- Metaplanet to difficulty ¥1 billion in bonds to buy Bitcoin.

- Evaluation of Bitcoin’s market fundamentals steered restricted influence on total value.

Regardless of a latest downturn in Bitcoin’s [BTC] value, affecting the broader cryptocurrency market, Japanese agency Metaplanet is doubling down on its Bitcoin technique.

At press time, BTC was buying and selling at $62,825, reflecting a 2.3% decline during the last 24 hours and a 3.2% drop over the previous week.

No matter these market situations, Metaplanet has unveiled plans to bolster its Bitcoin holdings considerably.

Particulars of the funding

Early on the twenty fourth of June, Metaplanet announced a strategic transfer to difficulty ¥1 billion ($6.2 million) in bonds at a modest rate of interest of 0.5% to buy Bitcoin.

This signaled a powerful dedication to integrating cryptocurrency into its asset administration technique. A part of Metaplanet’s discover learn,

“Metaplanet Inc. (3350:JP) hereby publicizes that the Board of Administrators has resolved to buy Bitcoin price 1 billion yen as of immediately’s assembly. The funds for this buy might be allotted from the capital raised by the issuance of the second collection of odd bonds (with ensures), as disclosed individually immediately within the “Announcement on the Issuance of the Second Collection of Atypical Bonds (with Ensures).”

Metaplanet additional clarified its monetary technique concerning the BTC investments, indicating that that BTC designated for long-term holding might be logged at acquisition value.

This makes them exempt from market worth taxation at fiscal year-end. In distinction, different Bitcoin belongings might be repeatedly assessed at market worth every quarter, with any features or losses impacting non-operating monetary outcomes.

Regardless of a normal coverage of retaining BTC for prolonged intervals, the corporate famous that any Bitcoin used for operational functions could be accounted for as present belongings on their stability sheet.

Notably, the choice to amass extra Bitcoin by bond issuance aligns Metaplanet with notable corporations like MicroStrategy, which have adopted comparable methods to extend their BTC reserves.

In April, Metaplanet initially added Bitcoin to its balance sheet, following MicroStrategy’s method to make use of debt financing for buying Bitcoin.

The agency’s shift in the direction of vital cryptocurrency funding marks a transition from its earlier deal with working price range inns.

This transfer is a part of a broader technique to diminish the corporate’s reliance on the weakening Japanese yen, which has hit its lowest degree in opposition to the U.S. greenback since 1990.

Impression on Bitcoin?

With Metaplanet’s substantial monetary dedication to Bitcoin, the query stays whether or not a¥1 billion ($6.2 million) Bitcoin buy will considerably affect the market.

To evaluate this, it’s important to think about Bitcoin’s elementary metrics, significantly the present provide and demand dynamics.

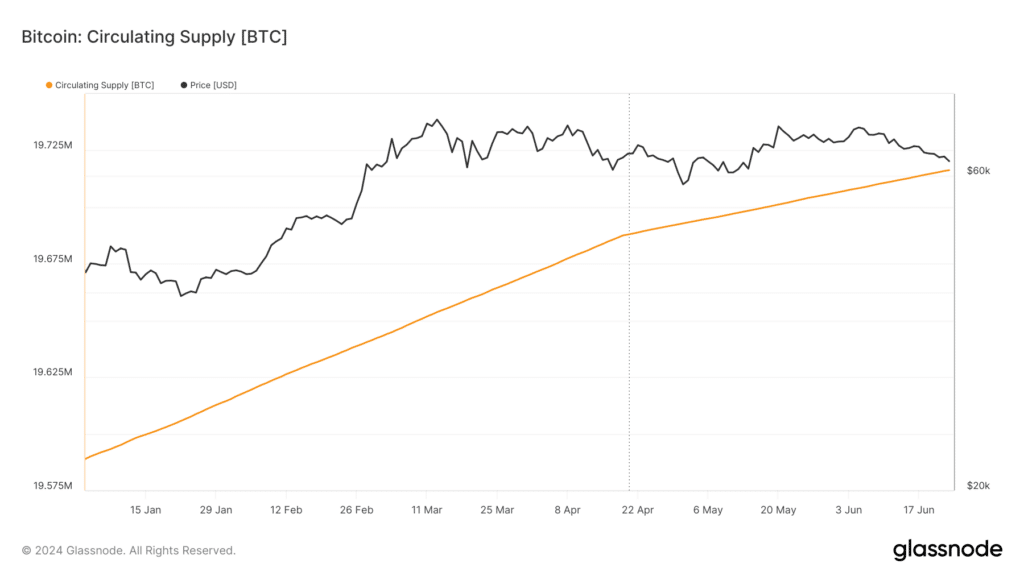

Observing the circulating provide, which has been steadily increasing, reveals that the proposed buy would represent solely a minor fraction of the market’s whole, suggesting it could not dramatically affect Bitcoin’s value.

Supply: Glassnode

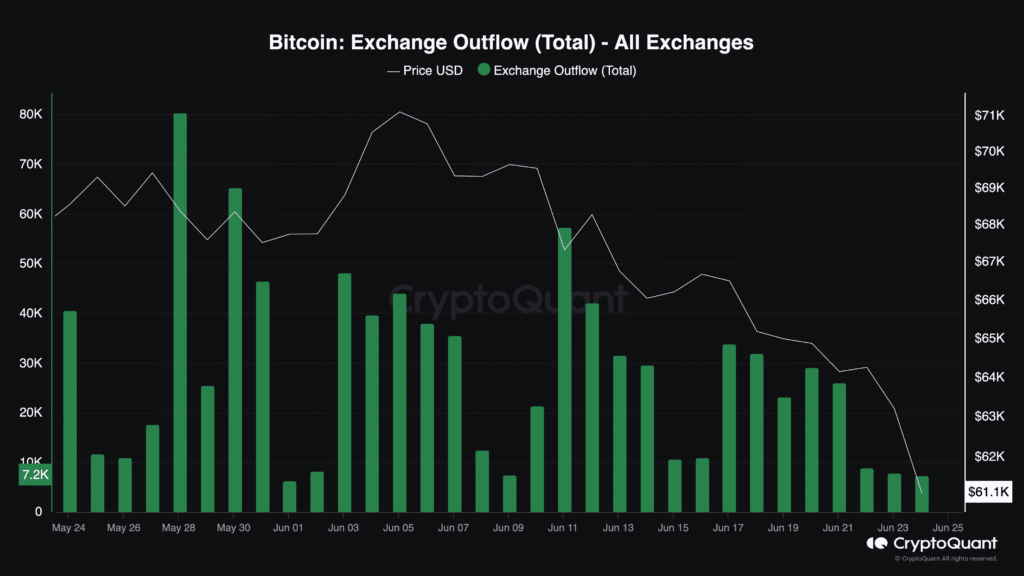

Moreover, it’s essential to look at the demand facet, particularly the change outflow developments. Data from CryptoQuant exhibits a 1.75% rise on this metric during the last 24 hours.

Nevertheless, a broader look revealed a month-long decline in outflows, indicating a lower in shopping for stress.

Supply: CryptoQuant

On the twenty third of June, about 7,852 BTC left exchanges—a pointy lower from the 80,000 BTC famous on the twenty eighth of Might.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This development, coupled with latest predictions from AMBCrypto that BTC may drop to $61k, steered that whereas Metaplanet’s funding gained’t possible trigger substantial value actions by itself.

It varieties a part of a broader market context the place demand seems to be waning.