- Bitcoin’s accumulation was sturdy amongst custodial wallets.

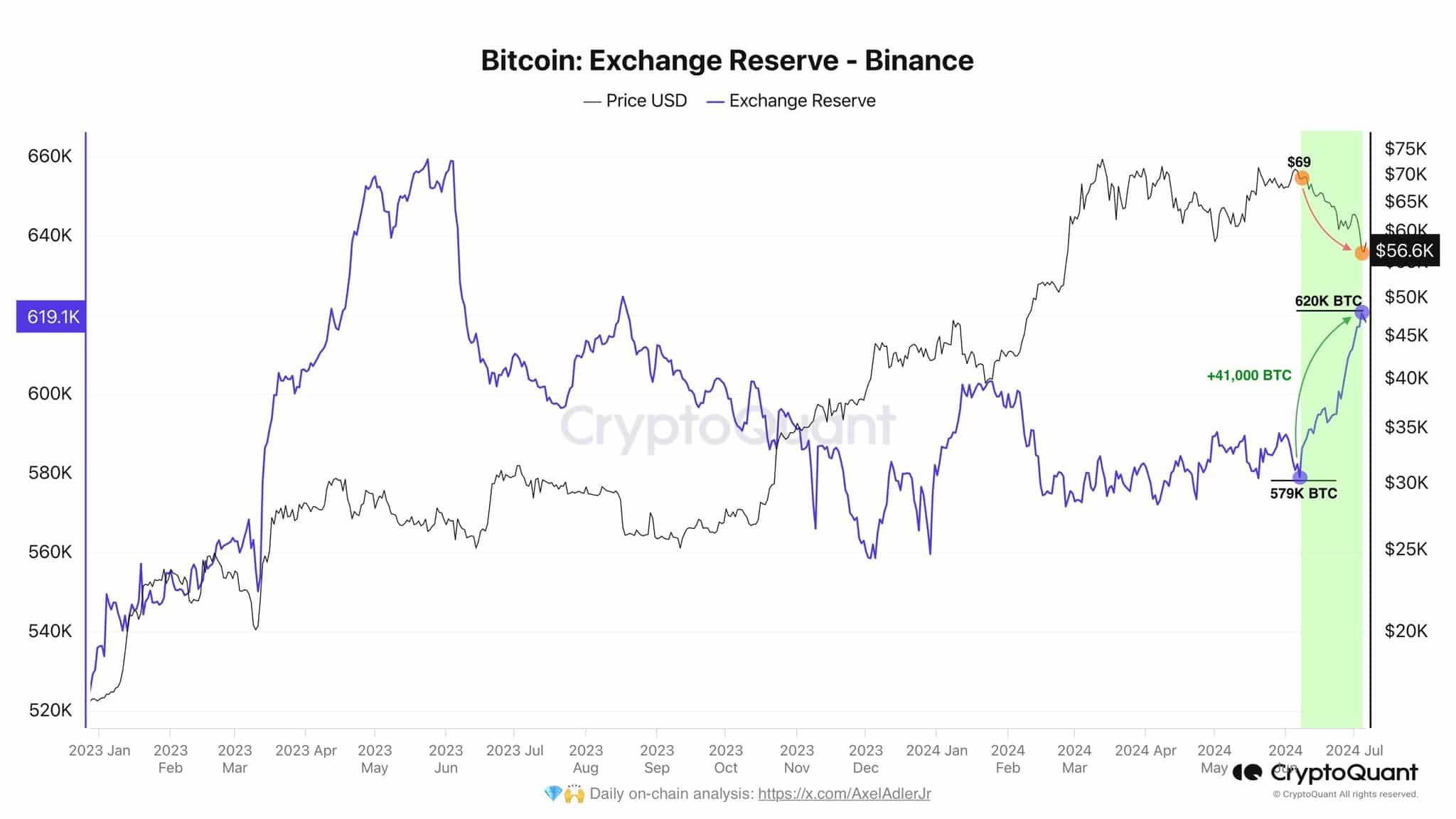

- The biggest crypto trade, Binance, has added to its reserves, similar to in early 2024.

