Injective (INJ), the native token of the decentralized trade protocol Injective Protocol, stands poised for a pivotal second. On January twenty first, a remaining tranche of three.66 million INJ tokens might be unlocked, bringing the whole circulating provide to a definitive 100 million.

Injective Token Unlock: Market Dynamics Shift

This marks the fruits of a phased launch schedule outlined in Injective’s token distribution plan, and can see the remaining 16% of token provide flood the market.

Analysts stay divided on the potential influence of this occasion. Some anticipate elevated promoting stress because of the sudden inflow of tokens, doubtlessly resulting in a worth dip. Others view the unlock as a constructive catalyst for liquidity, making INJ simpler to commerce and doubtlessly attracting new buyers.

Closing Cliff Unlocks Alert

Mark your calendars for January 21, 2024$INJ might be totally unlocked (100%)

Prepare for the large cliff unlocks.

3.66 m tokens

132.4 m {dollars}

4.35% of cir. provide

Allocations:

– Advisors: $12.04 m

– Workforce: $120.37 m$INJ was… pic.twitter.com/EYCyv4hsuC— Token Unlocks (@Token_Unlocks) January 7, 2024

INJ market cap at present at $3.19 billion. Chart: TradingView.com

Whatever the short-term worth motion, the complete token unlock undeniably represents a turning level for Injective, marking the whole transition from preliminary distribution to sustained market dynamics.

It will likely be fascinating to look at how the group and market reply to this milestone occasion, and whether or not it paves the best way for additional development and adoption of the Injective Protocol.

$INJ Bullish Flag Formation..!!

Appears lie Prepared for One other Bullish Rally.#Crypto #InjectiveNetwork #INJ pic.twitter.com/OcPsNJ7laX

— Captain Faibik (@CryptoFaibik) January 6, 2024

Some market members, such as analyst Captain Faibik, imagine that Injective could also be prepared for one more rally in anticipation of the upcoming occasion. In keeping with Faibik, INJ has established a bullish flag and may see an increase past $60.

Faibik examines the chart and finds two rallies which can be joined by a short interval of consolidation. These may doubtlessly result in a unbroken upswing with greater highs and lowers.

Nonetheless, provided that the market crashed on January 3 and that INJ price initially dropped to $33.55, promoting stress may very well be imminent. The 4-hour chart exhibits rising volatility, and the Bollinger Bands level to overbought circumstances following INJ’s prior surge to $40.28.

INJ Value Evaluation

Supply: TradingView

The value of INJ has been trending downwards over the previous 24 hours. It’s at present buying and selling at $37.412, down from a excessive of $37.875 earlier within the day.

- The Bollinger Bands (BB) are additionally trending downwards. This means that volatility is reducing, as the value is staying nearer to the transferring common.

- The Chaikin Cash Movement (CMF) is damaging. This means that bears are at present answerable for the market.

- The quantity is comparatively low. This means that the current worth decline just isn’t as a result of a considerable amount of promoting stress.

Total, the chart means that INJ is in a bearish pattern. Nonetheless, the low quantity means that this pattern is probably not sustained. You will need to be aware that that is only a snapshot of the market and that circumstances can change rapidly.

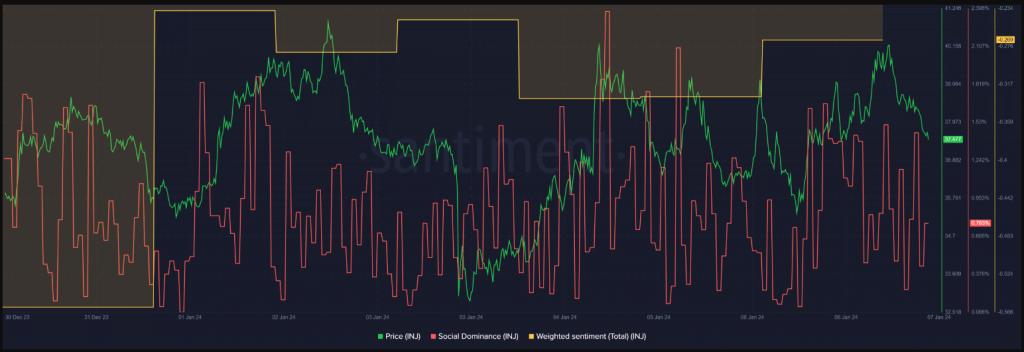

Supply: Santiment

The continuing unlocking of the token holds the promise of bolstering INJ’s social metrics, not directly contributing to a constructive affect on its worth.

That is notably essential as elevated group engagement usually aligns with greater social metrics, reinforcing the token’s recognition. The sustained excessive Social Dominance of INJ signifies sturdy group assist, an important consider navigating the unpredictable cryptocurrency market.

Concurrently, the development in INJ’s Weighted Sentiment signifies a prevailing bullish sentiment throughout the market. This constructive outlook amongst buyers units the stage for heightened buying and selling exercise, doubtlessly triggering an uptrend within the token’s valuation.

Each Social Dominance and Weighted Sentiment function useful indicators, offering insights into the token’s present state and the prevailing market sentiment.

Featured picture from Shutterstock

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site completely at your personal danger.