Andrzej Rostek/iStock through Getty Photos

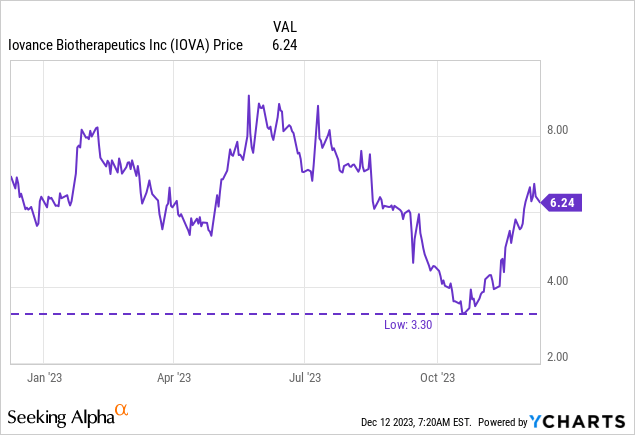

Once I wrote about Iovance Biotherapeutics (NASDAQ:IOVA) in October, I rated the corporate a purchase. An replace from the FDA, whereas making a delay in potential advertising and marketing approval of IOVA’s tumor infiltrating lymphocyte product (lifileucel), created a commerce setup with the inventory at 52-week lows. On this article, I check out the place IOVA’s advertising and marketing software, and the lengthy commerce, stands now.

IOVA’s software remains to be not accredited

Whereas the US Meals and Drug Administration (FDA) has not but accredited IOVA’s advertising and marketing software (for lifileucel for the therapy of superior melanoma), this is no surprise. The unique Prescription Drug Consumer Price Act (PDUFA) purpose date, by which the FDA goals handy down a choice on advertising and marketing approval or in any other case, was November 25, 2023. For the reason that FDA shifted that date three months, to February 24, 2024, on account of useful resource constraints, it is not stunning that the FDA hasn’t ended up solely needing a number of extra weeks.

An early determination (earlier than February 24, 2024) might nonetheless come, but when the FDA wants all the additional time it allowed itself, then I will not learn into that myself. That’s to say, simply because approval hasn’t come early, does not imply it will not be accredited. Certainly I nonetheless discover the truth that IOVA mentioned the FDA had agreed “to work with Iovance to expedite the remaining evaluation,” to be fairly bullish. Going past that, with the Q3’23 earnings name, IOVA estimated {that a} January approval might be potential.

… we predict that our BLA can be accredited maybe earlier than the PDUFA date in January, someday in January, the PDUFA date is February 2024.

… So the FDA likes to approve merchandise with the unmet medical want, no less than 4 to six weeks previous to PDUFA date, as they’ve achieved with — on all CAR-T merchandise and different merchandise as effectively. So with that, holding that in thoughts FDA will wish to — they wish to approve the product sooner earlier than the PDUFA date. So we predict the identical for the Lifileucel.

Raj Puri, EVP Regulatory Technique and Translational Drugs, IOVA, November 7, 2023, earnings name.

Monetary Overview

IOVA reported Q3’23 earnings on November 7. Money, money equivalents, investments and restricted money had been $427.8M as of September 30, 2023. R&D bills had been $87.5M for Q3’23 and SG&A bills had been $27M in Q3’23. Revenues of $0.5M in Q3’23 got here from product gross sales of Proleukin. Internet loss was $113.8M within the quarter and internet money utilized in working actions was $277.9M within the first 9 months of 2023. Taking out restricted money of $66.4M, yields money of $361.4M which can be utilized for a money burn calculation, suggesting 3.9 quarters of money remaining on the present price. Usually launching a drug can be related to an uptick in bills, however IOVA does appear to make some claims on the contrary within the Q3’23 earnings name.

We’ve got not too long ago accomplished headcount progress and vital onetime investments in industrial manufacturing readiness actions to arrange for launch and broaden our pipeline. Following these onetime investments in strategic portfolio prioritization, we will cut back quarterly and annual working bills within the the rest of 2023 and full 12 months 2024, whereas persevering with all key medical applications and inner manufacturing capabilities.

Frederick Vogt, Interim CEO, President, Normal Counsel & Company.

IOVA’s convention name additionally got here with the steering that its September 30 money place would fund it into 2025. In any case, IOVA does not want to boost money this month, in fact, if approval comes and the inventory rallies, IOVA might select to do an providing or use its at-the-market facility.

There have been 255,918,448 shares of IOVA’s widespread inventory excellent at October 30, 2023, giving IOVA a market cap of $1.6B ($6.25 per share). There have been 19,274,301 choices excellent as of September 30, 2023, with a weighted common train value of $18.59. There have been additionally 3,788,605 restricted inventory models excellent as of September 30.

Conclusions, rankings, and dangers

IOVA appears fairly assured in its odds of approval, even predicting approval might come earlier than the February PDUFA purpose date. Whereas the title is up about 90% because the time of my final article, I might nonetheless predict the inventory might rally on approval primarily based on the present valuation and market potential of lifileucel. Even when the corporate solely had the therapy capability for two,000 sufferers per 12 months at present (not together with its third get together), at $0.5M per affected person, we might be $1B in revenues. In a earlier article on IOVA, Edmund Ingham famous a possible $4.5B in revenues available by gamers within the superior melanoma market (utilizing an estimated value of $0.3M and 15,000 sufferers with superior melanoma). Ingham famous if IOVA grabbed simply 20% of that market, that may indicate lifileucel is a possible blockbuster (>$1B)

Since I view IOVA as doubtlessly only a month away from starting to faucet into this multi-billion greenback market, I do not assume approval is basically constructed into the present value. All of this does not think about the potential of IOVA’s remedy in different indications, similar to lung most cancers and ovarian most cancers. As such, I nonetheless price IOVA as a purchase, whereas the value has elevated, the corporate appears to be much more assured of lifileucel being accredited in superior melanoma.

There are a number of dangers to any lengthy place in IOVA, a number of of which I am going to point out right here. Firstly, regardless of the corporate’s upbeat assertion of anticipating early approval for lifileucel (in January moderately than February 2024), if there are delays or a bigger challenge, then the inventory might fall.

Secondly, if IOVA stories up to date information from any of its research, similar to in non-small cell lung most cancers (NSCLC), that does not look as spectacular as beforehand, the inventory might tumble.

Lastly, if IOVA does not rally on approval, as a result of expectation of approval, a promote the information response might happen, particularly if the corporate publicizes an providing.