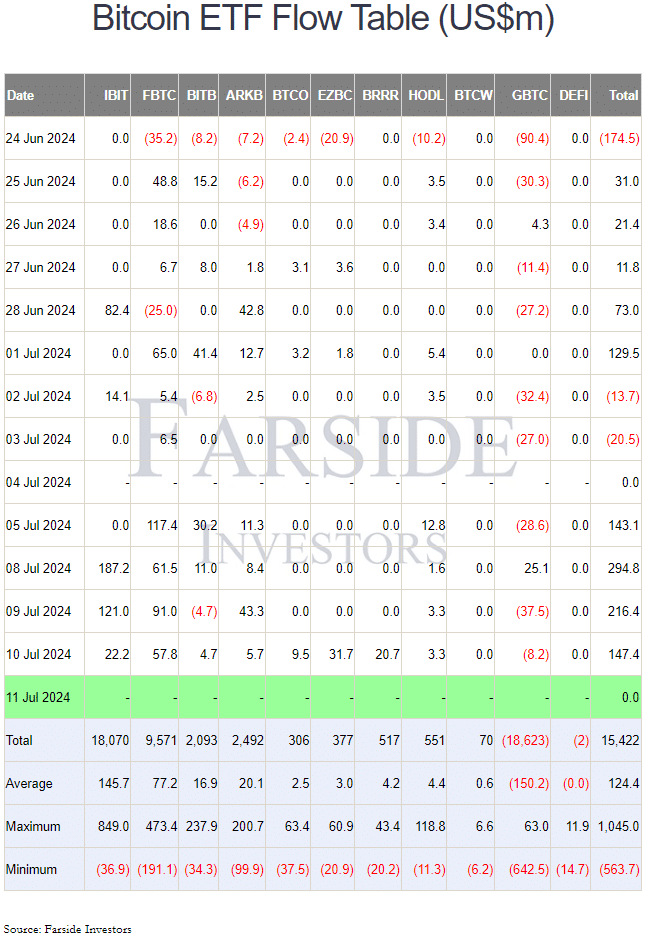

Bitcoin [BTC] confirmed indicators of accumulation regardless of its value drop under the $60k zone. Its ETF inflows have been constructive over the previous few days, which was an encouraging signal about its market sentiment.

There was large shopping for strain behind the king coin, however is it sufficient to beat the correction of the previous month? Ought to merchants put together for a fast restoration or hunker down for a consolidation part?

Bitcoin everlasting holders add to their positions

Crypto analyst Axel Adler noticed in a post on X (previously Twitter) that for the reason that Bitcoin correction started simply over a month in the past, 41k BTC have been added to the Binance reserves.

The trade accumulates BTC for its reserves and liquidity functions. January 2024’s additions have been adopted by a robust rally past $40k.

It won’t be stunning in the event that they, with their expertise and experience, have been shopping for the dip for a month now. Merchants won’t need to take this as actionable data, however extra as meals for thought.

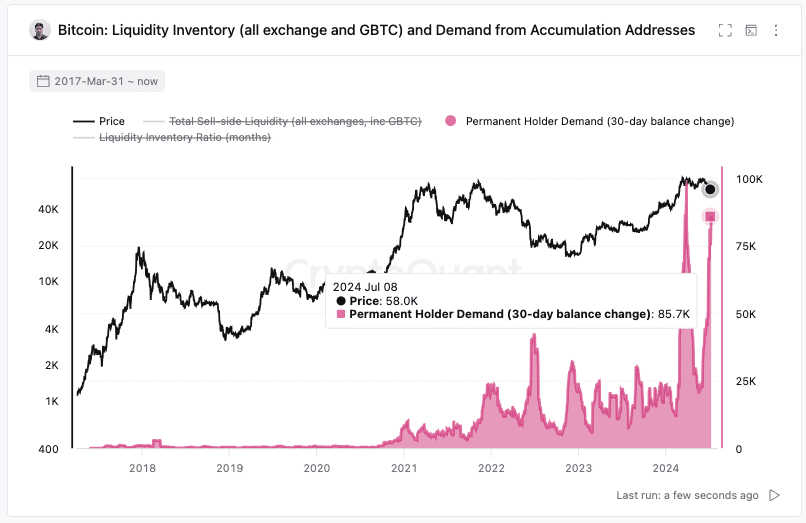

Ki Young Ju, the founder and CEO of CryptoQuant famous that custodial wallets with no outflows have been including in the course of the value dip. They amassed 85k BTC over the previous month, whereas 16k BTC flowed out of ETF reserves.

