2nd illustrations and images/iStock through Getty Pictures

After a few years of Cumberland’s US Fairness ETF portfolios being obese within the healthcare sector, we are actually at our lowest relative market weight for a very long time. Our solely industry-specific place throughout the sector is IBB, the larger-cap biotech ETF. We additionally acquire sector publicity with the broad-based ETFs. We’re beneath the healthcare sector market weight for the primary time since earlier than the 2019 Covid pandemic threat was identified.

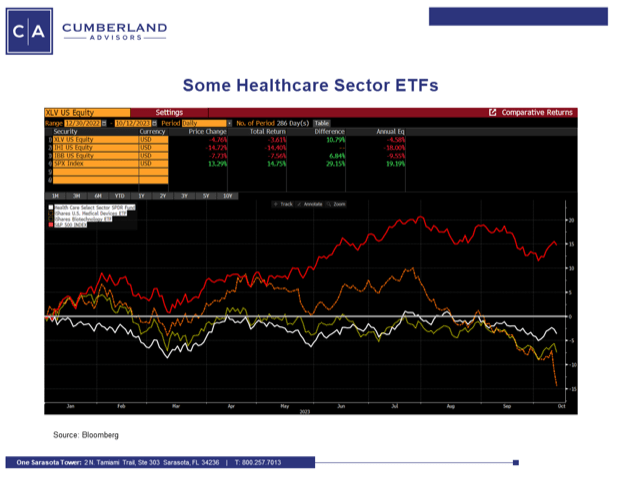

There are a number of the explanation why we made this structural change. Within the chart beneath, you will notice the efficiency of the healthcare sector ETF, whose image is XLV. Additionally, you will see the not too long ago bought place image IHI. IHI has been in our portfolios for a very long time and has been a rewarding place. Additionally, you will see SPX (the S&P 500 Index) for comparability.

Right here’s why we made the change.

The financial advantages to the sector from the Covid pandemic are over. Covid itself isn’t over, in my view. It has morphed from a pandemic to develop into an endemic illness. And there may be nonetheless the danger of a mutation that might flip it once more right into a severe, increasing, life-threatening occasion. However the governments of the world and the neighborhood within the US have moved on from Covid. From an investor’s viewpoint, which means the demand facet for remedy and prevention is diminishing. Right here’s an excerpt from the most recent CDC report (by way of August).

“Most (COVID) hospitalized adults aged ≥65 years (90.3%; 95% CI = 87.2%-92.8%) had a number of underlying circumstances, and fewer than one quarter (23.5%; 95% CI = 19.5%-27.7%) had obtained the beneficial COVID-19 bivalent vaccine. As a result of adults aged ≥65 years stay at elevated threat for COVID-19-associated hospitalization and extreme outcomes, steering for this age group ought to proceed to concentrate on measures to stop SARS-CoV-2 an infection, encourage vaccination, and promote early remedy for individuals who obtain a constructive SARS-CoV-2 take a look at consequence to scale back their threat for extreme COVID-19-associated outcomes.”

The federal finances points have put strain on the funding of healthcare by the federal authorities. The political deadlock within the Congress has made federal assist for healthcare a political goal. So, we see a diminishing focus of healthcare funding. Relying on the outcomes of the finances funding political combat (at present unknown), we could witness a cessation of growth of funding. Some proposals are for precise chopping.

Sadly, the nationwide image of America’s healthcare system is a deteriorating one. We see this as life expectancy has fallen for greater than two years in a row. The vary among the many states is widening. Life expectancy could also be decrease than 75 in Mississippi and better than 80 in Hawaii. The graphic throughout the hyperlink is thru 2020. Anecdotal information since has indicated that nothing has improved life expectancy statistically in 2021 and 2022.

As well as, markets are pricing in a distinct regime in relation to rates of interest and the affect greater charges have on capitalization constructions and on value/earnings ratios. Greater rates of interest imply the fairness threat premium computations utilized by funding practitioners are adjusted within the course of downward market costs for a selected inventory or group of shares.

Lastly, there may be the difficulty of federal funding within the forthcoming budgets and sooner or later past the 2024 presidential election. That’s extremely unsure. Thus, the (unmeasurable) uncertainty premium is presumed by this author to be greater and nonetheless rising.

We proceed with holdings within the biotech sector as a result of the pipelines of those firms are excellent. Moreover, they’ve the capability to accumulate smaller firms when these gamers make the breakthrough discoveries that originate with biotech.

Our weight within the US Fairness ETF Portfolio in healthcare is at present beneath market weight.

After all, this will change at any time.

Editor’s Word: The abstract bullets for this text have been chosen by Looking for Alpha editors.