Andrii Yalanskyi/iStock by way of Getty Photos

Funding Thesis

Invesco Mortgage Capital Inc. (NYSE:IVR) shares have been on a downward trajectory after hitting its 52-week excessive of $15.56. It has misplaced about 50% and its present value of $7.78 is a brand new 52-week low down from the earlier $8.21. From a technical evaluation, the inventory seems to be in a powerful bearish pattern with no signal of a reversal. With its low internet curiosity margins, high leverage, and declining e book worth, I consider the corporate is just not a great funding in the intervening time.

Additional, the rising interest rates, which can function a serious headwind, rising prices, and lowering profitability margins, strengthens my skeptical view. Moreover, the corporate’s dividend historical past is just not pleasing since it’s characterised by declining dividends and a poor payout ratio, which makes it unsustainable. Given this background and backed by technical evaluation, I like to recommend promoting the inventory to keep away from additional losses.

Unimpressive IVR

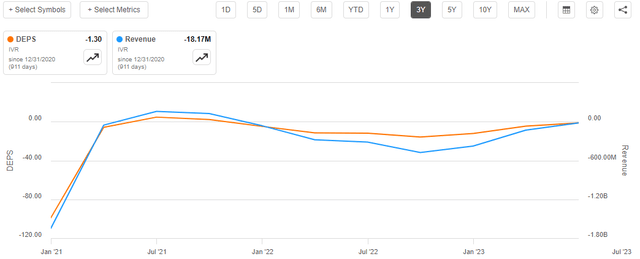

Primarily based on my evaluation, IVR has some traits that make the inventory unattractive. IVR inventory has been declining after reaching its 52-week excessive of $15.56. It’s presently buying and selling at a brand new 52-week low of $7.78 after shedding roughly 50%, and it seems to be in a powerful bearish momentum based mostly on technical evaluation, as will likely be mentioned later on this article. Additional, the inventory additionally has destructive earnings per share [EPS] of -1.3, which signifies that the corporate is just not worthwhile and, thus, for my part, is just not a great funding. Additional, its revenues have been poor for the final three years and presently stand at a destructive worth of $18.17 million, which isn’t pleasing for my part as a result of it speaks volumes about how weak the corporate’s monetary well being is.

Looking for Alpha

IVR can also be undesirable to me due to its falling e book worth. Its common e book worth per share progress charge over the previous 12 months is -26.40% per yr, the common annual progress charge of e book worth per share during the last three years is -57.00%, the common e book worth per share progress charge during the last 5 years is -43.00% yearly and the common e book worth per share progress charge over the earlier ten years is -21.10% yearly.

Looking for Alpha

This demonstrates unequivocally that the corporate’s internet value has decreased dramatically over the previous ten years, and the pattern appears to proceed. I consider this pattern has been propelled by elements such because the unfavorable rate of interest atmosphere, which has diminished the worth and profitability of the corporate’s mortgage investments, particularly the company residential mortgage-backed securities (Company RMBS). The corporate acknowledged that its book value declined as a consequence of a traditionally difficult atmosphere for Company RMBS, as expectations for the elimination of financial coverage lodging by the Federal Reserve accelerated additional.

Secondly, it might be as a result of poor financial results and dividend cuts, which have diminished the arrogance and belief of traders, analysts, and prospects within the firm’s future prospects and viability.

Primarily based on this pattern, I’m skeptical in regards to the firm’s future prospects as a result of I consider a decline in e book worth might point out that the corporate is just not investing in its future progress or aggressive benefit, reminiscent of innovation, analysis, and growth. Additional, it might signify that the corporate is impairing or writing off its property, reminiscent of goodwill, intangible property, and stock. With this in thoughts, I consider IVR is just not a great funding in the intervening time.

Certainly, the share costs might fall beneath the e book worth per share, which is the ratio of fairness out there to frequent shareholders divided by the variety of excellent shares. In my opinion, this might make the corporate weak to takeover makes an attempt or liquidation stress.

