- The share of BTC provide in revenue has declined by 15% since 5 March

- Coin’s Age Consumed and Community Realized Revenue/Loss metrics refuted claims of a value backside

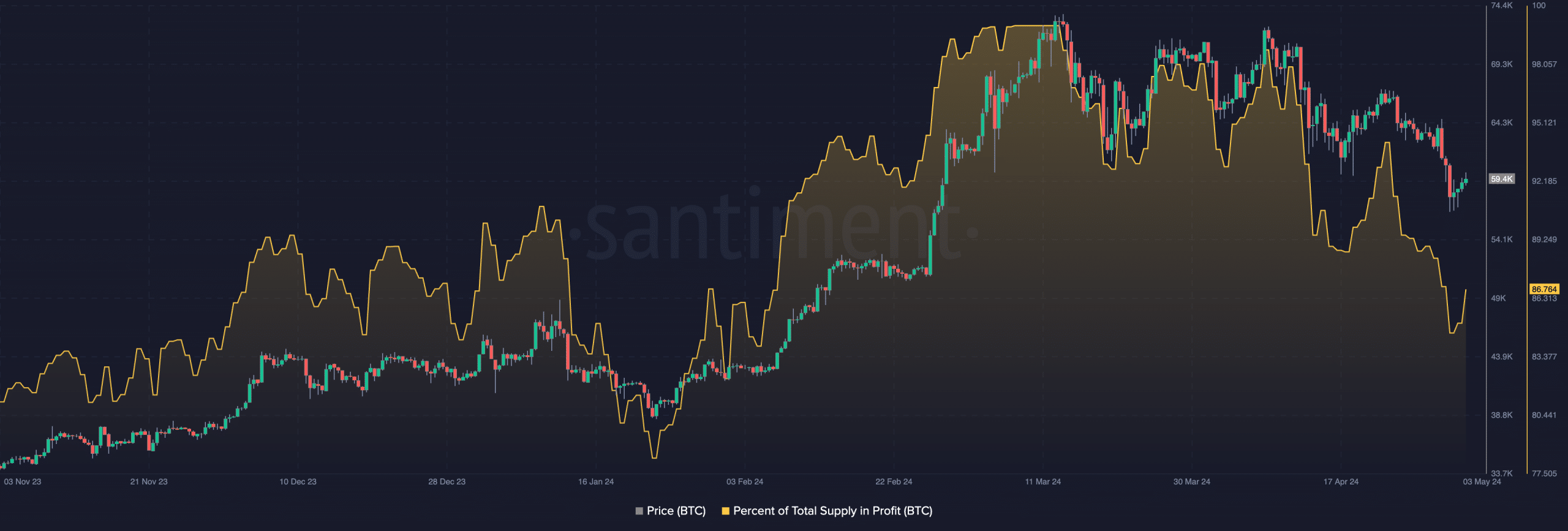

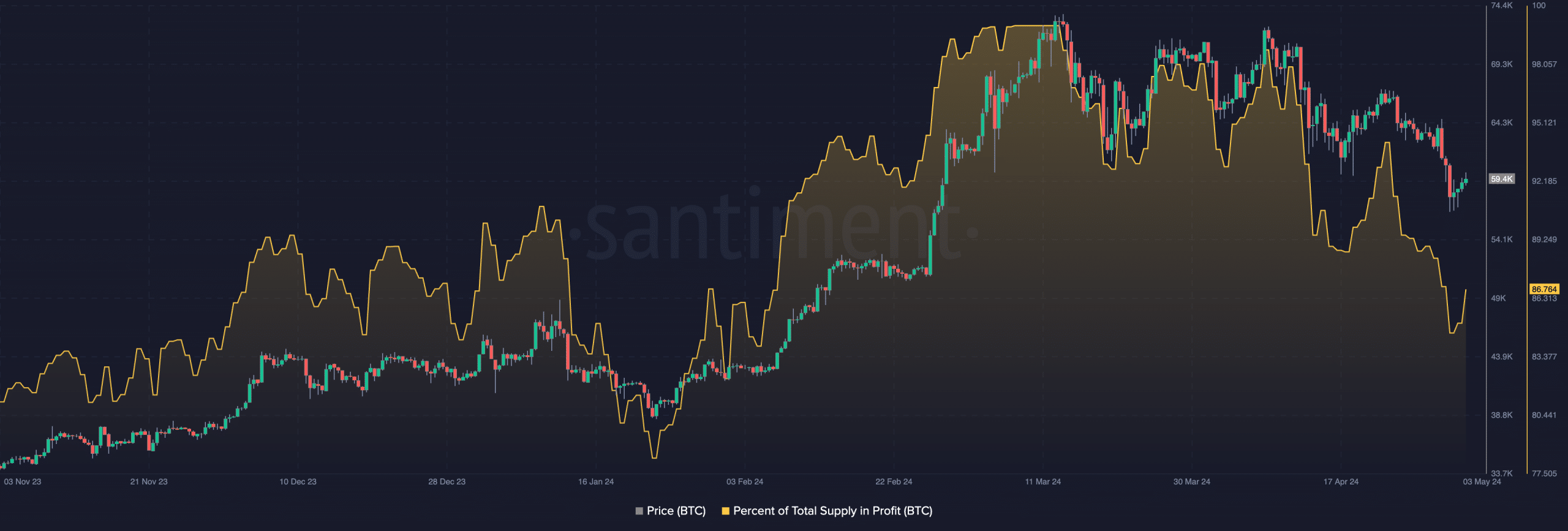

The share of Bitcoin [BTC] provide in revenue has dropped to a two-month low of 84.4%, in line with Santiment’s newest update on X (Previously often known as Twitter).

The truth is, in line with the on-chain knowledge supplier, figures for a similar rallied to a year-to-date peak of 99.93% on 5 March. Nevertheless, it has since fallen on the charts.

Supply: Santiment

When this ratio declines on this method, it signifies that an rising portion of BTC traders maintain their cash at a loss. This typically occurs when BTC’s value see a slight correction and short-term holders who purchased comparatively just lately at larger costs panic and start to promote their holdings.

In its put up, Santiment assessed the metric’s historic efficiency and concluded that “decrease ranges usually justify extra bullish situations.”

This, as a result of a low supply-in-profit ratio will be considered as a contrarian indicator. When it falls, it signifies that weak/paper arms have been faraway from the market, making means for brand spanking new demand available in the market. A declining supply-in-profit ratio might sign that an asset’s value is approaching its backside, as there are fewer sellers left available in the market.

Is the underside in?

