- TON maintained its dominance out there, leaving SOL in the dead of night

- Whereas different metrics surged, growth slowed down on the blockchain

For the umpteenth time, Toncoin [TON] has demonstrated why it’s a token to be careful for this cycle. On earlier events, AMBCrypto defined intimately how TON has been giving different initiatives a run for his or her cash.

Within the final 24 hours, that didn’t change as the worth of the cryptocurrency jumped by 18.15%. Although the worth of different cryptocurrencies jumped too, not one of the prime ones outperformed TON.

A “TON” of supremacy

An evaluation of the market confirmed that solely Solana [SOL] closed in on TON’s efficiency with a ten.38% hike. Nevertheless, Toncoin’s worth was not alone in its hike on the charts.

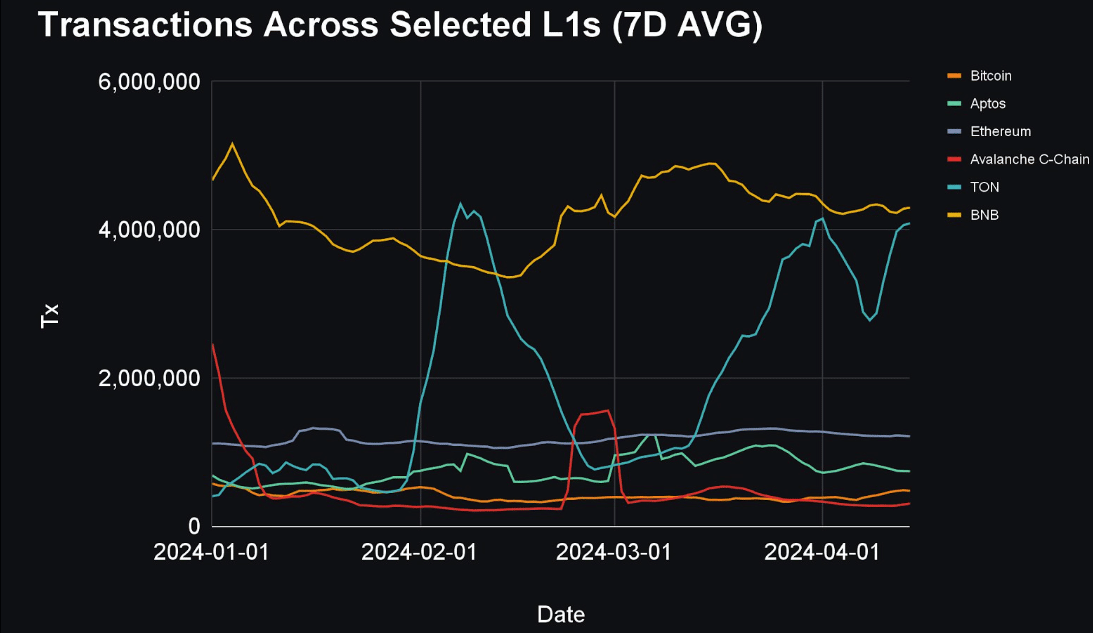

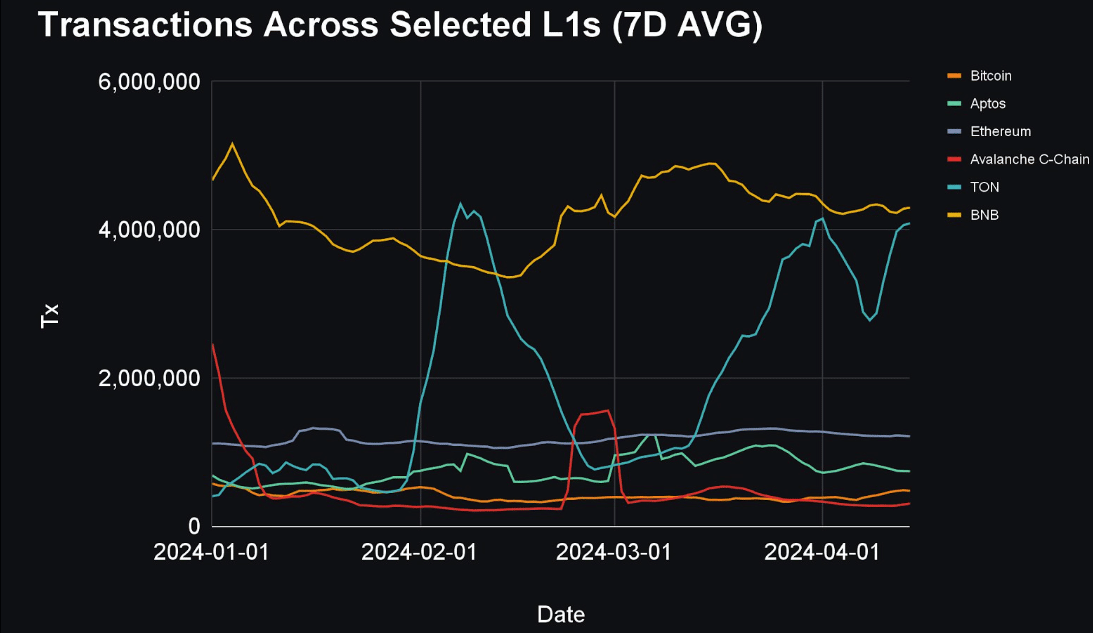

Based on our evaluation, a number of metrics on the blockchain have been surging over the previous month. For example, transaction progress on the community has risen by an incredible 100% since mid-March, in accordance with Artemis information.

Supply: Artemis

When transactions rise, it implies growing curiosity in a challenge. Primarily based on AMBCrypto’s analysis, it may be inferred that Toncoin is now competing with BNB Chain, by way of transactions per day.

With this information, one can affirm that TON has the potential to flip different Layer-1 initiatives. Other than the transaction hike, Toncoin additionally had the best liquid staking charge, which led the analysis platform to note,

“TON stakers have HIGHEST liquid staking charge: We have been wanting on the liquid staking charge of various chains, and TON Stakers is doing an unimaginable job of attracting liquid TON and is properly forward of established protocols.”

Will the challenge proceed to draw extra?

A excessive staking charge is proof that TON has enticed many buyers, with many displaying confidence in its worth motion. Nevertheless, staking won’t be as rewarding if the worth of the token collapses.

If TON loses its latest good points, stakers on the blockchain may need to deal with inflation. For now, nevertheless, the alternative is the case.

Confidence within the challenge was additionally reflected by the Complete Worth Locked (TVL). On the time of writing, TON’s TVL was $161.08 million. Whereas the worth for a similar fell barely within the final 24 hours, it did so on the again of a 262% 30-day enhance.

Supply: DeFiLlama

If demand for TON continues to rise, so will its TVL. Nevertheless, if market contributors take out liquidity from the protocol, the metric may fall.

