Regardless of latest corrections within the Ethereum (ETH) worth, Ethereum’s Day by day Energetic Addresses proceed to rise, suggesting sustained curiosity and engagement throughout the community. This contradiction between worth motion and community exercise raises questions concerning the rapid way forward for ETH worth.

The transfer of ETH into the ‘Perception — Denial’ zone, as indicated by NUPL knowledge, mixed with EMA strains suggesting a possible section of consolidation or additional correction, poses a pivotal query: Will ETH worth stabilize in a consolidation section, or are we on the cusp of extra corrections?

Regardless of Current Corrections, Day by day Energetic Addresses Are Nonetheless On The Rise

From February 22 to March 11, the worth of ETH witnessed a major surge of 36.52%, with its each day energetic addresses concurrently growing from 449,000 to 545,000, highlighting a interval of sturdy development and engagement throughout the Ethereum community. Nevertheless, the development took a flip lately, as ETH’s worth underwent a correction, declining from roughly $4,000 on March 13 to $3,400 by March 21.

Historically, there was a noticeable correlation between the variety of energetic addresses on the Ethereum community and the worth of ETH, suggesting that energetic community participation typically mirrors worth actions. But, this previous week has seen a divergence from this sample.

Regardless of the worth correction, Ethereum each day energetic addresses continued to climb, rising from 540,000 to 626,000 between March 14 and March 21.

This divergence would possibly suggest that the Ethereum community’s growing person exercise and sustained engagement may probably buffer towards steep worth corrections. As a substitute of witnessing robust downturns, the bolstering variety of each day energetic addresses and ongoing community exercise would possibly present sufficient assist to stabilize the ETH worth, hinting at a extra consolidated market stance within the face of corrections.

Learn Extra: Ethereum (ETH) Price Prediction 2024/2025/2030

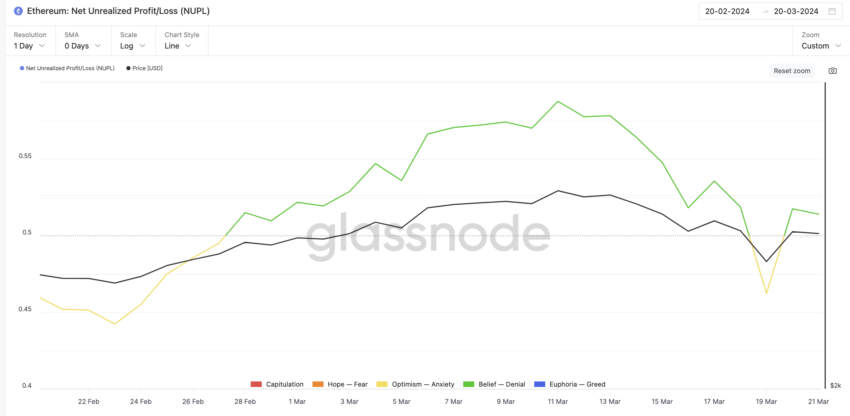

Ethereum NUPL Metric Fluctuates

The ETH Internet Unrealized Revenue/Loss (NUPL) metric has been oscillating between the ‘Optimism – Nervousness’ and ‘Perception — Denial’ states, suggesting that a good portion of ETH buyers understand their holdings in a constructive mild.

This notion exhibits a rising confidence and an optimistic outlook in direction of Ethereum’s worth and its future potential. The NUPL metric, by measuring the general unrealized positive aspects versus losses throughout Ethereum pockets addresses, offers a complete view of the community’s total monetary well being and investor sentiment.

This wavering between optimism and perception hints on the neighborhood’s anticipation as they intently monitor worth actions to strategize their subsequent strikes, probably stabilizing costs via cautious buying and selling conduct. Ought to the NUPL persistently development in direction of ‘Optimism – Nervousness,’ it’d point out the conclusion of latest market corrections, signaling a interval of restoration and stability for ETH costs as investor sentiment solidifies in anticipation of Ethereum’s upward trajectory.

ETH Worth Prediction: $3,000 Subsequent?

The ETH worth chart has revealed a major motion: its short-term Exponential Transferring Averages (EMAs) have lately dipped under the longer-term EMAs, with all converging close to the present worth degree. This sample usually suggests a second of resolution for the asset’s future worth path.

When short-term EMAs cross under their longer-term counterparts, it typically signifies a shift towards bearish sentiment, signaling that latest costs are decrease than they’ve been on common, which may foretell a downward development.

EMAs are designed to supply a extra responsive measure of an asset’s development by emphasizing latest worth knowledge over older costs. This sensitivity to new market knowledge makes EMAs significantly helpful for merchants trying to gauge short-term market momentum and determine potential development reversals.

Not like easy transferring averages, EMAs alter extra rapidly to cost modifications, providing a nuanced view of market dynamics and serving to buyers make knowledgeable selections primarily based on the newest tendencies.

Learn Extra: What Is Wrapped Ethereum (WETH)?

If this bearish development occurs, as urged by the EMA strains, the ETH worth may quickly discover itself testing the $3,000 mark, a crucial assist zone.

Nevertheless, ETH can be extremely attentive to information and developments throughout the ecosystem. As an example, constructive information, akin to developments on the approval of an Ethereum ETF, may swiftly alter investor sentiment and push costs again in direction of $4,000 and even larger.

Disclaimer

In step with the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.