Overview

Galena Mining Restricted (ASX:G1A, Galena) owns 60 p.c of the Abra base metals mine positioned within the Gascoyne area of Western Australia – house to one of many largest lead and silver deposits on this planet, set to provide the highest-grade, cleanest lead focus obtainable globally. The corporate is capitalizing on its Tier 1 asset in a Tier 1 jurisdiction, strengthened by and leveraging partnerships with Japan’s largest zinc and lead smelter, in addition to with one of many high base metals buying and selling corporations on this planet.

The corporate additionally owns 100% of the Jillawarra Undertaking, which covers 76 kilometers of strike extension on to the west of Abra. The Jillawarra Undertaking comprises a number of large-scale analogous exploration targets together with the Woodlands Complicated, Quartzite Properly and Copper Chert areas.

Galena’s main partnerships embrace Toho Zinc (TSE:5707), Japan’s largest zinc and lead smelter, and IXM SA, one of many world’s high three base metals buying and selling corporations. Toho supplied AU$90 million challenge fairness and has a long-term offtake settlement to buy 40 p.c of Abra’s manufacturing; whereas IXM has entered right into a 10-year take-or-pay offtake contract to buy the remaining 60 p.c.

The corporate’s administration staff brings many years of expertise within the mining and base metals trade and has a confirmed observe report of success all through all levels of exploration, from improvement to manufacturing.

In November 2020, Galena put in place US$110 million in finalized debt services organized by Taurus Funds Administration. The services embrace a US$100-million challenge finance facility plus a US$10-million price overrun facility.

The challenge finance facility consists of a 69-month time period mortgage primarily to fund capital expenditures for the event of Abra. Key phrases embrace:

- Mounted curiosity of 8 p.c each year on drawn quantities, payable quarterly in arrears.

- 1.125 p.c internet smelter return royalty.

- No obligatory hedging.

- Early compensation allowed with out penalty.

- 15 quarterly repayments commencing on 31 December 2023.

The associated fee overrun facility is a mortgage to finance recognized price overruns on the challenge in capital expenditure and dealing capital. Mounted curiosity of 10 p.c each year applies to quantities drawn underneath the fee overrun facility.

The Taurus debt services have been absolutely drawn and are secured towards Abra Undertaking property and over the shares that every of Galena and Toho personal in Abra.

Firm Highlights

- Positioned to appreciate worth for shareholders:

- Abra mine development accomplished in December 2022, on time and on finances.

- First in-specification focus cargo achieved in March 2023.

- Abra is among the largest and cleanest lead-silver deposits on this planet (high-grade, high-value focus 1/tenth typical deleterious parts).

- Thrilling exploration floor and identified copper-gold mineralisation beneath the Abra lead-silver deposit.

- JV between Galena (60 p.c) and Japan’s largest zinc and lead smelter Toho Zinc (40 p.c) underpins lengthy mine life (10+ years) in an thrilling new mineral province in Western Australia.

- Galena has a 10-year offtake settlement with IXM, one of many world’s largest base metals merchants.

- Annual steady-state steerage:

- Mill throughput of greater than 1.3 million tonnes each year (Mtpa), producing +90,000 tonnes each year lead and +550,000 ounces each year silver.

- Annual common lead C1 direct money price of US$0.55 to US$0.65/lb.

- Annual common EBITDA (earnings earlier than curiosity, taxes, depreciation, and amortization) of AU$90 million to $100 million.

- The Abra mine is positioned within the Gascoyne Area of Western Australia, house to one of many largest undeveloped lead deposits on this planet and the highest-grade lead focus obtainable, globally.

- The Abra mine carries a JORC mineral useful resource estimate (July 2023) of 16.2 million tons (Mt) at 7.3 p.c lead and 19 grams per ton (g/t) silver within the indicated class, and 16.9 Mt at 6.9 p.c lead and 15 g/t silver within the inferred class.

- Abra has been named the world’s lowest-cost main lead mine by Wooden Mackenzie, a number one mining analysis and consultancy group.

- US$110 million of challenge financing debt services from main mining-specialist lending fund Taurus Funds Administration.

- Galena’s administration staff brings many years of expertise within the mining and base metals trade and has a confirmed observe report of success all through all levels of exploration, from improvement to manufacturing.

