- Holders of Bitcoin may accumulate extra, prompting options of a value enhance.

- An important indicator revealed that BTC may plunge once more earlier than it hits one other all-time excessive.

Investing in crypto might be dangerous. However one factor that Bitcoin [BTC], the cryptocurrency with the biggest market cap, has proven, is that selecting the coin can yield rewards that only some property can dream of.

However don’t take AMBCrypto’s phrase as recommendation.

As a substitute, a fast have a look at BTC’s all-time efficiency revealed that that is no fluke. In accordance with knowledge from CoinMarketCap, Bitcoin’s value has elevated by a mind-blogging 103,942,579% since its inception.

Nonetheless, one factor buyers can guarantee you is that it’s not simply glitz and glamour on Bitcoin’s finish.

As an example, the market crash of 2022 was proof that “up solely” is just a fantasy, as any Bitcoin funding can go down as soon as the market hits a bear section.

Be careful! The route is just not at all times north

In 2021, Bitcoin hit an All-Time excessive (ATH) of $69,000. However a 12 months again, triggered by sure occasions, the coin dropped beneath $16,000, confirming that the asset’s volatility may have an disagreeable impression on buyers.

Quick-forward to 2024, the coin surpassed its all-time excessive, reaching $73,750 on the 14th of March. Regardless of the hike, the coin retraced. As of this writing, it modified palms at $64,298.

This worth represented a 5.58% lower within the final 30 days. However is Bitcoin an excellent funding for you? Nicely, sure elements affect the value of the coin.

As an example, the approval of spot Bitcoin ETFs earlier this 12 months influenced the rally to its new all-time excessive. Nonetheless, the superb inflows of the primary quarter are nowhere to be discovered.

As such, buyers are left with the basics and key indicators to rely on. For starters, AMBCrypto checked out Bitcoin’s potential to present good returns utilizing on-chain metrics.

