- Arbitrum lively addresses registered figures of 900,000 for consecutive days

- ARB’s market pattern has continued to fall although

Arbitrum is within the information right this moment after it appeared to solidify its place and asserted itself within the Layer 2 ecosystem. It did so after sustaining a degree of lively addresses above a sure threshold, setting a brand new report for day by day lively addresses by doing so.

Moreover, its transaction rely has seen a notable enhance currently too. Regardless of these developments, nevertheless, the amount and value of its native token have remained comparatively secure on the charts.

Arbitrum units report for lively addresses

An evaluation of lively addresses on Growthepie revealed that Arbitrum achieved a report variety of lively addresses on 15 Could. The chart illustrated that the lively addresses surpassed 972,000, setting a brand new report for the L2 community and all Layer 2 networks. Additionally, Arbitrum maintained a median of over 900,000 lively addresses during the last seven days – one other report.

On the time of writing, the community had registered over 786,000 lively addresses within the final 24 hours. Base, the closest L2 competitor, famous simply round 299,000 lively addresses, highlighting Arbitrum’s vital affect.

Moreover, an evaluation of the transaction count revealed that Arbitrum led different L2 networks with roughly 2.1 million transactions, on the time of writing. This hike in lively addresses positively correlated with the rise in transaction rely, demonstrating its dominance within the L2 area.

