da-kuk

By Tony DeSpirito

With all eyes on generative AI (genAI) and its transformative potential, particular person buyers’ curiosity has been piqued. The market-moving innovation definitely has generated a variety of hype – and questions. Fairness CIO Tony DeSpirito parses three causes for pleasure and three areas for consciousness.

GenAI has commanded consideration and moved markets this yr, incomes comparisons to the web and smartphones for its transformative potential. We imagine genAI can be setting as much as be a key contributor to market dispersion, because it has the potential to ship some companies hovering whereas disrupting or displacing others. We sponsored some inside debate on the subject and supply the next observations on this important innovation:

Worthy of pleasure

1. Common utility

In contrast to different know-how improvements that had fleeting fame earlier than fading to the background, we see genAI having a far-reaching and lasting influence. Leaders of our know-how workforce imagine its utilization is poised to be unprecedented relative to prior improvements with a extra restricted scope (e.g., 3D printing, augmented actuality, metaverse). The important thing distinction: GenAI is a platform with parts of humanlike intelligence that give it common applicability that may lengthen throughout industries, companies, and disciplines.

Corporations promoting the “picks and shovels” of the AI gold rush are the preliminary beneficiaries. The early rewards for customers are prone to take the type of value financial savings – eliminating some jobs whereas making people extra environment friendly at others. Later within the AI evolution, we anticipate to see the emergence of recent revenue-generating enterprise fashions.

2. Funding alternative now – and for years to return

GenAI is evolving and the conclusion of its full benefit will take time, making this a multi-decade alternative. But corporations are spending actual cash on genAI now in an effort to harness its huge potential. Within the constructing part, the funding alternatives reside primarily within the know-how area. The secret’s to know the place we’re within the AI lifecycle and what parts of the know-how “stack” could also be positioned to profit.

Contemplate this: The substantial funding within the present web, which is powered primarily by CPU chips, will transition towards GPUs (the graphics processing models which are optimized for AI). We see the creation of an AI-supported net driving years-long funding alternatives.

We view investing in genAI as an lively pursuit, given the should be nimble and know the place the chance is at every stage of progress. An evaluation of the know-how stack (proven beneath) illustrates present and potential alternatives – all topic to vary as genAI itself sharpens, smartens, and evolves.

The genAI know-how funding stack

|

What it’s |

The place to speculate |

|

|

IV. Instruments & functions |

The instruments to create apps and the precise devices and apps powered by generative AI. |

Corporations that construct apps and the instruments to create them. Current apps might be enhanced; many start-ups prone to emerge. |

|

III. Knowledge(personal & public/free) |

The knowledge upon whichAI fashions will “assume,” course of and generate content material. |

Suppliers of data and analytics, and people concerned in information staging. AI makes personal information extra helpful and, due to this fact, extra invaluable. |

|

II. AI fashions(proprietary & open supply) |

The software program required to trainAI to “assume” and do. |

Corporations concerned within the analysis and improvement of AI studying and language fashions. |

|

I. Infrastructure & cloud |

The {hardware} and computing assets wanted to allow AI operate and progress. Contains GPUs, storage and reminiscence. |

Cloud service suppliers constructing AI-enabled information facilities; semiconductors and makers of chip manufacturing gear are important inputs. |

Supply: BlackRock Elementary Equities, September 2023.

3. Alternative effectively past tech

Past the impacts and alternatives within the know-how sector are the eventual use circumstances for AI that can emerge all through the economic system. Name facilities will doubtless get replaced. Elsewhere, the makes use of could also be much less transformative and extra nuanced, resembling an AI-powered co-pilot added to an present software program bundle. We see private and non-private funding alternatives from AI, with many early-stage alternatives maybe greatest expressed via personal investments.

