- BTC’s momentum has turned bullish for the primary time in H2 2024.

- Will the uptrend proceed and observe historic US pre-election traits?

Final week was a fantastic and bullish one for Bitcoin [BTC]. It pumped almost 10%, rallying from $62.5K to $69.4K on account of robust spot market demand.

The latest rally made BTC solely 7% away from its ATH of $73.7K, which it hit in March.

In response to analyst Stockmoney Lizards, final week’s rally flipped BTC momentum bullish and might be accelerated by historic uptrends linked to US elections.

He noted that BTC’s momentum turned bullish for the primary time in H2 2024.

“Momentum is popping bullish”

Supply: X

For perspective, the SMI (Stochastic Momentum Index) is a momentum indicator that gauges an BTC value relative to a latest midpoint. It exhibits whether or not it’s overbought or oversold.

The present studying on the 2-week chart confirmed a rebound above the impartial 50-level, indicating a bullish reversal was in play.

This was much like the 2020 development simply earlier than BTC broke its re-accumulation vary and will sign a possible bullish breakout.

BTC: US pre-elections development

Supply: X

The analyst added that explosive BTC upsides related to the US pre-election would possibly play out once more.

In 2016 and 2020, two weeks earlier than the US elections, BTC pumped 10% and 18%, respectively.

If the development repeats in 2024, Stockmoney Lizards projected a brand new ATH earlier than the US elections might be seemingly.

“For 2024, this might imply, we might see a brand new ATH earlier than the elections (+10% = $74,000) with an enormous pump in November and December.”

However do on-chain metrics additionally lean in direction of this bullish outlook?

