David Ramos

Recap: Xiaomi’s Efficiency Since February 2023

We initiated a Purchase score on Xiaomi (OTCPK:XIACF) (OTCPK:XIACY) in February 2023. The inventory has elevated 28% since then and damaged out above its technical resistance stage. Xiaomi is scheduled to report its third-quarter earnings on November 20. We’ll evaluate Xiaomi’s latest progress for traders and what traders ought to anticipate from its third-quarter earnings report.

Searching for Alpha

Funding Thesis: Why We’re Bullish on Xiaomi

We have been bullish on the corporate as a result of we consider it’s cycle-resistant given its giant person base and numerous income streams.

Its outcomes have demonstrated that it was in a position to return to robust profitability progress amid a weak smartphone market via progress in its IoT and value-added providers segments.

The corporate was in a position to enhance gross margins throughout all enterprise segments and keep a clear stock place. This has put them in an advantaged place to pivot from protection to progress.

Xiaomi can be main in upgrading its IoT gadgets by incorporating AI assistants with giant language fashions. We predict Xiaomi is an early beneficiary in AI know-how as AI empowers its ecosystem.

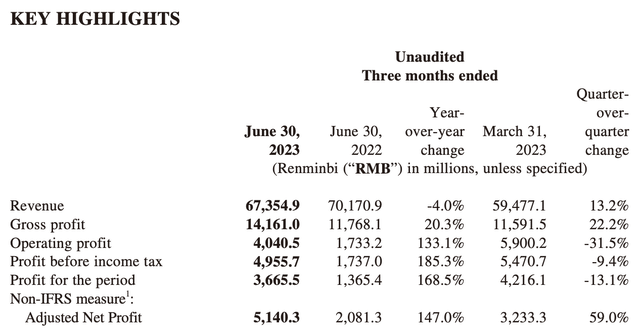

Monetary Assessment: Xiaomi’s Momentum

The corporate accelerated its top-line and bottom-line progress sequentially, excluding the fair-value adjustment in its most popular fairness investments. This demonstrates its progress momentum is constructing.

Xiaomi Xiaomi

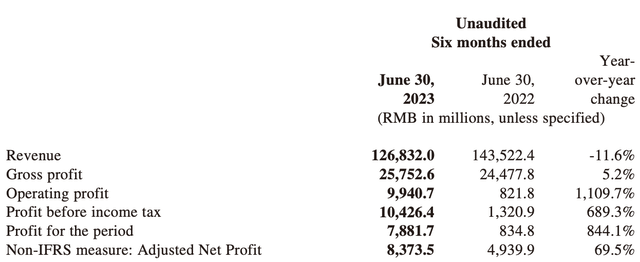

Market Share Chief

Xiaomi maintained its #3 rating within the world smartphone market share after Samsung and Apple. Contemplating Xiaomi does not have a presence within the US market, its place is definitely fairly robust. The corporate has been actively increasing product classes exterior of smartphones via its AIoT technique. Xiaomi has been profitable within the TV phase in China. We take into account TVs to be a mature however strategic marketplace for shopper electronics, as TV includes a big share of leisure time spent by shoppers. Xiaomi’s success in TVs units a powerful basis for the corporate to stay related and differentiate itself from different smartphone friends.

