sommart

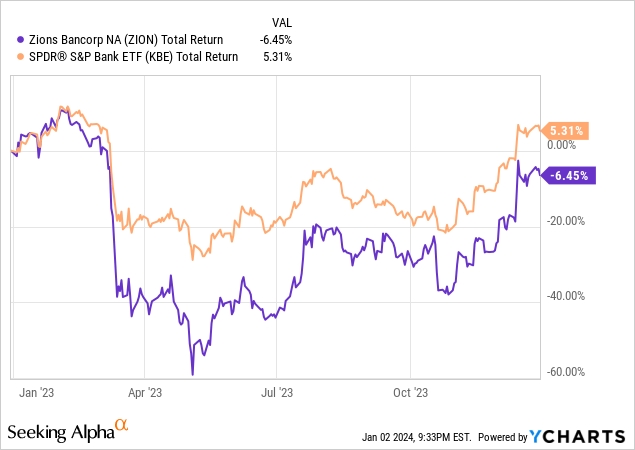

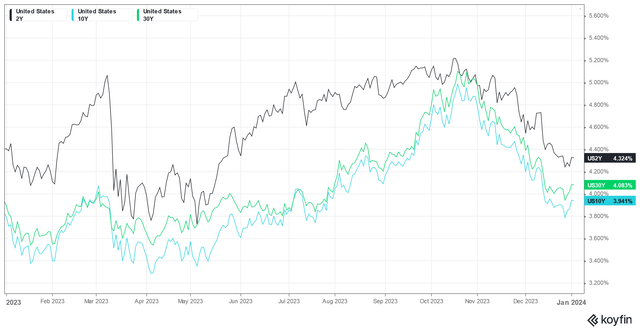

Zions Bancorporation (NASDAQ:ZION) endured a wild journey in 2023 together with many different small regional banks because of the banking disaster in March 2023 led by the collapse of Silicon Valley Financial institution. The principle offender was a sudden surge in long-term US Treasury yields which triggered the banks’ lengthy length belongings to devalue significantly, triggering withdrawals en masse. Nevertheless, because the long-term charges peaked in October 2023 at about ~5% for the 10-year which has come down considerably to only below 4%, financial institution shares discovered reprieve and rose strongly in 4Q.

Koyfin

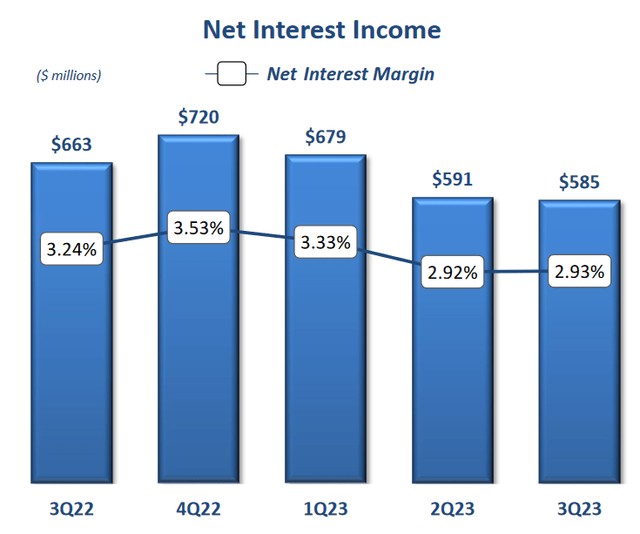

3Q earnings missed however the market may even see softening charges as signal

Zions registered a sequential decline in 3Q23 web curiosity earnings of $585M from $591M in 2Q23. Internet curiosity margin of two.93% vs 2.92% from the earlier quarter might be thought to be flattish whereas asset repricing offset funding value strain.

Common complete deposits elevated 8.8% q/q to $75.7B whereas in November this quantity stands at $75.4B.

