Binance’s $4.3 billion settlement with U.S. regulators was an enormous shift within the mentality of institutional adoption of digital property, which has suffered many dismissals from institutional gamers who label digital property as showy, nugatory property propelled by criminals.

Progressively, the tectonic plates of concepts that formed the feelings of those institutional corridors of energy have shifted. For the primary time in many years, digital property like Bitcoin (BTC) may very well be in ideological collision with an indicator of institutional acceptance.

Many revolutionary concepts stream into the cryptocurrency house, creating infinite market alternatives. Binance’s collaboration with Signum, which permits huge gamers within the cryptocurrency house to maintain their property elsewhere, additional amplifies many revolutions and can allow establishments to discover digital property.

Moreover, establishments have continued to move into the crypto market after spot Bitcoin exchange-traded fund (ETF) approval, permitting many corporations to commerce a proxy with low administration charges and enabling them to take part in different methods like hedging.

These elements have pushed a lot consideration and the cash move into the crypto house, as this has been considerably seen in Bitcoin’s efficiency, which has hit new all-time highs. Sensible cash, retailers, households, hedge funds, and firms have all just lately added Bitcoin as a technique for portfolio diversification.

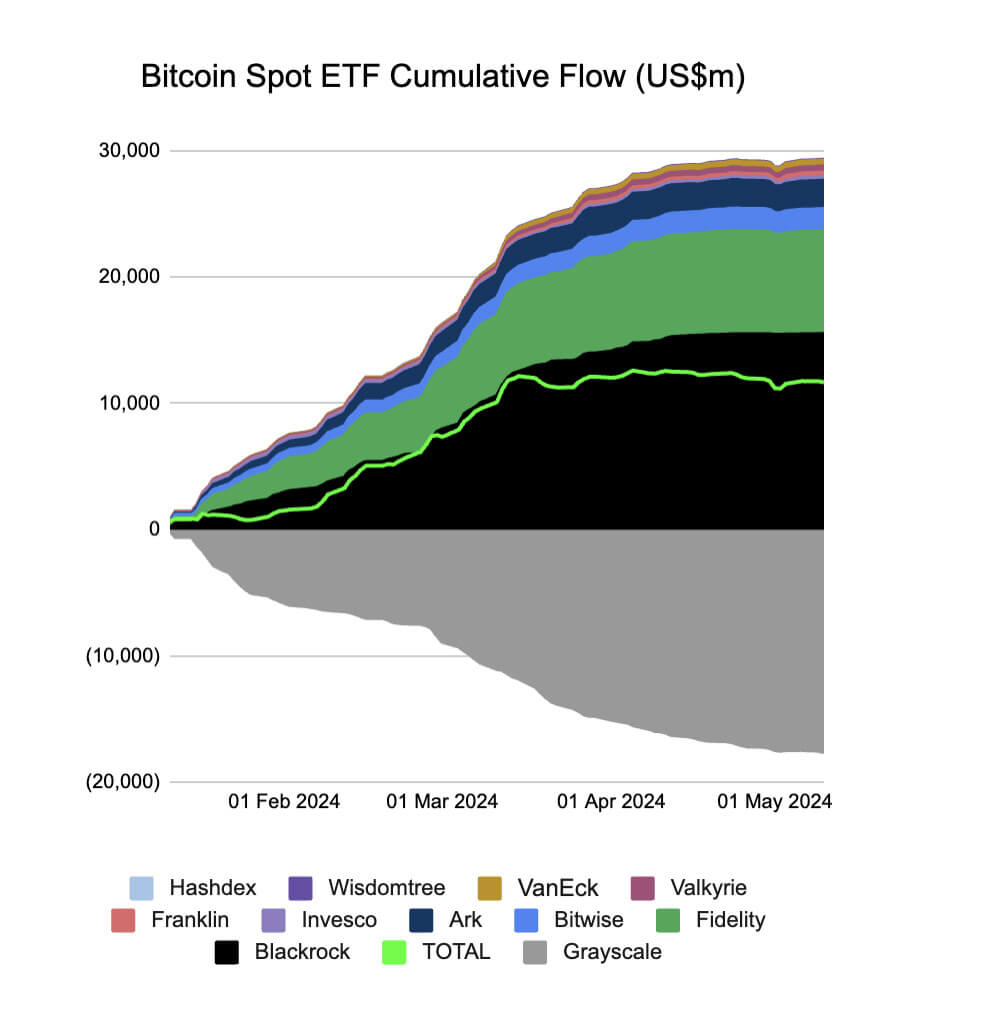

Analysis has proven {that a} staggering $17 billion of institutional capital has flooded the cryptocurrency house simply this 12 months alone as establishments proceed to allocate a proportion of their investments to digital property.