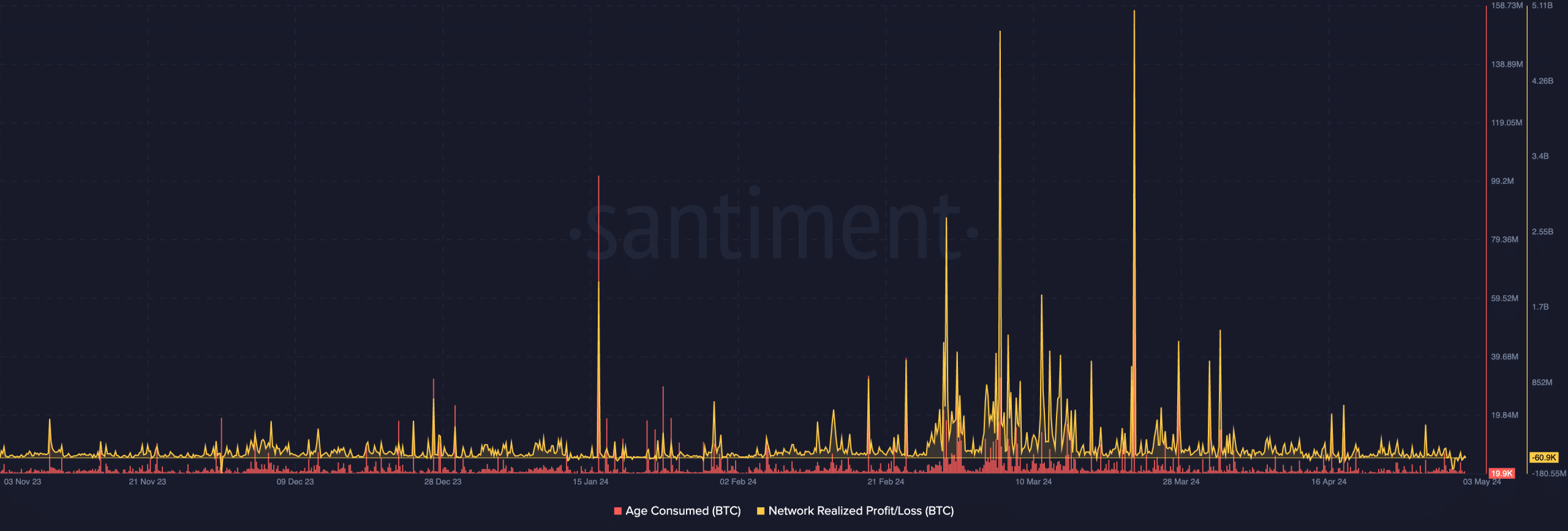

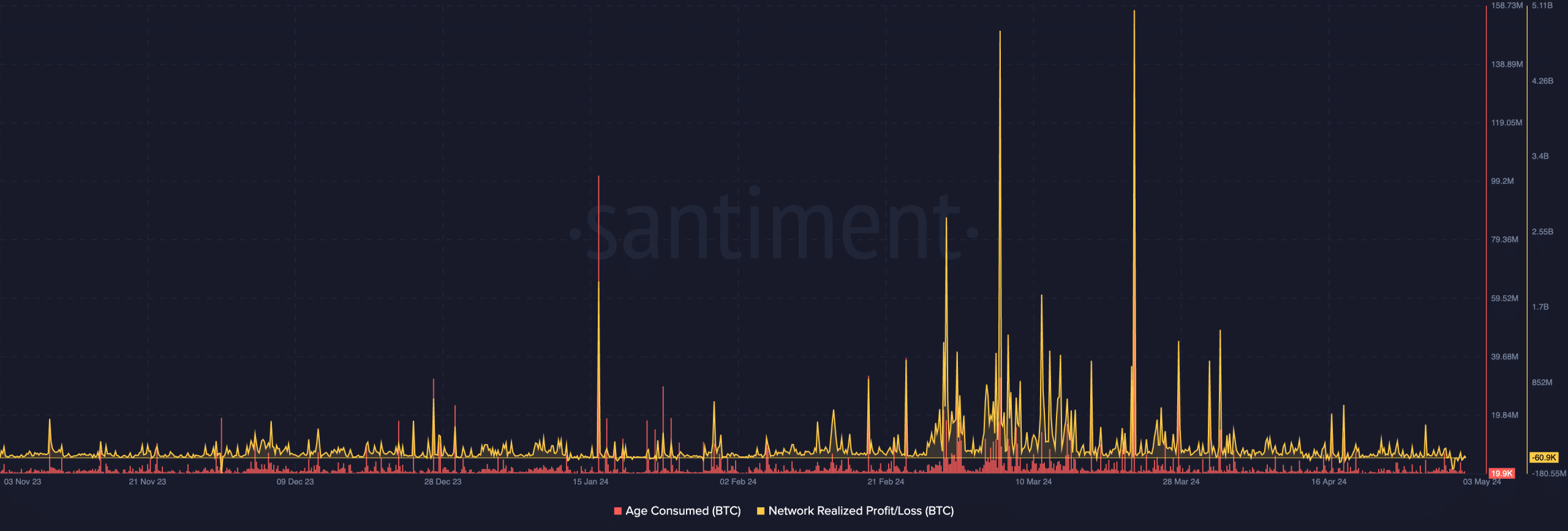

To evaluate whether or not BTC’s value has reached its backside and if a rally is subsequent, a key metric to think about is the coin’s Age Consumed. This metric tracks the motion of its long-held idle cash. This metric is deemed to be marker of property’ native value tops and bottoms as a result of long-term holders hardly ever transfer their dormant cash round. As such, once they do, it’s noteworthy because it typically leads to main shifts in market traits.

When this metric rises, it alerts {that a} important variety of beforehand held idle tokens have begun to vary addresses.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Conversely, when it falls, it signifies that long-held cash stay in pockets addresses with out being traded.

In keeping with Santiment, BTC’s Age Consumed has been comparatively flat since 3 April, suggesting that there has not been any important motion of dormant cash, which might have marked an area backside.

One other necessary metric to think about is BTC’s Community Realized Revenue/Loss (NPL). It tracks the distinction between the worth at which cash have been final moved on the blockchain and their present market value. Traditionally, NPL declines are a marker for when an asset has reached an area backside. This, as a result of when these dips occur, they sign the short-term capitulation of ‘weak arms’ and the re-entry of latest cash into the market.

As per the identical, there isn’t a indication {that a} value backside has been reached on the charts but.

Supply: Santiment