metamorworks

Funding Thesis

Impinj (NASDAQ:PI) operates an revolutionary platform for wirelessly connecting billions of on a regular basis gadgets to the cloud, serving to companies observe and analyze bodily gadgets to realize operational efficiencies. With main market share in RAIN RFID expertise, a big patent portfolio, and secular progress tailwinds from provide chain digitization, Impinj possesses thrilling long-term potential. Nevertheless, near-term headwinds from weak end-market demand, elevated stock, and stretched valuations in opposition to still-volatile fundamentals lead me to fee PI a maintain for now.

Firm Deep Dive

Impinj gives cloud-based merchandise connectivity leveraging RAIN RFID expertise throughout its built-in platform spanning endpoint ICs, reader ICs, readers/gateways, and software program. This expertise allows Impinj’s prospects – together with retailers, logistics suppliers, automotive corporations, and healthcare techniques – to determine, find, observe, authenticate, and interact with the billions of things they manufacture, transport, and promote.

Impinj has shipped over 85 billion RAIN RFID endpoint ICs up to now that get embedded by tag companions like Avery Dennison into merchandise tags and labels. Every tiny endpoint IC features a distinctive serial quantity to determine the merchandise, together with further reminiscence and safety features. The endpoint ICs wirelessly join gadgets to Impinj’s platform, which incorporates fastened readers and gateways that scan and acquire knowledge from the ICs utilizing RFID expertise.

Impinj’s platform turns this real-time merchandise connectivity into actionable analytics, alerts, and automation for purchasers throughout features like loss prevention, stock visibility, cargo verification, conveyor automation and extra. The corporate segments its enterprise into two main items:

1. Endpoint ICs – That is Impinj’s most important chip enterprise targeted on endpoint IC gross sales to tag and inlay companions who produce completed RFID merchandise tags. The billions in endpoint ICs shipped present the numerous consumable nature and recurring income stream of endpoint ICs as gadgets get restocked and replenished over time.

2. Programs – This consists of Impinj’s reader ICs, fastened readers {hardware}, gateways, and software program offered largely by distributors for large-scale deployments. Whereas lumpy quarter-to-quarter, these massive deployments characterize sticky enterprise-grade options as soon as applied.

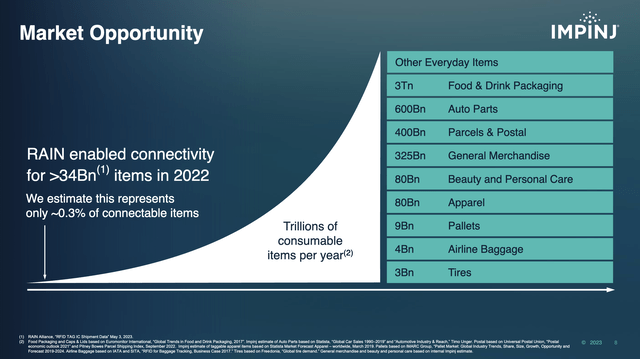

Key end-market publicity right now consists of retail attire & footwear and provide chain/logistics, however Impinj is increasing into different verticals together with basic merchandise, automotive, aviation, healthcare, meals and extra. World digitization and automation tendencies underpin sturdy tailwinds for merchandise connectivity, whereas RAIN RFID expertise nonetheless solely penetrates 0.3% of items globally. Impinj sees a >25% CAGR trajectory for RAIN RFID pushed by tendencies like omnichannel retail, loss prevention, provide chain visibility and effectivity.

Market Alternative (Investor Presentation)

Monetary Profile

Impinj maintains a debt-free stability sheet however has been burning money and swinging to losses in current quarters. During the last 12 months, the corporate generated detrimental free money move of ~$63 million. It additionally posted web losses of ~$28 million over this stretch from its still-heavy working expense load. Stock has likewise ballooned year-over-year from $31.9 million to $106.8 million final quarter, attributed to extra channel inventory and security buffers constructed given previous tightness. Between the stock construct and losses, Impinj’s money place has dropped to $113 million from over $180 million final 12 months. Whereas nonetheless in no hazard, the liquidity profile reveals a enterprise investing considerably regardless of risky demand indicators within the near-term.

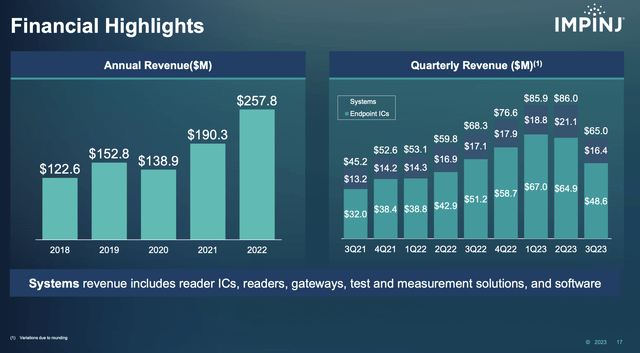

Q3 outcomes marked a dramatic shift in Impinj’s current trajectory, which had proven great progress since 2020 coming off COVID impacts. Final quarter noticed endpoint IC income drop 25% sequentially and techniques income fall 22% pushed by stock reductions throughout retail channels and weaker retail spend general. With whole revenues declining 24% and no visibility but on a requirement restoration, Impinj swung to a $15.8 million web loss in Q3 and burned by $28 million in free money move.

Whereas This autumn forecasts do name for slight enchancment from “inlay accomplice demand”, expectations stay muted as the corporate works by the surplus stock state of affairs. Till end-market visibility improves, volatility in monetary outcomes and money burn warrant a impartial view.

Monetary Highlights (Investor Presentation)

Valuation

Shares have fallen over 35% from highs to account for weaker fundamentals. Even so, PI nonetheless trades at over 8x EV/gross sales and almost 140x ahead non-GAAP EPS, with no trailing income. Upside feels restricted given stretched multiples and volatility, warranting a impartial stance.

Catalysts

Catalysts that would make me revisit the lengthy case embody:

– Robust endpoint IC quantity progress exiting this 12 months – Proof of retail stabilization and restock demand enhancing – Success ramping giant deployments with logistics and basic merchandise customers-Materials progress resolving extra inventories over the following 6-12 months-Bettering margin and money move profile from future working leverage

Dangers

Dangers which will stress the inventory embody:

– Extended weak retail and macro circumstances affecting finish buyer demand – Additional stock corrections resulting in further income volatility-Lack of progress on key account ramps like UPS logistics deployment-Margin compression from worth concessions (if demand slowdown persists)- Litigation outcomes or authorized prices negatively impacting earnings

Conclusion

Impinj operates an revolutionary industry-leading RAIN RFID connectivity platform and maintains thrilling secular drivers from provide chain digitization. Nevertheless, outcomes stay pressured within the near-term from weak retail demand and extra inventories. Whereas valuation has are available in, it nonetheless appears full in opposition to risky fundamentals. I imagine persistence is prudent till visibility on finish markets and inventories improves, warranting a impartial stance.