This meant that the market-savvy long-term holders have been including to their baggage whereas the extra retail-oriented ETFs have been responding to their shoppers’ strain, revealing a attainable divide between good cash and retail sentiment.

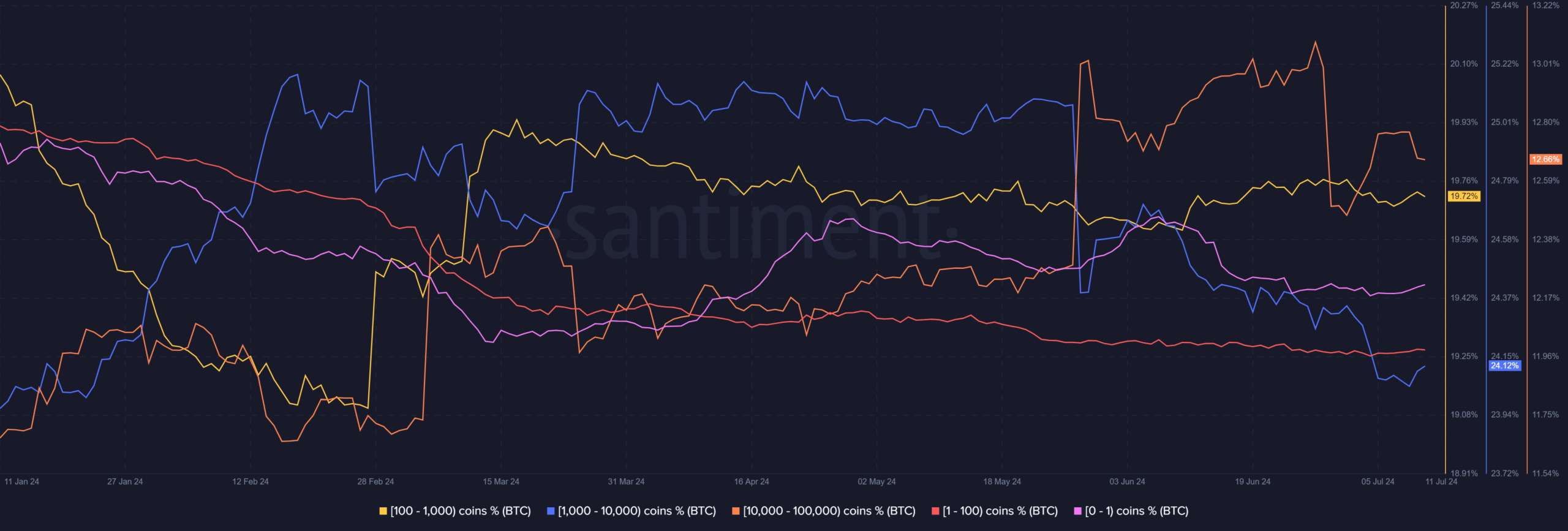

Analyzing whale conduct

The whale cohort with 1k-10k BTC holdings has been promoting since mid-Might, which was not encouraging. Nonetheless, the 10k-100k holders had aggressively added in late Might however offered portion towards the tip of June.

In the meantime, the smaller wallets with 100-1k Bitcoin additionally amassed.