Extra beneficial properties could also be coming

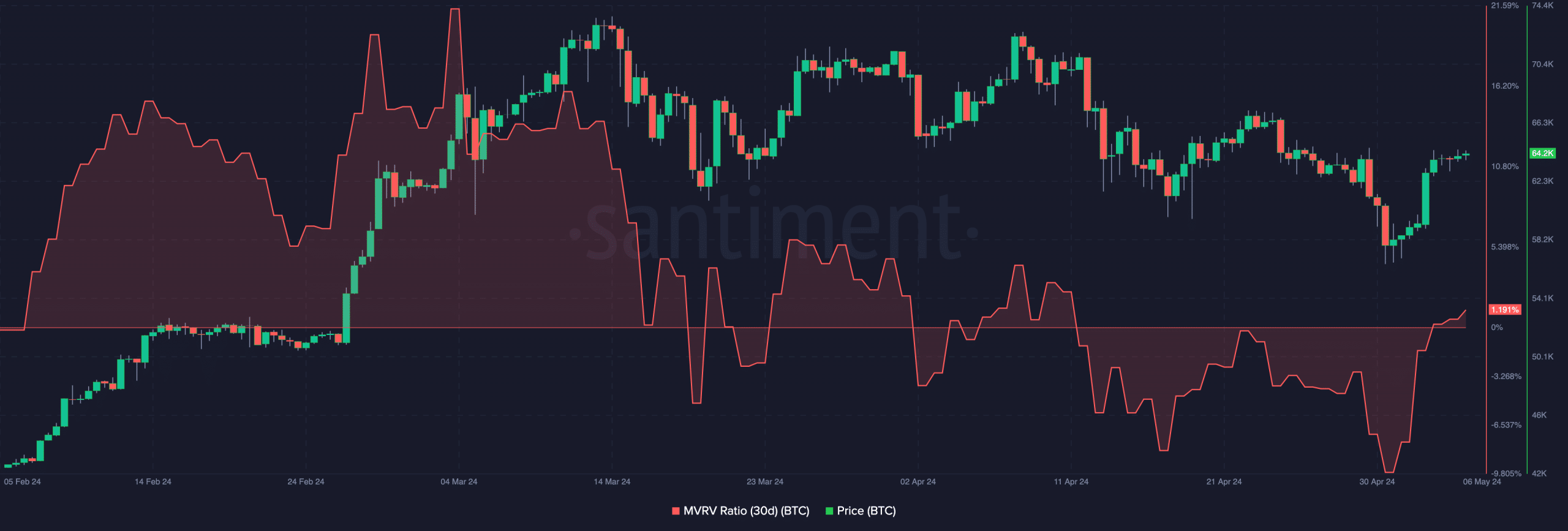

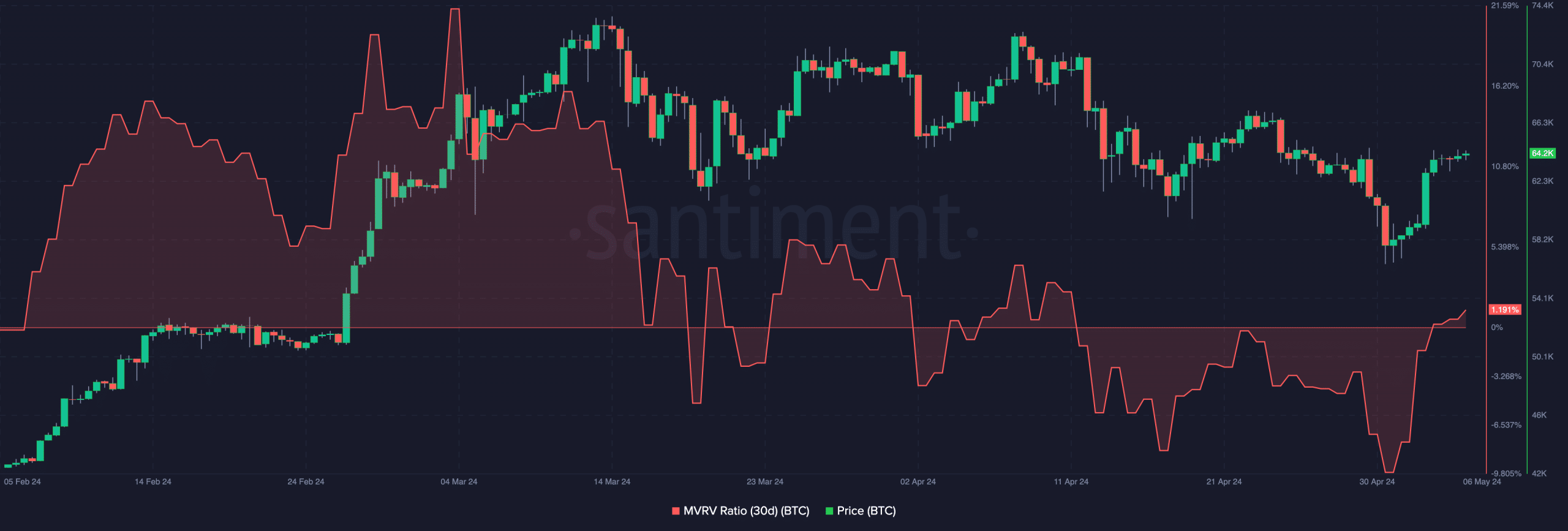

One of many metrics we checked out was the Market Worth to Realized Worth (MVRV) ratio. The MVRV ratio exhibits the profitability of BTC holders.

At press time, the 30-day MVRV ratio was 1.1.9%. Which means if holders of Bitcoin promote their property, the typical return could be round this share.

Supply: Santiment

However that is unlikely to occur, because the unrealized beneficial properties do not seem enticing sufficient to set off a widespread sell-off. Subsequently, the cheap motion could be for buyers to carry to their cash.

Additionally, when the MVRV ratio was 21.30%, Bitcoin’s value was over $71,000. With this knowledge, extra accumulation may happen, and this might lead BTC again to a extra worthwhile area.

Will Bitcoin add an additional 40% enhance?

Moreover, there have been predictions that the coin may hit $100,000 this cycle. Whereas some argue in favor of the forecast, others desire to be on the conservative aspect.

For the bullish ones, the ETF and ATH earlier than halving was proof that Bitcoin may add one other 40% to its value earlier than it hit the highest.

