Bet_Noire

The disparity between publicity to shares by lively establishments and that of particular person buyers stays sharp.

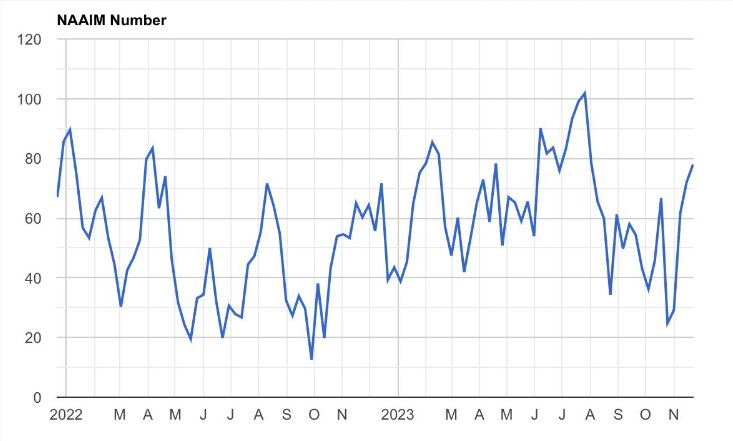

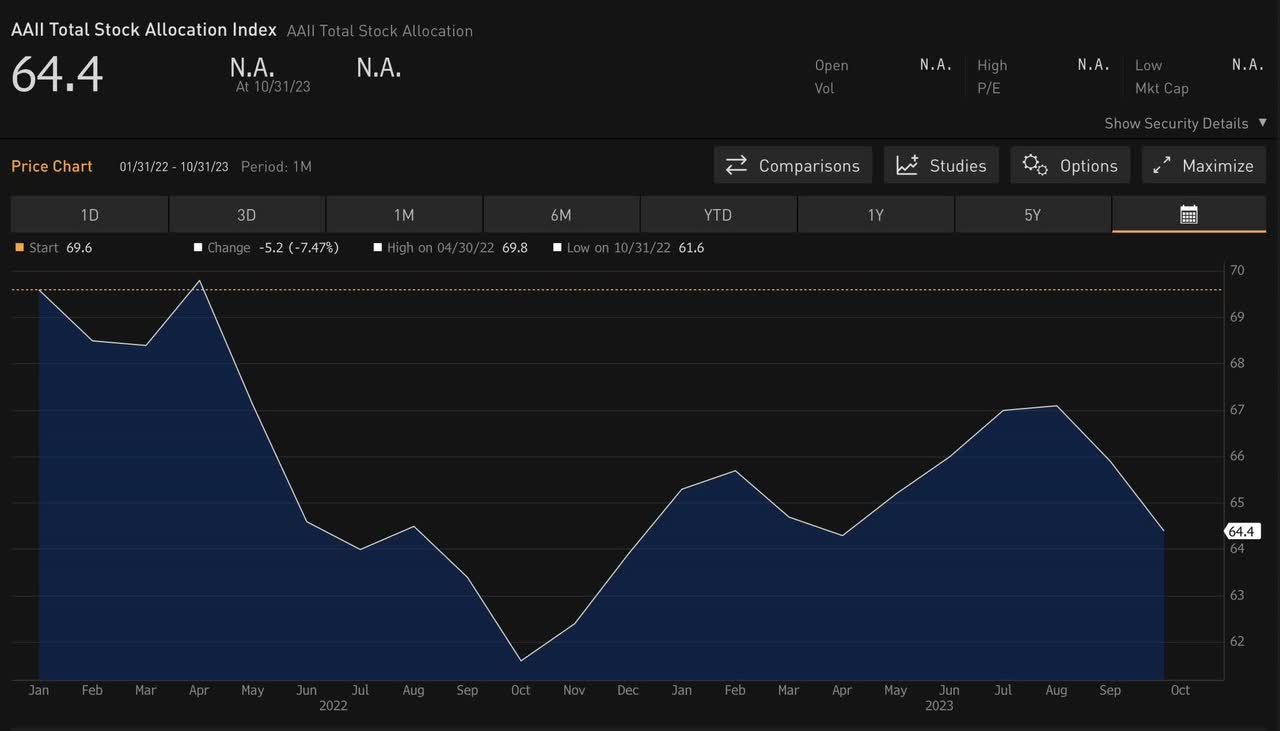

The Nationwide Affiliation of Lively Funding Managers’ Fairness Publicity Index and the American Affiliation of Particular person Traders’ Whole Inventory Allocation Index are displaying two completely different instructions.

Liz Ann Sonders, chief funding strategist at Charles Schwab & Co, posted on X.com two charts displaying the NAAIM’s fairness publicity for lively cash managers, in comparison with the AAII’s.

The NAAIM Publicity Index represents the common publicity to U.S. fairness markets reported by Charles Schwab, she mentioned. It “supplies perception into the precise changes lively danger managers have made to consumer accounts over the previous two weeks.”

Supply: Liz Ann Sonders through X.com

The AAII Whole Inventory Allocation Index, from Jan. 31, 2022, to Oct. 31, 2023, reveals present worth.

Barclays notes at present, “general retail flows nonetheless stay skewed towards Gov’t bond funds, with cash flowing out of most danger property, together with international equities and US credit score (each IG and HY).”

“US cash market funds had been the clear winner by way of inflows this 12 months, having obtained effectively north of $1 trillion in new cash on a YTD foundation.”

Supply: Liz Ann Sonders through X.com