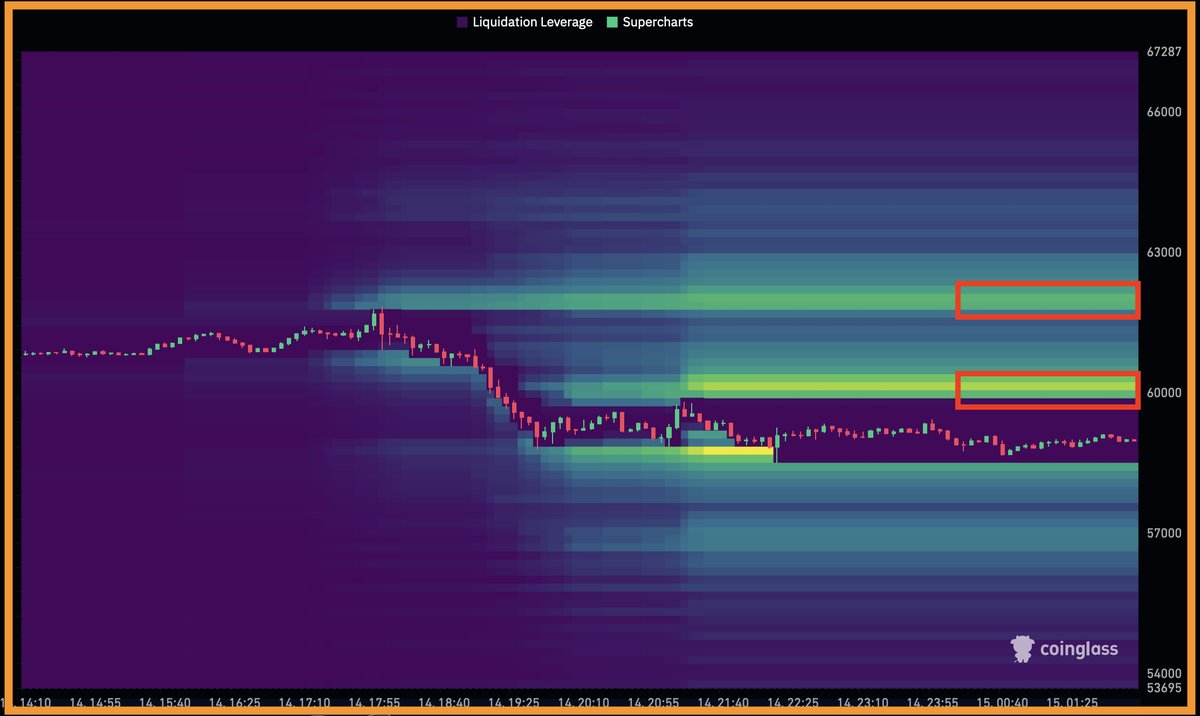

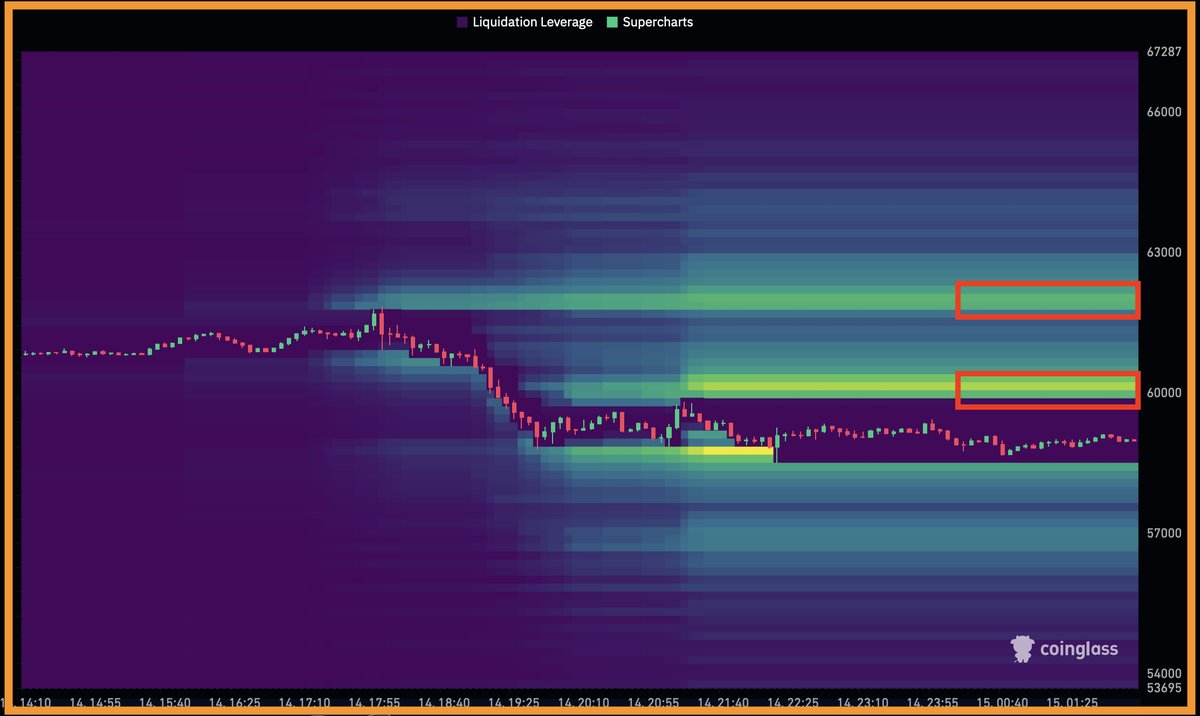

Leverage liquidation looking is a key issue inflicting value actions throughout excessive timeframes.

Bitcoin might climb and maintain above $60k to set off liquidations, the place $93 million is positioned between $60-60.4K, and one other $75 million between $61.8-62.2K.

This might drive Bitcoin to surpass its earlier all-time excessive of $74,000, doubtlessly resulting in even greater costs.

Supply: Coinglass

Lastly, Bitcoin’s Stochastic RSI signaled that BTC will enter a “Rebound Zone” within the coming months. This is a key alternative for merchants and buyers to build up Bitcoin earlier than a possible surge in its value.

What this indicator additionally implies is a excessive chance of BTC hitting new highs, reinforcing the concept now’s a strategic time to put money into Bitcoin.

Supply: Dealer Tardigrade, TradingView