Many think about dYdX to be one of the crucial profitable Perp DEXs, and it definitely is. Nevertheless, it’s more and more challenged than earlier than.

The DeFi world sees know-how iterations day-after-day, and no mission can relaxation on pioneering benefits. Revolutionary latecomer derivatives buying and selling platforms comparable to GMX, MYX, Hyperliquid and others are doing every thing they will to get nearer to dYdX.

The dYdX redemption

dYdX is an enthralling and dependable mission. Based in 2017, it makes use of the standard central restrict order ebook and matching engine to facilitate transactions on a decentralized sensible contract protocol. Because the “older brother” in Perp DEXs, dYdX is continually upgrading itself and has now been up to date to V4. Nonetheless, in comparison with new derivatives buying and selling platforms, dYdX lags behind, particularly in terms of commerce facilitation mechanisms.

Not like different high DEXs, dYdX used a central restrict order ebook as a substitute of the AMM mannequin. This mannequin introduced many advantages to early dYdX customers: buying and selling on dYdX is similar to buying and selling on centralized exchanges, and customers can study to commerce in a short time; the order ebook design can present deeper liquidity and help for superior order varieties.

Nevertheless, the order ebook mannequin will not be with out its warts. It brings challenges comparable to the necessity for a considerable amount of liquidity, the low effectivity of capital use, the vulnerability to sandwich assaults and different typical on-chain assaults, the excessive prices of information storage and on-chain computation that make it restrict the variety of tradable knowledge. Cash. Even with continued upgrades, dYdX stays caught within the query of tips on how to obtain “self-procurement of order ebook design.”

The third era DDEX revolution led by MYX

The third-generation DDEX revolution is led by MYX, a spinoff protocol present in 2023. In comparison with dYdX, MYX is totally a “freshman”. Though the valuation is presently comparatively low, MYX has grow to be the quickest rising Perp DEX with its MPM (Matching Pool Mechanism), reaching $1B Each day Vol in simply 39 days. By comparability, dYdX reached this quantity inside 208 days.

MYX achieves MPM by introducing the idea of the liquidity pool, whereby Liquidity Suppliers (LPs) can present funds, passively take positions and act as counterparties to facilitate fast buying and selling. This mechanism ensures good liquidity available in the market and permits customers to open or shut positions at any time. LPs cowl potential losses by reserving collateral and have the chance to earn buying and selling charges and earnings on their positions. On the similar time, MYX innovatively introduces financing charges and “Maker Low cost” into MPM as a strategy to stability the pursuits of each the lengthy and brief sides and clear up the issue of long-term place imbalance.

In a balanced market, MYX’s MPM mechanism can show greater capital effectivity than conventional P2Pools. As a result of the MPM solely carries the online publicity of lengthy and brief positions, LPs carry much less threat. In a market the place lengthy and brief positions develop alternately, MPM can help open curiosity with restricted capital that’s tens of instances bigger than its personal place dimension. This not solely will increase LPs’ returns and eliminates their over-reliance on “betting returns”, but additionally permits the platform to cut back buying and selling prices to as little as 1bps.

To handle the market imbalance, MYX has launched a dual-token design, which permits LPs to obviously handle their very own publicity, flexibly select to hedge their passive positions in different markets, or improve earnings and bear losses brought on by place fluctuations. On the similar time, MYX additionally makes use of an oracle machine to facilitate order matching. Counting on the off-chain computing capabilities of oracle machines, MYX customers can expertise comparable and even higher buying and selling experiences than CEXs.

Because the crypto market usually experiences excessive fluctuations, MYX has additionally launched the Auto-Deleveraging System (ADL) to take care of this situation. When buying and selling quantity will increase dramatically and the scale of open positions is far bigger than that of the liquidity pool, the system will reject new orders. ADL forces the liquidation of essentially the most worthwhile opposing place to alleviate the magnitude of the market imbalance.

