- Bitcoin’s open curiosity hits report $20 billion, simply 8% beneath its ATH, signaling potential value volatility.

- Whales are accumulating Bitcoin, with internet outflows from exchanges surging over the previous 7 days.

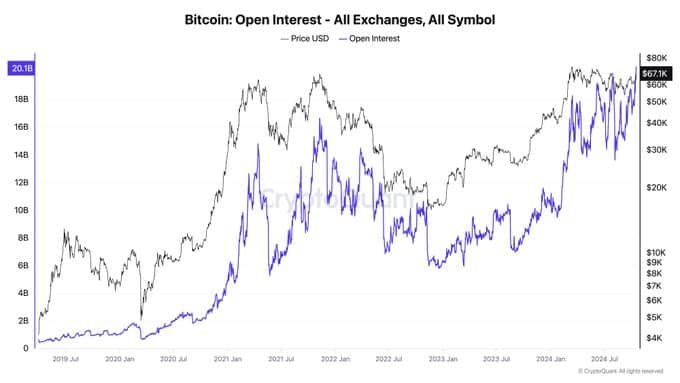

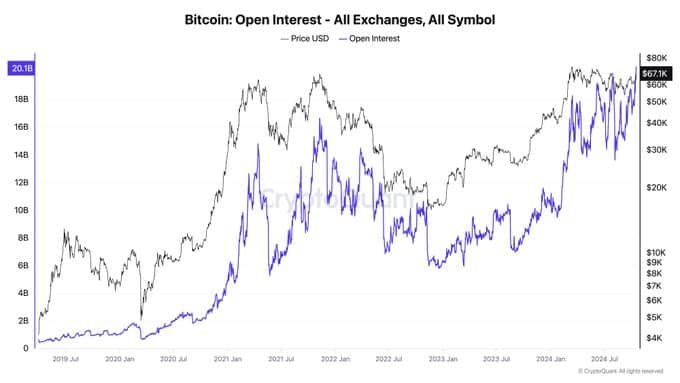

Bitcoin [BTC] open curiosity throughout all exchanges has reached a record-breaking $20 billion, as noted by Ki Younger Ju, CEO of CryptoQuant.

In the meantime, this surge in open curiosity comes as Bitcoin hovers simply 8% beneath its earlier all-time excessive (ATH), signaling anticipation of a significant value motion. The rising participation in futures markets is a key indicator of rising curiosity in Bitcoin, notably amongst institutional traders.

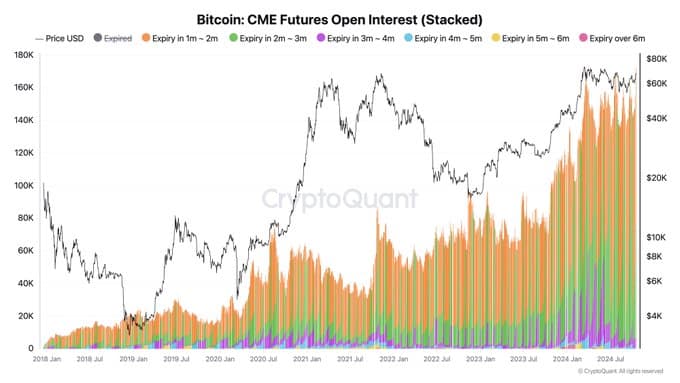

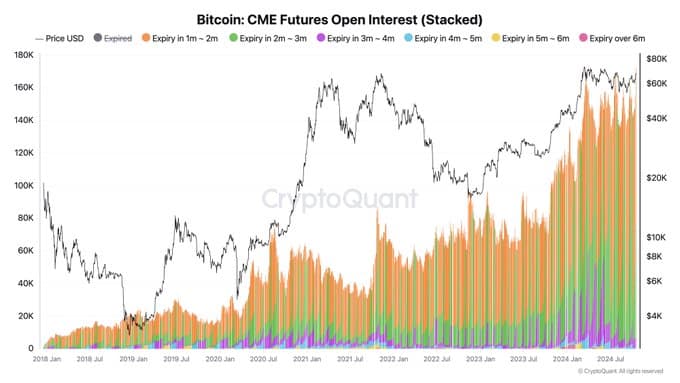

On the similar time, CME Bitcoin Futures open curiosity has also hit an all-time high. This simultaneous enhance in each the value and futures positions means that merchants are getting ready for a interval of heightened market exercise.

Supply: X

Bitcoin open curiosity surges in 2024

The connection between Bitcoin’s value and open curiosity has been traditionally sturdy, particularly throughout bull runs. Within the earlier rally from mid-2020 to late 2021, open curiosity and value moved upward collectively, pushed by elevated hypothesis and leveraged buying and selling.

Open curiosity peaked alongside Bitcoin’s ATH in late 2021, reflecting merchants’ confidence within the rising market.

Supply: X

Nonetheless, throughout the bear market of 2022, each open curiosity and value dropped considerably, with merchants exiting or decreasing positions.