The farside Bitcoin ETF move exhibits that huge gamers similar to BlackRock, Constancy, VanEck, and different institutional corporations have proven a lot curiosity in digital property, with institutional cash taking part in a key position within the present buzz of the cryptocurrency market.

Greater than seven out of ten institutional traders have proven an eagerness to diversify their investments into digital property, with greater than 5 of those institutional traders taking many actions to personal these crypto property.

BlackRock Spearheads Institutional Cash Coming Into Crypto

BlackRock, a number one asset supervisor and one of many world’s largest institutional giants, has proven nice curiosity within the cryptocurrency ecosystem, driving a lot innovation into the tokenization of cryptocurrency property.

These actions from well-respected monetary providers show a rising adoption of blockchain applied sciences amongst conventional organizations. The unimaginable advantages the blockchain ecosystem supplies, similar to transparency, liquidity, and use instances by completely different tasks, are driving this adoption.

Non-public companies have initially dominated the blockchain ecosystem, however the mass adoption of it by establishments might pave the way in which for extra operational effectivity. Revolutionary concepts such because the tokenization of digital property by a crypto startup, Libre, sparked a lot consideration from JPMorgan and BlackRock, shifting their focus extra on bringing innovation to this house and tokenizing digital property.

BlackRock’s CEO, Larry Fink, sees blockchain expertise and tokenization of crypto property as a blueprint to sometime replicate such nice concepts on shares and bonds to attain a unified blockchain ledger enabling instantaneous transactions.

Unlocking Institutional Alternatives

Amidst the quickly evolving world of finance, asset tokenization continues to be rampant amongst institutional organizations similar to BlackRock, JPMorgan, Constancy, and others. It goals to be a pivotal pressure and a extremely promising transformation for these establishments within the close to future.

Current analysis from Boston Group Consulting (BGC) and funding firm ADDX exhibits a transparent route for many institutional corporations exhibiting extra curiosity within the cryptocurrency ecosystem as their curiosity tilts to asset tokenization. Asset tokenization is projected to be a $4 trillion business because it attracts extra establishments into the house and will materialize within the subsequent many years.

This shift in asset tokenization by monetary establishments isn’t speculative in comparison with the foreign money market development, because it has been concretely manifested by these market gamers, who acknowledge this business has potential. The centre stage for conventional finance and blockchain expertise bridging its hole could be a ball set in movement, as this might enable liquidity, effectivity, and higher accessibility.

As this supplies many alternatives for institutional traders, rising applied sciences similar to synthetic intelligence (AI), copy buying and selling, social buying and selling, and others have been adopted by many retailers to faucet into the infinite cash flowing into the crypto house by institutional traders.

Margex Copy Buying and selling Helps Retailers Place Higher In The Market

The thought of conventional finance getting into the cryptocurrency market was a mirage. Not till just lately have many conventional finance establishments proven a lot curiosity within the crypto house.

Conventional finance Establishments coming into the cryptocurrency market excite many retailers. A lot recent cash has been pumped into the market, suggesting the present market uptrend is an element of their presence. Many retailers want to leverage the present market sentiment.

Change-traded funds (ETFs) and real-world property (RWAs) have caught establishments’ consideration. Digital property beneath this development have exceeded expectations up to now couple of months, with the Margex platform making certain that these high-conviction property can be found for trades.

