- U.S. spot Bitcoin ETF inflows, Millennium Administration’s holdings show rising institutional involvement

- Galaxy Digital’s earnings surge and elevated ETF investments propelled Bitcoin’s newest hike too

As Bitcoin hiked previous $66,000 on the worth charts, U.S. spot Bitcoin [BTC] ETFs registered a notable hike. In doing so, it recorded two-week excessive inflows of $303 million.

In actual fact, in response to knowledge printed by Farside Investors, all spot Bitcoin ETFs aside from BlackRock’s iShares Bitcoin Belief (IBIT) noticed inflows on 15 Could.

Supply: Farside Traders

Attention-grabbing knowledge units

Surprisingly, IBIT remained stagnant for the third consecutive day, neither seeing important inflows nor outflows. Constancy’s FBTC was the one main the cost with a considerable inflow of $131.3 million. Moreover, Grayscale’s GBTC marked its first day of inflows in per week, attracting $27 million.

Seeing this efficiency, Sunnydecree, a Bitcoin investor/analyst famous,

“$303’000’000 Bitcoin ETF inflows yesterday. We’re so again!”

Including to the joy, one other X person, ‘Bitcoin for Freedom’ stated,

“That’s a Bull Market A number of of 276! Nobody is prepared for this bullrun. We’ve seen nothing but!”

