- The rise in market inflation indicated that BTC holders have been promoting a few of their property.

- Knowledge confirmed that the value may rise towards $72,000 earlier than a serious correction.

If the indicators AMBCrypto acquired from Glassnode’s on-chain information are something to go by, Bitcoin [BTC] may very well be set for a major worth lower.

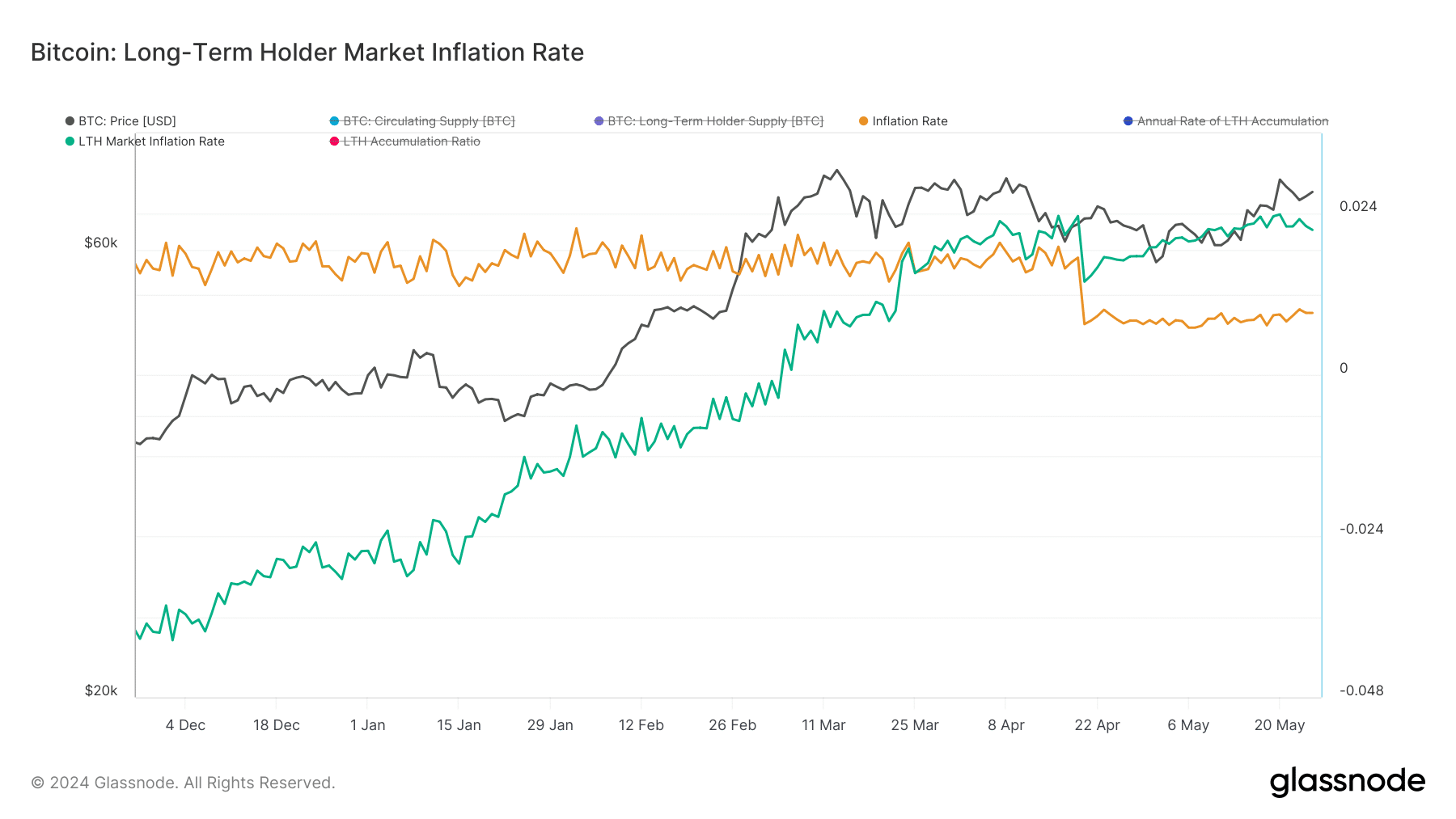

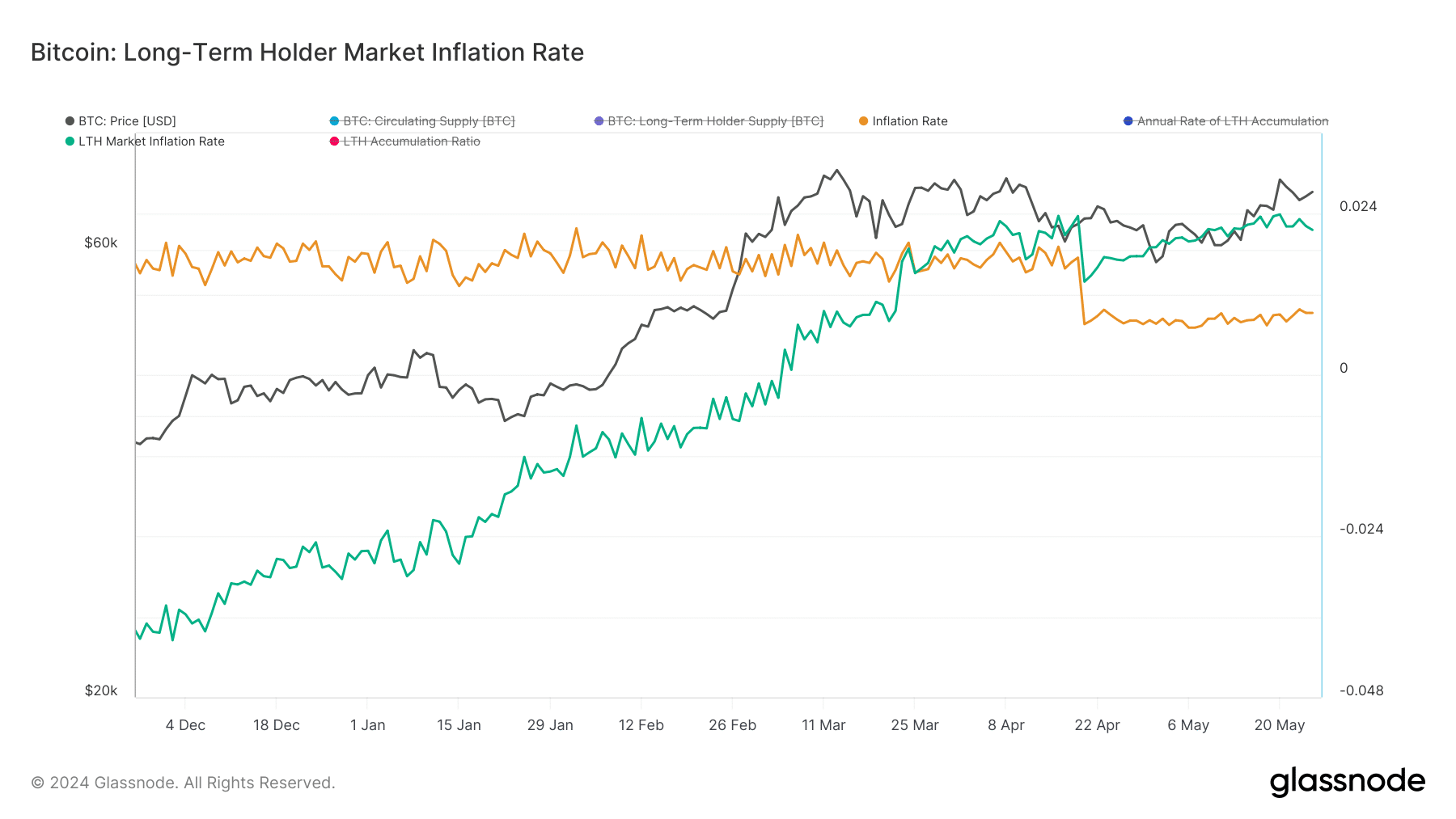

Main this prediction is the LTH Market Inflation Charge. LTH stands for Lengthy Time period Holders out there.

The LTH Market Inflation Charge makes use of the extent of accumulation or distribution to find out Bitcoin’s subsequent path.

Nevertheless, two strains exist on this chart, as proven beneath. Inexperienced represents the market inflation fee, whereas the manila coloration signifies the nominal inflation fee.

Investor perception doesn’t equate their actions

In bull cycles, if the market inflation drops beneath the nominal inflation, it signifies that long-term holders are accumulating. As such, this might drive a worth enhance for Bitcoin.