Lastly, the corporate’s financial return, which measures the change in its e book worth per frequent share plus dividends paid, was destructive 1.8% within the second quarter of 2023. Additional, the corporate has a complete return of destructive 87.86% during the last 5 years; this exhibits that the corporate’s shareholders have suffered a considerable lack of worth of their funding, which I consider makes it not a great funding selection in the intervening time.

Looking for Alpha

The opposite factor that, in my view, detracts from IVR is its dividend coverage, which I’ll talk about within the succeeding part. These crimson flags, in my view, present that IVR is coping with important dangers and challenges that might impair its capability to provide income and add worth for its shareholders. In consequence, it won’t be a great funding at the moment.

Dividend: Very Risky And Unsustainable

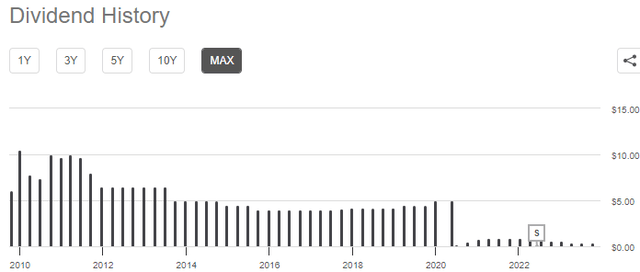

Since 2009, IVR has had a steady dividend fee file, with dividends presently distributed quarterly. Regardless of the constant payout, its dividend fee has been extremely unstable, with many dividend cuts, as illustrated beneath.

Looking for Alpha

As of in the present day, the corporate has a 12-month trailing dividend yield of twenty-two.26% and a 12-month ahead dividend yield of 19.25%. This implies an expectation of decreased dividend funds over the following 12 months. The annual dividend progress charge for the corporate during the last three years is about 40%. This charge elevated to about 31% yearly when the time-frame was stretched to 5 years. Moreover, its annual dividends per share progress charge over the previous ten years has been roughly -17%. This explains how fickle and unappealing its dividend is, in my view.

By way of sustainability, its dividend is sort of unsustainable. IVR has a dividend payout ratio [TTM][GAAP] of zero. Additional, with its poor profitability and earnings, It’s affordable to claim that its dividend could be very unsustainable. In a nutshell, although very constant, the corporate’s dividend fee could be very unstable and filled with dividend cuts. For my part, it’s fairly unsustainable, which makes this firm not a great dividend selection.

IVR’s Optimistic Indicators

Although I’ve a destructive outlook for the corporate, sure issues are going for it which may make it a greater funding prospect sooner or later.

- It has an opportunistic and diversified strategy to investing in mortgage securities and loans, which permits it to seize a broader spectrum of alternatives and mitigate dangers. I consider this strategy may be very productive ought to the corporate flip round its destiny and generate good returns on invested capital.

- It improved its liquidity place by elevating $300 million of recent fairness capital in January 2022 and $31 million in Q2 2023, which enhanced its capacity to benefit from market alternatives and cut back leverage. Though the transfer has a dilutive impact, the improved liquidity, if effectively utilized, can assist the corporate flip round its woes no less than marginally.