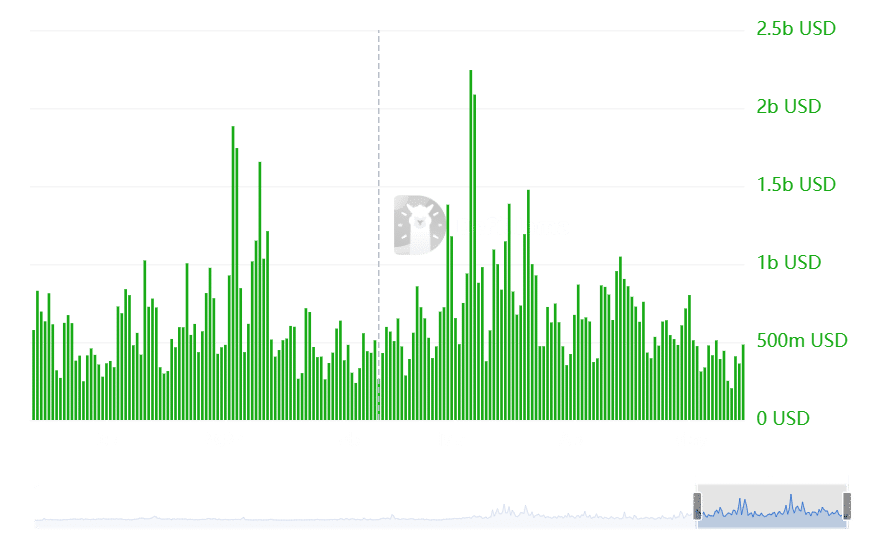

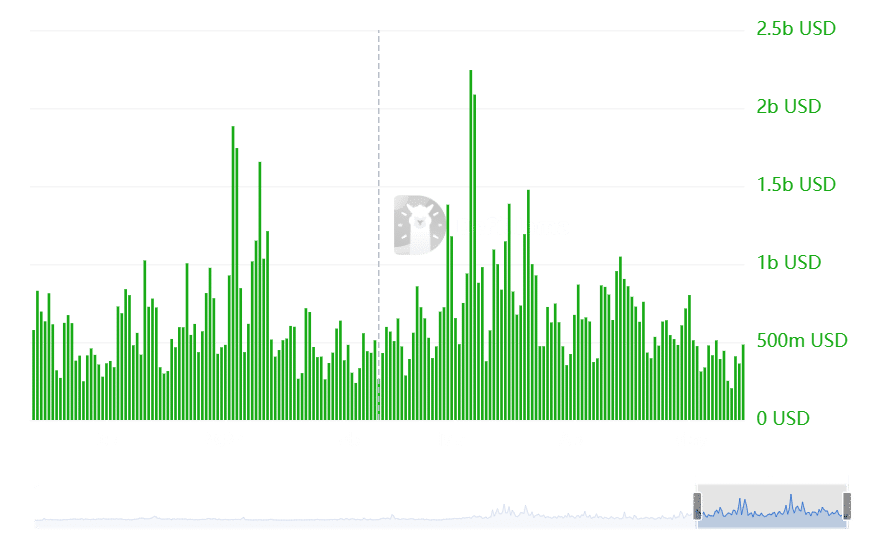

Arbitrum quantity stays regular

Arbitrum has seen report exercise relating to lively addresses over the previous few days. Nevertheless, an evaluation of its quantity didn’t reveal any vital actions. In truth, knowledge from DefiLlama revealed that there have been no notable modifications in L2 quantity over the previous seven days.

However, the community recorded its highest quantity inside this timeframe within the final 24 hours, totaling round $483 million.

Supply: DefiLlama

Moreover, Arbitrum’s Whole Worth Locked (TVL) noticed a slight hike of over 1% within the final 24 hours.

In keeping with knowledge from L2 Beats, Arbitrum’s TVL surpassed $16 billion, on the time of writing, after climbing by over 1.2%.