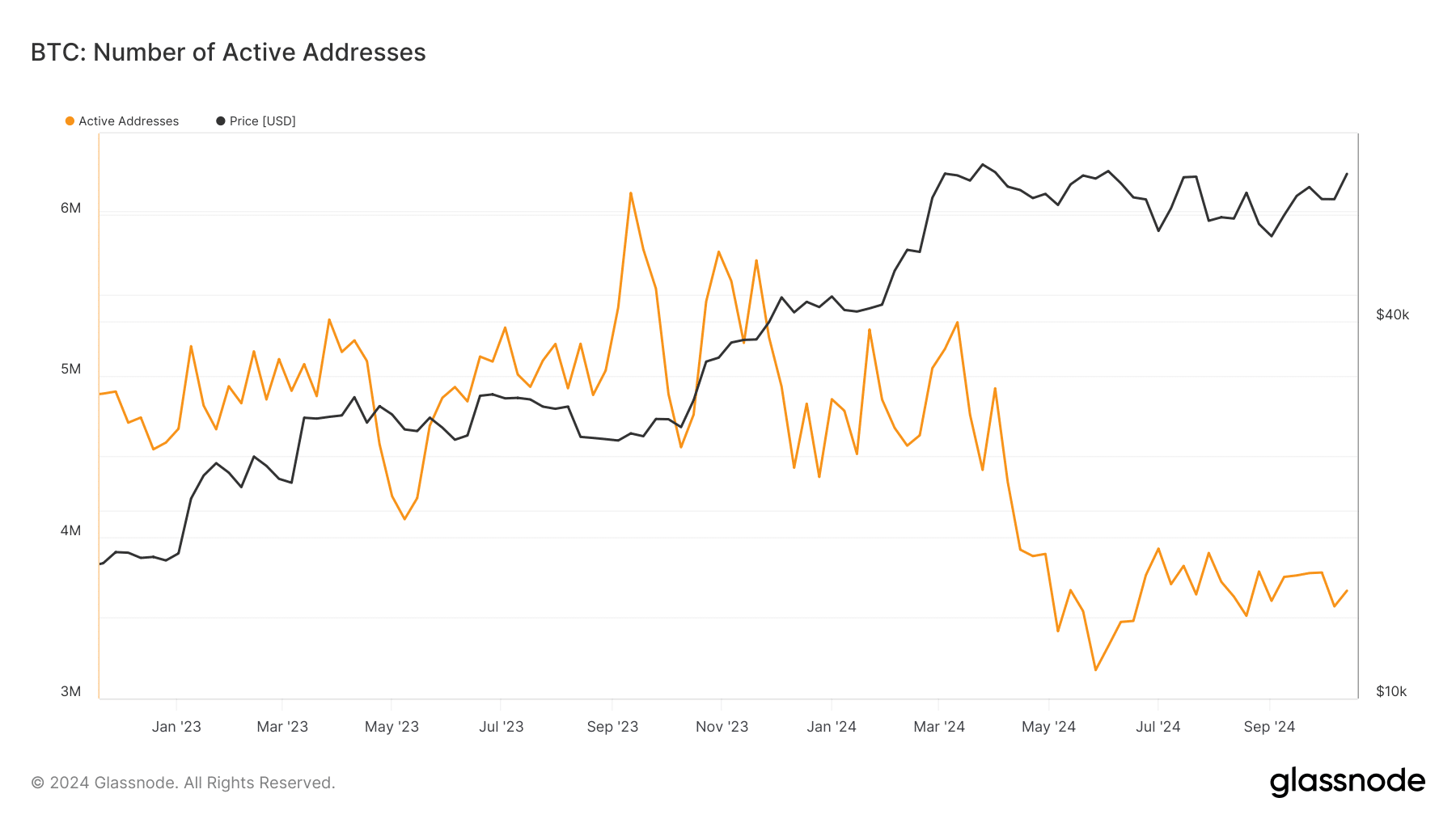

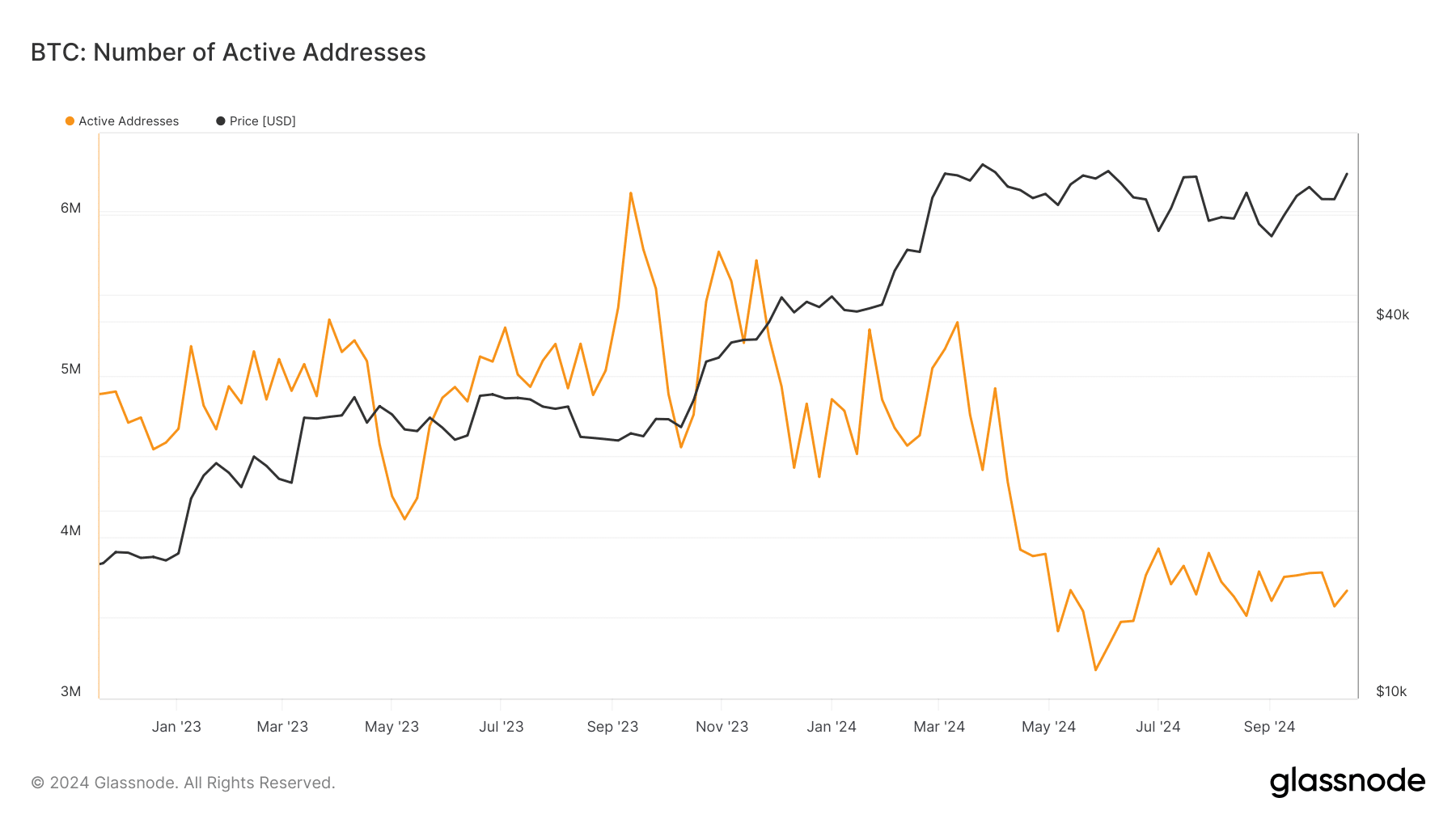

Supply: Glassnode

Since July, total curiosity and community development in BTC has stagnated, as seen in every day energetic addresses.