However, the market inflation fee rising above the nominal fee means that holders are considerably including to the promote strain.

Therefore, BTC may very well be on the verge of a notable fall. At press time, the metric shaped the latter sample.

Supply: Glassnode

Bitcoin modified fingers at $69,164 at press time, representing a 2.98% enhance within the final seven days.

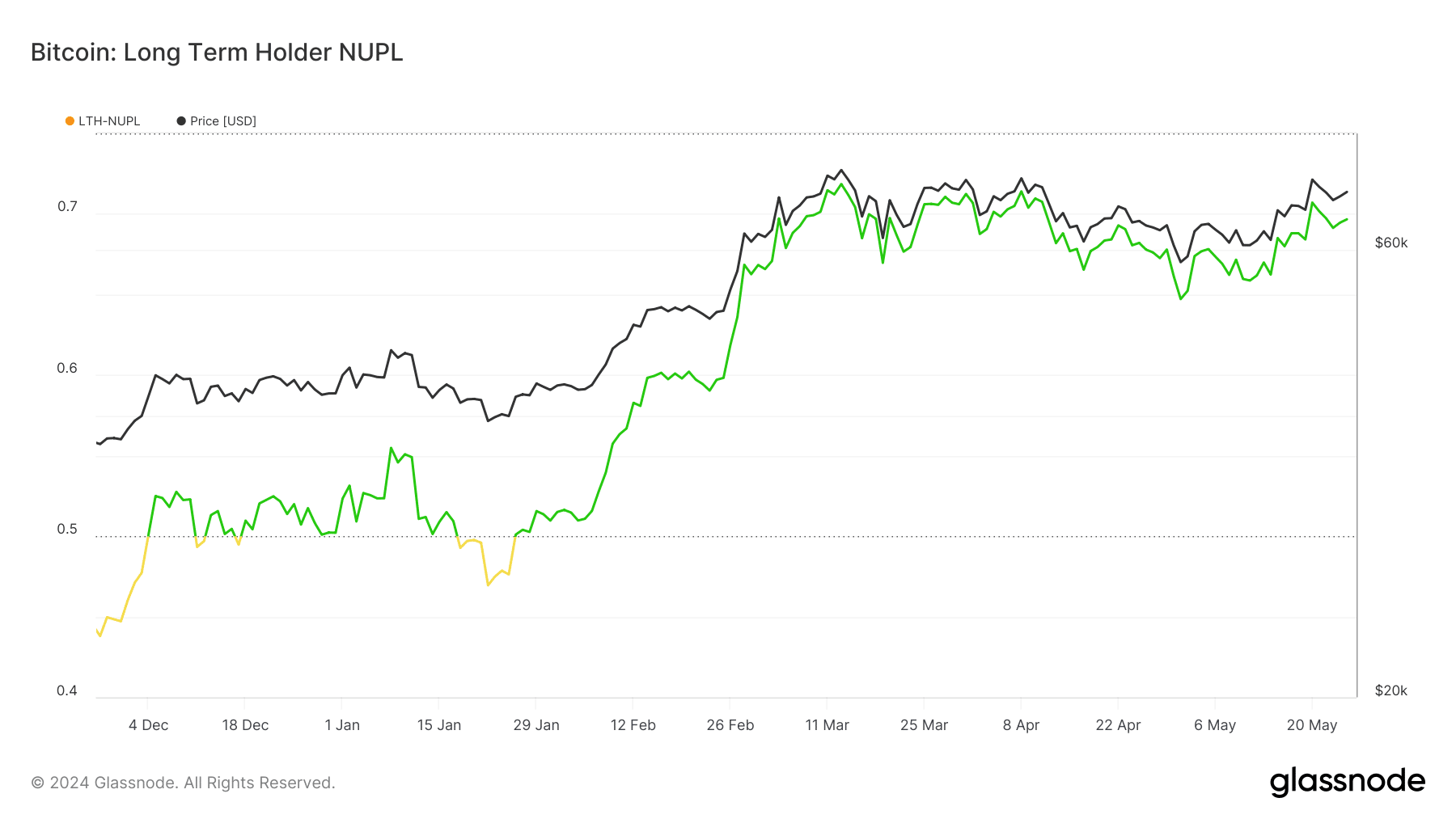

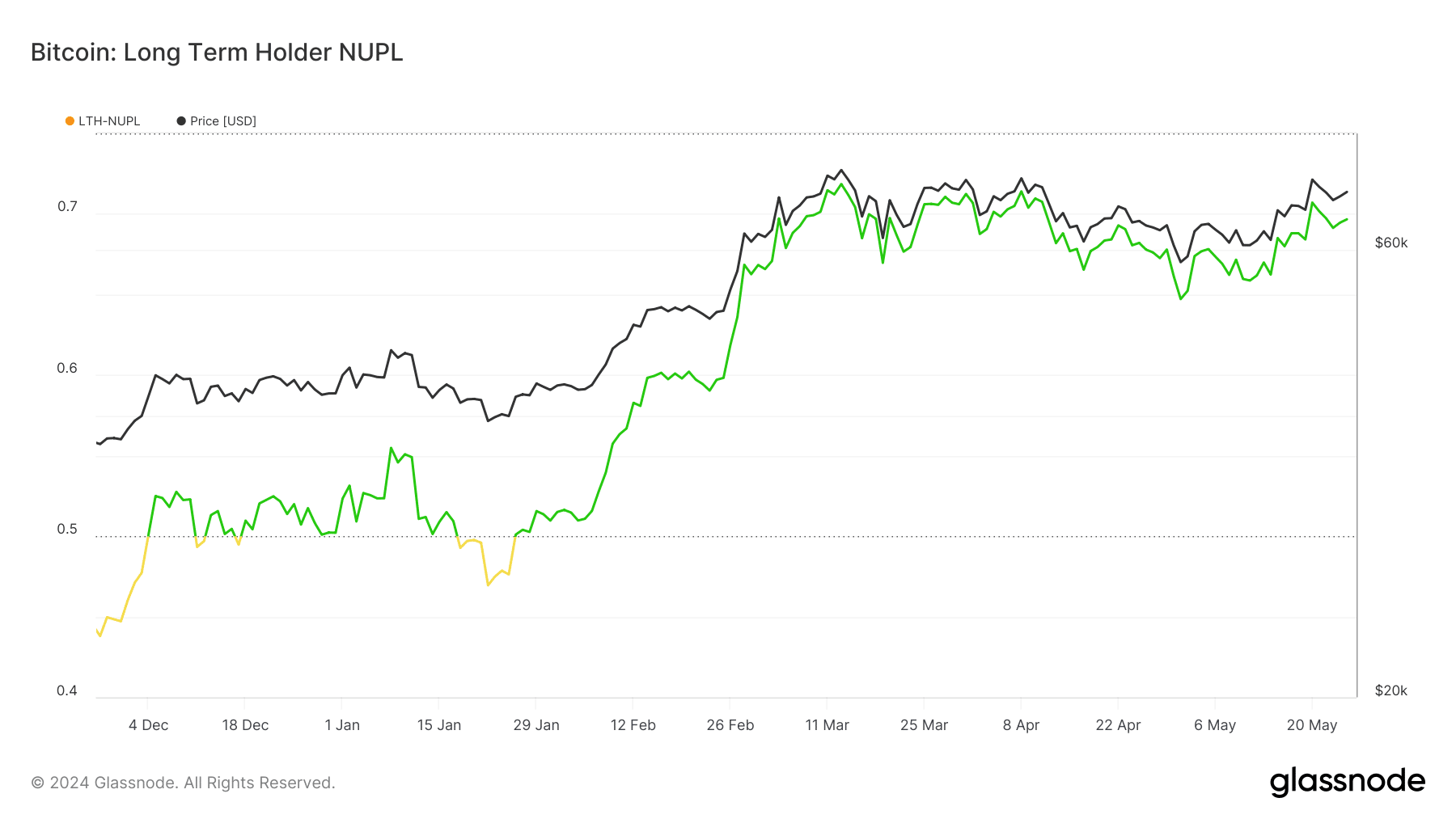

However earlier than concluding that holders may push BTC to the draw back, AMBCrypto analyzed the sentiment holders have concerning the coin.

To do that, we appeared on the LTH-NUPL. This metric is an acronym for Lengthy Time period Holder – Web Unrealized Revenue/Loss. With this, one can have an concept of the behavior of long-term holders.

As of this writing, the LTH-NUPL was within the perception zone (inexperienced). This means that holders, who’ve held the coin for at the least 155 days, are assured that in Bitcoin’s potential.