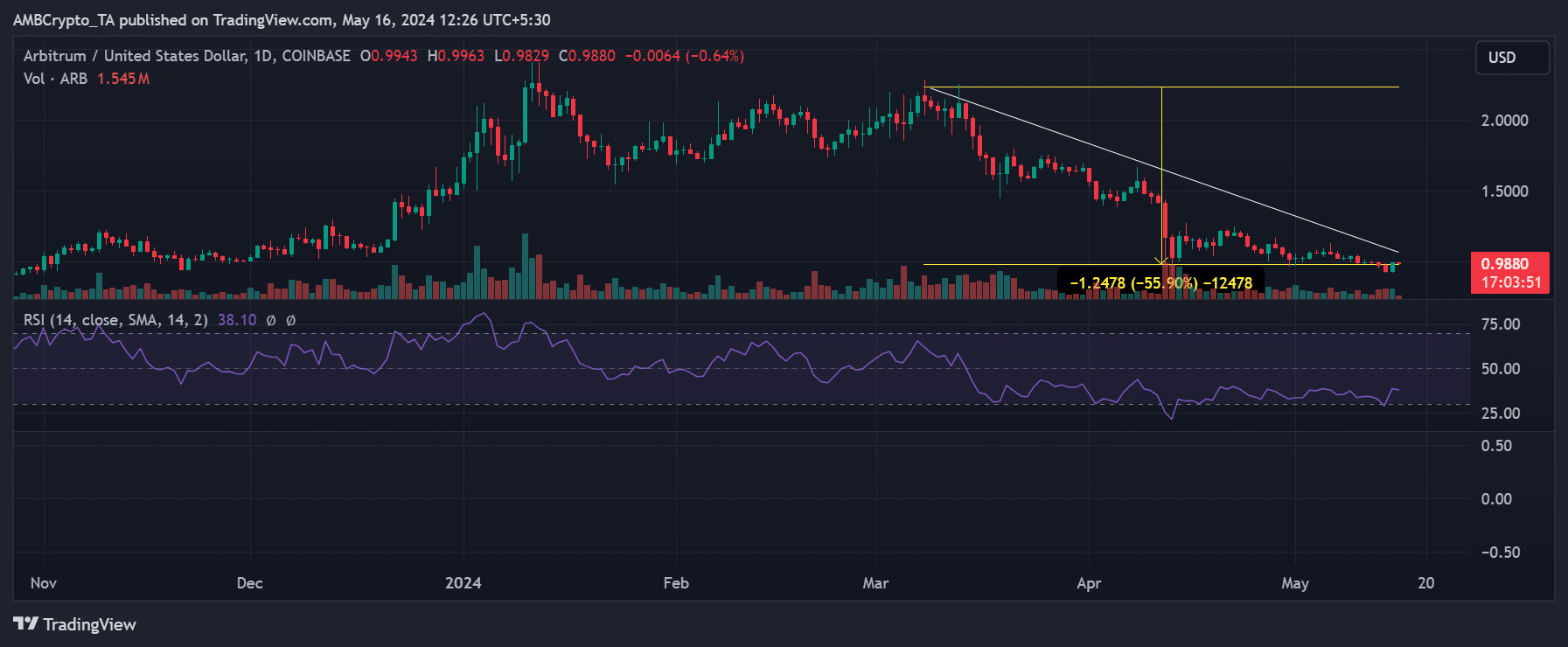

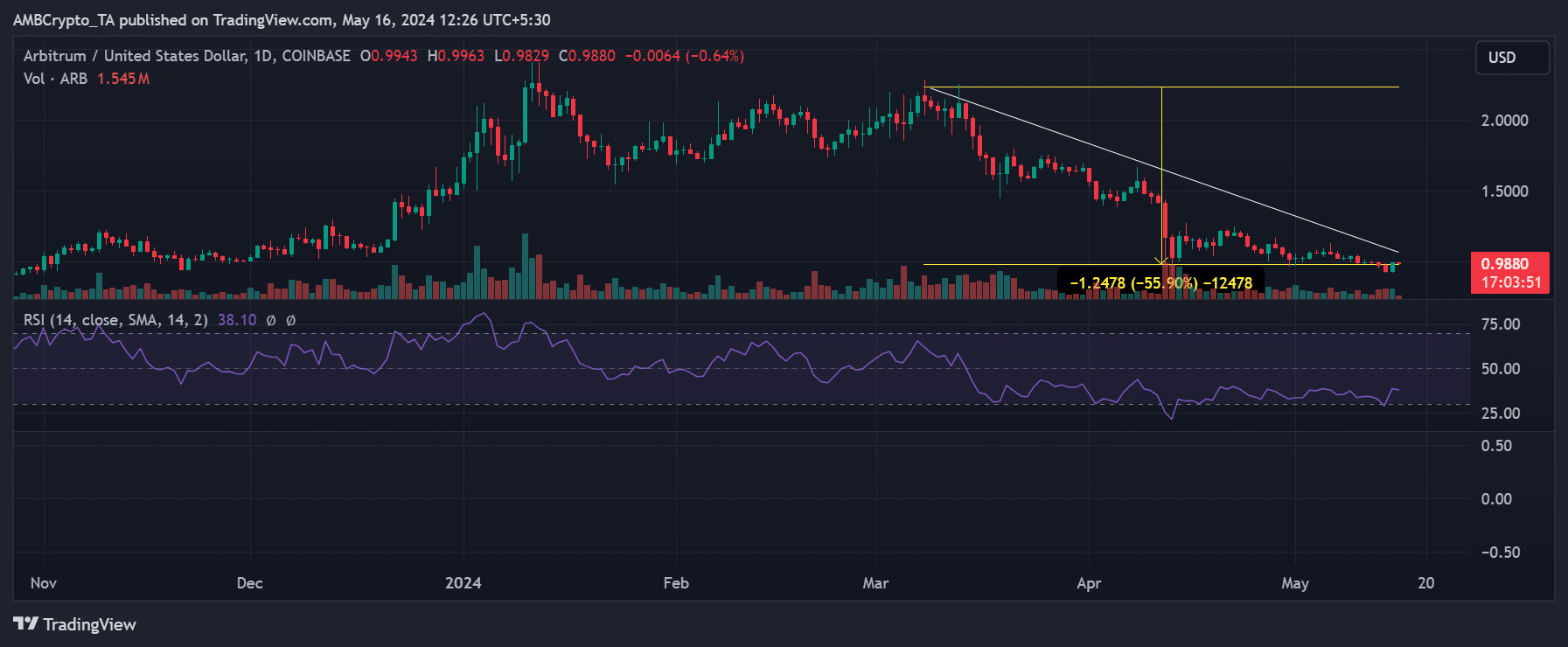

ARB stays bearish

Nevertheless, the momentum seen in Arbitrum’s lively addresses and Whole Worth Locked (TVL) didn’t translate to its native token – ARB. In truth, an evaluation of ARB on the day by day timeframe chart revealed a downtrend since March.

Supply: TradingView

– Sensible or not, right here’s ARB’s market cap in BTC’s phrases

In keeping with the worth vary software, ARB has fallen by roughly 55% because the downtrend started again then.