Technical Evaluation

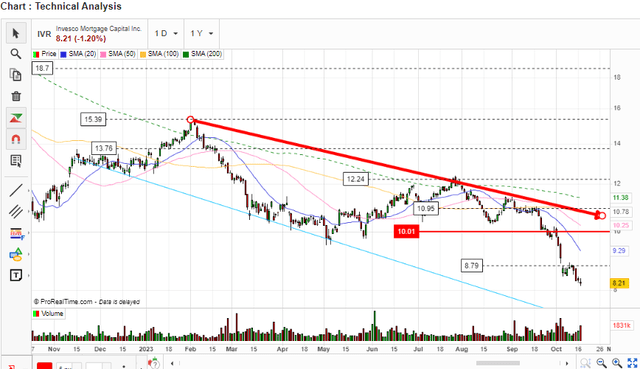

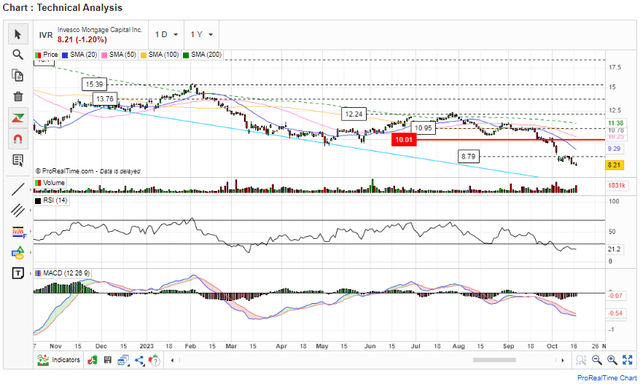

Right here is my technical evaluation for IVR based mostly on a number of indicators. To start with, the inventory value has been in a downtrend since February 2023, when it reached a 52-week excessive of $15.56. It has misplaced about 50% of its worth since then and is presently buying and selling at $7.78 a brand new 52-week low. The inventory is beneath its 50-day, 100-day, and 200-day shifting averages, that are additionally sloping downward, indicating a bearish pattern.

Creator Evaluation On Market Screener

The opposite indicators are the amount and momentum indicators. The on-balance quantity [OBV] indicator exhibits that the promoting stress has been dominant prior to now few months, because the OBV line has been making decrease lows together with the worth. The buildup/distribution line additionally confirms the destructive divergence between value and quantity, indicating that traders are distributing their shares. The typical directional index [ADX] exhibits that the downtrend is robust and steady, because the ADX line is above 25 and rising, whereas the destructive directional indicator [-DI] is above the optimistic directional indicator [+DI].

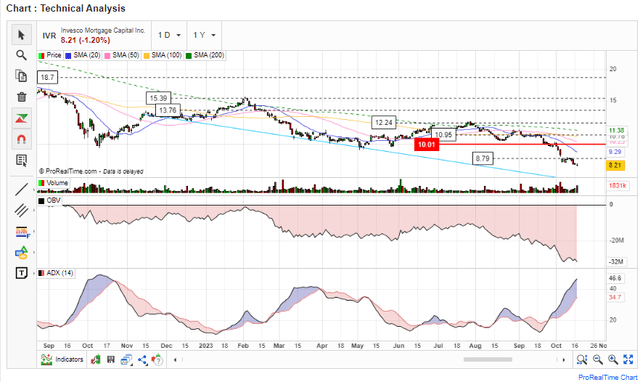

Creator Evaluation On Market Screener

The opposite indicators are the MACD and the RSI. The MACD indicator exhibits that the bearish momentum is rising because the MACD line is beneath the sign line, and each traces are shifting additional away from the zero line. The MACD histogram can also be destructive and rising bigger. Additional, the RSI exhibits that the inventory is oversold, because the RSI line is beneath 30. Nevertheless, this doesn’t essentially imply {that a} reversal is imminent, because the RSI can stay oversold for a very long time in a powerful downtrend.

Creator Evaluation On Market Screener

Primarily based on my technical evaluation, I’d suggest traders keep away from shopping for or holding IVR shares at the moment, because the inventory is in a powerful downtrend and exhibits no indicators of reversal; the very best plan of action is promoting the shares and ready till the bearish momentum reverses.

My Funding Take

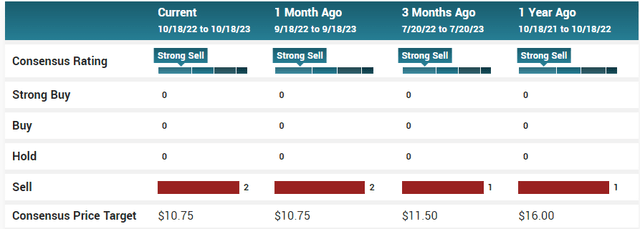

Given the stable bearish momentum, as proven by the technical evaluation and the unimpressive traits of IVR, I charge the corporate as a purchase as a result of the present momentum exhibits no indicators of a reversal. To help my promote score is a consensus promote score with a declining value goal, the SA, and Wall Avenue scores as proven beneath.

Market Beat.

Looking for Alpha