Supply: Glassnode

Nevertheless, this may not be for the brief time period, as the identical set of individuals may contribute to BTC’s distribution.

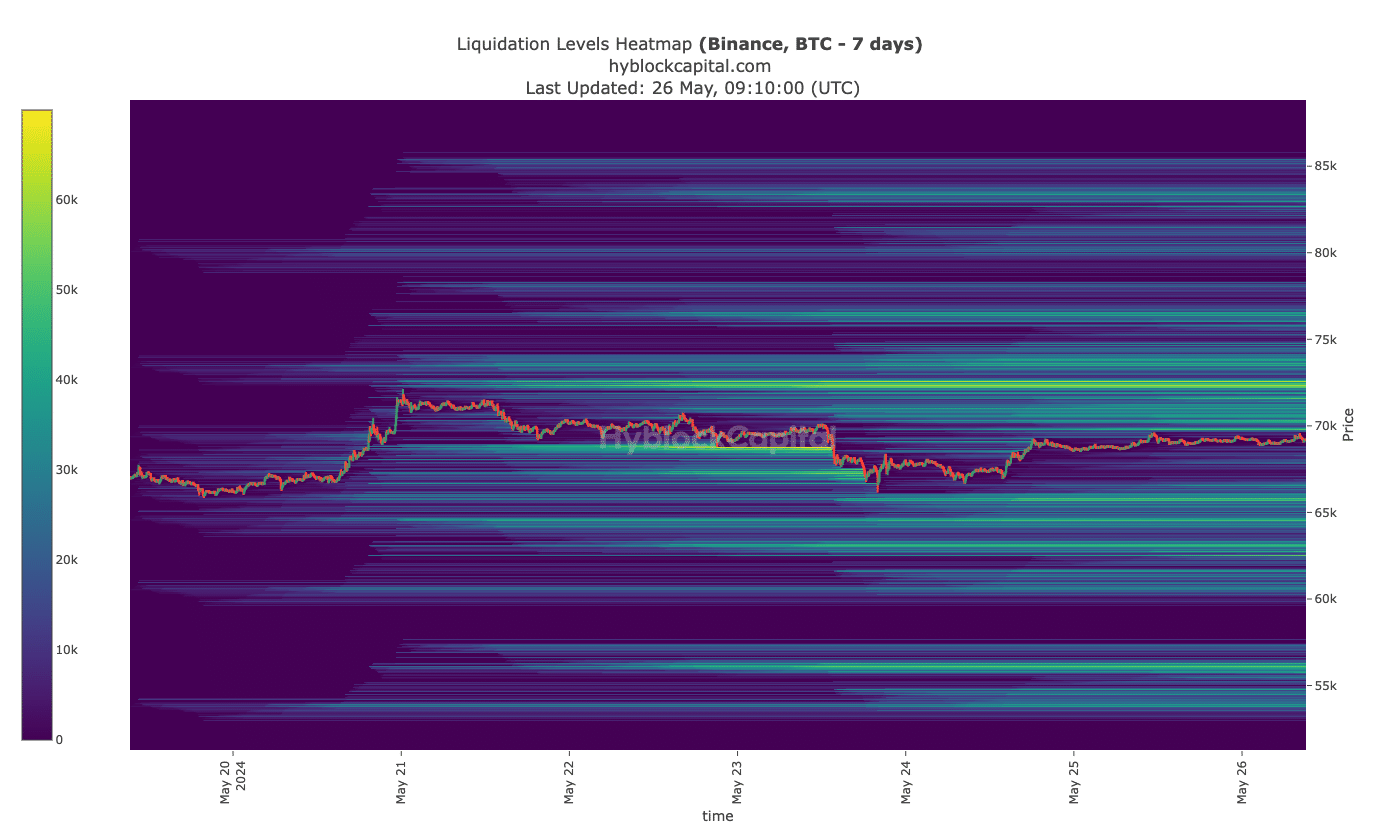

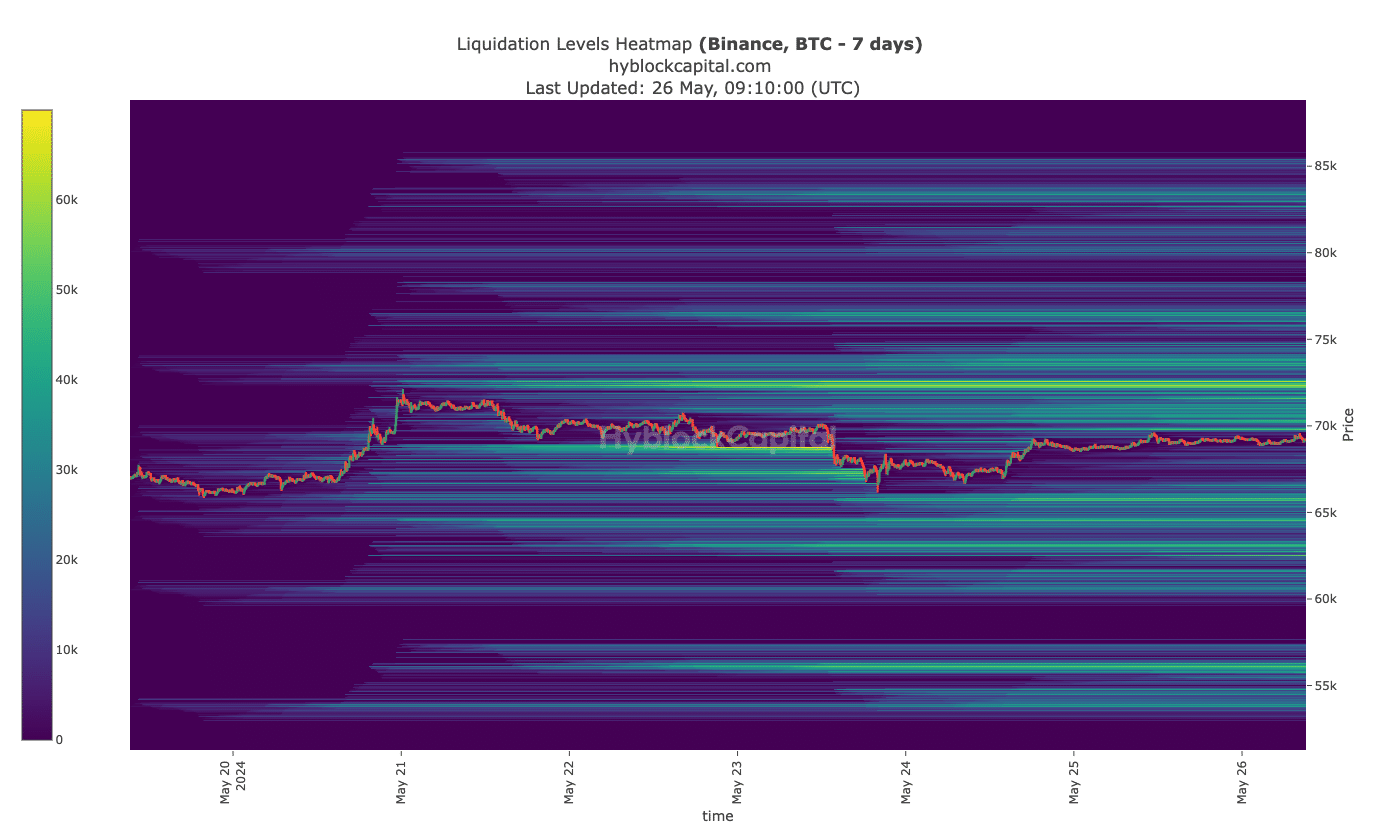

When it comes to worth prediction, the liquidation heatmap supplied insights into the coin’s motion.

$72K, then $63K

Liquidation heatmap helps merchants to search out the most effective liquidity positions. If liquidity is concentrated in an space, costs can transfer in that path. Nevertheless, excessive liquidity zones may also be resistance or help zones.

Utilizing information from Hyblock, AMBCrypto recognized a magnetic zone at $72,350, indicating that Bitcoin’s worth may transfer towards that area.

Nevertheless, the identical zone may act as resistance for the coin. If BTC rises to the aforementioned worth and will get rejected, it may spell doom for the cryptocurrency.

It’s because the opposite main high-liquidity space was at $63,050.

Supply: Hyblock

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Going by the indications above, Bitcoin’s worth can enhance. However when the correction seems, it may very well be troublesome for the coin to rebound.

Ought to the coin lose maintain of $63,050, the subsequent decline may ship BTC to $56,200. Nevertheless, if this doesn’t occur, Bitcoin may bounce towards $70,000 yet another time.