As Bitcoin recovered from its lows, open curiosity started to climb once more, finally reaching new highs in 2024. Regardless of Bitcoin nonetheless being barely beneath its ATH, the rising open curiosity means that market contributors expect a significant value motion within the close to time period.

Whale accumulation and community exercise

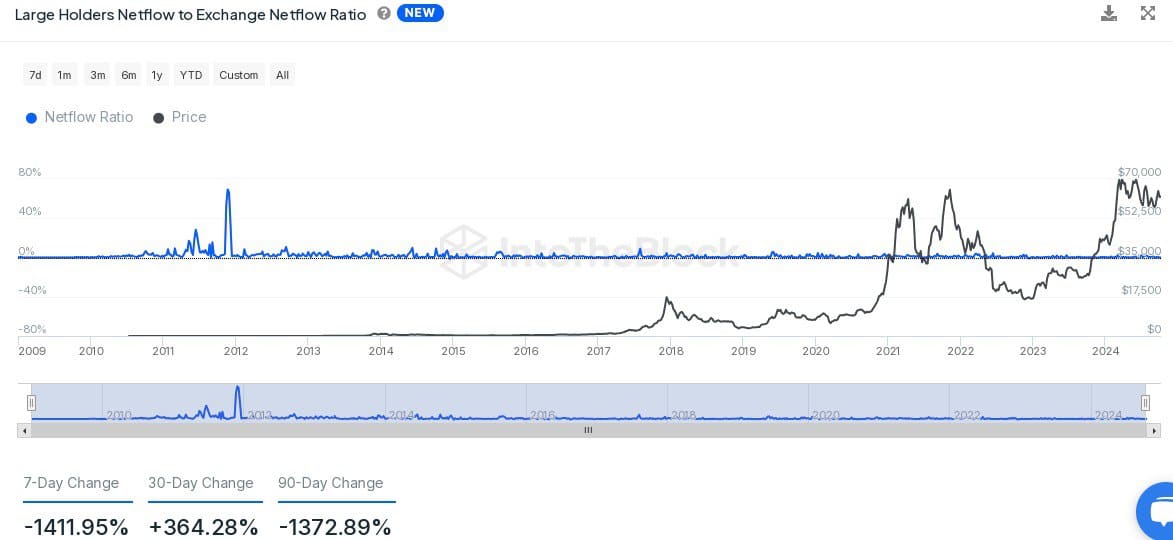

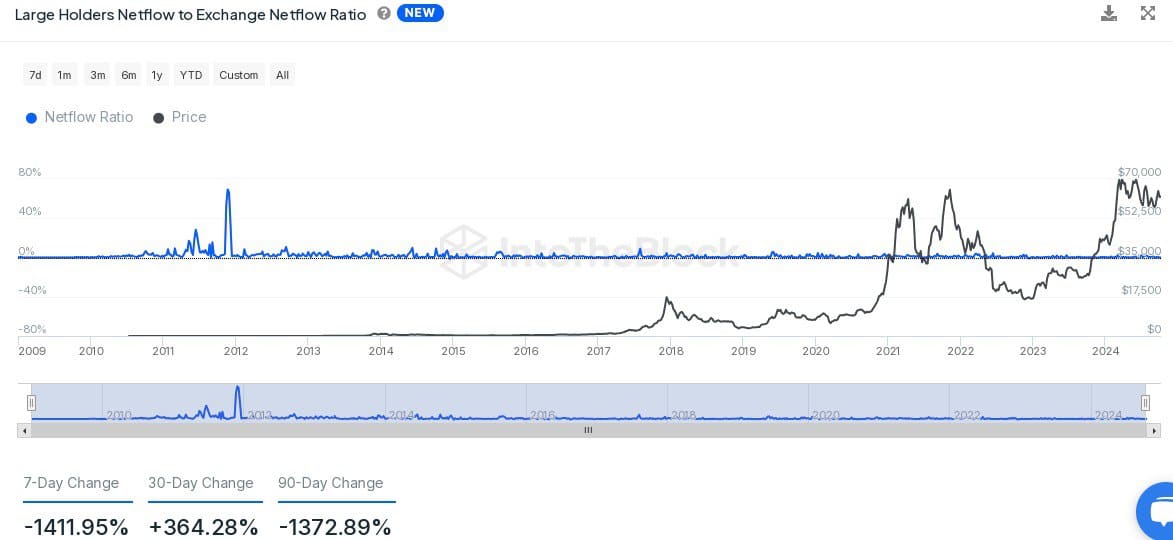

Knowledge from IntoTheBlock exhibits that enormous Bitcoin holders have been constantly shifting their holdings off exchanges, which is commonly an indication of accumulation.

Over the previous 7 days, there was a -1411.95% change in netflows to exchanges, indicating that whales are possible getting ready to carry their Bitcoin for the long run.

Supply: IntoTheBlock

On-chain metrics additionally replicate the rising curiosity. New addresses have elevated by 9.59%, and energetic addresses are up by 8.20% over the previous week.