Key Tasks

Abra Mine

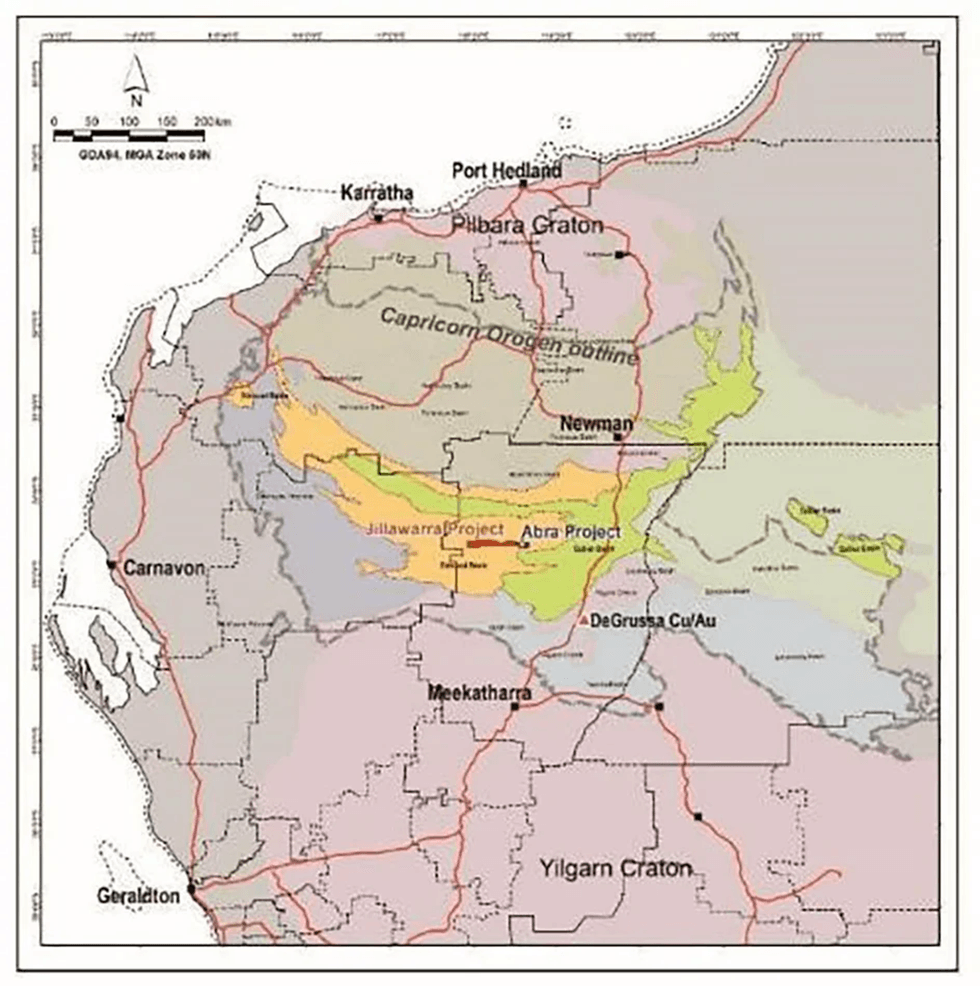

The Abra Mine is a 60:40 three way partnership between Galena and Japanese lead producer Toho Zinc. It’s a globally important lead-silver challenge positioned within the Gascoyne area of Western Australia, between the cities of Newman and Meekatharra roughly 110 kilometers from the DeGrussa copper mine owned by Sandfire Sources (ASX:SFR).

Abra Mine Website Location

The Abra mine carries a complete JORC mineral useful resource estimate printed in July 2023 of 33.4 Mt at 7.1 p.c lead and 17 g/t silver (5 p.c Pb cut-off grade), which incorporates 0.3 Mt at 7.3 p.c lead and 32 g/t silver within the measured class; 16.2 Mt at 7.3 p.c lead and 19 g/t silver within the indicated class; and 16.9 Mt at 6.9 p.c lead and 15 g/t silver within the inferred class.

All permits for the Abra challenge have been obtained from the suitable Western Australian regulatory our bodies. The challenge can be topic to an present land use and heritage settlement with the Jidi Jidi Aboriginal Company. The Abra property is well-serviced by public roads and highways, and all the required infrastructure has been developed to move lead-sulphide concentrates to the Port of Geraldton, Abra’s main export port.

Abra Processing Plant

A ultimate funding resolution to finish the Abra Undertaking was made in June 2021 and development was accomplished in December 2022, on time and on finances. A number of vital milestones had been achieved within the March 2023 quarter, together with the commissioning of the processing plant, first ore fed into the plant and first focus produced in January 2023.

The processing plant achieved in-specification focus manufacturing from the graduation of focus manufacturing and through the 2023 calendar 12 months, 967,622 tons of ore was processed and 61,800 tons of lead focus was produced.

The corporate is presently enterprise detailed technical work to develop an up to date manufacturing plan for 2024 manufacturing targets and steerage.