Xiaomi

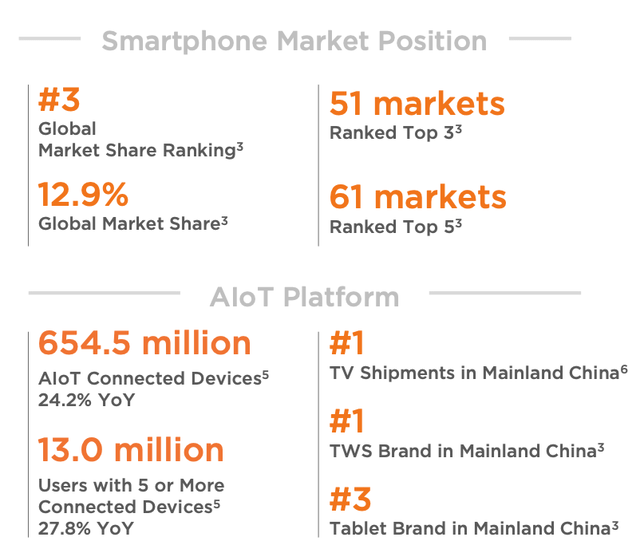

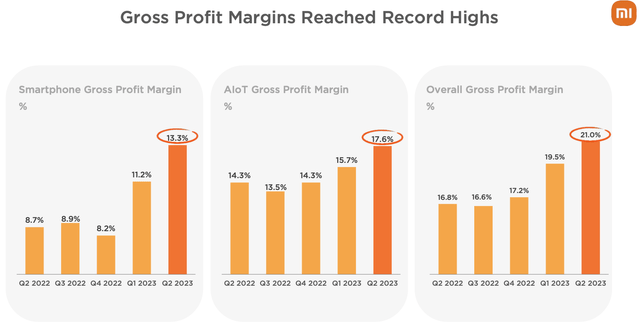

Gross Margin Growth

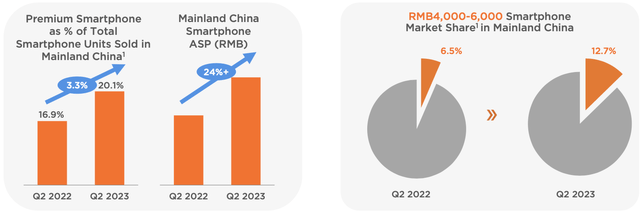

The corporate continued to develop gross margins throughout its three enterprise segments. Regardless of weak spot in abroad smartphone markets (primarily India) impacting its top-line progress, Xiaomi was in a position to enhance its gross margin by increasing its high-end market share in China.

Xiaomi Xiaomi

Its common promoting value (“ASP”) in China elevated by 24% and its market share of smartphones within the RMB4,000-RMB6,000 value phase in China elevated to 12.7% from 6.2% final 12 months. This implies its model picture is enhancing amongst Chinese language shoppers. The success of its high-end technique may also profit the corporate in increasing services going ahead.

Xiaomi

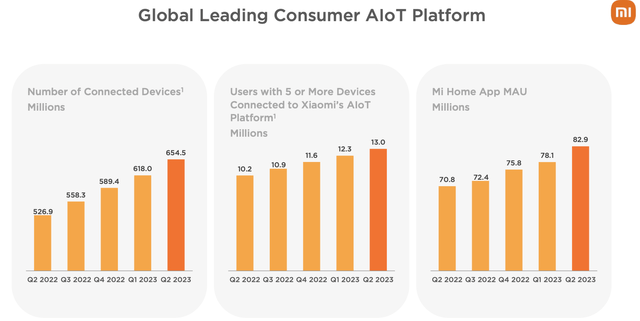

Consumer Base Progress

Regardless of its smartphone unit gross sales being dragged down by the weak world market, Xiaomi continued to develop its person base, as its month-to-month lively customers (“MAU”) of MIUI reached a file excessive of 606 million, a ten.8% enhance year-over-year. This implies that regardless of Xiaomi going through headwinds within the smartphone market over the previous a number of quarters, its ecosystem has continued to develop. Subsequently, web providers income ought to proceed to develop and change into a steady income stream to offset volatility in product gross sales that outcome from fluctuating shopper cycles.

Xiaomi

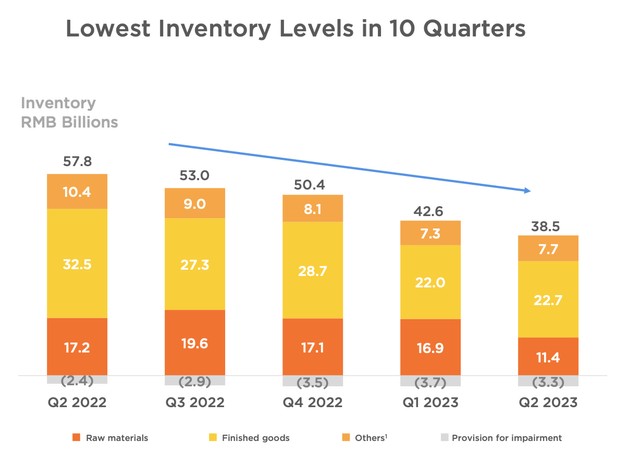

Stock Administration

As well as, Xiaomi decreased its stock by 28% in comparison with final 12 months. That is sooner than its income progress fee. This implied that the enterprise is in a clear stock place and ready to transition from protection to progress mode.

Xiaomi

AIoT Technique: Enhancing Buyer Expertise

The corporate was optimistic about its AIoT technique as this could enhance the general expertise for its clients. Initially, Xiaomi executed its IoT ecosystem via partnerships with third events to develop shopper merchandise like fridges, TVs, and air conditioners. Xiaomi centered on enhancing capabilities and including new capabilities to those merchandise to distinguish from friends. For instance, the corporate helped shoppers have a custom-made expertise by storing and consolidating shopper information within the cloud throughout gadgets. The emergence of generative AI has helped Xiaomi in smoothing the patron expertise throughout gadgets and rising performance.

Moreover, Xiaomi introduced the launch of its Hyperconnect platform to assist builders create seamless experiences throughout Xiaomi gadgets. For instance, by enabling cameras to acknowledge objects in video, customers can discover their pets at residence or program temperature changes based mostly on the variety of folks occupying an area. These illustrations demonstrated how including AI know-how to IoT gadgets improves the product’s performance. This enhances Xiaomi’s AI ecosystem’s general person expertise.

Xiaomi Xiaomi

One other example is that Xiaomi’s AI assistant audio system can detect music and regulate flash lighting to create an immersive expertise for patrons.