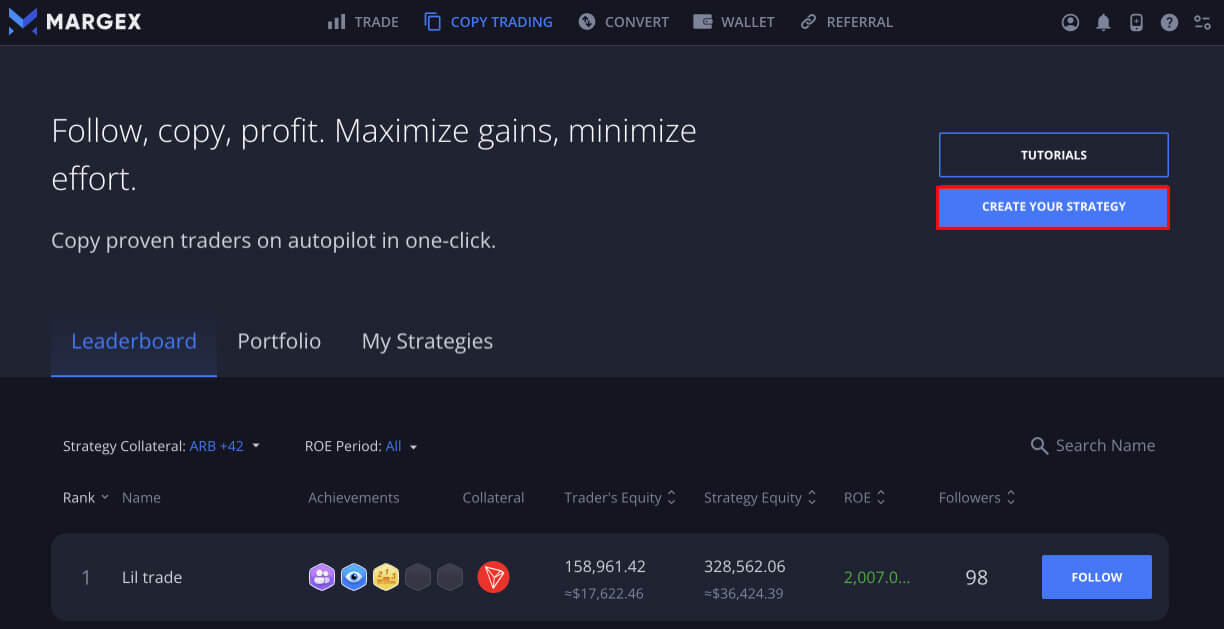

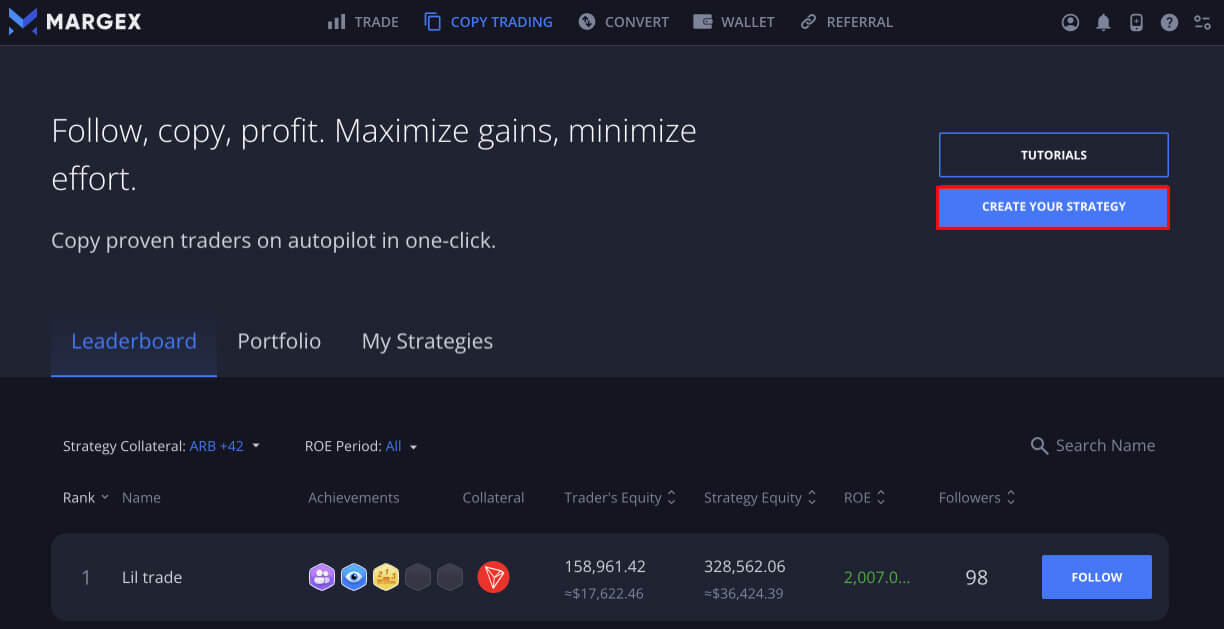

Margex is a number one cryptocurrency copy buying and selling platform that permits customers to copy the trades of knowledgeable merchants. This offers customers the chance to discover digital property with real-world use instances and higher revenue potential.