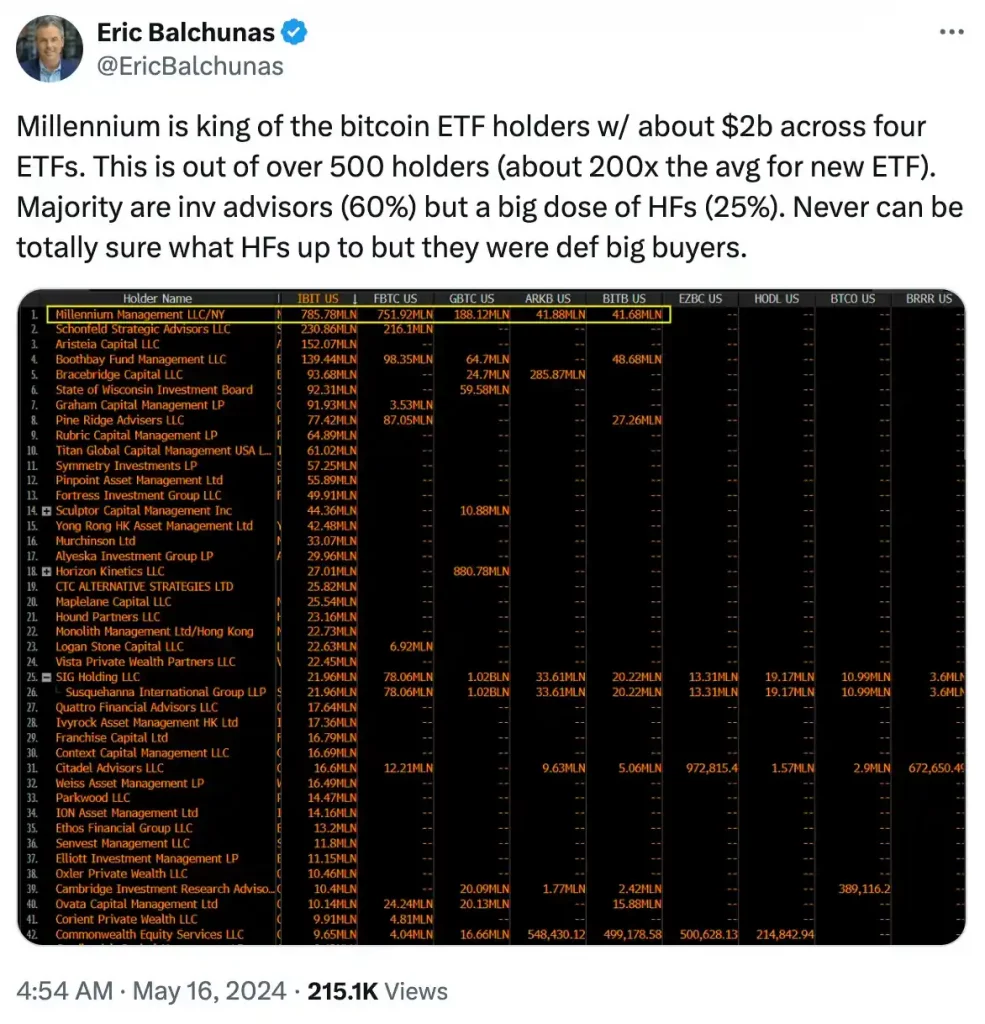

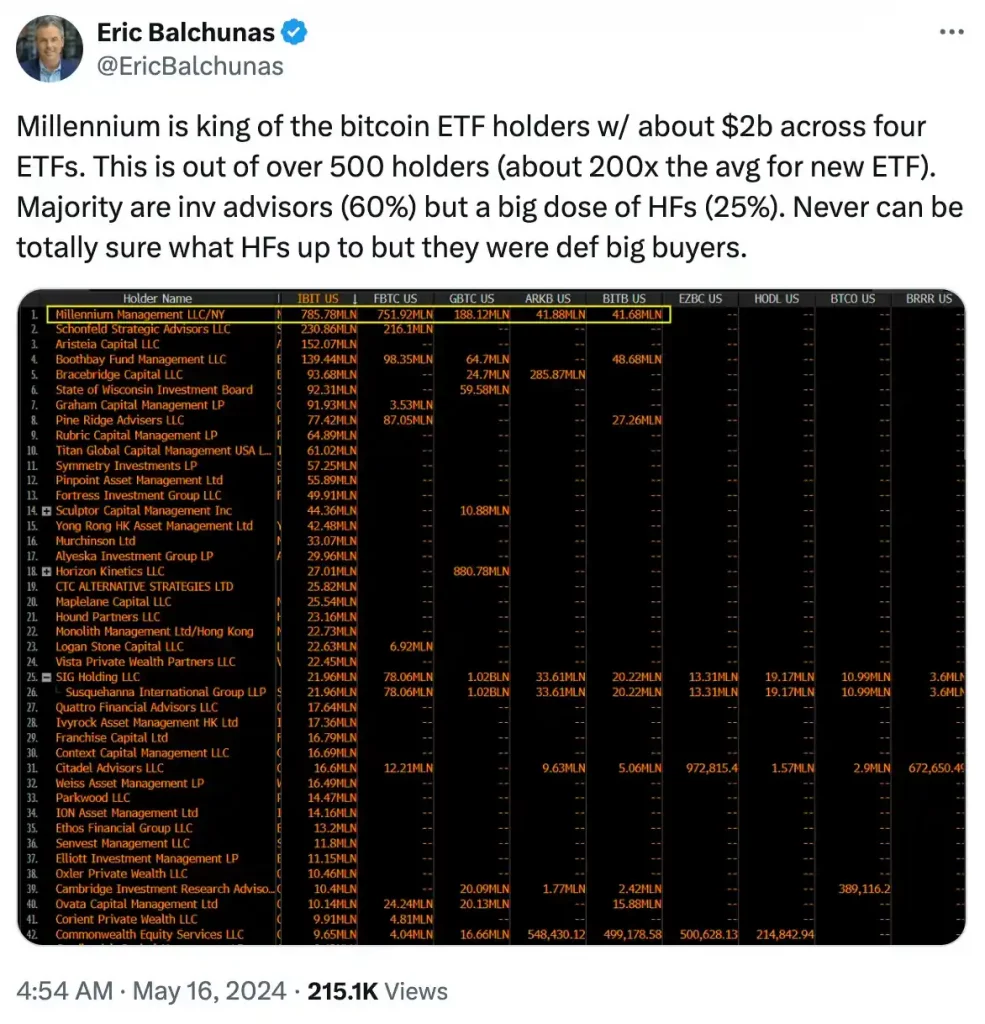

Millennium Administration’s large transfer

Effectively, the story doesn’t finish right here! In accordance with 13F filings, worldwide hedge fund Millennium Administration has reported holding almost $2 billion in spot Bitcoin ETF shares. As of 31 March, Millennium had a complete of $1.94 billion invested throughout 5 spot Bitcoin ETFs. These ETFs embrace ARK 21Shares, Bitwise, Grayscale, iShares, and Constancy’s choices.

Notably, BlackRock’s Bitcoin fund represents the hedge fund’s largest allocation, with over $844 million invested, adopted carefully by Constancy’s fund with simply over $806 million in shares held.

Offering additional insights on the identical, Bloomberg ETF analyst Eric Balchunas famous,

Supply: Eric Balchunas/X

In response to this James Seyffart added,

“It’s solely retail merchants shopping for the #bitcoin ETFs”

Becoming a member of the critics of ETFs, Salim Ramji, the newly appointed CEO of Vanguard in a current dialog with ‘Barron’s’, stood agency on the corporate’s determination to not pursue a spot Bitcoin ETF launch.

These remarks underline the distinctive nature of those investments and counsel a nuanced and sophisticated market perspective.

Enhance in institutional traders

Regardless of criticism, institutional traders and banking giants are flocking in direction of Bitcoin investments. In accordance with the most recent SEC filings, Bracebridge Capital disclosed a $363 million funding in spot Bitcoin ETFs, whereas J.P. Morgan’s purchasers contributed $731,246 to the identical.

Furthermore, on 15 Could, Galaxy Digital Holdings Ltd. made waves with a outstanding 40% hike in web earnings to $422 million, attributed to the affect of spot Bitcoin ETFs.

Therefore, these current resurgences in spot Bitcoin ETF investments might need been the most important elements behind Bitcoin’s hike this week.