Jillawarra Undertaking

Exploration and progress related to the 100% Galena-owned Jillawarra Undertaking covers a extremely potential elongated tenement bundle overlaying roughly 76 kilometers of steady strike size and 508 sq. kilometers on to the west of Abra.

The Jillawarra Undertaking hosts many base metals prospects which have had restricted shallow exploration work accomplished because the Seventies by numerous firms. The majority of the exploration work was accomplished by Amoco, Geopeko, Apex Minerals and Abra Mining Restricted. The work accomplished up to now has recognized a number of base metals, manganese and gold prospects, of which the Woodlands Complicated, Quartzite Properly, Manganese Vary, Copper Chert, TP and 46-40 had been topic to early-stage exploration. A lot of the drilling accomplished throughout the Jillawarra Undertaking investigated the primary 100 to 200-meter depth which, based mostly on current data of Abra, might not have reached the depths required.

The primary potential hall throughout the Jillawarra Undertaking lies throughout the margins of the Quartzite Properly – Lyons River Fault zones which prolong east-west alongside the whole tenement bundle. Additionally, the contact between the dolomitic sediments of Irregully Formation and the decrease sedimentary unit, polymictic conglomerate, of the Kiangi Creek Formation represents an vital marker for the prevalence of base metallic mineralisation as seen at Abra.

The Woodlands Complicated is an Australian scaled geophysical anomaly which represents a major goal space with the anomaly being 12 kilometers lengthy and 10 kilometers vast. Restricted work and technical analysis have occurred at Woodlands which presents an awesome alternative for Galena within the years to return. Ongoing geophysical and exploration drilling will happen concurrently with the event of Abra. The data and understanding of Abra as a result of its improvement will present a major exploration benefit at Jillawarra.

Administration Staff

Tony James – Managing Director and CEO

Tony James is a mining engineer with over 30 years’ mine working and challenge improvement expertise predominantly in Western Australia. He additionally has earlier expertise at managing director degree of three ASX-listed firms with two of these firms efficiently guided via a merger and takeover course of benefiting the shareholders. He has a robust mine working background (examples being the Kanowna Belle gold mine and the Black Swan nickel mine) and a robust feasibility examine / mine improvement background (examples being the Pillara zinc/lead mine and the Trident/Higginsville gold mine).

Adrian Byass – Non-executive Chairman

Adrian Byass has greater than 25 years of expertise within the mining trade each in listed and unlisted entities globally. He has served as non-executive and government director of varied listed and unlisted mining entities, which have efficiently transitioned to manufacturing in bulk, treasured and specialty metals around the globe. He presently serves on the boards of ASX gold, base metals and lithium firms.

Neville Gardiner – Non-executive Director

Neville Gardiner has over 30 years of expertise advising boards on mergers and acquisitions,

fairness and debt capital markets, transaction structuring, capital allocation and sophisticated

business preparations. His profession achievements embrace senior government management

roles in Deloitte, Torridon Companions, and at Financial institution of America Merrill Lynch, the place he spent 5 years as the top of its Australian Pure Sources Staff. He additionally spent 9 years with Macquarie Financial institution, the place he had accountability for its Western Australian Company Finance enterprise and its Australian Oil and Gasoline Advisory enterprise. He has a really sturdy expertise and data base related to the sources sector in Australia.

Stewart Howe – Non-executive Director

Stewart Howe has greater than 40 years of expertise within the world useful resource trade together with 18 years in mining. He was chief improvement officer at Zinifex, one of many world’s largest miners and smelters of lead and zinc. He led the spin-off of Zinifex’s smelters to create Nyrstar NV, and restarted the event of the Dugald River mine.

Craig Barnes – Chief Monetary Officer

Craig Barnes has over 25 years of expertise in senior finance and monetary administration throughout the mining trade and beforehand the monetary companies trade. He has appreciable expertise in challenge financing, mergers and acquisitions, joint ventures, treasury and implementation of accounting controls and techniques.

Earlier than becoming a member of Galena, he held the place of CFO of Paladin Vitality for greater than 5 years and was a part of the staff that efficiently accomplished the corporate’s capital restructuring in 2018. Previous to that, he was the chief monetary officer of DRDGOLD (NYSE and JSE:DRD) and its affiliated subsidiaries for greater than seven years.

Aida Tabakovic – Firm Secretary

Aida Tabakovic has over 11 years of expertise within the accounting career, which incorporates monetary accounting reporting, firm secretarial companies, ASX and ASIC compliance necessities. She has been concerned in itemizing a number of junior exploration firms on the ASX and is presently firm secretary for quite a few ASX-listed firms