Margex has spent over $3 million redesigning its platform, specializing in usability. It launched a zero-fee converter to allow customers to swap tokens simply with no fees. Margex plans to unveil an ultra-modern pockets that offers customers a lot safety to property and helps them have full custody of property throughout the similar platform.

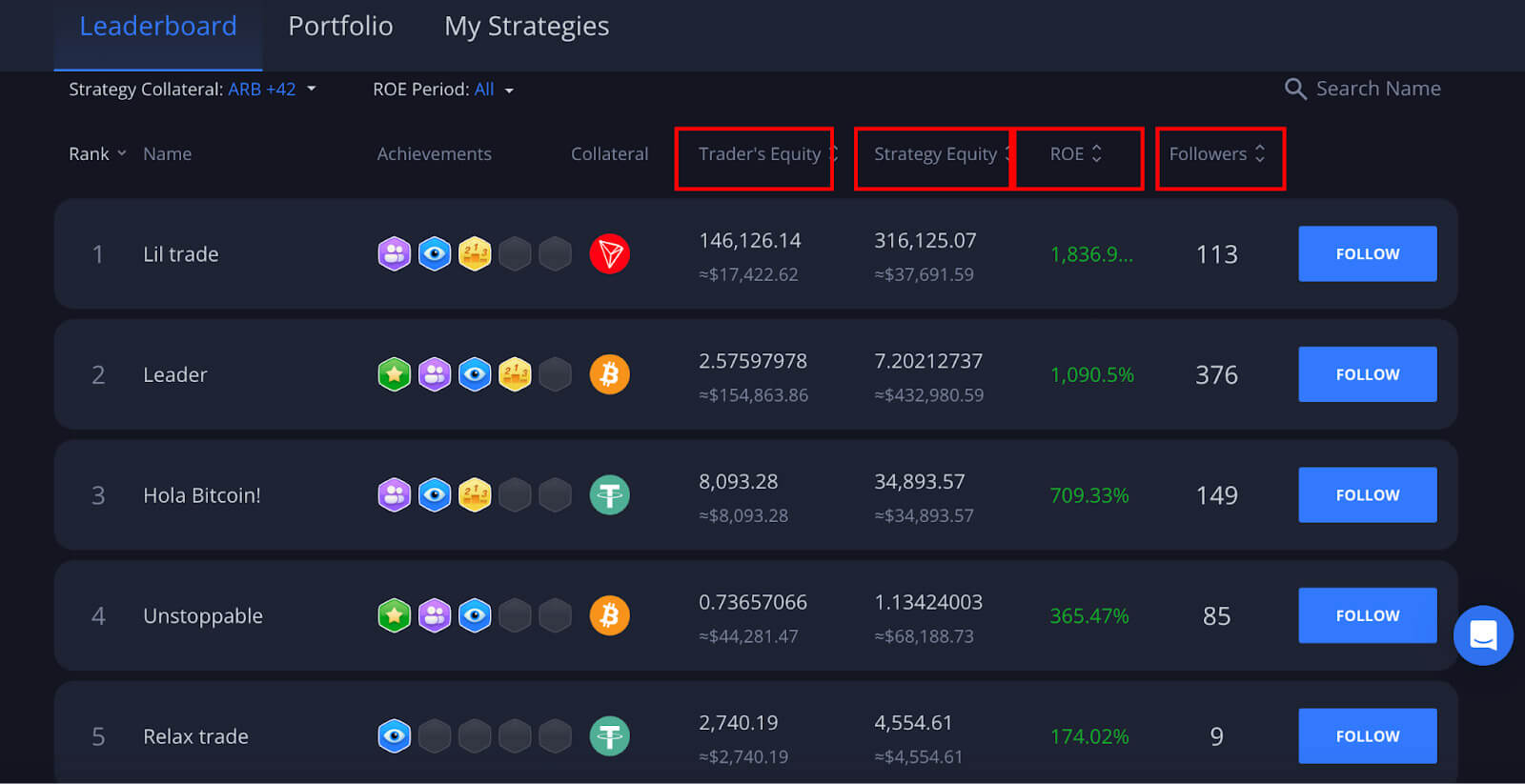

Margex’s design of its copy buying and selling platform provides customers an edge over different platforms. It allows customers to repeat one of the best merchants with over 90% win charge and correct threat administration of customers’ property. Above all, trades are executed robotically with out a lot monitoring.

Exploring Margex copy buying and selling and incomes mouth-watering returns from automated trades has by no means been simpler. Here’s a three-step course of for utilizing the Margex copy buying and selling technique.