Warranting consciousness

1. Nice expectations

Given excessive valuations within the first a part of the know-how stack, some AI-related shares could possibly be weak to disappointment, even from only a slowdown within the fee of progress. A scarcity of important chips (GPUs) has allowed corporations that make them to quickly earn an abnormally excessive margin, posing a threat as soon as provide catches as much as demand and competitors kicks in. Enterprise historical past is riddled with tales of provide shortages that finally turned to provide gluts.

Basically, the early levels of a know-how hype cycle embody a variety of pleasure and hypothesis, but improvements of their infancy are tough to worth. Fixed monitoring is required to evaluate whether or not expectations are aligned to the monetary and basic realities. Questions across the unknown however inevitable regulation of AI globally additionally complicate the calculus.

2. Construct it and they’ll come?

In previous cycles, new applied sciences weren’t at all times absolutely utilized after the constructions to assist them have been constructed. AI’s universality may make this time completely different. One other important component to the functioning of AI for enterprises and organizations is information. Whereas AI fashions will be skilled on public information, that information have to be enriched with the proprietary sort to make choices for a selected enterprise. That is an space the place many organizations are hamstrung attributable to inadequate, unorganized, or siloed information, doubtlessly slowing or limiting AI uptake.

3. Capital chasing the unknown

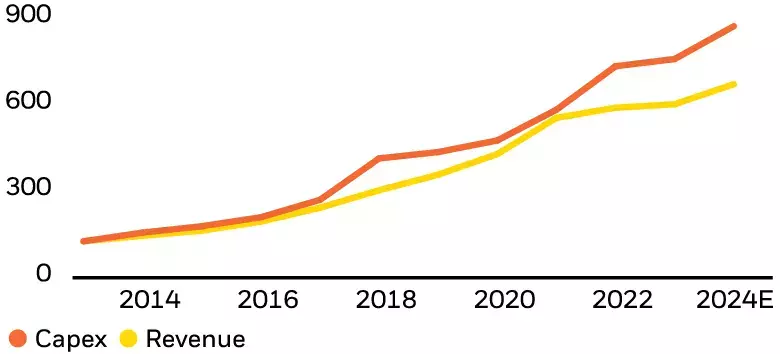

Capital expenditures on genAI have elevated upfront of the income it generates, as proven within the chart beneath. A key query is whether or not corporations will observe via and use the providers to maintain the wave of spending. Among the early funding could represent FOMO (concern of lacking out) – corporations don’t wish to fall behind in the event that they fail to put money into a successful innovation. However companies should assess whether or not AI, for the productiveness enhance it gives, is price steady spending – investing much less on hype and extra on ROI (return on funding) calculations.

Investing for an (eventual) AI payday

Hyperscale information facilities, capex and income, 2013-2024

Supply: BlackRock Elementary Equities, Aug. 4, 2023. Chart exhibits the combination quantity of annual capex spent and income generated among the many eight largest cloud corporations globally for his or her funding in giant information facilities to assist genAI. Estimates for 2023 and 2024 are primarily based on consensus analyst estimates. Knowledge is listed and rebased to 100 as of Jan. 1, 2013.

No matter whether or not there’s a near-term hiccup, the long-term potential for AI seems shiny. As the quantity of knowledge will increase and the price of processing it comes down throughout time, we anticipate AI will proceed to develop. But AI functions will in the end meet with various levels of success, suggesting genAI may contribute to dispersion throughout particular person corporations and their inventory costs. For that reason, we embody AI amongst 5 factors favoring stock selection in what we describe as a brand new period for fairness investing.

The underside line

We see generative AI on an enchancment curve with prospects to remodel companies around the globe. But it’s exactly as a result of genAI is new, thrilling, and evolving that it requires an lively funding strategy. As fundamental-based stock pickers, we’re frequently fact-checking the funding case because the cycle round generative AI advances from peak expectations to enlightenment and productiveness. The genAI story has solely simply begun and, we anticipate, might be written for a few years to return.

This post initially appeared on the iShares Market Insights.

Editor’s Word: The abstract bullets for this text have been chosen by Searching for Alpha editors.