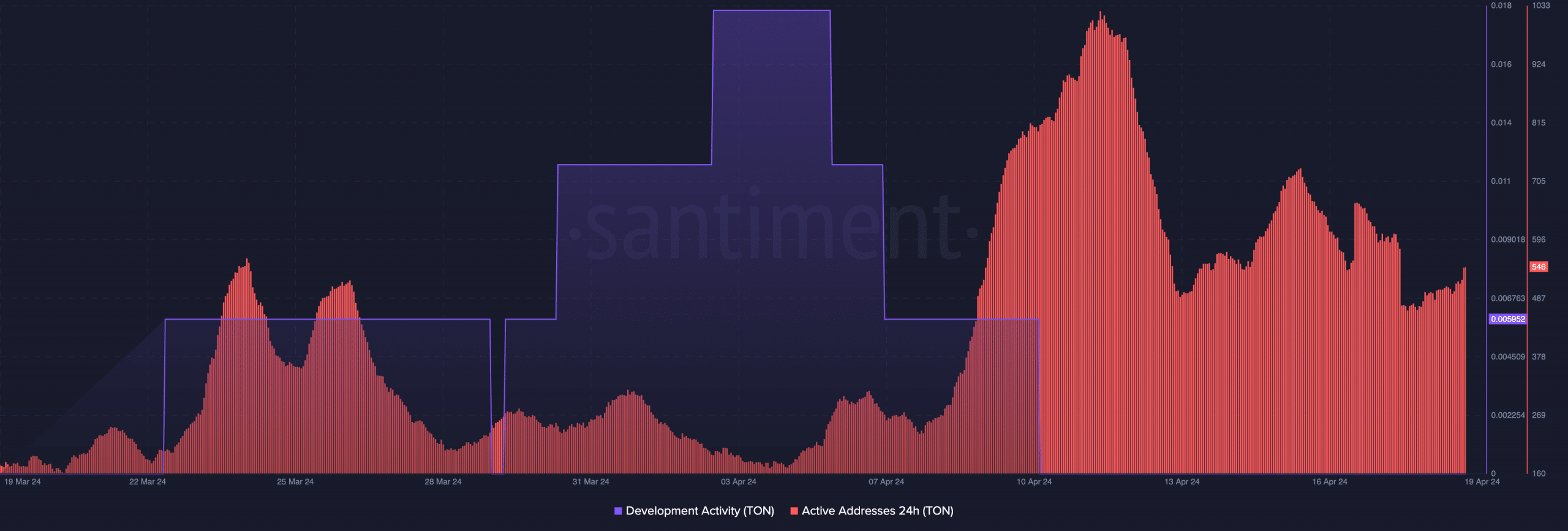

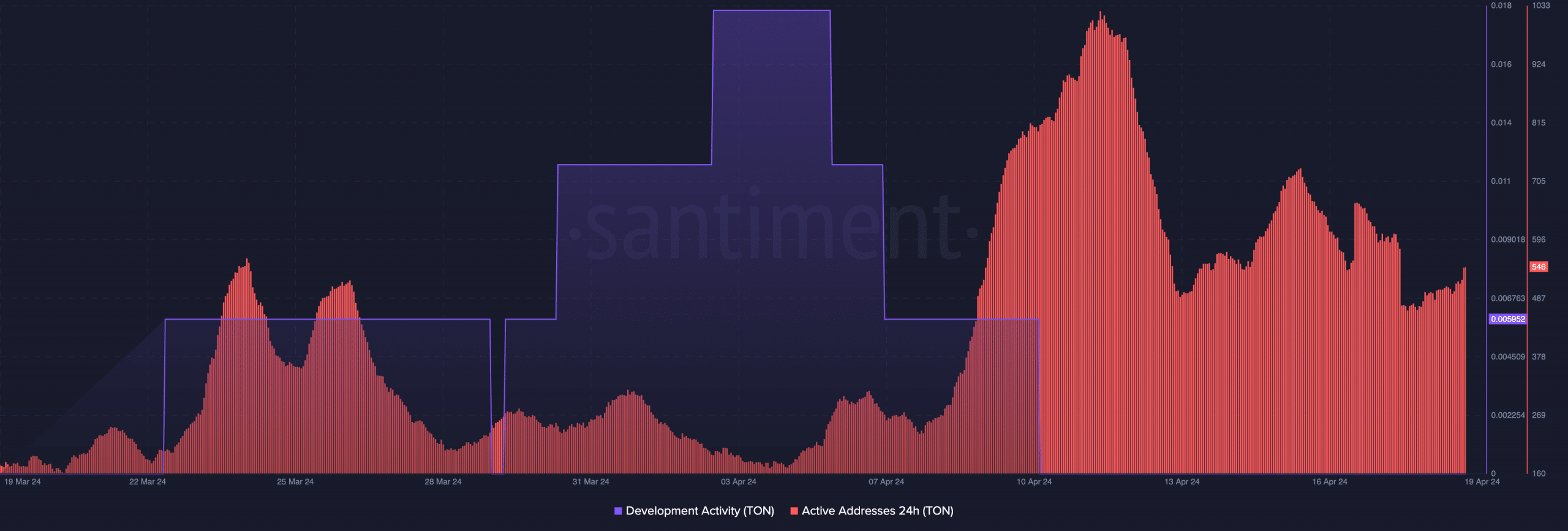

In the meantime, the challenge’s growth exercise dropped. Beforehand, the metric spiked after Toncoin confirmed partnerships with Telegram and HumanCode, an AI growth agency.

A fall in growth exercise signifies a sliding dedication to deploying new options on the blockchain. Whereas this could possibly be a bearish signal, rising lively addresses can invalidate this thesis.

Supply: Santiment

Is your portfolio inexperienced? Examine the TON Revenue Calculator

At press time, on-chain information revealed a rise on this metric, indicating higher consumer exercise. Ought to consumer exercise proceed to climb, TON’s worth may keep increased than $7.15.

Quite the opposite, if progress stalls, the token’s worth may head south.