stockstudioX

Industrial Logistics Properties Belief (NASDAQ:ILPT), included in 2017 and headquartered in Newton, MA, owns and leases industrial and logistics properties throughout 39 states.

The corporate’s portfolio is likely one of the most tasty ones I’ve noticed within the industrial REIT house and the present low cost to NAV may be very giant. Nonetheless, its excessive leverage, drying liquidity, reducing money circulation, and really low dividend make an funding on this enterprise extremely speculative for my part.

Portfolio

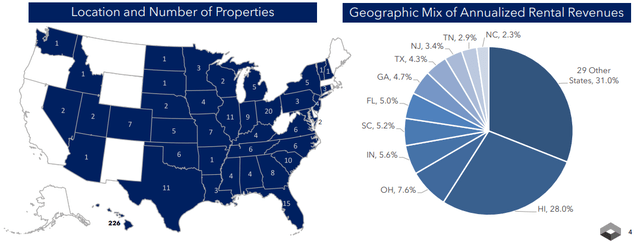

As of September 30, 2023, ILPT’s portfolio consisted of 413 consolidated properties aggregating ~60 million rentable sqft situated in 38 states and the island of Oahu, Hawaii. Beneath is the breakdown of the portfolio based mostly on annualized rental income:

Investor Presentation

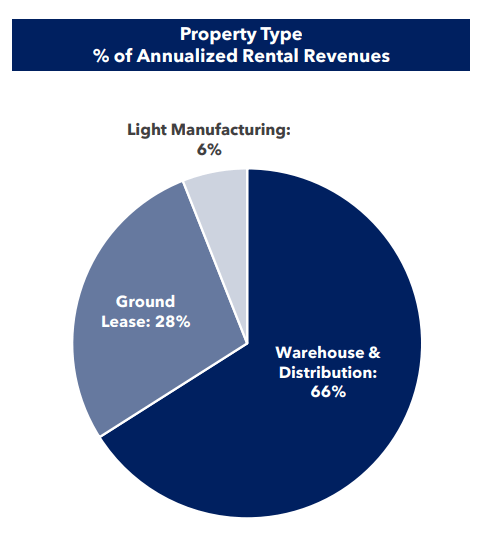

For the REIT’s present market cap, the portfolio is very large and impressively well-diversified. It is also additional diversified based mostly on property kind with extra publicity to floor leases and lightweight manufacturing:

Investor Presentation

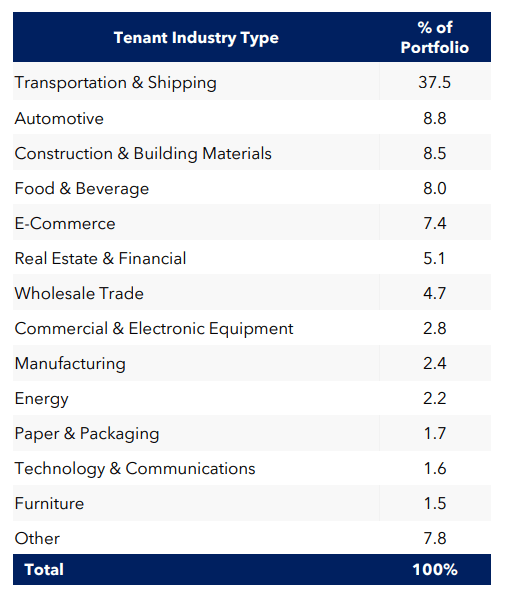

And to high all of it off, Industrial Logistics serves firms belonging to industries aside from transportation/delivery as is common for industrial REITs. The breakdown seems to be fairly engaging right here too:

Investor Presentation

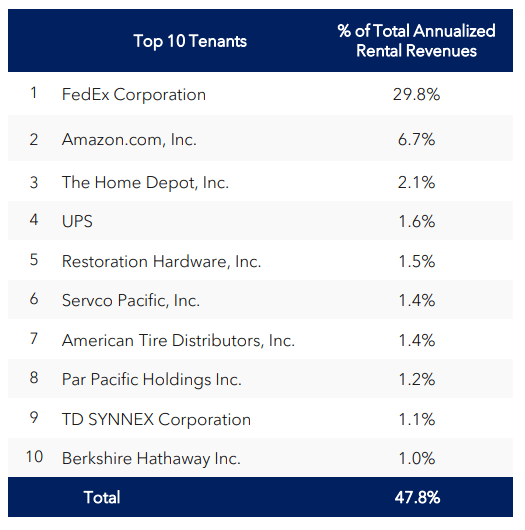

The one space it falls quick is its vital publicity to FedEx:

Investor Presentation

Efficiency

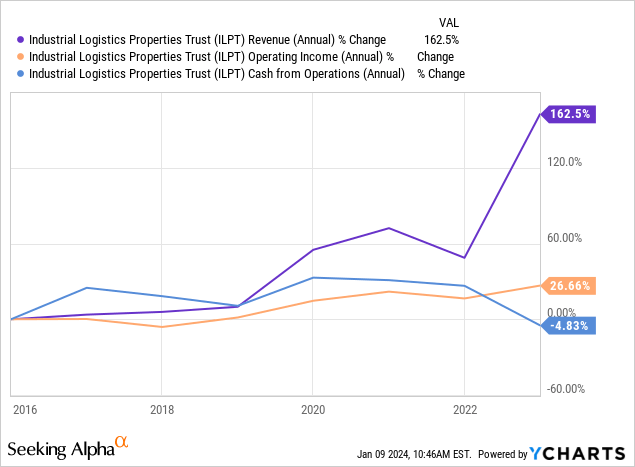

Relating to the REIT’s long-term historic working efficiency, the image is combined. Although a 162.5% income enhance is respectable in 6 years, working earnings and money circulation efficiency have been underwhelming:

Arguably, it is a pretty younger REIT and it would deserve some slack as enlargement might be very costly within the early years. Nonetheless, newer outcomes give the same image; although rental income and NOI have been increasing, FFO has taken a deep dive.

Beneath, I current the distinction between the typical annual figures from the final 3 fiscal years and the most recent quarterly figures annualized:

| Rental Income Progress | 53.22% |

| NOI Progress | 51.35% |

| AFFO Progress | -70.26% |

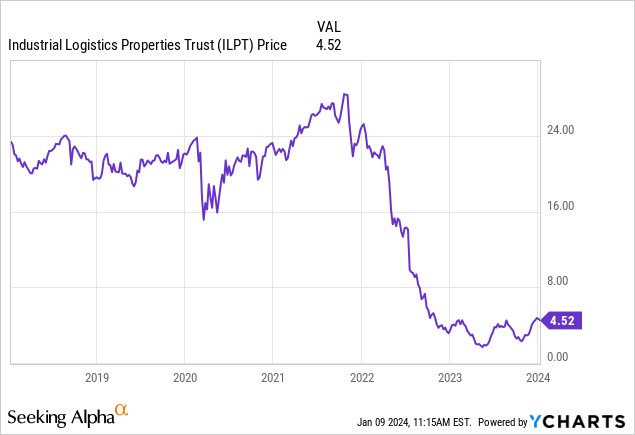

Not surprisingly, this problem is nicely mirrored within the value efficiency:

That is a really giant dip to easily attribute it to rising rates of interest. Nonetheless, the current change within the dividend coverage was doubtless the gasoline of such a market response as we’ll see shortly.

Leverage

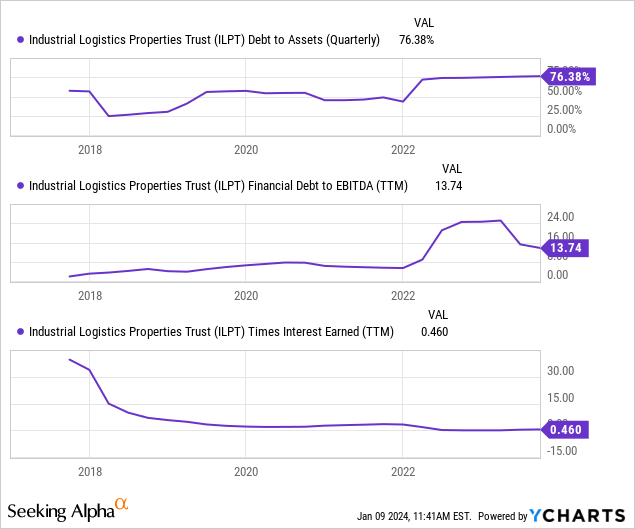

One other downside with this REIT is the very excessive leverage it makes use of. With a debt-to-assets ratio of 76.38% and a debt/EBITDA ratio of 13.74x, the heavy reliance on debt and the low liquidity are evident.