Xiaomi

Xiaomi was already famend for its giant IoT shopper ecosystem. The corporate was additionally early to market in launching its AI-assistant speaker, forward of OpenAI, Google, Amazon, or Apple. This gives Xiaomi with an awesome head begin and first-mover benefit in monetizing and constructing a big ecosystem powered by AI know-how.

Valuation

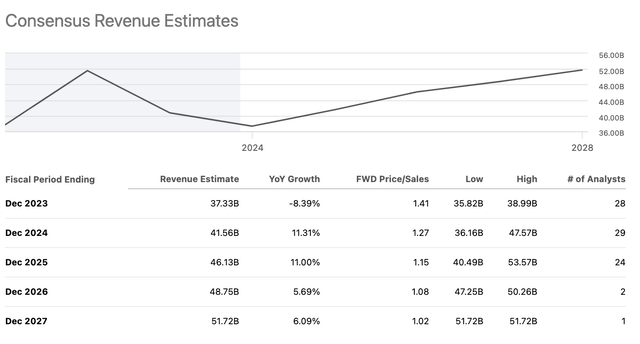

The corporate’s inventory at the moment trades at a P/S ratio of 1.45x, in keeping with its historic ranges.

YChart

From a forward-looking perspective, the inventory doesn’t appear costly contemplating the anticipated common income progress of 11% over the following two years. Its P/S ratio based mostly on 2024 and 2025 estimates are 1.27x and 1.15x respectively. Subsequently, regardless of the inventory rising 28% since our preliminary protection, we expect there may be nonetheless upside potential.

Searching for Alpha

Dangers

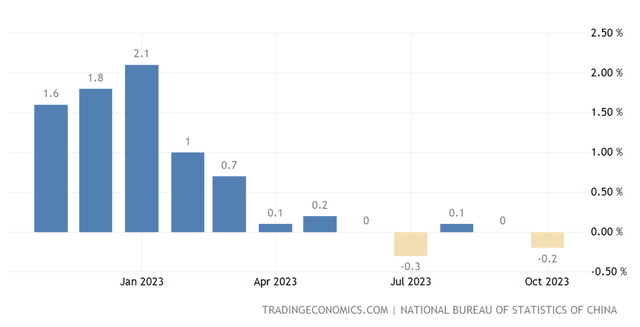

There are some big-picture dangers that would affect Xiaomi’s inventory value, just like the slowing financial system in China and globally. The most recent inflation information out of China does appear regarding – shopper costs there really dropped 0.2% in October in comparison with a 12 months in the past. That would sign some weak spot forward for China’s financial system.

Buying and selling Economics

On the similar time, we observed one thing fascinating up to now few quarters – Xiaomi’s personal financials have not moved in lockstep with the broader Chinese language financial system. Regardless of the weak atmosphere, they’ve managed to maintain income and earnings steady. We predict it is as a result of their enterprise is fairly diversified past simply China, plus they have been increasing extra internationally. So that may assist insulate them from any home slowdown. We’ll should maintain watching the way it performs out, however to this point they appear to be charting their very own course.

IoT may very well be a brand new progress space for Xiaomi in China as they begin constructing extra AI into related gadgets. We predict these sensible residence and wearable merchandise have the potential to essentially take off over the following few years.

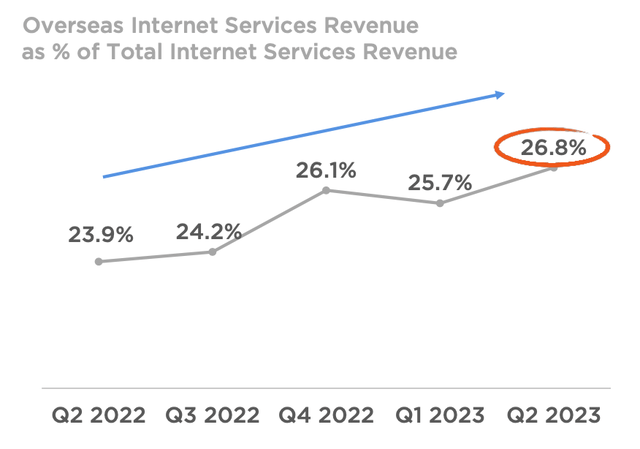

Plus, their web providers enterprise exterior of China appears to be gaining momentum and changing into a bigger portion of whole web income. That abroad piece gives some good stability to stability out the ups and downs of {hardware} gross sales.

So between the IoT alternative and the regular progress of worldwide web providers, we consider Xiaomi has some promising new drivers that ought to assist proceed rising the enterprise.

Xiaomi

Conclusion

We consider Xiaomi has a powerful model and upside potential to develop its ecosystem. The corporate has maintained a clear stock place and continued to develop its share within the high-end smartphone market whereas main within the TV phase. Regardless of ongoing uncertainties across the world and Chinese language economies, we expect the corporate can proceed to develop with the assist of its robust person base. We keep our Purchase score on Xiaomi.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.