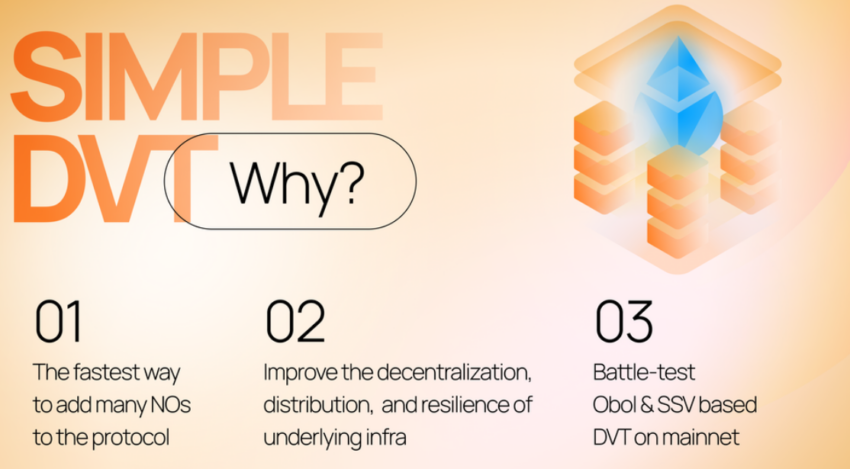

The decentralized finance (DeFi) panorama has been buzzing with exercise over the previous week. Main the way in which, Lido Finance introduced the launch of its Easy Distributed Validator Expertise (DVT) on the Ethereum mainnet.

This innovation permits particular person and group stakeholders to make use of validators, democratizing participation and enhancing the safety and decentralization of the node operator ecosystem.

Aave continues to make strides in DeFi with simple DVT implementation

In an effort to streamline staking, the Aave group launched the FastPass proposal, with the intention of permitting a portion of Security Module stakers to skip the standard 20-day cooling-off interval for a charge. If accepted, this proposal may considerably enhance liquidity and suppleness for Aave stakers.

Aave marks one other development in decentralized finance (DeFi) with the rollout of its Easy Distributed Validator Expertise (DVT) module. Following a decisive Lido DAO vote six months in the past, the protocol has laid the muse for a diversified node operator set, integrating group and solo stakers into the Ethereum stake ecosystem.

Easy distributed validator expertise: why? Supply: Lido

The current activation of the Easy DVT module implies that new ETH staked at Lido will routinely move to this method. This mechanism stays in impact till it reaches full capability, at which level new deployments return to the Curated Module. This improvement displays Aave’s dedication to decentralization and innovation.

The third Obol testnet is already exceeding minimal efficiency benchmarks and heralding the onboarding of the primary cohort of 12 clusters. The upcoming completion of the third SSV Community testnet additional underscores the sturdy efficiency metrics important to Aave’s pioneering efforts in DeFi.

With expectations so as to add 250 new Node Operators, Aave reveals that DVT is a quick observe to strengthening operational robustness and decentralization, a vital step within the evolution of the protocol inside DeFi.

Different notable occasions from the previous week

Amid these updates, the Angle Protocol USDA stablecoin went stay for public use. The USDA goals to offer a ten% return backed by actual property and contains mechanisms to counter de-pegging situations along with liquidity akin to the USDC.

Nonetheless, not all developments had been optimistic. Hedgey Finance fell sufferer to a big safety breach, with exploits on Ethereum and Arbitrum blockchains leading to a mixed lack of $44.7 million, highlighting the ever-present want for sturdy safety measures on DeFi platforms.

Ether.fi has introduced plans to introduce wrapped Ethereum (weETH) into a number of Layer 2 options, increasing its attain and value. Moreover, within the wake of Ether.fi’s replace this week, there was a plethora of integrations, partnerships, and proposed modifications, all pointing to an interconnected and quickly evolving DeFi ecosystem.

In gentle of those speedy developments, business observers are intently monitoring the potential influence of those improvements on the DeFi sector. With important quantities of cash flowing into varied tasks, from infrastructure to gaming and AI, the implications for funding methods and market dynamics are profound.

The group can be eagerly anticipating upcoming releases and proposals comparable to Worldcoin’s World Chain on Optimism’s stack and Myso Finance’s Preliminary Open Provide. These occasions are anticipated to additional gasoline the momentum of the DeFi house and convey new alternatives and challenges.