Curiosity protection just isn’t precisely depicted above due to the inclusion of non-cash bills earlier than protection is calculated, however the ever-decreasing ratio is helpful to assist us perceive how liquidity has been drying up since incorporation. Moreover, the curiosity protection earlier than depreciation and amortization is 1.08x; nonetheless dangerously low.

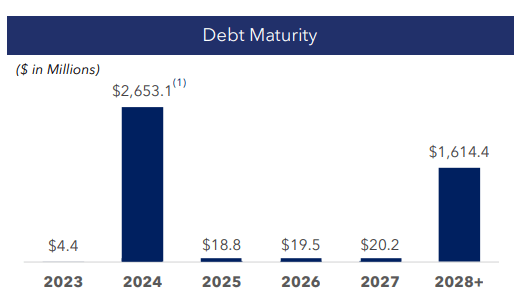

On the brilliant aspect, its mortgages carry a weighted common rate of interest of 5.5% which is low contemplating the REIT’s substantial publicity to floating-rate debt and the present rate of interest surroundings. Furthermore, no vital maturities are approaching anytime quickly. Assuming the REIT workout routines its three one-year extension choices concerning the principal funds coming due in 2024 (which may be very doubtless), the following particular vital maturity could be pushed to 2027:

Investor Presentation

Dividend & Valuation

In July 2022, ILPT introduced a dividend lower from $0.33/share to $0.01/share per quarter; a distribution that leads to a ahead yield of 0.88%. Though the corporate was anticipating that it will be capable to enhance it again to or near the earlier distribution in 2024, that is extremely unlikely as its leverage profile hasn’t improved since, which was what the administration claimed to be what they’d reasonably concentrate on.

Loads has already been stated concerning the choice to chop the dividend to almost nothing and what led to it. The one factor I wish to add is that though AFFO has shrunk rather a lot these days, the payout ratio is 8.29% on the subject of the present dividend. True, something near $0.33 per share would shortly drive the REIT to insolvency. However there may be loads of room for a extra respectable distribution, which ILPT refuses to make use of.

Now, largely due to this choice for my part, the shares are buying and selling at an 8.08% implied cap charge, a really uncommon stage for such a various portfolio of commercial properties. Take into account that the median implied cap rate for industrial REITs was round 5% not too long ago and charges for such belongings are forecast to common about 5% this 12 months. So based mostly on such a charge, the inventory is buying and selling at an 89.71% low cost to NAV ($44 per share) proper now.

Regardless, ~$28 per share is the very best the inventory value has reached and there aren’t any drivers in place for a good valuation so far as I can see. I consider the market has misplaced religion on this enterprise and I discover this sentiment justified till I see vital enchancment with ILPT.

Dangers

Apparently, an important danger is expounded to that market sentiment. The present value could also be traditionally very low, however I’ve no purpose to suppose that the “storm earlier than the calm” is close to its finish.

One other danger has to do with the REIT’s largest tenant which is accountable for one-third of its income. To be honest, FedEx is an enormous tenant and is unlikely to run into monetary bother. An important danger right here lies within the state of affairs it chooses to cease doing enterprise with ILPT. Troublesome, however I nonetheless want to notice this danger.

Lastly, we should be cautious concerning valuation. Proper now, ILPT is probably not a distressed vendor, however that may change if it turns into bancrupt in a high-interest surroundings. In such a case, our 5% cap charge assumption can show very optimistic at greatest and fully out of contact with actuality at worst.

Verdict

Subsequently, I assign a maintain score on ILPT for now and urge traders to look elsewhere for worth alternatives. No NAV low cost is definitely worth the danger that comes with investing in a extremely leveraged REIT that not too long ago decreased its dividend by 98% and has skilled a protracted money circulation downtrend.

In case you do not thoughts the low dividend yield, you is likely to be excited about studying my current evaluation of Plymouth Industrial (PLYM) which is much less dangerous and trades at an honest low cost to NAV.

What’s your take? Do you personal ILPT or intend to? Why or why not? Go away a remark beneath and I will get again to you quickly. Thanks for studying!