1 Create A Margex Account

Making a Margex allows customers to entry its copy buying and selling.

2 Observe Worthwhile Skilled Merchants

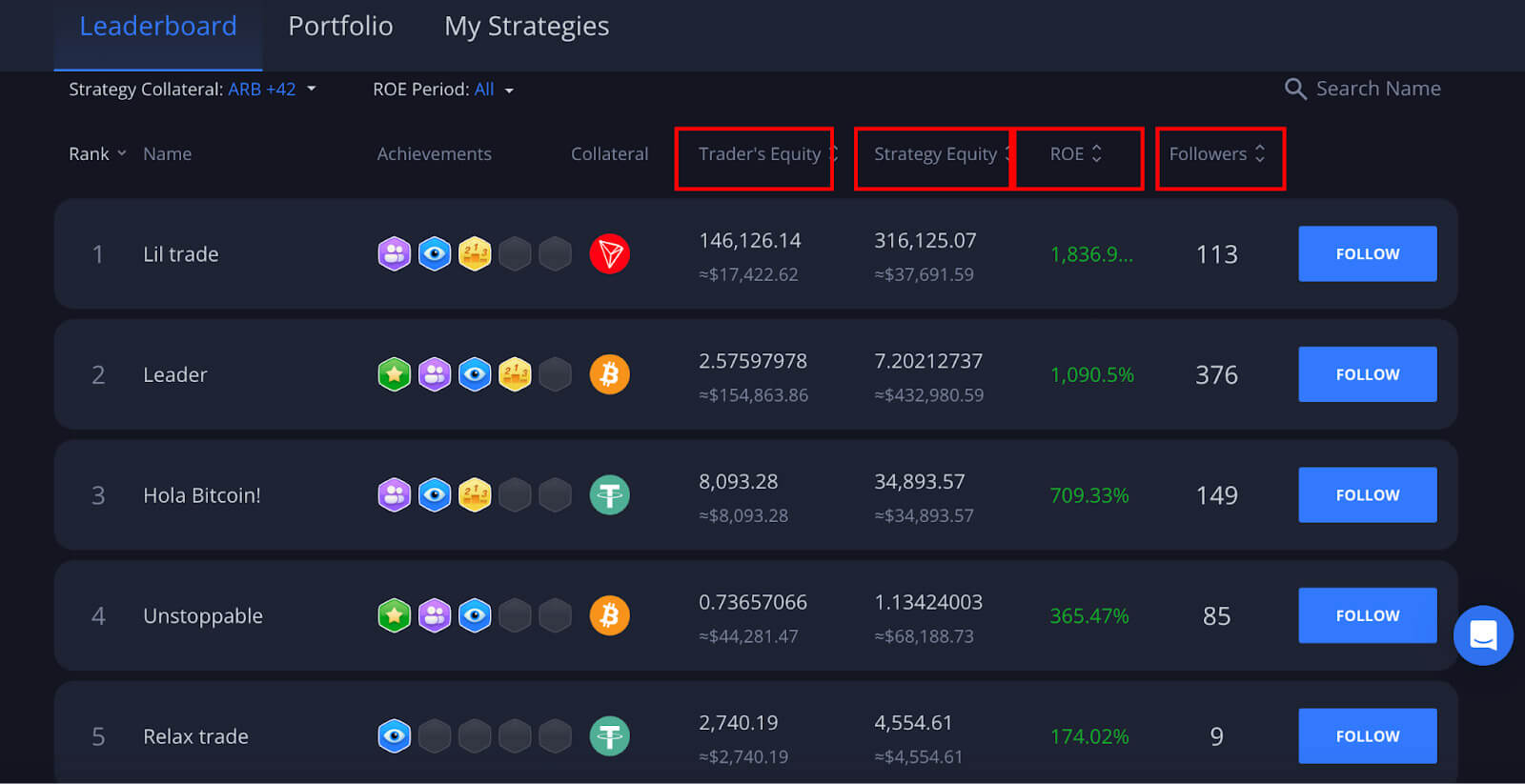

Observe your most well-liked knowledgeable dealer to copy all trades and methods robotically. Margex copy buying and selling leaderboards present all the knowledge customers must take advantage of knowledgeable resolution about which knowledgeable dealer to repeat.

3 Allocate Funds To Automate Copy Buying and selling

All trades executed in real-time enable customers to repeat the technique or create a plan that matches them after allocating their desired quantity to be entered per commerce.

As little as $10 is the minimal quantity Margex requires to take part in copy buying and selling methods.