Though this might derail an explosive breakout for BTC, whales have been massively including positions.

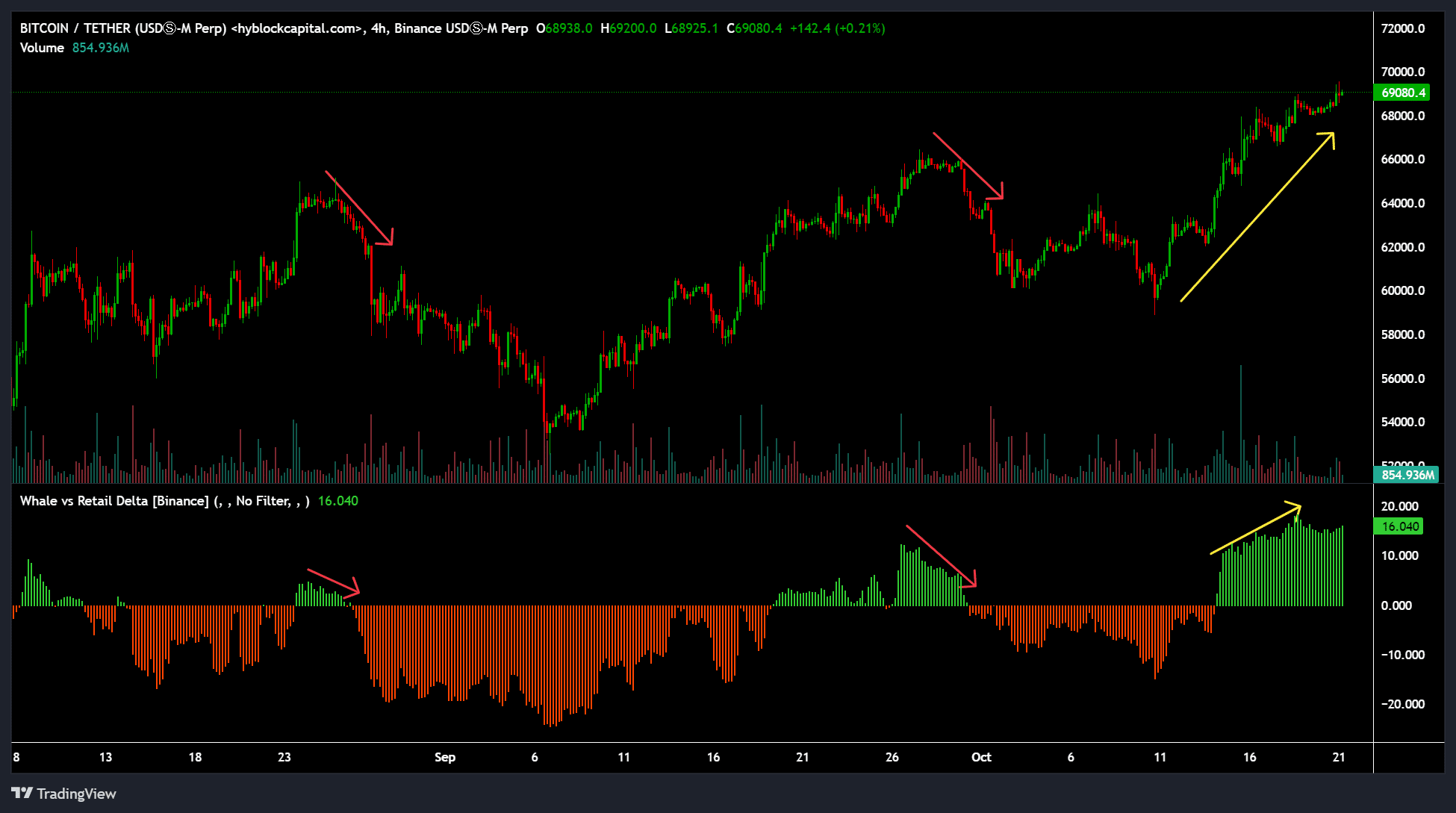

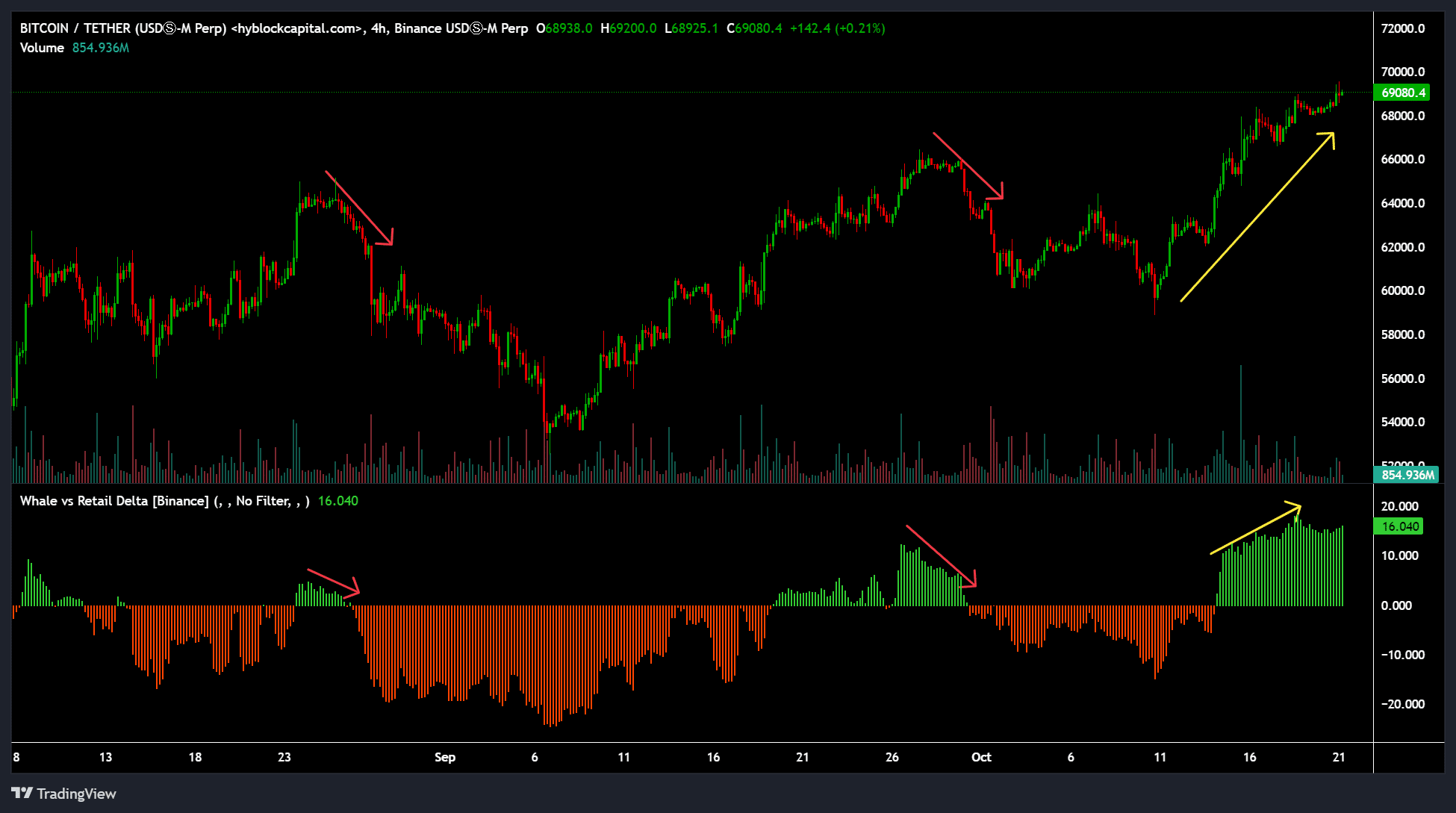

Since final week, whales have held extra BTC positions than retailers, per the constructive Whale vs. Retail Delta metric. This steered that whales have been massively accumulating and have been assured of a value uptrend.

Supply: Hyblock

Nevertheless, a decline within the metric might sign a possible BTC retracement, with $66K a key degree of curiosity if a short-term pullback ensues.