The convergence of decentralized funds and synthetic intelligence has created a brand new story that is named Defai in Web3. This idea is ready to bridge the Defi -access hole through the use of AI to scale back entry thresholds.

Business leaders count on Defai to be a transcendental success and encourage builders to imagine his intrinsic traits or run the chance of being left behind. Beincrypto spoke with specialists from Mira, Rogerthat, Woo X and Offchain Labs to search out out extra concerning the use circumstances and potential for future innovation.

The Defi -Problem

When Web3 skilled its very first decentralized finance (Defi) tree in 2020, it represented a reworking motion away from conventional monetary techniques.

The revolution, led by Ethereum, created direct, peer-to-peer transactions and funding choices with out intermediaries. The strategy eradicated a somewhat elementary dependence on central authorities.

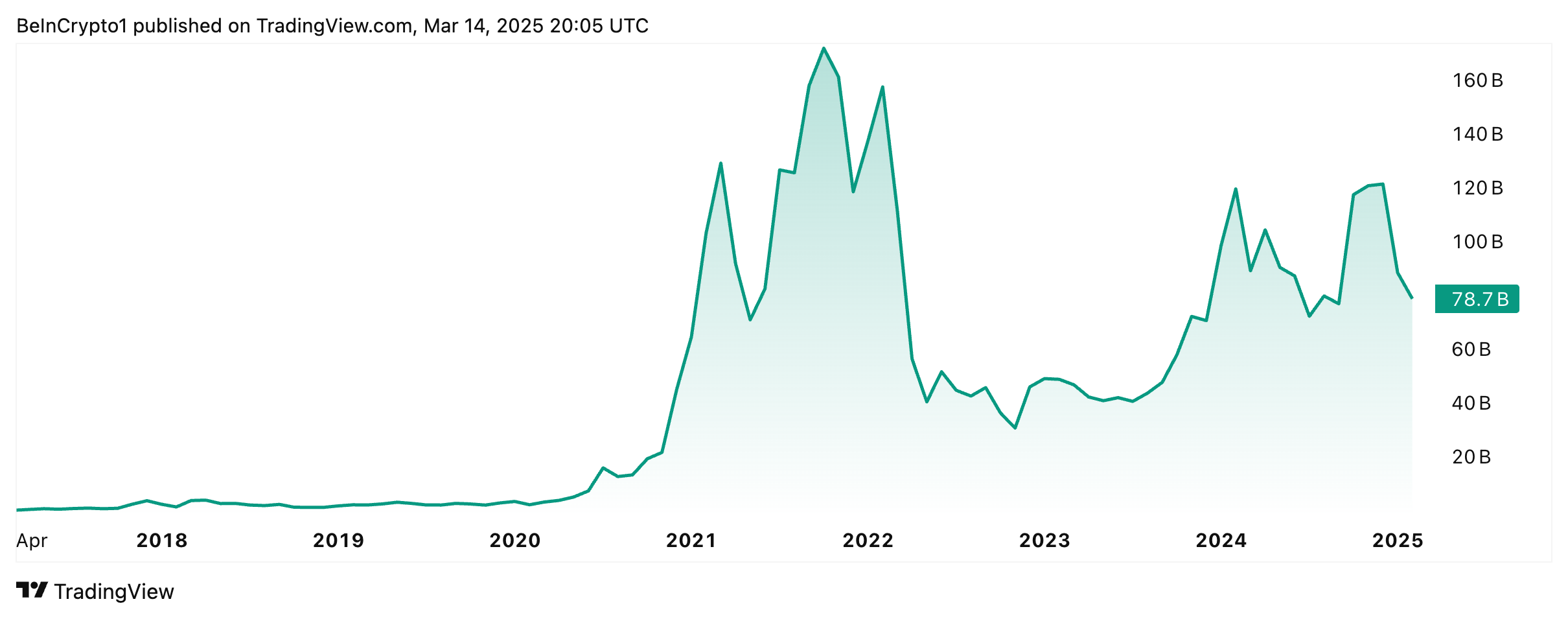

By October 2021, the Defi market had reached its highest market capitalization, with a price of just about $ 172 billion. As we speak that quantity relies $ 78.7 billion.

The evolution of the market capitalization of Defi. Supply: TradingView.

Defi platforms, nonetheless, stay complicated right now. By wading these techniques requires appreciable technical data, together with danger administration, knowledge interpretation and steady market consciousness, which could be daunting.

“Conventional Defi platforms typically overwhelm customers with complicated technical particulars and non-intuitive interfaces,” Jack Tan, co-founder of WOO X, advised Beincrypto.

The data wanted to efficiently use and implement these functions is adequate to make sure new customers from leaping from web2 to web3.

The Daybreak of Defai

The promised advantages of Defi are sometimes troublesome to capitalize due to the necessities associated to interplay with a repeatedly lively market. Consequently, builders rapidly sought strategies to make use of the chances of Defi with out overwhelming customers with its complexity.

Quickly synthetic intelligence (AI) was the duty. The potential to simplify resolution -making and to streamline processes in numerous industries, after all led to the delivery of Defai.

