The Worldwide Group of Securities Commissions (IOSCO) has now launched its last report, together with 9 coverage suggestions aimed toward managing DeFi dangers.

The first purpose of those coverage suggestions is to extend market integrity and investor safety within the quickly evolving DeFi area.

IOSCO emphasizes consistency with laws

In a latest report, IOSCO highlighted the significance of constant regulatory frameworks and supervision throughout member jurisdictions.

Nevertheless, the suggestions cowl essential areas resembling understanding DeFi constructions. As well as, reaching standardized regulatory outcomes and figuring out and managing key dangers. This ensures clear and complete disclosures, enforces relevant legal guidelines and promotes cross-border cooperation.

These DeFi coverage suggestions work in tandem with the coverage suggestions for crypto and digital asset markets (CDA). These have been issued by IOSCO in November 2023.

Each units of suggestions align with IOSCO’s Crypto-Asset Roadmap 2022/2023, and the coordination between them is detailed within the accompanying Umbrella Notice launched alongside the DeFi Remaining Report.

Having made these complete suggestions, IOSCO now turns its consideration to the implementation part, monitoring progress and assembly the capability constructing and technical help wants of its numerous members.

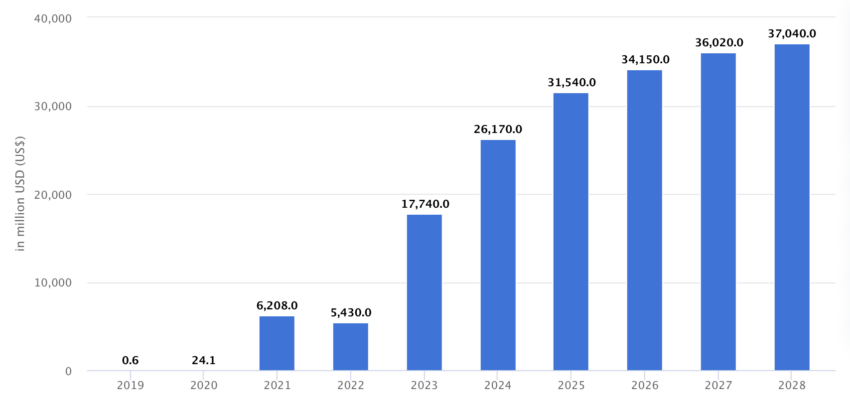

Statista predicts that the DeFi market will attain $37.04 billion in income by 2028.

Annual income within the world DeFi market. Supply: Statista

Learn extra: DeFi Neighborhood Constructing: A Step-by-Step Information

IOSCO acknowledges the necessity for a tailored strategy

The IOSCO acknowledges that jurisdictions are at totally different phases of addressing cryptocurrency market dangers. Moreover, IOSCO acknowledges the necessity for a tailored strategy. Whereas some jurisdictions have already got present regulatory regimes, others are lagging behind.

Nevertheless, Jean-Paul Servais, President of IOSCO, expressed his satisfaction with the group’s fast progress.

“The dangers of crypto asset markets are actual. And we’re addressing these in a coordinated method, in search of constant implementation of those IOSCO suggestions throughout our members to greatest shield buyers worldwide.”

Tuang Lee Lim, Chairman of the IOSCO Board-Degree Fintech Activity Pressure, emphasised the coherence and robustness of the coverage framework. He highlighted its function in selling accountable innovation, investor safety and market integrity outcomes within the crypto asset markets.

Learn extra: Figuring out and investigating dangers on DeFi lending protocols