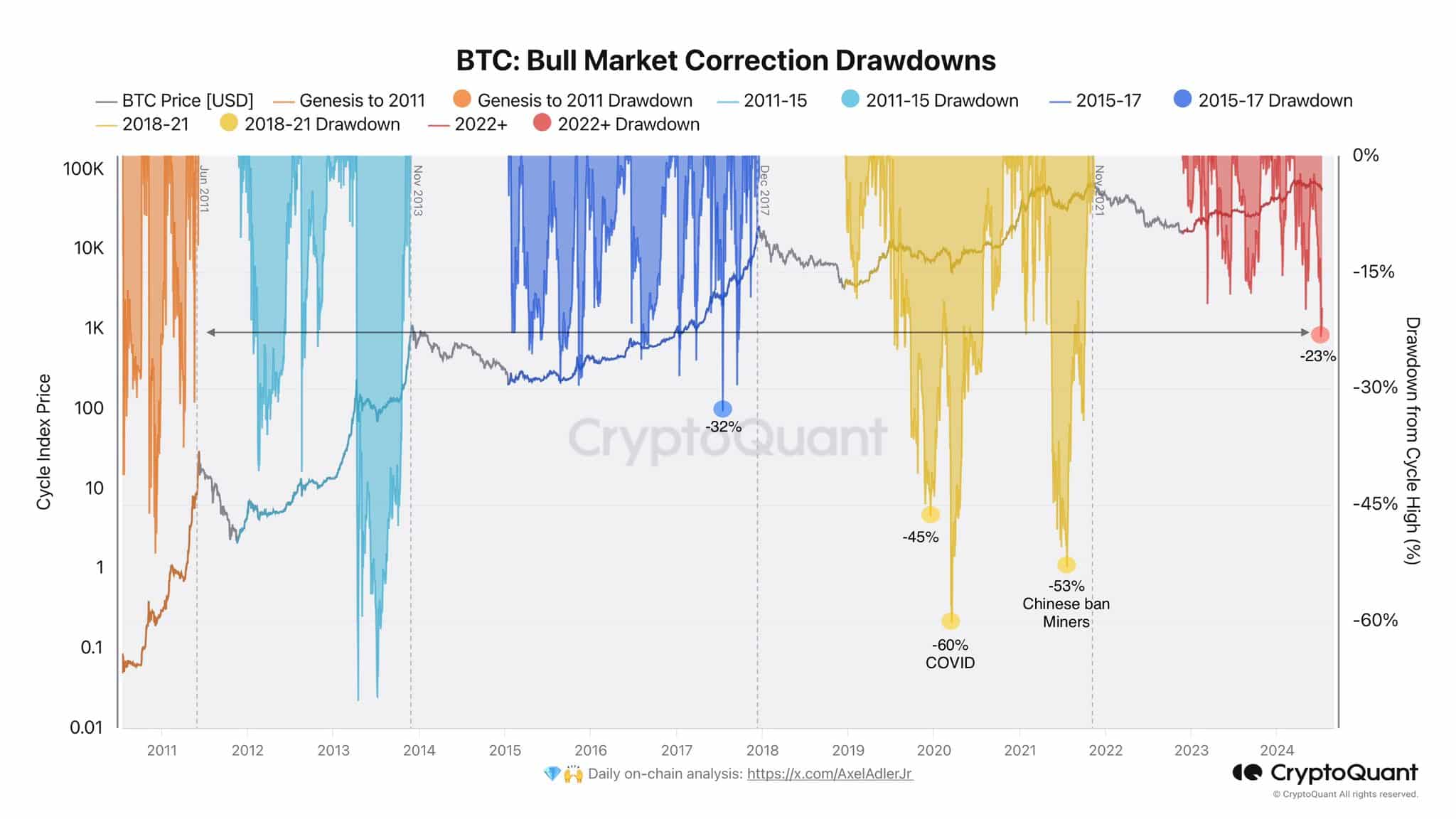

The chart from Axel Adler underlined the necessity for traders to not lose their heads. The earlier cycles noticed many sharp value downturns.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The present one won’t be at an finish, and $52k and $46k are the subsequent ranges to look at.

Primarily based on the info at hand, the value backside could be close to, but it surely’s unclear simply how close to, and merchants would need to be ready for a situation the place the $52k assist may briefly be misplaced.