Authored by Ven Ram, Bloomberg strategist,

Inventory traders had appeared fairly impervious to danger aversion till not too long ago.

However with yields pushing greater, they’ve began making an about-turn. An escalation of the battle within the Center East could be what sends indexes again to honest worth, and that may imply a drop of 14% for the Nasdaq 100.

Whereas the contours of any ensuing battle are past of the scope of dialogue right here, a protracted floor invasion could be what forces a broad rethink of valuations throughout markets – and that can be notably troubling for equities which have ignored fundamentals.

The honest worth is 12,877 for the Nasdaq 100.

That “par worth” is bootstrapped from the belief that know-how shares could also be seen as long-duration bonds.

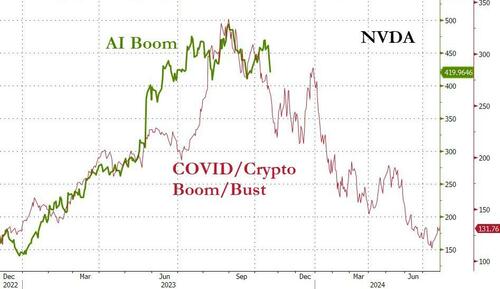

The index has surged some 36% this 12 months, a mirrored image of the passion surrounding the potential of synthetic intelligence.

That frenzy has neglected hovering Treasury yields. Whereas it was simpler for merchants to miss risk-free nominal yields as they climbed successively by 3% and 4%, charges above 5% pose a big hurdle for the straightforward motive that the latter is usually the low cost price most fitted to a number of investor teams.

Foundations, as an example, are usually required to spend not less than 5% of their asset worth yearly, so their focused returns are usually round 7%+ – in order the low cost price will get greater and better, the much less in actual returns they should spend from.

So the longer Treasury yields keep above 5%, the extra equities will endure.

With the geopolitical backdrop showing essentially the most menacing it has in many years and with low cost charges climbing greater and but greater, the primary port of name for the Nasdaq 100 might be slightly below 13,000.

The depth of the battle and the way widespread it turns into will decide its path thereafter.

Loading…