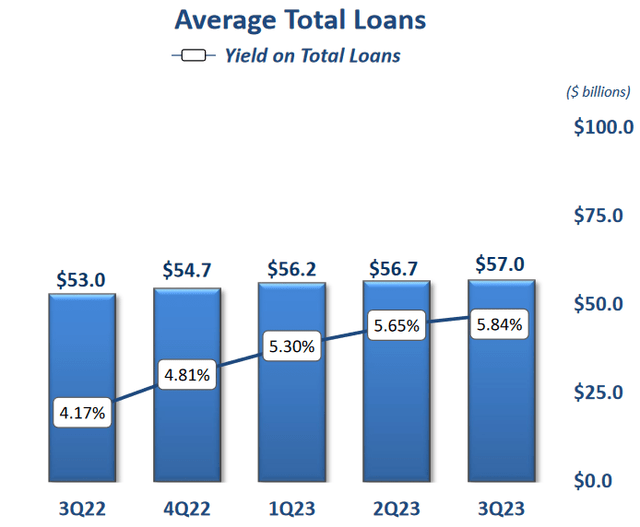

Common complete loans grew 0.5% to $57B and within the newest replace in November this determine stood at $56.9B.

The administration guides to a gradual web curiosity margin in 4Q23.

Firm

Firm

Firm

Credit score high quality stays benign

Trailing 12 months web charge-offs at simply 0.04% of common loans which is comparatively low.

Allowance for credit score losses sit at 1.30% of complete loans and leases, up 5 bps from 2Q23 reflecting a rise within the reserve for CRE Workplace and different portfolios probably impacted by larger rates of interest. However, as a result of long-end charges have come down by about 1% for the reason that finish of Q3, we are able to anticipate that mentioned allowance will lower sooner or later.

Properly capitalized

Complete loans to deposit ratio is ~75% as of November with CET1 ratio of 10.2%. Zions Bancorp. credit score rankings is BBB+/BBB+/A- from S&P/Fitch/Kroll and its ranking outlook is Damaging/Steady/Constructive from S&P/Fitch/Kroll.

Valuation

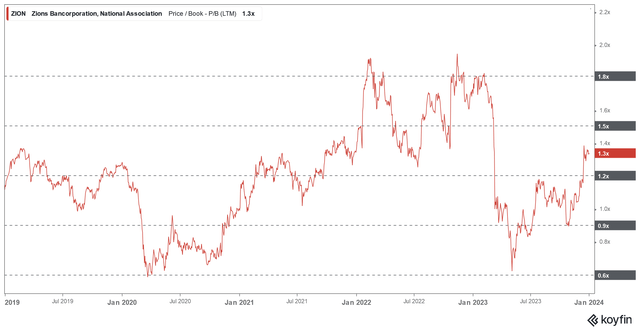

Not deeply undervalued however outlook is considerably extra constructive after a retreat in lengthy finish yields. The inventory trades at about 1.3x e book worth with a ahead ROE of about 11.5% within the subsequent 12 months. Ahead dividend yield is at the moment 3.7% and buyback (TTM) was 1.5%.

The chart beneath signifies the worth to e book worth the inventory has been buying and selling up to now 5 years. The vary lows had been made in the course of the 1Q20 as markets offered off as a result of COVID fears and in 1H23 owing to the banking disaster.

We see Zions Bancorp’s current rally as a justified re-rating as a result of normalizing value of fairness and the market ought to proceed to charge the inventory larger as we see Fed’s mountain climbing cycle ending (and reversing) and that ought to enhance outlook in 2024 for lending.

Himalayas Analysis, Koyfin

A phrase on the US treasury rally

Previous to the rally, larger lengthy finish charges introduced concerning the concern of late cycle dynamics as excessive inflation which is typical of overextended economies compelled the Federal Reserve to hike charges at an unprecedented tempo. Following the banking disaster in March, traders prevented smaller banks as a result of deposit outflows. Now give that inflation is massive contained and that the Fed will now probably embark on a gradual charge reduce cycle, the outlook on banks have immediately made an 180 diploma flip.

Wanting on the ahead charge curve, a 3.0%-3.5% brief charge appears anchored for 2025 with an upward sloping curve. That is typically helpful to banks as decrease brief finish charges will enhance CET1 ratios and business actual property portfolios whereas a comparatively larger lengthy finish will enhance lending charges. As a consequence of elevated regulation up to now decade, credit score development has been inline with GDP development and losses have been extra front-loaded due to new accounting requirements. This results in extra reserves than probably wanted.