This enhance in community exercise, coupled with Bitcoin’s rising value, means that consumer engagement is rising, contributing to the constructive sentiment surrounding the market.

Supply: IntoTheBlock

Whale transactions and short-term value outlook

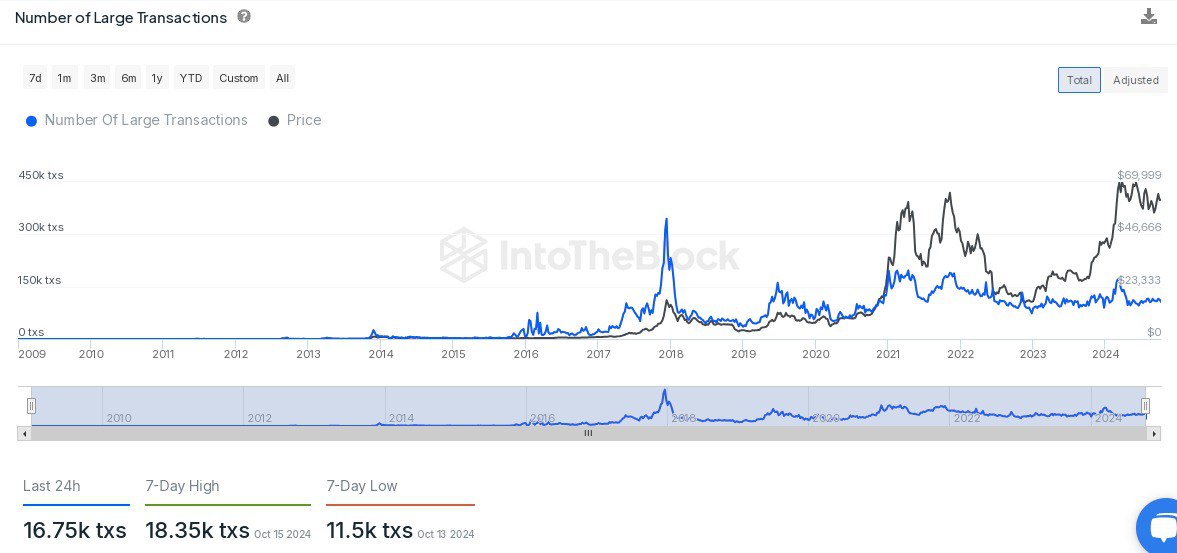

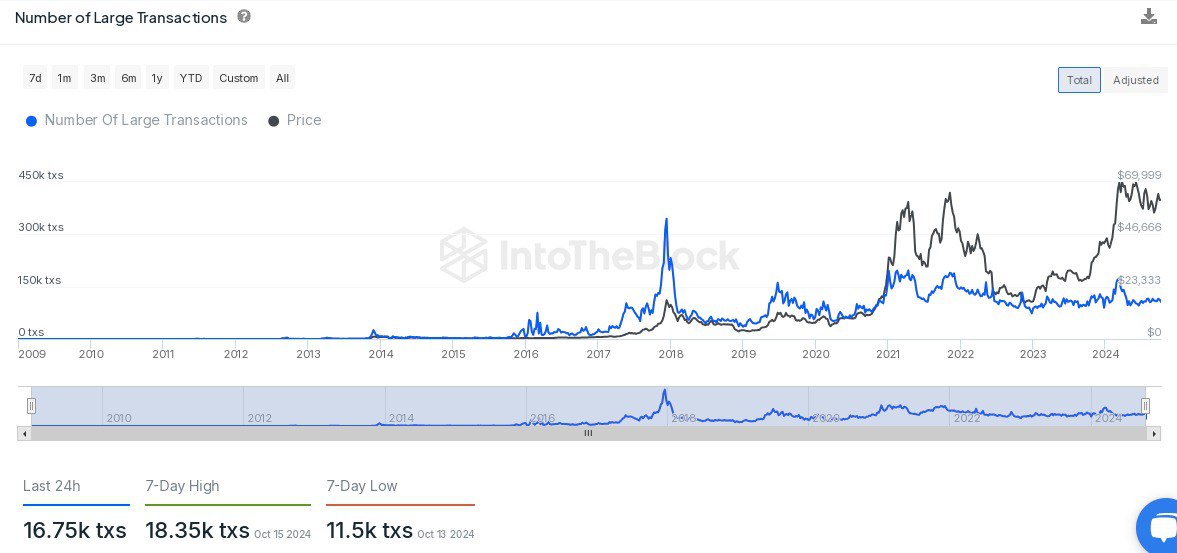

Whale exercise has additionally been notable prior to now 24 hours, with 16.75K giant transactions recorded. Whereas barely beneath the 7-day excessive of 18.35K transactions, the present quantity remains to be nicely above the latest low of 11.5K transactions.

Supply: IntoTheBlock

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

This regular circulate of huge transactions signifies that whales are actively buying and selling, which might contribute to potential value actions within the coming days.

As BTC approaches its ATH, the mix of rising futures open curiosity, whale accumulation, and elevated community exercise factors to the potential for a major value transfer.