AMBCrypto spoke to Ben Cousens concerning the matter. Cousens is the Chief Technique Officer at ZBD, an organization utilizing the Bitcoin lightning community to energy funds.

Whereas the ZBD chief didn’t give a selected value prediction, he displayed optimism in his remark, saying that,

“Throughout the Bitcoin ecosystem as an entire, traditionally, the halving has coincided with rising fiat costs because of the provide shock. his halving got here at a time when ETFs have been growing institutional adoption, taking part in an even bigger function with extra of an impression. The extra pleasure concerning the halving results in a brand new cohort of customers who learn to use Bitcoin.”

Going by Cousens’s opinion, a brand new wave of latest buyers may come for Bitcoin. Ought to this be the case, rising demand may result in increased costs, and most investments is likely to be price it.

A brief-term outlook could not lower it

Nonetheless, short-term buyers may have to be cautious. As a lot as BTC could be a good funding, the value may additionally bear a correction.

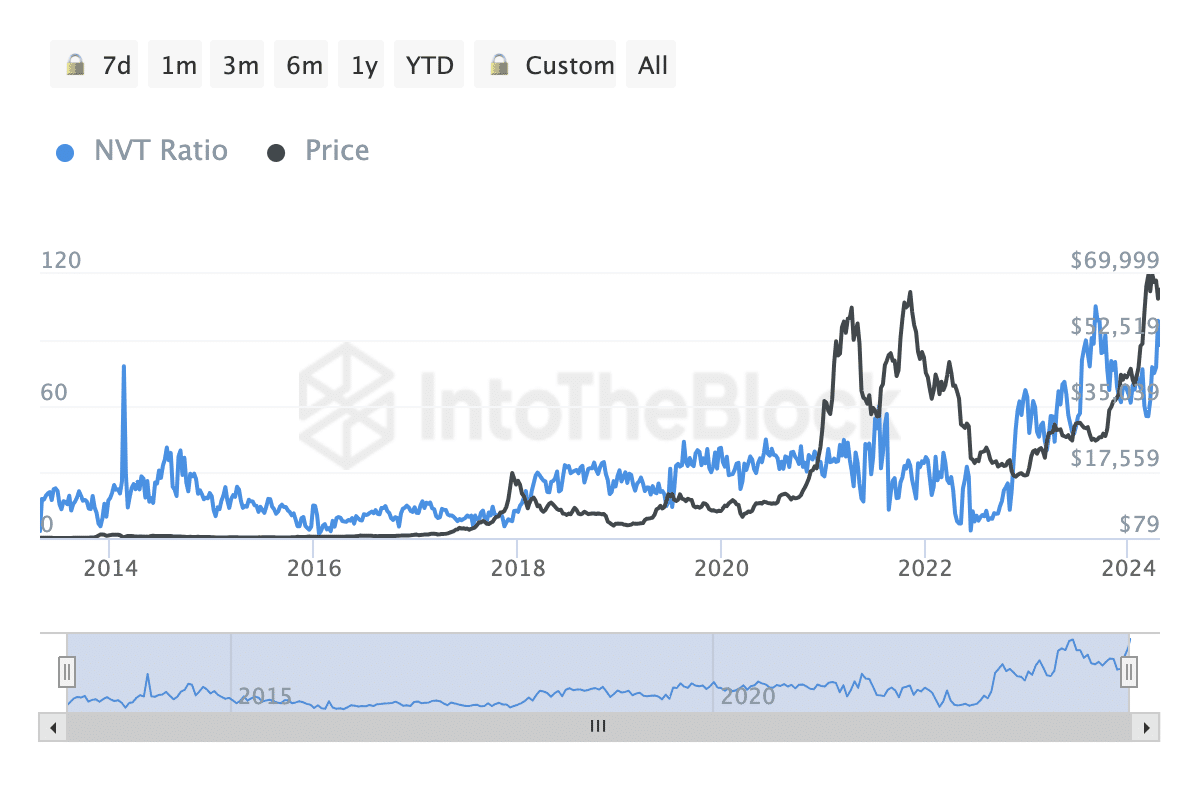

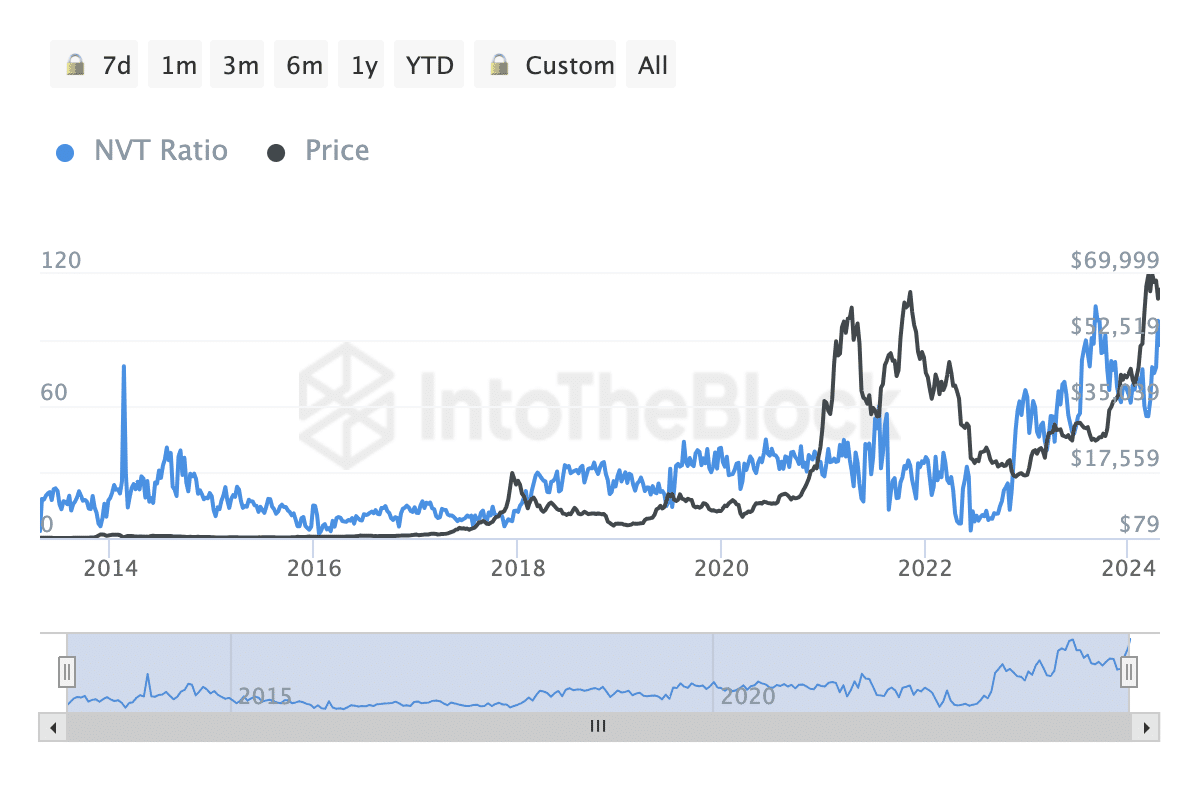

One of many causes for that is the Community Worth to Transaction (NVT) ratio. This metric appears at a coin’s market cap relative to its whole buying and selling quantity.

If the NVT ratio will increase, it signifies that the coin could possibly be overvalued within the brief time period. Nonetheless, a low NVT ratio suggests an undervaluation of the present asset worth.

On the time of writing, IntoTheBlock knowledge showed that Bitcoin’s NVT ratio had risen to 98.79, implying {that a} return beneath $64,000 could possibly be imminent.

Supply: Santiment

Ought to this be the case, the value of Bitcoin may collapse to $59,000 once more. However in the long term, Bitcoin could be a good funding relying on the acquisition value.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

For this cycle, the value of the coin is anticipated to hit between $87,000 and $92,000. Subsequently, shopping for at press time value or ready for one more decline is likely to be an excellent transfer.

Both method, buyers ought to be looking out for happenings within the ecosystem, as an unfavorable occasion may invalidate this thesis.