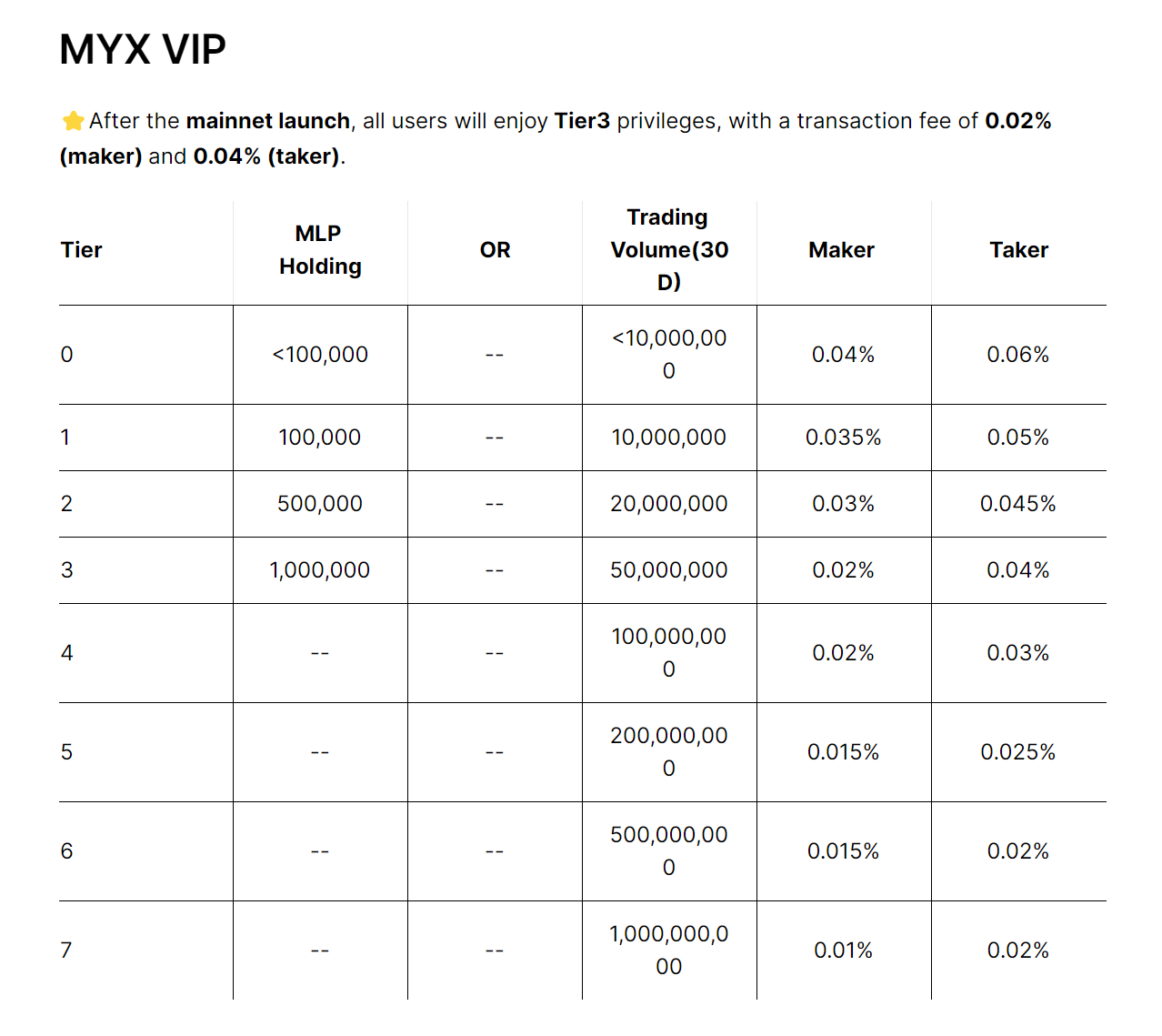

Whereas providing a high-level buying and selling expertise with very low buying and selling charges (0.02% for the maker and 0.04% for the taker), MYX additionally pays shut consideration to the pursuits of its customers and group supporters. In March this 12 months, MYX launched “Undertaking Origin”, which continues to be ongoing, dropping 200,000,000 tokens (20% of the whole token provide) to group members and supporters. It’s estimated that the third section of “Undertaking Origin” will go dwell very quickly.

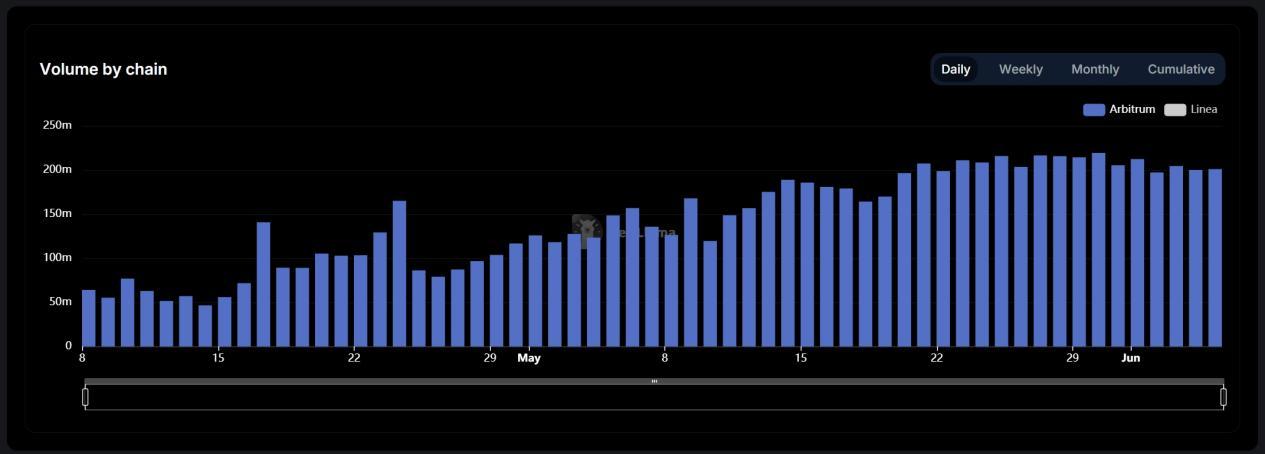

With its steady, clean and environment friendly buying and selling expertise, MYX has attracted over 33,000 customers with a every day buying and selling quantity of over $200 million shortly after its launch on Arbitrum in February this 12 months. Such a progress price in person numbers and buying and selling quantity is staggering even in in the present day’s crypto market. MYX will reportedly launch on Scroll within the close to future. We now have little question that MYX won’t solely deliver a model new buying and selling expertise to all customers of the Scroll ecosystem, but additionally proceed its speedy progress momentum.

The blue-eyed boy of worldwide capitals and high VCs

MYX’s progressive product and speedy person progress attracted the eye of high worldwide capitals from the very starting of its existence. In November 2023, MYX accomplished a $5 million seed funding spherical at a $50 million valuation, led by HongShan (Sequoia China), Consensys, Hack VC and different main enterprise capital funds. Backed by high VCs, MYX reached varied types of strategic collaboration with crypto gamers comparable to OKX, Izumi, zkPASS, Pyth, and so on. to strengthen its ecosystem.

With the steady and clean buying and selling expertise supported by MPM, MYX will undoubtedly grow to be a member of the “Prime Perp DEXs Membership”. It is like a compressed spring. In the event you make investments extra and guess on it, it’ll acquire extra kinetic vitality, silently retailer its energy, and for the time being of launch it’ll leap up and multiply the funding you made in it, because it soars into the air.