“Think about that you just solely say:” Hey Anon, purchase Sol if it drops 20%, “and Defai treats the remainder. The purpose is that the normal friction crypto often brings to the desk. By simplifying the method and making every thing extra automated, Defai Defi opens for a a lot wider viewers, even those that aren’t conversant in all technical issues, ”defined Dominic Cypher, co-founder of Rogerthat.

As a result of steady innovation refines the capacities of Defai, the challenges associated to conventional Defi will grow to be outdated.

Defai as Web3 Adoption Accelerator

For Karan Sirdesai, CEO and co-founder of Mira, Defai will pace up the pace of the adoption of crypto and blockchain.

“Defai will utterly reverse the crypto adoption story. We’re at present asking customers to grasp blockchain, to study Defi ideas and handle complicated dangers. Defai modifications this essentially. As an alternative of customers who adapt to crypto, now we have clever techniques that alter to customers crypto. An proprietor of a small firm could not perceive bridges or liquidity swimming pools of the chains to achieve entry to optimum yields. Gerified AI brokers can deal with this complexity and on the similar time provide clear, confirmed details about their selections, “he stated.

In keeping with Offchain Labs Chief Technique Officer AJ Warner, Defai can dramatically improve the exercise on the chain earlier than the Defi person base is expanded.

“Defai has the chance to extend exercise on the chain with an order of dimension earlier than it has a single person on boards. If each person within the chain had a cop to reinstall his LP positions, to watch the well being of the mortgage or act on their behalf, the overall transit on the chain on the chain could be exponentially increased, “he stated.

In the end, Defai Know-how will exchange the chances of even probably the most skilled merchants.

A monetary advisor on an auto pilot

Defai goes additional than simplifying interactions. It really works autonomously and likewise creates predictive analyzes and managing actual -time dangers on the similar time.

“As an alternative of demanding customers to regulate their methods manually, Defai AI makes use of to robotically assign property, to reinstall portfolios and optimize the yield, whereas repeatedly monitoring the info on the chains for market shifts,” Tan Beincrypt stated.

In the end individuals would not have to overlook a full evening’s sleep, figuring out that their agent monetary adviser can handle their portfolio at any time with out supervision.

“Quickly Defai will handle customers 24/7, the place AI analyzes market circumstances in actual time and robotically alter positions. It would optimize the yield methods, perform transactions and restrict dangers with out human intervention, in order that customers can profit from market alternatives across the clock, “Tan added.

For Sirdesai this may solely happen as soon as a trustless verification system has been established.

“Customers shouldn’t solely see what AI brokers do, however why they make particular selections. The interfaces that can win are those that make verified autonomous operations clear and comprehensible. When customers can confidently delegate complicated Defi operations to AI brokers whereas retaining clear supervision, we are going to see the common adoption take off, “he stated.

Given the present and future prospects of Defai, specialists predict that the story will obtain exponential progress.

Market progress and institutional significance

Though Defai is lower than a 12 months outdated, market leaders have warned that the rising sector will redefine the cryptocurrency market in 2025 after which. Main platforms comparable to Coingecko and Coinmarketcap have been devising total sections to comply with the expansion.

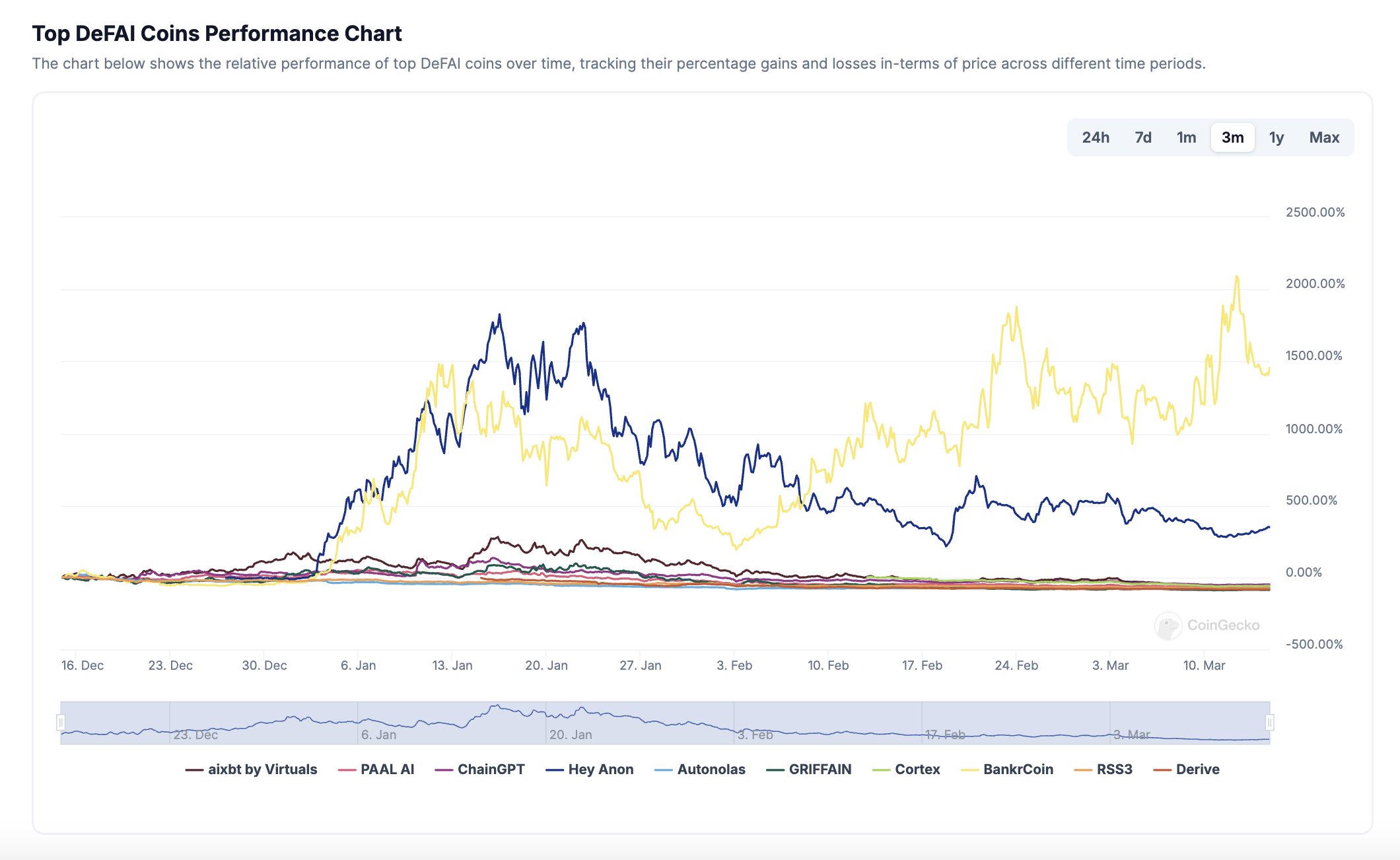

The efficiency and progress of main Defai initiatives over time. Supply: Coingecko.

In keeping with Coingecko -data, Defai cash have already collected greater than $ 853 million in market capitalization. The highest initiatives that lead the graphs are Aixbt by virtuals, pole AI, Chaingpt, Hey Anon, Autonolas and Griffain.

“See how briskly AI rises now – solely Chatgpt grows sooner than Fb, Tiktok and virtually every thing else. The identical will occur with Defai. Whereas we automate Defi with AI, make it smarter and enhance the person expertise, we see an enormous improve in adoption and market capitalization, “Cypher advised Beincrypto.

Within the meantime, the success of the sector has attracted the eye of enormous institutional gamers in conventional funds.

“Specialists predict exponential progress out there capitalization of Defai and numerous elements assist these prospects. Firstly, Defai builds on the rising demand for AI-driven automation in Defi, making decentralized financing extra accessible to a wider viewers. Institutional gamers comparable to BlackRock and Goldman Sachs are already exploring Defi, which strengthens belief in the long run within the sector, “Tan stated.

Within the meantime, conventional Defi platforms should start thinking about how these functionalities could be built-in into their current initiatives to stay aggressive.

AI -Integration approaches

In keeping with Sirdesai, platforms use contrasting AI integration pavings. Some develop their very own AI options, whereas others deal with constructing accessible APIs to make interplay with AI brokers of third events doable.

“Probably the most progressive platforms notice that verified AI integration just isn’t non-obligatory, it’s existential. When customers have entry to superior commerce methods or can ship optimization by verified AI interfaces, they don’t return to handbook administration of positions over a number of protocols. However what actually tells is how integration approaches. Some platforms rush to launch Primary AI capabilities, whereas others construct in depth frameworks for agent integration, “he stated.

Sirdesai famous that probably the most obligatory innovation takes place on newer, AI-Native platforms as a substitute of established protocols.

“They construct the belief that the majority interactions will in the end be the agent, the place individuals set parameters at a excessive stage as a substitute of finishing up particular person transactions. This architectural shift will pressure conventional platforms to regulate or run old-fashioned outdated as capital flows to extra environment friendly, ai-compatible techniques, “he added.

All of the whereas the shift should be accompanied by person -friendly interfaces.

A return to the fundamentals: person expertise

In keeping with Cypher, product growth should be carried out whereas the prevailing data gaps in web3 are thought-about.

“Making it straightforward. Defi has all the time been intimidating for newcomers, so making a platform that’s intuitive and straightforward to navigate is the important thing. The purpose ought to be to make complicated duties, comparable to commerce, yield of agriculture or liquidity that feels straightforward, virtually like the usage of one other app, “he stated.

Warner expressed an identical opinion and cooked a very powerful issues for designing user-friendly Defai interfaces in 4 easy questions:

“Is that this one thing I’d use? May my mom use this? How does this make the expertise of a person higher or simpler? Is that this a method that may work for an extended interval? “He stated.

Though the potential of Defai to democratize decentralized financing, it’s clear how platforms will navigate by the combination of AI and the extent of belief that has been established by verifiable actions, the last word course of will decide it.